false

0000050292

0000050292

2024-12-24

2024-12-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

December 24, 2024

IEH

Corporation

(Exact Name of Registrant as Specified in Charter)

| New York |

|

0-5278 |

|

13-5549348 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

140 58th Street, Suite 8E

Brooklyn, NY 11220

(Address of Principal Executive Offices, and

Zip Code)

(718) 492-4440

Registrant’s Telephone Number, Including

Area Code

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

IEHC |

OTC Pink Market |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communication

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communication

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Employment Agreement with Chief Executive Officer

On December 24, 2024, IEH entered into an employment agreement with

David Offerman, its Chief Executive Officer and President. The employment agreement with Mr. Offerman is effective as of January 1, 2025

and will expire on December 31, 2029. The following is a summary of the terms of the employment agreement with Mr. Offerman, which summary

is qualified in its entirety by reference to the full text of such agreement, which is filed as Exhibit 10.1 to this Current Report on

Form 8-K.

Mr. Offerman serves as the Chief Executive Officer and President of

IEH Corporation. and as a member of its board of directors. Under the employment agreement, Mr. Offerman will receive a base salary of

$491,745 per annum and be eligible to receive an annual bonus of up to 100% of base salary for each fiscal year of employment based on

performance targets and other key objectives established by the Compensation Committee of the board of directors (the “Committee”).

He will also be eligible to receive option grants under the Company’s

2020 Equity Based Compensation Plan. In connection with the execution of the employment agreement, he will receive a grant of 25,000 options

to purchase shares of common stock, par value $0.01 per share at an exercise price of $10.75 per common share for the fiscal year ended

March 31, 2025. All such options granted are immediately vested.

During the term of the employment agreement, he shall also be eligible

to receive equity or performance awards pursuant to any long-term incentive compensation plan adopted by the Committee or the board of

directors.

In the event of the termination of Mr. Offerman’s employment

by us without “cause” or by him for “good reason”, as such terms are defined in the employment agreement, he would

be entitled to: (a) a severance payment of 36 months of base salary; (b) continued participation in our health and welfare plans for up

to 24 months; and (c) all accrued but unpaid compensation. Further, under the employment agreement, if within the three (3) year period

of a “change in control” (as defined in the employment agreement) either Mr. Offerman’s employment is terminated, or

his title, position or responsibilities are materially reduced and he terminates his employment, the Company shall pay and/or provide

to him substantially the same compensation and benefits as if his termination was without “cause” or for “good reason”,

subject to limitation to avoid the imposition of the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended

(the “Code”) if such payments would constitute an “excess parachute payment” as defined in Section 280G of the

Code. Pursuant to the employment agreement, Mr. Offerman is subject to customary confidentiality, non-solicitation of employees and non-competition

obligations that survive the termination of such agreement.

The information furnished pursuant to Item 5.02 of this Current Report,

including Exhibit 10.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed

incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and

Exhibits |

(d) Exhibits

The following

exhibit relating to Item 5.02 shall be deemed to be furnished, and not filed:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

IEH Corporation |

| |

|

| |

By: |

/s/ Subrata Purkayastha |

| |

Name: |

Subrata Purkayastha |

| |

Title: |

Chief Financial Officer |

| Date: December 24, 2024 |

|

EXHIBIT INDEX

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS AGREEMENT is made on

the 24th day of December, 2024 (the “Execution Date”) and shall be effective on January 1, 2025 (the “Effective Date”),

by and between David Offerman (the “Employee”) and IEH Corporation, a New York corporation (the “Company”).

W I T N E S S E T H:

WHEREAS, the Company is engaged

in the business of designing, developing and manufacturing printed circuit and plastic circular connectors for high performance applications

utilizing the HYPERBOLOID contact design; and

WHEREAS, the Employee is currently

employed by the Company as the Chief Executive Officer and President of the Company, and the Company desires to continue the employment

of the Employee and secure for the Company the experience, ability and services of the Employee; and

WHEREAS, the Employee desires

to continue his employment with the Company, pursuant to the terms and conditions herein set forth, superseding all prior oral and written

employment agreements, and term sheets and letters between the Company, its subsidiaries and/or predecessors and Employee;

NOW, THEREFORE, it is mutually

agreed by and between the parties hereto as follows:

ARTICLE

I

DEFINITIONS

1.1 Accrued

Compensation. “Accrued Compensation” shall mean an amount which shall include all amounts earned or accrued through

the Termination Date (as defined below) but not paid as of the Termination Date, including: (a) Base Salary; (b) reimbursement for business

expenses incurred by the Employee on behalf of the Company, pursuant to the Company’s expense reimbursement policy in effect at

such time; (c) vacation pay; and (d) unpaid bonuses and incentive compensation earned and awarded prior to the Termination Date.

1.2

Cause. “Cause” shall mean: (a) willful disobedience by the Employee of a material and lawful

instruction of the Board of Directors of the Company (the “Board”); (b) formal charge, indictment or conviction of

the Employee of any misdemeanor involving fraud or embezzlement or similar crime, or any felony; (c) conduct amounting to fraud, dishonesty,

gross negligence, willful misconduct or recurring insubordination; or (d) excessive absences from work, other than for illness or Disability;

provided that the Company shall not have the right to terminate the employment of Employee pursuant to the foregoing clauses (a), (c),

and (d) above unless written notice specifying such breach shall have been given to the Employee and, in the case of breach which is

capable of being cured, the Employee shall have failed to cure such breach within 30 days after his receipt of such notice.

1.3

Change in Control. A “Change in Control” shall mean any of the following events:

(a) (i) An acquisition

(other than directly from the Company) of any voting securities of the Company (the “Voting Securities”) by any “Person”

(as the term person is used for purposes of Section 13(d) or 14(d) of the Securities Exchange Act of 1934, as amended (the “1934

Act”)) immediately after which such Person has “Beneficial Ownership” (within the meaning of Rule 13d-3 promulgated

under the 1934 Act) of twenty percent (20%) or more of the combined voting power of the Company’s then outstanding Voting Securities;

provided, however, that in determining whether a Change in Control has occurred, Voting Securities which are acquired in a “Non-Control

Acquisition” (as defined below) shall not constitute an acquisition which would cause a Change in Control. A “Non-Control

Acquisition” shall mean an acquisition by: (1) an employee benefit plan (or a trust forming a part thereof) maintained by (x)

the Company or (y) any corporation or other Person of which a majority of its voting power or its equity securities or equity interest

is owned directly or indirectly by the Company (a “Subsidiary”); or (2) the Company or any Subsidiary; and

(ii) Notwithstanding the foregoing, a Change

in Control shall not be deemed to occur solely because a Person (the “Subject Person”) gained Beneficial Ownership

of more than the permitted amount of the outstanding Voting Securities as a result of the acquisition of Voting Securities by the Company

which, by reducing the number of Voting Securities outstanding, increases the proportional number of shares Beneficially Owned by the

Subject Person, provided that if a Change in Control would occur (but for the operation of this sentence) as a result of the acquisition

of Voting Securities by the Company, and after such share acquisition by the Company, the Subject Person becomes the Beneficial Owner

of any additional Voting Securities which increases the percentage of the then outstanding Voting Securities Beneficially Owned by the

Subject Person, then a Change in Control shall occur.

(b) The individuals

who, as of the date this Agreement is approved by the Board, are members of the Board (the “Incumbent Board”), cease

for any reason to constitute at least two-thirds (⅔) of the Board; provided, however, that if the election, or nomination for election

by the Company’s stockholders, of any new director was approved by a vote of at least two-thirds (⅔) of the Incumbent Board,

such new director shall, for purposes of this Agreement, be considered and defined as a member of the Incumbent Board; and provided, further,

that no individual shall be considered a member of the Incumbent Board if such individual initially assumed office as a result of either

an actual “Election Contest” (as described in Rule 14a-11 promulgated under the 1934 Act) or other solicitation of

proxies or consents by or on behalf of a Person other than the Board (a “Proxy Contest”); or

(c) Approval by

stockholders of the Company of:

(i) A merger,

consolidation or reorganization involving the Company, unless: (1) the stockholders of the Company, immediately before such merger,

consolidation or reorganization, own, directly or indirectly immediately following such merger, consolidation or reorganization, at

least sixty percent (60%) of the combined voting power of the outstanding voting securities of the corporation resulting from such

merger or consolidation or reorganization (the “Surviving Corporation”) in substantially the same proportion as

their ownership of the Voting Securities immediately before such merger, consolidation or reorganization; (2) the individuals who

were members of the Incumbent Board immediately prior to the execution of the agreement providing for such merger, consolidation or

reorganization constitute at least two-thirds (⅔) of the members of the board of directors of the Surviving Corporation; and

(3) no Person (other than the Company, any Subsidiary, any employee benefit plan (or any trust forming a part thereof) maintained by

the Company, the Surviving Corporation or any Subsidiary) becomes Beneficial Owner of twenty percent (20%) or more of the combined

voting power of the Surviving Corporation’s then outstanding voting securities as a result of such merger, consolidation or

reorganization, a transaction described in clauses (1) through (3) shall herein be referred to as a “Non-Control

Transaction”; or

(ii) An agreement

for the sale or other disposition of all or substantially all of the assets of the Company, to any Person, other than a transfer to a

Subsidiary, in one transaction or a series of related transactions;

(iii) The shareholders

of the Company approve any plan or proposal for the liquidation or dissolution of the Company.

(d) Notwithstanding

anything contained in this Agreement to the contrary, if the Employee’s employment is terminated prior to a Change in Control and

the Employee reasonably demonstrates that such termination: (i) was at the request of a third party who has indicated an intention or

taken steps reasonably calculated to effect a Change in Control (a “Third Party”); or (ii) otherwise occurred in connection

with, or in anticipation of, a Change in Control, then for all purposes of this Agreement, the date of a Change in Control with respect

to the Employee shall mean the date immediately prior to the date of such termination of the Employee’s employment.

1.4 Continuation

Benefits. “Continuation Benefits” shall be the continuation of the Benefits, as defined in Section

5.1, for the period commencing on the Termination Date and terminating 24 months thereafter, or such other period as

specifically stated by this agreement (the “Continuation Period”) at the Company’s expense on behalf of the

Employee and his dependents; provided, however, that: (a) in no event shall the Continuation Period exceed 24 months from the

Termination Date; and (b) the level and availability of benefits provided during the Continuation Period shall at all times be

subject to the post-employment conversion or portability provisions of the benefit plans. The Company’s obligation hereunder

with respect to the foregoing benefits shall also be limited to the extent that if the Employee obtains any such benefits pursuant

to a subsequent employer's benefit plans, the Company may reduce the coverage of any benefits it is required to provide the Employee

hereunder as long as the aggregate coverage and benefits of the combined benefit plans is no less favorable to the Employee than the

coverage and benefits required to be provided hereunder. This definition of Continuation Benefits shall not be interpreted so as to

limit any benefits to which the Employee, his dependents or beneficiaries may be entitled under any of the Company’s employee

benefit plans, programs or practices following the Employee’s termination of employment, including, without limitation,

retiree medical and life insurance benefits.

1.5

Disability. “Disability” shall mean a physical or mental infirmity which impairs the Employee’s

ability to substantially perform his duties with the Company for a period of sixty (60) consecutive days and the Employee has not returned

to his full-time employment prior to the Termination Date as stated in the “Notice of Termination” (as defined below).

1.6

Good Reason. “Good Reason” shall mean without the written consent of the Employee: (a) a

material breach of any provision of this Agreement by the Company; (b) failure by the Company to pay when due any compensation to the

Employee; (c) a reduction in the Employee’s Base Salary; (d) failure by the Company to maintain the Employee in the positions referred

to in Section 2.1 of this Agreement; (e) assignment to the Employee of any duties materially and adversely inconsistent with the

Employee’s positions, authority, duties, responsibilities, powers, functions, reporting relationship or title or any other action

by the Company that results in a material diminution of such positions, authority, duties, responsibilities, powers, functions, reporting

relationship or title; or (f) a Change in Control, provided the event on which the Change of Control is predicated occurs within 90 days

of the service of the Notice of Termination by the Employee, it being understood that Employee shall have the right to terminate his employment

under this Section 1.6(f) for any reason or no reason within such 90-day period; and provided further, however, that the

Employee agrees not to terminate his employment for Good Reason pursuant to clauses (a) through (e) unless: (i) the Employee has given

the Company at least 30 days’ prior written notice of his intent to terminate his employment for Good Reason, which notice shall

specify the facts and circumstances constituting Good Reason; and (ii) the Company has not remedied such facts and circumstances constituting

Good Reason to the reasonable and good faith satisfaction of the Employee within a 30-day period after receipt of such notice.

1.7

Notice of Termination. A “Notice of Termination” shall mean a written notice from the Company,

or the Employee, of termination of the Employee’s employment which indicates the provision in this Agreement relied upon, if any

and which sets forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Employee’s

employment under the provision so indicated. A Notice of Termination served by the Company shall specify the effective date of termination.

1.8

Pro Rata Bonus. “Pro Rata Bonus” shall mean an amount equal to the maximum bonus Employee

had an opportunity to earn pursuant to Section 4.2 multiplied by a fraction, the numerator of which shall be the number of days

from the commencement of the fiscal year to the Termination Date, and the denominator of which shall be the number of days in the fiscal

year in which Employee was terminated.

1.9

Severance Payment. “Severance Payment” shall mean an amount equal to the sum of 36 months

of Employee’s Base Salary in effect on the Termination Date. The Severance Payment shall be payable in equal installments on each

of the Company’s regular pay dates for executives during the 36 months commencing on the first regular executive pay date following

the Termination Date. The Severance Payment is conditioned on the Employee executing a termination agreement and release in a form reasonably

acceptable to the Employee and the Company.

1.10 Termination

Date. “Termination Date” shall mean: (a) in the case of the Employee’s death, his date of death; (b) in

the case of Good Reason, 30 days from the date the Notice of Termination is given to the Company, provided the Company has not

remedied such facts and circumstances constituting Good Reason to the reasonable and good faith satisfaction of the Employee; (c) in

the case of termination of employment on or after the Expiration Date, the last day of employment; and (d) in all other cases, the

date specified in the Notice of Termination; provided, however, if the Employee’s employment is terminated by the

Company for any reason except Cause, the date specified in the Notice of Termination shall be at least 30 days from the date the

Notice of Termination is given to the Employee, and provided further that in the case of Disability, the Employee shall not have

returned to the full-time performance of his duties during such period of at least 30 days.

ARTICLE

II

EMPLOYMENT

2.1

Upon the terms and subject to the conditions of this Agreement, the Company hereby agrees to continue the employment of the Employee,

and the Employee hereby agrees to continue such employment, as President and Chief Executive Officer of the Company. The Employee’s

position includes acting as an officer and/or director of any of the Company’s subsidiaries as determined by the Board of Directors.

The Company shall nominate Employee, and use its best efforts to have Employee elected to the Board throughout the term of this Agreement

and if elected by the shareholders of the Company, the Employee agrees to serve in this role. The Employee agrees to resign from the Board

upon the termination of employment for any reason.

ARTICLE

III

DUTIES

3.1

The Employee shall, during the term of his employment with the Company, and subject to the direction and control of the Company’s

Board of Directors, report directly to the Board of Directors and shall exercise such authority, perform such executive duties and functions

and discharge such responsibilities as are reasonably associated with his executive position or as may be reasonably assigned or delegated

to him from time to time by the Company’s Board of Directors, consistent with his position as President and Chief Executive Officer.

3.2

The Employee shall perform, in conjunction with the Company’s executive management, to the best of his ability the following

services and duties for the Company and its subsidiary corporations (by way of example, and not by way of limitation):

(a)

Those duties attendant to the position of Chief Executive Officer;

(b)

Establish and implement current and long range objectives, plans, and policies, subject to the approval of the Board of Directors;

(c)

Financial planning including the development of, liaison with, financing sources and investment bankers;

(d)

Managerial oversight of the Company’s business;

(e)

Shareholder relations;

(f)

Compliance with local, state and federal regulations and laws governing business operations;

(g)

Business expansion of the Company including acquisitions, joint ventures, and other opportunities; and

(h)

Promotion of the relationships of the Company and its subsidiaries with their respective employees, customers, suppliers and others

in the business community.

3.3

The Employee agrees to devote full business time and his best efforts in the performance of his duties for the Company and any

subsidiary corporation of the Company.

3.4

Employee shall undertake regular travel to the Company’s executive and operational offices, and such other occasional travel

within or outside the United States as is or may be reasonably necessary in the interests of the Company. All such travel shall be at

the sole cost and expense of the Company and shall include reasonable lodging and food costs incurred by Employee while traveling.

ARTICLE

IV

COMPENSATION

4.1

During the term of this Agreement, Employee shall be compensated initially at the rate of $491,745 per annum, subject to such increases,

if any, as determined by the Board, or, if applicable, the Board so designates, the Compensation Committee (the “Committee”),

in its discretion, at the commencement of each of the Company’s fiscal years during the term of this Agreement (the “Base

Salary”). The Base Salary shall be paid to the Employee in accordance with the Company’s regular executive payroll periods.

4.2

Employee may receive a bonus (the “Bonus”) in the sole discretion of the Committee in accordance with the following

parameters:

(a)

Employee will have an opportunity to earn a cash Bonus of up to 100% of Employee’s Base Salary for each fiscal year of employment.

The Bonus will be based on performance targets and other key objectives established by the Board, or if applicable, the Committee, at

the commencement of each fiscal year, and the determination of whether the performance criteria shall have been attained shall be solely

in the discretion of the Board, or if applicable, the Committee.

4.3

The Company shall deduct from Employee’s compensation all federal, state, and local taxes which it may now or hereafter be

required to deduct.

4.4

The Employee is also eligible to receive option grants under the Company’s 2020 Equity Based Compensation Plan as follows.

In connection with the execution of this Agreement, the Employee will receive a grant of 25,000 options to purchase shares of common stock,

par value $0.01 per share (each a “Common Share”) at an exercise price of $10.75 per Common Share for the fiscal year

ended March 31, 2025 (a “2024-2025 Option Award Grant”), provided that all options granted hereunder shall be immediately

vested.

4.5

Employee may receive such other additional compensation as may be determined from time to time by the Board, or if applicable,

the Committee, including bonuses, additional grants of options or other form of equity and other long term compensation plans. Nothing

herein shall be deemed or construed to require the Board, or if applicable, the Committee, to award any bonus or additional compensation.

4.6

Notwithstanding any other provisions in this Agreement to the contrary, the Employee agrees and acknowledges that any incentive-based

compensation, or any other compensation, paid or payable to Employee pursuant to this Agreement or any other agreement or arrangement

with the Company which is subject to recoupment or clawback under any applicable law, government regulation, or stock exchange listing

requirement, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act and such regulations as may be

promulgated thereunder by the Securities and Exchange Commission, will be subject to such deductions and clawback (recovery) as may be

required to be made pursuant to applicable law, government regulation, stock exchange listing requirement or any policy of the Company

adopted pursuant to any such law, government regulation, or stock exchange listing requirement. This section shall survive the termination

of this Agreement for a period of three (3) years.

ARTICLE

V

BENEFITS

5.1

During the term hereof, the Company shall provide Employee with the following benefits (the “Benefits”): (a)

group health care and insurance benefits as generally made available to the Company’s senior management; (b) travel expenses, including

use of a company car, appropriate automobile insurance, EZ Pass and other commuting-related costs; and (c) such other insurance benefits

obtained by the Company and made generally available to the Company’s senior management. The Company shall reimburse Employee, upon

presentation of appropriate vouchers, for all reasonable business expenses incurred by Employee on behalf of the Company upon presentation

of suitable documentation.

5.2 In

the event the Company wishes to obtain Key Man life insurance on the life of Employee, Employee agrees to cooperate with the Company

in completing any applications necessary to obtain such insurance and promptly submit to such physical examinations and furnish such

information as any proposed insurance carrier may request.

5.3

For the term of this Agreement, Employee shall be entitled to paid vacation at the rate of four (4) weeks per annum.

ARTICLE

VI

NON-DISCLOSURE

6.1

The Employee shall not, at any time during or after the termination of his employment hereunder, except when acting on behalf of

and with the authorization of the Company, make use of or disclose to any person, corporation, or other entity, for any purpose whatsoever,

any trade secret or other confidential information concerning the Company’s business, finances, marketing, accounting, personnel

and/or staffing business of the Company and its subsidiaries, including information relating to any customer of the Company or pool of

temporary or permanent employees, governmental customer or any other nonpublic business information of the Company and/or its subsidiaries

learned as a consequence of Employee’s employment with the Company (collectively referred to as the “Proprietary Information”).

For the purposes of this Agreement, trade secrets and confidential information shall mean information disclosed to the Employee or known

by him as a consequence of her employment by the Company, whether or not pursuant to this Agreement, and not generally known in the industry.

The Employee acknowledges that Proprietary Information, trade secrets and other items of confidential information, as they may exist from

time to time, are valuable and unique assets of the Company, and that disclosure of any such information would cause substantial injury

to the Company. Trade secrets and confidential information shall cease to be trade secrets or confidential information, as applicable,

at such time as such information becomes public other than through disclosure, directly or indirectly, by Employee in violation of this

Agreement.

6.2

If Employee is requested or required (by oral questions, interrogatories, requests for information or document subpoenas, civil

investigative demands, or similar process) to disclose any Proprietary Information, Employee shall, unless prohibited by law, promptly

notify the Company of such request(s) so that the Company may seek an appropriate protective order. Notwithstanding the foregoing, Employee

understands that nothing contained in this Agreement limits Employee’s ability from reporting possible violations of federal law

or regulation to any federal, state or local governmental agency or entity, including but not limited to the Department of Justice, the

Securities and Exchange Commission, or any agency Inspector General (“Government Agencies”), or making other disclosures

that are protected under the whistleblower provisions of federal law or regulation. Employee further understands that this Agreement does

not limit Employee’s ability to communicate with any Government Agencies or otherwise participate in any investigation or proceeding

that may be conducted by any Government Agency, including providing documents or other information, without notice to the Company. This

Agreement does not limit Employee’s right to receive an award for information provided to any Government Agencies.

6.3 Except

as otherwise may be agreed by the Company in writing, in consideration of the employment of Employee by the Company, and free of any

additional obligations of the Company to make additional payment to Employee, Employee hereby agrees to irrevocably assign to the

Company any and all of Employee’s rights (including patent rights, copyrights, trade secret rights and other rights,

throughout the world), title and interest in and to all inventions, software, manuscripts, documentation, improvements or other

intellectual property whether or not protectable by any state or federal laws relating to the protection of intellectual property,

relating to the present or future business of the Company that are developed by Employee during the term of his/her employment with

the Company, either alone or jointly with others, and whether or not developed during normal business hours or arising within the

scope of his/her duties of employment. Employee agrees that all such inventions, software, manuscripts, documentation, improvement

or other intellectual property shall be and remain the sole and exclusive property of the Company and shall be deemed the product of

work for hire. Employee hereby agrees to execute such assignments and other documents as the Company may consider appropriate to

vest all right, title and interest therein to the Company and hereby appoints the Company as Employee’s attorney-in-fact with

full powers to execute such document itself in the event employee fails or is unable to provide the Company with such signed

documents. Employee shall also assign to, or as directed by, the Company, all of his right, title and interest in and to any and all

inventions and other intellectual property, the full title to which is required to be in the United States government of any of its

agencies. The Company shall have all right, title and interest in all research and work product produced by Employee as an employee

of the Company, including, but not limited to, all research materials. Notwithstanding the foregoing, this provision does not apply

to an invention for which no equipment, supplies, facility, or trade secret information of the Company was used and which was

developed entirely on Employee’s own time unless: (a) the invention relates: (i) to the business of the Company; or (ii) to

the Company’s actual or demonstrably anticipated research or development; or (b) the invention results from any work performed

by Employee for the Company.

ARTICLE

VII

RESTRICTIVE COVENANT

7.1

During the term of Employment with the Company, and for a period of one (1) year following termination of employment for any reason,

Employee agrees that he will not, directly or indirectly, enter into or become associated with or engage in any other business (whether

as a partner, officer, director, shareholder, employee, consultant, or otherwise), which is involved in the business of: (a) designing,

developing and manufacturing printed circuit connectors and plastic circular connectors for high performance applications utilizing the

HYPERBOLOID contact design; or (b) is otherwise engaged in the same or similar business as the Company in direct competition with the

Company, or which the Company was in the process of developing, during the tenure of Employee’s employment by the Company (collectively,

a “Competitive Business”). Notwithstanding the foregoing, the ownership by Employee of less than five percent of the

shares of any publicly held corporation shall not violate the provisions of this Article VII.

7.2

In furtherance of, and in addition to, Section 7.1, during the period of non-competition specified in Section 7.1

(the “Restricted Period”), Employee shall not during the Restricted Period, directly or indirectly, whether as

a principal, agent, employee, independent contractor, employer, partner or shareholder, in connection with or related to any Competitive

Business, solicit: (a) any actual customers, partners or contracts addressed by the Company during the tenure of Employee’s employment;

or (b) any customers, partners or contracts that were within the Company’s business development pipeline within the twelve-month

period ending on the effective date of the termination of employment. In addition, Employee will not during the Restricted Period, either

directly or indirectly, whether as a principal,

agent, employee, independent contractor, employer, partner or shareholder, solicit, hire, attempt to solicit or hire, or

participate in any attempt to solicit or hire, any person who is employed by the Company or retained as a consultant by the Company (or

who was employed or retained by the Company within 12 months of the Termination Date or who was being actively recruited by the Company)

to: (A) terminate his employment or engagement with the Company; (B) accept employment or engagement with anyone other than the Company;

or (C) in any manner interfere with the business of the Company.

7.3

Employee hereby acknowledges that the covenants and agreements contained in Article VI and Article VII of this Agreement

(the “Restrictive Covenants”) are reasonable and valid in all respects and that the Company is entering into this Agreement,

inter alia, on such acknowledgement. If Employee breaches, or threatens to commit a breach, of any of the Restrictive Covenants,

the Company shall have the following rights and remedies, each of which rights and remedies shall be independent of the other and severally

enforceable, and all of which rights and remedies shall be in addition to, and not in lieu of, any other rights and remedies available

to the Company under law or in equity: (a) the right and remedy to have the Restrictive Covenants specifically enforced by any court having

equity jurisdiction, it being acknowledged and agreed that any such breach or threatened breach will cause irreparable injury to the Company

and that money damages will not provide an adequate remedy to the Company; (b) the right and remedy to require Employee to account for

and pay over to the Company such damages as are recoverable at law as the result of any transactions constituting a breach of any of the

Restrictive Covenants; (c) if any court determines that any of the Restrictive Covenants, or any part thereof, is invalid or unenforceable,

the remainder of the Restrictive Covenants shall not thereby be affected and shall be given full effect, without regard to the invalid

portions; and (d) if any court construes any of the Restrictive Covenants, or any part thereof, to be unenforceable because of the duration

of such provision or the area covered thereby, such court shall have the power to reduce the duration or area of such provision and, in

its reduced form, such provision shall then be enforceable and shall be enforced. The parties intend to and hereby confer jurisdiction

to enforce the Restrictive Covenants upon the courts of any jurisdiction within the geographical scope of such Restrictive Covenants.

If the courts of any one or more such jurisdictions hold the Restrictive Covenants wholly unenforceable by reason of the breadth of such

scope or otherwise, it is the intention of the parties that such determination not bar or in any way affect the Company’s right

to the relief provided above in the courts of any other jurisdiction, within the geographical scope of such Restrictive Covenants, as

to breaches of such Restrictive Covenants in such other respective jurisdiction such Restrictive Covenants as they relate to each jurisdiction

being, for this purpose, severable into diverse and independent covenants.

ARTICLE

VIII

TERM

8.1

This Agreement shall be for a term (the “Initial Term”) commencing on the Effective Date as set forth above

(the “Commencement Date”) and terminating on December 31, 2029 (the “Expiration Date”), unless sooner

terminated upon the death of the Employee, or as otherwise provided herein.

8.2

Unless this Agreement is earlier terminated pursuant to the terms hereof, the Company agrees to use its best efforts to notify

Employee in writing of the Company’s intention to continue Employee’s employment after the Expiration Date no less than ninety

(90) days prior to the Expiration Date. In the event the Company either: (a) fails to notify the Employee in accordance with this Section

8.2; (b) notifies Employee that it does not intend to continue the Employee’s employment after the Expiration Date; or (c) after

notifying the Employee pursuant to Section 8.2, fails to reach an agreement on a new employment agreement prior to the Expiration

Date, then upon termination of the Employee’s employment on or after the Expiration Date for any reason except Cause, the Company

shall pay Employee the Severance Payment, Accrued Compensation and the Continuation Benefits.

ARTICLE

IX

TERMINATION

9.1

The Company may terminate this Agreement by giving a Notice of Termination to the Employee in accordance with this Agreement:

(a)

for Cause;

(b)

without Cause; and

(c)

for Disability.

9.2

Employee may terminate this Agreement by giving a Notice of Termination to the Company in accordance with this Agreement, at any

time, with or without Good Reason.

9.3

If the Employee’s employment with the Company shall be terminated, the Company shall pay and/or provide to the Employee (or

in the case of his death, to his heirs and beneficiaries) the following compensation and benefits in lieu of any other compensation or

benefits arising under this Agreement or otherwise:

(a)

if the Employee was terminated by the Company for Cause, or the Employee terminates without Good Reason: the Accrued Compensation;

(b)

if the Employee was terminated by the Company for Disability: (i) the Continuation Benefits; (ii) the Accrued Compensation; and

(iii) the Severance Payment;

(c)

if termination was due to the Employee’s death: (i) the Accrued Compensation; (ii) the Continuation Benefits; (iii) the Pro

Rata Bonus; and (iv) the Severance Payment; or

(d)

if the Employee was terminated by the Company without Cause, or the Employee terminates this Agreement for Good Reason: (i) the

Accrued Compensation; (ii) the Severance Payment; and (iii) the Continuation Benefits.

9.4

The amounts payable under this Section 9, shall be paid as follows:

(a)

Accrued Compensation shall be paid to the Employee (or in the case of his death, to his heirs and beneficiaries) within five (5)

business days after the Employee’s Termination Date (or earlier, if required by applicable law);

(b)

If the Continuation Benefits are paid in cash, the payments shall be made to the Employee (or in the case of his death, to his

heirs and beneficiaries) on the first day of each month during the Continuation Period (or earlier, if required by applicable law); and

(c)

The Severance Payment shall be payable to the Employee (or in the case of his death, to his heirs and beneficiaries) in equal installments

on each of the Company’s regular pay dates for executives (or earlier, if required by applicable law) during the 36-month period

for which Employee is entitled to the Severance Payment, commencing on the first regular executive pay date following the Termination

Date.

9.5

Notwithstanding the foregoing, in the event Employee is a member of the Board of Directors on the Termination Date, the payment

of any and all compensation due hereunder, except Accrued Compensation and Employee’s right to exercise any options to purchase

shares of the Company’s Common Shares (“Employee Stock Options”) after the Termination Date, is expressly conditioned

on: (i) Employee’s resignation from the Board of Directors of the Company and with any Subsidiary of the Company, within five (5)

business days of notice by the Company requesting such resignation; (ii) Employee’s execution (and not revoking) a general release

and waiver of claims against the Company in a form reasonably acceptable to the Employee and the Company; and (iii) full and continued

compliance by Employee with the covenants and obligations described in Article VI and Article VII of this Agreement.

9.6

The Employee shall not be required to mitigate the amount of any payment provided for in this Agreement by seeking other employment

or otherwise and no such payment shall be offset or reduced by the amount of any compensation or benefits provided to the Employee in

any subsequent employment except as provided in Section 1.4.

ARTICLE

X

STOCK OPTION AWARDS

10.1

During the term of this Agreement, Employee shall be eligible to receive Employee Stock Options pursuant to grants by the Board

or, if applicable the Committee under the Company’s 2020 Equity Based Compensation Plan or such other equity compensation plan as

may be adopted by the Company in the discretion of the Committee or the Board. The actual grant date value of any such awards shall be

determined in the discretion of the Committee or Board and any such awards shall include such vesting conditions and other terms and conditions

as determined by the Committee or the Board.

ARTICLE

XI

EXTRAORDINARY TRANSACTIONS

11.1

The Company’s Board of Directors has determined that it is appropriate to reinforce and encourage the continued attention

and dedication of members of the Company's management, including the Employee, to their assigned duties without distraction in potentially

disturbing circumstances arising from the possibility of a change in control of the Company.

11.2

In the event that within the three (3) year period following a Change of Control, Employee is terminated, or Employee’s status,

title, position or responsibilities are materially reduced and Employee terminates his Employment, the Company shall pay and/or provide

to the Employee, the following compensation and benefits, in lieu of any other payments due hereunder: (i) the Accrued Compensation; (ii)

the Continuation Benefits; and (iii) a lump sum payment within ten (10) days of the Termination Date equal to 200% of the sum of (a) Employee’s

Base Salary in effect on the effective date of the Change of Control, and (b) Employee’s Bonus amount for the prior fiscal year

of employment.

11.3 Notwithstanding

the foregoing, if the payment under this Article XI, either alone or together with other payments which the Employee has the right

to receive from the Company, would constitute an “excess parachute payment” as defined in Section 280G of the Internal

Revenue Code of 1986, as amended (the “Code”), the aggregate of such credits or payments under this Agreement and

other agreements shall be reduced to the largest amount as will result in no portion of such aggregate payments being subject to the

excise tax imposed by Section 4999 of the Code. The priority of the reduction of excess parachute payments shall be in the

discretion of the Employee. The Company shall give notice to the Employee as soon as practicable after its determination that Change

of Control payments and benefits are subject to the excise tax, but no later than ten (10) days in advance of the due date of such

Change of Control payments and benefits, specifying the proposed date of payment and the Change of Control benefits and payments

subject to the excise tax. Employee shall exercise his option under this Section 11.3 by written notice to the Company within

five (5) days in advance of the due date of the Change of Control payments and benefits specifying the priority of reduction of the

excess parachute payments.

11.4 Option

awards granted to Employee under any of the Company’s plans, which are vested as of the effective date of the termination of Employee’s

employment pursuant to Section 11.2 shall remain exercisable in accordance with the Plan, but in no event after the Expiration Time under

any such Plan (it being agreed and acknowledged that unvested options shall be void immediately upon the occurrence of such a termination

event).

11.5 In

the event that upon a Change of Control Employee is terminated, or Employee’s status, title, position or responsibilities are materially

reduced and Employee terminates his Employment, any and all unvested option awards granted to Employee shall be immediately vested and

exercisable.

ARTICLE

XII

SECTION 409A COMPLIANCE

12.1 To

the extent applicable, it is intended that any amounts payable under this Agreement shall either be exempt from Section 409A of the

Code or shall comply with Section 409A (including Treasury regulations and other published guidance related thereto) so as not to

subject Employee to payment of any additional tax, penalty or interest imposed under Section 409A of the Code. The provisions of

this Agreement shall be construed and interpreted to the maximum extent permitted to avoid the imputation of any such additional tax,

penalty or interest under Section 409A of the Code yet preserve (to the nearest extent reasonably possible) the intended benefit

payable to Employee. Notwithstanding the foregoing, the Company makes no representations regarding the tax treatment of any payments hereunder,

and the Employee shall be responsible for any and all applicable taxes, other than the Company’s share of employment taxes on the

severance payments provided by the Agreement. Employee acknowledges that Employee has been advised to obtain independent legal, tax or

other counsel in connection with Section 409A of the Code.

12.2 Notwithstanding

any provisions of this Agreement to the contrary, if Employee is a “specified employee” (within the meaning of Section 409A

of the Code and the regulations adopted thereunder) at the time of Employee’s separation from service and if any portion of the

payments or benefits to be received by Employee upon separation from service would be considered deferred compensation under Section 409A

of the Code and the regulations adopted thereunder (“Nonqualified Deferred Compensation”), amounts that would otherwise

be payable pursuant to this Agreement during the six-month period immediately following Employee’s separation from service that

constitute Nonqualified Deferred Compensation and benefits that would otherwise be provided pursuant to this Agreement during the six-month

period immediately following Employee’s separation from service that constitute Nonqualified Deferred Compensation will instead

be paid or made available on the earlier of (i) the first business day of the seventh month following the date of Employee’s separation

from service and (ii) Employee’s death. Notwithstanding anything in this Agreement to the contrary, distributions upon termination

of Employee’s employment shall be interpreted to mean Employee’s “separation from service” with the Company (as

determined in accordance with Section 409A of the Code and the regulations adopted thereunder). Each payment under this Agreement

shall be regarded as a “separate payment” and not of a series of payments for purposes of Section 409A of the Code.

12.3 Except as otherwise

specifically provided in this Agreement, if any reimbursement to which the Employee is entitled under this Agreement would constitute

deferred compensation subject to Section 409A of the Code, the following additional rules shall apply: (i) the reimbursable

expense must have been incurred, except as otherwise expressly provided in this Agreement, during the term of this Agreement; (ii) the

amount of expenses eligible for reimbursement during any taxable year will not affect the amount of expenses eligible for reimbursement

in any other taxable year; (iii) the reimbursement shall be made as soon as practicable after Employee’s submission of such

expenses in accordance with the Company’s policy, but in no event later than the last day of Employee’s taxable year following

the taxable year in which the expense was incurred; and (iv) the Employee’s entitlement to reimbursement shall not be subject

to liquidation or exchange for another benefit.

ARTICLE

XIII

ARBITRATION AND INDEMNIFICATION

13.1

Any controversy, dispute or claim arising out of or relating to this Agreement or breach thereof, with the sole exception of any

claim, breach, or violation arising under Articles VI or VII hereof, shall be shall first be settled through good faith negotiation.

If the dispute cannot be settled through negotiation, the parties agree to attempt in good faith to settle the dispute by mediation administered

by JAMS. If the parties are unsuccessful at resolving the dispute through mediation, the parties agree to final and binding arbitration

before a three- member arbitration panel in the State of New York, Kings County, in accordance with the Rules of the American Arbitration

Association then in effect. The arbitrators shall be selected by the Association and each shall be an attorney-at-law experienced in the

field of corporate and/or employment law. However, the parties explicitly agree to appellate review of any such award by a court of competent

jurisdiction. Thus, any arbitration award may be entered in any court of competent jurisdiction in the State of New York, Kings County,

provided that in the event that a party moves to confirm or vacate the arbitration award, the parties agree that the applicable standard

of review shall be de novo.

13.2

The Company hereby agrees to indemnify, defend, and hold harmless the Employee for any and all claims arising from or related to

his employment by the Company at any time asserted, at any place asserted, to the fullest extent permitted by law, except for claims based

on Employee’s fraud, deceit or willfulness. The Company shall maintain such insurance as is necessary and reasonable to protect

the Employee from any and all claims arising from or in connection with his employment by the Company during the term of Employee’s

employment with the Company and for a period of six (6) years after the date of termination of employment for any reason. The provisions

of this Section 13.2 are in addition to and not in lieu of any indemnification, defense or other benefit to which Employee may

be entitled by statute, regulation, common law or otherwise.

ARTICLE

XIV

SEVERABILITY

14.1

If any provision of this Agreement shall be held invalid and unenforceable, the remainder of this Agreement shall remain in full

force and effect. If any provision is held invalid or unenforceable with respect to particular circumstances, it shall remain in full

force and effect in all other circumstances.

ARTICLE

XV

NOTICE

15.1 For

the purposes of this Agreement, notices and all other communications provided for in the Agreement shall be in writing and shall be deemed

to have been duly given when: (a) personally delivered; or (b) sent by: (i) a nationally recognized overnight courier service; or (ii)

certified mail, return receipt requested, postage prepaid and in each case addressed to the respective addresses as set forth below or

to any such other address as the party to receive the notice shall advise by due notice given in accordance with this paragraph. All notices

and communications shall be deemed to have been received on: (A) if delivered by personal service, the date of delivery thereof; (B) if

delivered by a nationally recognized overnight courier service, on the first business day following deposit with such courier service;

or (C) on the third business day after the mailing thereof via certified mail. Notwithstanding the foregoing, any notice of change of

address shall be effective only upon receipt.

The current addresses of the

parties are as follows:

| |

IF

TO THE COMPANY: |

IEH

Corporation |

| |

|

140

58th Street |

| |

|

Suite

8E |

| |

|

Brooklyn,

New York 11120 |

| |

|

Attention:

Chief Financial Officer |

| |

|

|

| |

WITH

A COPY TO: |

Steven

L. Glauberman, Esq. |

| |

|

Becker

New York, P.C. |

| |

|

45

Broadway, 17th Floor |

| |

|

New

York, New York 10006 |

| |

|

|

| |

IF

TO THE EMPLOYEE: |

David

Offerman |

| |

|

17

Mohawk Trail |

| |

|

Westfield,

NJ 07090 |

ARTICLE

XVI

BENEFIT

16.1

This Agreement shall inure to, and shall be binding upon, the parties hereto, the successors and assigns of the Company, and the

heirs and personal representatives of the Employee. The respective rights and obligations of the parties hereunder shall survive any termination

of this Agreement to the extent necessary to the intended preservation of such rights and obligations.

ARTICLE

XVII

AMENDMENTS AND WAIVERS

17.1

No supplement, modification, amendment or waiver of the terms of this Agreement shall be binding on the parties hereto unless executed

in writing by the parties to this Agreement. No waiver of any of the provisions of this Agreement shall be deemed to or shall constitute

a waiver of any other provisions hereof (whether or not similar), nor shall such waiver constitute a continuing waiver unless otherwise

expressly provided. Any failure to insist upon strict compliance with any of the terms and conditions of this Agreement shall not be deemed

a waiver of any such terms or conditions and the waiver by either party of any breach or violation of any provision of this Agreement

shall not operate or be construed as a waiver of any subsequent breach of construction and validity.

ARTICLE

XVIII

GOVERNING LAW

18.1 This

Agreement has been negotiated and executed in the State of New York which shall govern its construction, validity and enforceability.

ARTICLE

XIX

JURISDICTION

19.1

Any or all actions or proceedings which may be brought by the Company or Employee under this Agreement shall be brought in courts

having a situs within the State of New York, and Employee and the Company each hereby consent to the jurisdiction of any local, state,

or federal court located within the State of New York.

ARTICLE

XX

ENTIRE AGREEMENT

20.1

This Agreement sets forth the entire agreement between the parties and supersedes all prior agreements, letters and understandings

between the parties, whether oral or written prior to the Effective Date of this Agreement, except for the terms of employee stock option

plans, restricted stock grants and option certificates (unless otherwise expressly stated herein).

ARTICLE

XXI

INTERPRETATION AND INDEPENDENT REPRESENTATION

21.1 The

parties agree that they have both had the opportunity to review and negotiate this Agreement, and that any inconsistency or dispute related

to the interpretation of any of the provisions of this Agreement shall not be construed against either party. The headings used in this

Agreement are for convenience only and are not to be considered in construing or interpreting this Agreement. The Employee has been advised

and had the opportunity to consult with an attorney or other advisor prior to executing this agreement. The Employee understands, confirms

and agrees that counsel to the Company (Becker New York, P.C.) has not acted and is not acting as counsel to the Employee and that Employee

has not relied upon any legal advice except as provided by its own counsel.

ARTICLE XXII

EXECUTION

22.1 This

Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party, it being understood that

both parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission or by e-mail delivery

of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose

behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page was an original

thereof.

IN WITNESS WHEREOF, the parties hereto have

executed this Agreement and affixed their hands and seals the day and year first above written.

| |

IEH

CORPORATION |

| |

|

| |

By: |

/s/

Subrata Purkayastha |

| |

|

Subrata

Purkayastha |

| |

|

Chief

Financial Officer |

| |

|

| |

EMPLOYEE |

| |

|

| |

/s/

David Offerman |

| |

David

Offerman |

| |

Employee |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

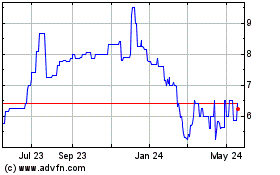

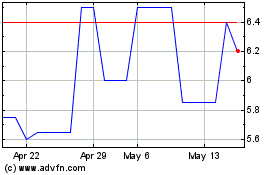

IEH (PK) (USOTC:IEHC)

Historical Stock Chart

From Jan 2025 to Feb 2025

IEH (PK) (USOTC:IEHC)

Historical Stock Chart

From Feb 2024 to Feb 2025