- Current report filing (8-K)

28 July 2010 - 8:04PM

Edgar (US Regulatory)

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of Report (Date of earliest event reported)

|

July 26, 2010

|

|

Laredo Oil, Inc.

|

|

(Exact Name of Registrant as Specified in Charter)

Delaware

|

|

(State or Other Jurisdiction of Incorporation)

|

|

333-153168

|

|

26-2435874

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2203 Townes Lane

Austin, Texas

|

78703

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code

|

(214) 296-4464

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On July 26, 2010, Laredo Oil, Inc. “the Company” entered into a Stock Purchase Agreement with Seaside 88, LP and Sutter Securities Incorporated (the “Purchase Agreement”) for the private placement of 1,000,000 shares of its common stock and warrants to purchase 750,000 shares of its common stock to Seaside 88, LP for an aggregate purchase price of $500,000, or $0.50 per share. The transactions contemplated by the agreement closed on July 27, 2010. Sutter Securities Incorporated received 225,000 warrants, with substantially the same terms as those warrants received by Seaside 88, LP, as compensation for its services as the placement agent in connection with this transaction. The warrants are immediately exercisable following issuance, have a term of exercise of 5 years and an exercise price of $0.50 per share. The shares of common stock offered in the private placement and the shares issuable upon exercise of the warrants have piggy-back registration rights if the Company elects to file a registration statement in the future, subject to customary underwriter cut-backs. The shares are price protected in the event the Company issues common stock to another investor at a price below $0.50 per share, until the Company raises additional financing of at least $500,000. Moreover, should the Company fail to raise $5,000,000 in equity within six months from the closing date, another one million shares will be issued to the investor and the warrant exercise price will be adjusted to $0.25 per share for all warrants issued in connection with this financing.

This foregoing description of the terms of the Purchase Agreement and warrants does not purport to be complete and is qualified in its entirety by the terms and conditions of the Purchase Agreement attached hereto as Exhibit 10.1 and the Common Stock Purchase Warrant attached hereto as Exhibit 10.2, incorporated by reference herein.

Item 3.02. Unregistered Sales of Equity Securities

The information set forth in Item 1.01 of this report on Form 8-K is hereby incorporated by reference into this Item 3.02 in its entirety. The common stock and the warrants were offered and sold without registration under the Securities Act of 1933, as amended, or any state securities laws. The Company is relying on the exemption from the registration requirements of the Securities Act afforded by Section 4(2) thereof and Rule 506 of Regulation D promulgated thereunder. The Current Report on Form 8-K is not an offer to sell or the solicitation to buy the shares of common stock or warrants.

Item 8.01. Other Events.

On July 27, 2010, the Company issued a press release announcing the execution of the Purchase Agreement. A copy of this release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

LAREDO OIL, INC.

|

|

|

|

|

|

|

|

Date: July 27, 2010

|

By:

|

/s/ Bradley E. Sparks

|

|

|

|

|

Bradley E. Sparks

|

|

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

10.1

|

Securities

Purchase Agreement

, dated as of July 26, 2010, among Laredo Oil, Inc. and each purchaser identified on the signature pages thereto.

|

|

10.

2

|

Form of Common Stock Purchase Warrant.

|

|

99.1

|

Press Release dated July 27, 2010 announcing Private Placement of Equity.

|

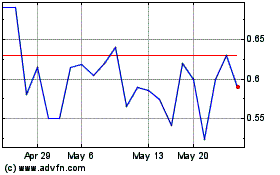

Laredo Oil (PK) (USOTC:LRDC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Laredo Oil (PK) (USOTC:LRDC)

Historical Stock Chart

From Jul 2023 to Jul 2024