Wind Power Write-Downs Cast Shadow Over Industry Outlook

02 November 2023 - 12:57AM

Dow Jones News

By Giulia Petroni

A wave of impairments is sweeping the wind-energy sector in the

U.S. and elsewhere amid high interest rates, inflation and

supply-chain woes, forcing developers to put off projects and

casting doubts over the industry's outlook.

Energy giants Oersted, BP and Equinor show the latest signs of

trouble.

The Danish developer said Tuesday that it booked $4 billion in

charges related to its U.S. offshore portfolio and abandoned the

development of two wind projects off the coast of New Jersey--Ocean

Wind 1 and 2--due to spiraling costs and supplier delays. Oersted

had previously flagged increasing risks for its projects in the

country, citing the lack of favorable progress on tax credits.

The decision came a week before legislative elections in New

Jersey, where wind turbines have become a top target for

Republicans against Democratic Gov. Phil Murphy's plan to have 100%

of the state's power coming from renewables by 2035.

"The industry isn't in a good shape," Stifel's vice president of

equity research for utilities and renewables, Martin Tessier, told

Dow Jones Newswires. "I think we'll see a softening of long-term

targets... and less projects will be developed in the long

term."

Governments around the world have set ambitious targets to

increase the share of renewables in their energy mixes, but their

plans are now under pressure as wind developers face a surge in

financing costs. Project owners usually sign long-term deals

outlining terms to sell electricity or secure subsidies before

construction starts. Some are now lamenting that these terms don't

reflect increased costs, and their projects aren't viable

anymore.

Earlier this week, BP booked a $540 million pretax impairment

charge on three wind projects off the coast of New York after

regulators rejected a bid to renegotiate power-purchase terms,

which the company requested to reflect inflationary pressures and

permitting delays. Equinor, BP's partner on the Empire Wind and

Beacon Wind projects, booked an impairment of around $300 million

on its U.S. portfolio. The companies said they are assessing the

impact of the regulators' decision on their future development

plans.

Other projects have also been canceled.

Iberdrola's subsidiary Avangrid scrapped power purchase

agreements for a 804-megawatt wind-farm project known as Park City

Wind in Connecticut due to financial challenges. SouthCoast Wind, a

joint venture between Shell New Energies US and Ocean Winds North

America, said it would terminate PPAs for a planned project in

Massachusetts due to a significant increase in projected capital

expenditures and finance costs. Ocean Winds was created by

Portugal's EDP Renovaveis and France's Engie.

Swedish developer Vattenfall said earlier this year that it saw

project costs climbing up to 40% after booking an impairment for

halting the development of the Norfolk Boreas wind farm in the U.K.

Germany's Siemens Energy said it sees its wind-turbine business

posting worse fiscal 2024 losses than market expectations as it

works through quality issues and ramp-up challenges in

offshore.

"The economics of wind are proving more difficult thanks to

higher costs of capital and higher interest rates," said Russ

Mould, AJ Bell's investment director, in a statement. "The laws of

physics are coming into play with regard to how the wind turbines

are made. They require large amounts of concrete, steel,

rare-earth-based magnets and lubricants to ensure they work

reliably in potentially hostile environments, but the costs are

going up, thanks to inflation, and this is taking its toll on

manufacturers."

But some projects are still moving forward. Oersted took a final

investment decision on Revolution Wind, an offshore 704-megawatt

project in Connecticut and Rhode Island. Utility Dominion Energy on

Tuesday received a key federal approval for its 2.6-gigawatt

offshore wind project in Virginia.

In Europe, policymakers recently released an action plan to

address the sector's mounting challenges, saying they are working

to ensure faster permitting, improved auction criteria, easier

access to finance and guarantees, as well as a more competitive

international environment. The European Union's plan was welcomed

as "a game-changer for the industry" by trade group WindEurope,

which called for action earlier this year amid high costs, long

permitting processes and rising competition from Chinese

manufacturers.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 01, 2023 09:42 ET (13:42 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

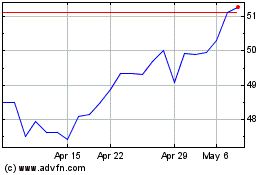

Iberdrola (PK) (USOTC:IBDRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

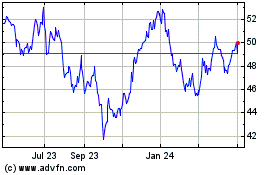

Iberdrola (PK) (USOTC:IBDRY)

Historical Stock Chart

From Apr 2023 to Apr 2024