WINDSOR, ON / ACCESSWIRE / APRIL 22, 2015 / The

Wealthy Venture Capitalist, an investment newsletter focused on

showing everyday investors new opportunities in rapidly growing,

little known stocks, would like to discuss a new and exciting

company in the natural resource and mining space: KAT Exploration

Inc. (PINKSHEETS:KATX).

Of all the base metals, copper has to be the most

underappreciated and unsung. Yet historically, and in a very

real-world sense of application, copper has proved its worth. Gold

and silver has its place for sure, but as a chief component, copper

has by far the most diversified application and reach of all the

base metals.

As stated in an "Admiral Metals" article, "Copper has long been

considered a leading indicator of global economic health. More than

any other base metal, copper is tied closely to manufacturing,

electrical engineering, industrial production, information

technology, construction, and the medical sector. In general,

rising copper prices have indicated strong demand and global

economic strength; lower prices, a weaker economy. Historically,

the price of copper has been strongly correlated with the price of

gold, the Chinese economy, world trade, and most consistently, with

the price of oil."

Kat Exploration Inc. (KATX) is an explorer and

developer of mineral properties in Canada with a focus on precious

metals and the company just this year announced the staking of two

new copper discoveries "Deer Harbour and the

Hodderville" copper projects in the eastern portion of the

province. The find is important for several reasons but there's a

nuanced understanding that has to be made for investors to really

unlock the opportunity inherent in companies like Kat Exploration

Inc.

It all lies in the way copper is distributed and used.

The real secret to copper is its very high thermal and

electrical conductivity. This means it is used extensively to

conduct heat and electricity, and it is a major source of building

material. The prevailing price of copper belies its real-world

importance and few investors would know for instance that it takes

around 23 kg of copper to make a car. Or that it takes around 181

kg of copper to build a house.

Name it and copper is a key part of that thing's DNA. Everything

from piping, shipbuilding, roofing, tiling and everyday consumer

products has some element of copper.

Investors have not had a full education of the red metal, due

largely in part to its shinier cousins (gold and silver). As a

result, only a true historical understanding of copper prices can

shine the light on the opportunity.

The price of copper was below $1 for much of the late 1990s and

only breached the $4 per pound mark in the second half of 2006.

Since then copper has been on a roller-coaster ride but a lateral

look at copper's ups and downs offers the insight that could be

worth a lot of investor profits.

Copper rises and falls with the global economy and its symbiotic

ties with the housing and automobile industries is a key marker for

any short term or long term investing strategy.

Both the housing and automobile industry has been experiencing a

renaissance since the downturn of the global economy started in

2008. Early reports in 2015 pointed to a slow, but steady growth in

house prices and the automobile industry had its biggest year in

2014 since 1996.

The strong outlook for both industries outlined above means any

current pricing outlook for copper has to be viewed through a very

finely-calibrated lens. This is the nuanced hole that many

investors will fall through as copper again takes center stage.

What cues should the smart investor be looking at?

Copper discoveries remains the single biggest factor for gauging

growth potential of any mining or exploration company that looks

like a bet – even in the slightest.

Kat Exploration's latest discovery is therefore an important

variable in the mix of things. The company's recent discovery of

the Hodderville Copper property on the Bonavista Peninsula

is comprised of 180 claims totaling 11,000 acres.

What's even more important from a practical perspective is that

Kat Exploration's claims have been staked through months of due

diligence. The company confirmed that since late summer of 2014,

its field crews has been doing extensive foot work to grab samples

from outcrop and float rocks over an extended area.

Kat Exploration's deep-level sampling has for the first time

provided evidence of native copper in the discovery belt known as

the Rocky Harbor group. The company believes that the definitive

evidence of native copper in the area which is accompanied by a

13KM NE/SW fault zone is a strong indicator of a possible feeder

zone for other copper discoveries.

More importantly, Kat Exploration is confirming that assay

results from the old field's pit ran as high as 2.5% Cu – an

important factor when it comes to drilling in the newly staked

area.

Looking at the global picture for copper, investors would be

wise to keep their eyes and ears on the ground. The recent downturn

of copper prices in recent months has caused a stir among some

analysts but the world's biggest suppliers of the red metal

continue to be very bullish. These suppliers believe that strong

demand from BRIC nations will continue to fuel demand for copper,

rendering Wall Street's estimates null and void.

In the grand scheme of things, it is starting to look like

copper may end up saving the mining industry after all. Of course

companies like Golden Star Resources, Ltd. (NYSE MKT:

GSS) continue to play a supporting role. The company in an

updated listing of its mineral reserves confirmed proven and

probable mineral reserves at 1.9 million ounces of Gold. Golden

star also confirmed that total measured and indicated mineral

resources increased 5% to 6.6 million ounces. A gold price

assumption of $1,400 per ounce was used.

Asanko Gold Inc. (NYSE MKT: AKG), another

mining company playing its part in keeping mining alive, was

recently tipped as a "better-ranked" stock in the mining space.

Asanko has seen its valuation rise after hitting a bottom of 1.25

in the last year. The strong resurgence back to around 1.48 is a

proving to be a strong draw for analysts who have some faith in the

long term prospects for gold.

McEwen Mining Inc. (NYSE: MUX) is also

strengthening its position on Wall Street's radar. The company's

exploration budget for Mexico is now set at $5.5 million and an

update has been issued on its El Gallo 1 gold mine. McEwen has

confirmed drill results which it expects will improve the life of

El Gallo 1 which has since been slated for an updated resource

estimate in Q3 2015.

Can it get better? Yesterday Kat Exploration Inc. announced the

purchase of RED HILL mines in Lordsburg, New Mexico. By the

company's own account, this is an investment into a potentially

enormous deposit of both silver and gold, indicated by the survey

analysis and preliminary vein deposits. The company will be further

exploring the mining district by engaging a geological firm to

carry out a comprehensive and thorough survey of the tailings to

closely determine the true size (tonnage) along with significant

sampling.

Gold and silver will continue to tease investors but the smart

money will also be on copper. Companies like Kat Exploration Inc.

will therefore continue to present themselves as attractive, smart

and relevant investment alternatives.

TO GET BREAKING NEWS FROM US:

Like us on Facebook: www.facebook.com/WealthyVC

Join our Facebook group:

www.facebook.com/groups/TheWealthyVentureCapitalist

Follow us on Twitter: www.twitter.com/Wealthy_VC

FOR FURTHER INFORMATION PLEASE CONTACT US

AT:

Toll Free: 1 (855) - 228-7336

Email: TheWealthyVentureCapitalist@Gmail.com

-------------------------------------------

This report/release/profile is a commercial

advertisement and is for general information purposes only. We are

engaged in the business of marketing and advertising companies

for monetary compensation unless

otherwise stated below.

The Wealthy Venture Capitalist and its employees are not a

Registered Investment Advisors, Broker Dealers or a member of any

association for other research providers in any jurisdiction

whatsoever and we are not qualified to give financial advice.

The information contained herein is based on sources which we

believe to be reliable but is not guaranteed by us as being

accurate and does not purport to be a complete statement or summary

of the available data. The Wealthy Venture Capitalist encourages

readers and investors to supplement the information in these

reports with independent research and other professional advice.

All information on featured companies is provided by the companies

profiled through their website, news releases, and corporate

filings, or is available from public sources and The Wealthy

Venture Capitalist makes no representations, warranties or

guarantees as to the accuracy or completeness of the disclosure by

the profiled companies. Further, The Wealthy Venture Capitalist has

no advance knowledge of any future events of the profiled companies

which includes, but is not limited to, news & press releases,

changes in corporate structure, or changes in share structure.

Our website and newsletter are for Entertainment purposes only.

This newsletter is NOT a source of unbiased information. Never

invest in any stock featured on our site or emails unless you can

afford to lose your entire investment.

Release of Liability:

Through use of this email and/or website advertisement viewing

or using you agree to hold The Wealthy Venture Capitalist, its

operators owners and employees harmless and to completely release

them from any and all liability due to any and all loss (monetary

or otherwise), damage (monetary or otherwise), or injury (monetary

or otherwise) that you may incur. The Wealthy Venture Capitalist

sponsored advertisements do not purport to provide an analysis of

any company's financial position, operations or prospects and this

is not to be construed as a recommendation by The Wealthy Venture

Capitalist or an offer or solicitation to buy or sell any

security.

Compensation:

The Wealthy Venture Capitalist has been compensated twenty four

thousand dollars cash via bank wire by KAT Exploration Inc.

(OTC:KATX) for a 1 month Investor Relations Contract. The Wealthy

Venture Capitalist does not own any shares of KATX. This

compensation constitutes a conflict of interest as to our ability

to remain objective in our communication regarding the profiled

company.

None of the materials or advertisements herein constitute offers

or solicitations to purchase or sell securities of the companies

profiled herein and any decision to invest in any such company or

other financial decisions should not be made based upon the

information provide herein. Instead The Wealthy Venture Capitalist

strongly urges you conduct a complete and independent investigation

of the respective companies and consideration of all pertinent

risks. Readers are advised to review SEC periodic reports: Forms

10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

The Wealthy Venture Capitalist further urges you to consult your

own independent tax, business, financial and investment advisors.

Investing in micro-cap and growth securities is highly speculative

and carries and extremely high degree of risk. It is possible that

an investor's investment may be lost or impaired due to the

speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides

investors a 'safe harbor' in regard to forward-looking statements.

Any statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives,

goals, assumptions or future events or performance are not

statements of historical fact may be "forward looking statements."

Forward looking statements are based on expectations, estimates,

and projections at the time the statements are made that involve a

number of risks and uncertainties which could cause actual results

or events to differ materially from those presently anticipated.

Forward looking statements in this action may be identified through

use of words such as "projects," "foresee," "expects," "will,"

"anticipates," "estimates," "believes," "understands," or that by

statements indicating certain actions "may," "could," or "might"

occur. Understand there is no guarantee past performance will be

indicative of future results. Past Performance is based on the

security's previous day closing price and the high of day price

during our promotional coverage.

In preparing this publication, The Wealthy Venture Capitalist

has relied upon information supplied by various public sources and

press releases which it believes to be reliable; however, such

reliability cannot be guaranteed. Investors should not rely on the

information contained in this email and website. Rather, investors

should use the information contained in this website as a starting

point for doing additional independent research on the featured

companies. The advertisements in this email and website are

believed to be reliable, however, The Wealthy Venture Capitalist

and its owners, affiliates, subsidiaries, officers, directors,

representatives and agents disclaim any liability as to the

completeness or accuracy of the information contained in any

advertisement and for any omissions of materials facts from such

advertisement. The Wealthy Venture Capitalist is not responsible

for any claims made by the companies advertised herein, nor is The

Wealthy Venture Capitalist responsible for any other promotional

firm, its program or its structure.

SOURCE: KAT Exploration Inc.

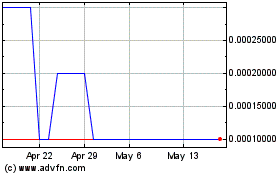

KAT Exploration (PK) (USOTC:KATX)

Historical Stock Chart

From Jan 2025 to Feb 2025

KAT Exploration (PK) (USOTC:KATX)

Historical Stock Chart

From Feb 2024 to Feb 2025