Logitech Announces Plans for $250M in Dividends Over Three Years

11 March 2015 - 3:30PM

Business Wire

Company Reiterates FY 2015 Outlook and

Long-Term Business Model; Provides FY 2016 Outlook at Analyst &

Investor Day in Zurich

Prior to a meeting today with financial analysts and investors

in Zurich, Logitech International (SIX:LOGN) (Nasdaq:LOGI)

announced:

- Full-year FY 2015 financial outlook of

$2.11 billion in sales and $185 million in non-GAAP operating

income.

- Full-year financial outlook for FY 2016

of $2.15 billion in sales (+2% year-over-year, +6% year-over-year

in constant currency) and $150 million in non-GAAP operating

income.

- A plan for returning up to $500 million

in cash to shareholders over a three year period featuring an

enhanced dividend plan of $250 million to complement the existing

Board-approved $250 million share buyback program.

“I’m very pleased that our profitability turnaround is on track

thanks to higher gross margins and disciplined spending,” said

Bracken Darrell, Logitech president and chief executive officer.

“While the strength of the U.S. dollar will have a significant

impact on our financial results moving forward, the underlying

fundamentals of our business are positive and we are projecting

solid sales growth in FY 2016 in constant currency. We are also

taking a number of actions in anticipation of a stronger dollar

moving forward, including pricing adjustments and the further

reduction of our global cost structure.

“Given our confidence in our ability to generate cash as we

continue to make progress towards achieving the sales and

profitability targets in our long-term business model, we are also

introducing a refined three-year capital allocation plan that

includes returning up to half a billion dollars to shareholders

through dividends and share buybacks.”

The Board of Directors plans to request shareholder approval of

the Swiss franc equivalent of an $85 million dividend for FY 2015

at Logitech’s next annual general meeting. Based on current

exchange rates and the current number of shares outstanding, this

represents approximately CHF 0.52 per share, double last year’s

dividend of CHF 0.26 per share.

The Company's Analyst and Investor Day will be held today at

9:00 a.m. Central European Time. A live webcast and replay of the

meeting will be available on the Logitech corporate Web site at

http://ir.logitech.com.

Use of Non-GAAP Financial Information

To facilitate comparisons to Logitech's historical results,

Logitech has included non-GAAP adjusted measures, which exclude

primarily share-based compensation expense, amortization of other

intangible assets, restructuring charges (credits), other

restructuring-related charges, investment impairment (recovery),

benefit from (provision for) income taxes, and one-time special

charges. Logitech also presents percentage sales growth in constant

currency, a non-GAAP measure, to show performance unaffected by

fluctuations in currency exchange rates. Percentage sales growth in

constant currency is calculated by translating prior period sales

in each local currency at the current period’s average exchange

rate for that currency and comparing that to current period sales.

Most of these excluded amounts pertain to events that have not yet

occurred and are not currently possible to estimate with a

reasonable degree of accuracy. Therefore, no reconciliation to GAAP

amounts has been provided. Nevertheless, Logitech believes this

information will help investors to evaluate its current period

performance, outlook and trends in its business.

About Logitech

Logitech is a world leader in products that connect people to

the digital experiences they care about. Spanning multiple

computing, communication and entertainment platforms, Logitech's

combined hardware and software enable or enhance digital

navigation, music and video entertainment, gaming, social

networking, audio and video communication over the Internet, video

security and home-entertainment control. Founded in 1981, Logitech

International is a Swiss public company listed on the SIX Swiss

Exchange (LOGN) and on the Nasdaq Global Select Market (LOGI).

This press release contains forward-looking statements within

the meaning of the federal securities laws, including, without

limitation, statements regarding: the Company's turnaround,

forecasts of fiscal year 2015 and fiscal year 2016 financial

results and sales growth, currency exchange rates, cash flow,

capital allocation plan, dividends, share repurchases, product

pricing and Logitech’s ability to affect product pricing, cost

reductions and their impact on profitability, and long-term

business model. The forward-looking statements in this release

involve risks and uncertainties that could cause Logitech's actual

results and events to differ materially from those anticipated in

these forward-looking statements, including, without limitation: if

our product offerings, marketing activities and investment

prioritization decisions do not result in the sales, profitability

or profitability growth we expect, or when we expect it; the demand

of our customers and our consumers for our products and our ability

to accurately forecast it; if we fail to innovate and develop new

products in a timely and cost-effective manner for our new and

existing product categories; if we do not successfully execute on

our growth opportunities in our new product categories or our

growth opportunities are more limited than we expect; if sales of

PC peripherals are less than we expect; the effect of pricing,

product, marketing and other initiatives by our competitors, and

our reaction to them, on our sales, gross margins and

profitability; if our products and marketing strategies fail to

separate our products from competitors’ products; if we do not

fully realize our goals to lower our costs and improve our

operating leverage; if there is a deterioration of business and

economic conditions in one or more of our sales regions or

operating segments, or significant fluctuations in exchange rates;

the effect of changes to our effective income tax rates. A detailed

discussion of these and other risks and uncertainties that could

cause actual results and events to differ materially from such

forward-looking statements is included in Logitech's periodic

filings with the Securities and Exchange Commission, including our

Quarterly Report on Form 10-Q for the fiscal quarter ended December

31, 2014 and our Annual Report on Form 10-K for the fiscal year

ended March 31, 2014, available at www.sec.gov, under the caption

Risk Factors and elsewhere. Logitech does not undertake any

obligation to update any forward-looking statements to reflect new

information or events or circumstances occurring after the date of

this press release.

Logitech, the Logitech logo, and other Logitech marks are

registered in Switzerland and other countries. All other trademarks

are the property of their respective owners. For more information

about Logitech and its products, visit the company's Web site at

www.logitech.com.

(LOGIIR)

Logitech InternationalJoe GreenhalghVice President, Investor

Relations – USA510-713-4430orKrista ToddSr. Director,

Communications – USA510-713-5834orBen StarkieCorporate

Communications – Europe+41-(0) 79-292-3499

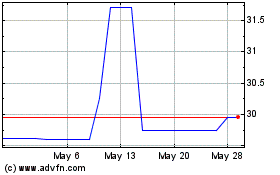

Logansport Financial (QB) (USOTC:LOGN)

Historical Stock Chart

From Jan 2025 to Feb 2025

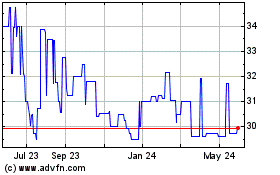

Logansport Financial (QB) (USOTC:LOGN)

Historical Stock Chart

From Feb 2024 to Feb 2025