Canadian Pension Plan Investment Board Signs Agreement in Support of Viterra Merger to Bunge

13 June 2023 - 9:33PM

Dow Jones News

By Adriano Marchese

One of Viterra's largest shareholders, the Canadian Pension Plan

Investment Board, said that it has signed an agreement to allow the

merger of the company to agribusiness giant Bunge.

On Tuesday, Bunge and privately held agriculture network company

Viterra signed a definitive agreement to merge in a cash-and-stock

deal that would create a large diversified agribusiness with global

reach.

CPP Investments, a Canadian Crown corporation which oversees and

invests Canada Pension Plan funds and which owns 40% of Viterra,

said that it has signed the agreement in support of the proposed

merger.

Under the terms of the agreement, Viterra shareholders would

receive about 65.6 million shares of Bunge stock with a value of

$6.2 billion, as well as $2 billion in cash.

Of the transaction, CPP Investments would receive a roughly 12%

stake in the newly combined business and about $800 million in

cash.

Glencore and British Columbia Investment Management Corporation,

who together own the other 60% of Viterra, will also become

shareholders of Bunge.

The transaction is expected to close in mid-2024 after receiving

the proper regulatory approvals and satisfying the closing

conditions.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

June 13, 2023 07:18 ET (11:18 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

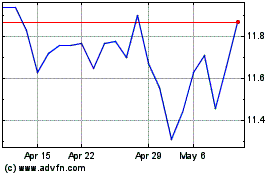

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

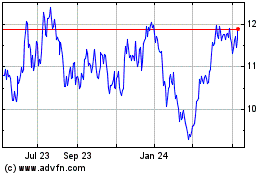

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Nov 2023 to Nov 2024