UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(Rule

14c-101)

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

(Amendment

No. )

|

Filed

by the Registrant ☒

|

Filed

by a Party other than the Registrant ☐

|

Check

the appropriate box:

|

☐

|

Preliminary

Information Statement

|

|

|

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

☒

|

Definitive

Information Statement

|

MADISON

TECHNOLOGIES, INC.

(Name

of Registrant as Specified in its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No

fee required.

|

|

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transactions applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transactions applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transactions computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transactions:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a) (2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

MADISON

TECHNOLOGIES, INC.

450

Park Avenue, 30th Floor

New

York, NY 10022

NOTICE

OF ACTION TO BE TAKEN WITHOUT A MEETING

To

our Stockholders:

The

purpose of this Information Statement is to notify our stockholders that on August 23, 2021, the Board of Directors (the “Board”)

of Madison Technologies, Inc., a Nevada corporation (the “Company” “we,” “us”

or “our”), and the holders of at least a majority of our outstanding voting powe, voting together as a single class

in accordance with their respective voting rights (the “Majority Stockholders”), each adopted resolutions by written

consent, to approve an amendment to our articles of incorporation, as amended (as amended, the “Articles of Incorporation”)

to effect a reverse stock split (the “Reverse Split”) of our common stock at a ratio of 1-for-25 (the “Action”).

The Reverse Split will be effected by filing a Certificate of Change to the Articles of Incorporation (the “Amendment”)

with the Secretary of State of the State of Nevada.

The

enclosed Information Statement is being furnished to holders of shares of our common stock and outstanding shares of preferred stock

(“Preferred Stock”), as of the close of business on August 23, 2021 (the “Record Date”).

The

enclosed Information Statement is being furnished to you to inform you that the Action has been approved by the stockholders holding

a majority of voting power with respect to the Action and the approval of the Action will become effective 20 days after the mailing

of this information statement when we file the Amendment with the Secretary of State of the State of Nevada. For the avoidance of doubt,

the Amendment will not be filed with the Secretary of State of the State of Nevada on a date that is earlier than 20 days after this

Information Statement is first mailed to our stockholders. Additionally, the Reverse Split is subject to FINRA approval, of which there

are no assurances when and if FINRA will provide such approval.

This

Information Statement also constitutes notice under the Nevada Revised Statutes that the Action was approved by the written consent of

the Majority Stockholders. The Board is not soliciting your proxy in connection with the adoption of these resolutions and proxies are

not requested from stockholders. You are urged to read the Information Statement in its entirety for a description of the Action taken

by the Majority Stockholders.

The

enclosed Information Statement will be mailed on or about November 23, 2021 to stockholders of record on the Record Date.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. NO VOTE OR OTHER ACTIONS OF THE COMPANY’S STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

|

|

By

Order of the Board of Directors,

|

|

|

|

|

|

/s/

Philip A. Falcone

|

|

|

Philip

A. Falcone

|

|

|

Chief

Executive Officer

|

|

|

November

18 , 2021

|

MADISON

TECHNOLOGIES, INC.

450

Park Avenue, 30th Floor

New

York, NY 10022

INFORMATION

STATEMENT PURSUANT TO SECTION 14(C)

OF

THE SECURITIES EXCHANGE ACT OF 1934

This

Information Statement is to notify our stockholders that on August 23, 2021, the Board of Directors (the “Board”)

of Madison Technologies, Inc., a Nevada corporation (the “Company” “we,” “us”

or “our”), and the holders of at least a majority of our outstanding voting power, voting together as a single class

in accordance with their respective voting rights (the “Majority Stockholders”), each adopted resolutions by written

consent, to approve an amendment to our articles of incorporation, as amended (as amended, the “Articles of Incorporation”)

to effect a reverse stock split (the “Reverse Split”) of our common stock at a ratio of 1-for-25 (the “Actions”).

The Reverse Split will be effected by filing a Certificate of Change to the Articles of Incorporation (the “Amendment”)

with the Secretary of State of the State of Nevada.

The

enclosed Information Statement is being furnished to holders of shares of our common stock as of the close of business on August 23,

2021, the record date set in connection with this Information Statement (the “Record Date”), pursuant to the Nevada

Revised Statutes (the “NRS”) and our Bylaws (the “Bylaws”).

Vote

Required

Under

Nevada law, our Certificate of Incorporation and Bylaws, approval of stockholders holding shares representing no less than the majority

of voting power with respect to the Actions (inclusive of holders of outstanding shares of common stock entitled to vote, or outstanding

shares of Preferred Stock entitled to vote on an as converted basis or otherwise, voting together as a single class) is entitled to approve

the Action.

As

of the Record Date, our authorized capitalization consisted of 500,000,000 shares of Common Stock, of which 23,472,565 shares of Common

Stock were issued and outstanding, 50,000,000 shares of preferred stock, par value $0.001 per share, of which 236,600 are issued and

outstanding. Of the Preferred Stock that is outstanding, 100,000 shares have been designated as Series A Convertible Preferred Stock,

of which 0 shares of Series A Convertible Preferred Stock were issued and outstanding, 100 shares has been designated as Series B Preferred

Stock, of which 100 shares of Series B Preferred Stock were issued and outstanding, 10,000 shares have been designated as Series C Convertible

Preferred Stock, of which 0 shares of Series C Convertible Preferred Stock were issued and outstanding, 230,000 shares has been designated

as Series D Preferred Stock, of which 230,000 shares of Series D Preferred Stock were issued and outstanding,1,000 shares have been designated

as Series E Convertible Preferred Stock, of which 1,000 shares of Series E Convertible Preferred Stock were issued and outstanding, 1,000

shares has been designated as Series F Preferred Stock, of which 1,000 shares of Series F Preferred Stock were issued and outstanding,

and 4,600 shares has been designated as Series G Preferred Stock, of which 4,600 shares of Series G Preferred Stock were issued and outstanding.

Holders

of our common stock are entitled to one vote for each share on all matters to be voted on by our shareholders. Holders of our common

stock have no cumulative voting rights. They are entitled to share ratably in any dividends that may be declared from time to time by

the Board of Directors in its discretion from funds legally available for dividends. Holders of our common stock have no preemptive rights

to purchase our common stock.

Our

Series B Preferred Stock has the right to vote together with the holders of the Common Stock, as a single class, upon all matters submitted

to holders of Common Stock for a vote. The shares of Series B Preferred Stock will carry a number of votes equal to 51% (representing

majority voting power) of all voting shares of every class, including 51% of all of the issued and outstanding shares of common stock

on the date of any shareholder vote, such that the holders of Series B Preferred Stock shall always possess the majority of voting rights,

and shall always out vote all holders of Common Stock. Holders of our Series D Preferred Stock and Series F Preferred Stock do not have

voting rights. Holders of our Series E Preferred Stock and Series G Preferred Stock vote on an as converted basis.

The

FFO I Trust, the holder of 100 shares of Series B Preferred Stock and 400 shares of Series E Convertible Preferred Stock, the FFO II

Trust, the holder of 400 shares of Series E Convertible Preferred Stock, KORR Value, LP, the holder of 200 shares of Series E Convertible

Preferred Stock, and Jeff Canouse, the holder of 6,177,000 shares of common stock, held the authority to votes cast, which constitute

in excess of fifty percent (50%) of the Company’s outstanding voting power and have voted in favor of the proposals herein.

Effective

Date of Actions by Written Consent of Majority Stockholders

Pursuant

to Rule 14c-2 promulgated under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), the earliest

date that the corporate Actions being taken pursuant to the written consent of the Majority Stockholders can become effective is 20 days

after the first mailing or other delivery of this Information Statement. After the foregoing 20-day period, we plan to file the Amendment

with the Secretary of State of the State of Nevada, which filing will result in the Reverse Split becoming effective. Additionally, the

Reverse Split is subject to FINRA approval, of which there are no assurances when and if FINRA will provide such approval. We recommend

that you read this Information Statement in its entirety for a full description of the Action.

No

Appraisal Rights

Neither

Nevada law, including the NRS, nor our Articles of Incorporation provide for dissenter’s rights of appraisal, and the Company will

not independently provide our stockholders with any such rights, in connection with Actions discussed in this Information Statement.

Interests

of Certain Persons

No

person who has been a director or officer of the Company at any time since the beginning of the last fiscal year has any substantial

interest, direct or indirect, in any matter discussed in this Information Statement which differs from that of other stockholders of

the Company.

Costs

of the Information Statement

We

are mailing this Information Statement and will bear the costs associated therewith. We are not making any solicitations. We will request

brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners

of our common stock and Preferred Stock held of record by them, and will reimburse such persons for their reasonable charges and expenses

in connection therewith.

REVERSE

STOCK SPLIT

Our

Board and the Majority Stockholders approved the Reverse Split, which will be effected by filing the Amendment with the Secretary of

State of the State of Nevada substantially in the form set forth on Appendix A. Our Board is authorized to effect the Reverse

Split at a ratio of 1-for-25.

Our

Board reserves the right to elect to abandon the Reverse Split if it determines, in its sole discretion, that the Reverse Split is no

longer in the best interests of the Company and its stockholders.

Reasons

to Effect a Reverse Split

Our

common stock is currently quoted on the OTCQB Venture market, one of the OTC Markets Group over-the-counter markets, which is not a national

securities exchange. In connection with our financing activities, our Board intends to apply for the listing of our common stock on the

NASDAQ Stock Market (“NASDAQ”) or a similar national stock exchange. One of the key requirements for initial listing

on NASDAQ is that our common stock must meet certain minimum bid price requirements, which requirements our common stock currently does

not meet. The Reverse Split is intended, in part, to help the Company meet the minimum bid price requirements for a potential up-listing

on NASDAQ.

If

our common stock is listed on NASDAQ, the liquidity of our common stock and coverage of our company by security analysts and media could

be increased, which could result in higher prices for our common stock than might otherwise prevail while our common stock traded on

the OTCQB, lowered spreads between the bid and asked prices for our common stock and lower transaction costs inherent in trading such

shares. Additionally, certain investors will only purchase securities that are listed on a national securities exchange. As a result,

a listing on NASDAQ may increase our ability to raise funds through the issuance of our common stock or other securities convertible

into our common stock in the future from a larger pool of potential investors.

Although

we believe that the Reverse Split would, at least initially, allow us to meet minimum bid price requirements for initial listing on NASDAQ,

the effect of the Reverse Split on the price of our common stock cannot be predicted with any certainty, and the history of similar reverse

stock splits for companies in similar circumstances is varied. As a result, there can be no assurance that:

|

|

●

|

the

price of our common stock would rise in proportion to the reduction in the number of shares of our common stock outstanding following

the Reverse Split;

|

|

|

●

|

even

if the Reverse Split is initially successful in raising the price of our common stock, we would be successful in maintaining the

minimum bid price of our common stock above the levels needed to achieve, and maintain, listing on NASDAQ for any extended period

of time;

|

|

|

●

|

even

if the price of our common stock satisfies the minimum bid price requirements for initial listing on NASDAQ, that we would be able

to meet, or continue to meet, the other initial and continued listing standards for NASDAQ;

|

|

|

●

|

even

if we are able to meet all initial standards for NASDAQ that we will be approved for listing; or

|

|

|

●

|

if

we achieve listing of our common stock on NASDAQ, that our common stock would not be delisted by NASDAQ for failure to meet other

continued listing standards in the future.

|

Moreover,

while it is the current intent of our Board to apply for listing of our common stock on NASDAQ, there can be no assurance that the Board

will not later decide that pursuing such listing is not in the best interests of the Company and its stockholders.

Additionally,

even though a Reverse Split, by itself, would not impact the Company’s assets or prospects, the Reverse Split could be followed

by a decrease in the aggregate market value of our common stock. The price of our common stock will also continue be based also on other

factors that are unrelated to the number of shares outstanding, including our future performance.

Our

Board believes that a higher share price for our common stock could also help generate investor interest in the Company. At its currently

low price, our common stock may not appeal to brokerage firms that are reluctant to recommend lower priced securities to their clients,

and analysts at many such firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. Many investment

funds may also be reluctant to invest in lower priced stocks and some potential investors may be prohibited from investing “penny

stocks” (as discussed in more detail below). Investors may also be dissuaded from purchasing lower priced stocks because the brokerage

commissions, as a percentage of the total transaction, tend to be higher for such stocks. Furthermore, various regulations and policies

restrict the ability of stockholders to borrow against or “margin” low-priced stock and declines in the stock price below

certain levels may trigger unexpected margin calls.

Notwithstanding

the foregoing, the liquidity of our common stock may be adversely affected by the Reverse Split as a result of fewer shares of common

stock being outstanding after giving effect to the Reverse Split. However, the Board believes that the anticipated higher bid price will

reduce, to some extent, the negative effects on the liquidity and marketability of the common stock inherent in some of the policies

and practices of institutional investors and brokerage houses described above.

Our

common stock is also currently deemed to be a “penny stock” (as defined in Rule 3a51-1 under the Exchange Act) and subject

to the penny stock rules of the Exchange Act specified in rules 15g-1 through 15g-100. Such rules require broker-dealers, before effecting

transaction in a penny stock, to meet certain additional disclosure requirements to their customers. The additional burdens imposed upon

broker-dealers by such requirements can discourage broker-dealers from making a market, seeking or generating interest in our common

stock and otherwise effecting transaction in our common stock, which can limit the market liquidity of our common stock and the ability

of investors to trade our common stock.

Moreover,

The Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require a broker-dealer to have reasonable

grounds for believing that the investment is suitable for that customer before recommending an investment to a customer. Under interpretations

of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least

some customers. Thus, the FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common

stock, which may also limit which the market liquidity of our common stock and the ability of investors to trade our common stock.

If

we are able to increase the price of our common stock through implementation of the Reverse Split (and, subsequently, achieve listing

of our common stock on NASDAQ), our common stock may no longer be deemed a penny stock, or be considered speculatively low priced for

purposes of FINRA Rules, and the burdens and limitations described above may be lifted.

Potential

Effects of the Proposed Reverse Split

General

Upon

effectiveness of the Reverse Split, our outstanding common stock will be combined, such that every 25 shares of existing common stock

will be combined into one new share of common stock. As of the date of this Information Statement, the Company had 1,563,990,027 shares

of our common stock outstanding, against a total of 6,000,000,000 authorized shares. As a result, the Reverse Split, will decrease the

Company’s issued and outstanding shares of common stock to approximately 62.5 million shares (without giving effect to the treatment

of fractional shares).

Except

for adjustments that may result from the treatment of fractional shares as described below, each stockholder will hold the same percentage

of the Company’s issued and outstanding common stock immediately following the Reverse Split as such stockholder holds immediately

prior to the Reverse Split. The Reverse Split will affect all holders of our common stock uniformly and will not affect any stockholder’s

percentage ownership interest in the Company or proportionate voting power (subject to the treatment of fractional shares). The Amendment

will also not change the terms of our common stock or outstanding preferred stock, which will continue to have the same voting rights

and rights to dividends and distributions and will be identical in all other respects to the common stock currently outstanding. Our

common stock will also remain duly authorized, fully paid and non-assessable.

Impact

on Shares of Common Stock Available for Future Issuance

Currently,

we are authorized to issue up to 6,000,000,000 shares of common stock, of which 1,563,990,027 shares were outstanding as of the date

of the mailing of this Information Statement. In connection with the Reverse Split, our Board has determined to keep the total number

of authorized shares of common stock the same under our Articles of Incorporation after giving effect to the Reverse Split. As a result,

we will have the ability to issue a greater percentage of our common stock in relation to our outstanding shares after the Reverse Split

than we currently have.

The

additional shares of common stock authorized for issuance would have the same rights and privileges under our Articles of Incorporation

as the shares of common stock currently authorized for issuance. Holders of the Company’s common stock do not have preemptive rights

to subscribe for and purchase any new or additional issues of common stock or securities convertible into common stock.

Our

Board believes that the availability of additional authorized shares of common stock is in the best interests of the Company and its

stockholders and will provide us with additional flexibility, including having shares available for issuance for such corporate purposes

as the Board may determine in its discretion, including, without limitation:

|

|

●

|

exercise

or conversion of securities convertible into, or exercisable for, shares of common stock (including the outstanding Preferred Stock,

convertible notes and debentures, warrants, options and other convertible securities);

|

|

|

●

|

investment

opportunities;

|

|

|

●

|

stock

dividends or other distributions;

|

|

|

●

|

issuance

in connection with compensation arrangements, including pursuant to future equity compensation plans; and

|

|

|

●

|

future

financings and other corporate purposes.

|

Although

the Company is actively discussing financing alternatives which may result in the issuance of additional shares of common stock, the

Company has no such plans, proposals, or arrangements, written or otherwise, at this time to issue any of the newly available authorized

shares of common stock (except shares of common stock that may be issued upon conversion or exercise of outstanding Preferred Stock,

convertible notes and debentures, warrants, options and other convertible securities).

No

further stockholder approval is required to issue any additional shares of common stock. Any issuance of additional shares of common

stock could have the effect of diluting any future earnings per share and book value per share of the outstanding shares of our common

stock, and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to obtain control

of the Company.

Anti-Takeover

Effects

Although

not designed or intended for such purposes, the overall effect of keeping the number of our authorized shares of common stock the same

under our Certificate of Incorporation after giving effect to the Reverse Split could be to enable our Board to render more difficult

or discourage an attempt to obtain control of the Company that may be favored by a majority of stockholders and/or that may provide an

above market premium to our stockholders, since the additional shares could be issued to purchasers who support our Board and are opposed

to a takeover.

Our

Board’s determination to keep the number of our authorized shares of common stock the same under our Articles of Incorporation

after giving effect to the Reverse Split is not prompted by any specific effort or perceived threat of takeover. We are not currently

aware of any pending or proposed transaction involving a change of control. Nor is the change in authorized shares of common stock a

plan by the Board or management to adopt a series of amendments to the Company’s certificate of incorporation or Bylaws to institute

an anti-takeover provision. The Company does not have any plans or proposals to adopt other provisions or enter into other arrangements

that may have material anti-takeover consequences.

Potential

Odd Lots

The

Reverse Split could result in some stockholders holding less than 100 shares of common stock and as a consequence may incur greater costs

associated with selling such shares. Brokerage commissions and other costs of transaction in odd lots may be higher, particularly on

a per-share basis than the cost of transaction in even multiples of 100 shares.

Accounting

Matters

The

Reverse Split would not affect the par value of our common stock, which will remain $0.001 per share of common stock. As a result, upon

effectiveness of the Reverse Split, the stated capital on our balance sheet attributable to the common stock will be reduced in proportion

to the fractions by which the number of shares of common stock are reduced, and the additional paid-in capital account shall be credited

with the amount by which the stated capital is reduced. The per share net income or loss and net book value of our common stock will

be retroactively increased for each period because there will be fewer shares of our common stock outstanding.

No

Going Private Transactions

The

Reverse Split is not intended as a “going private transactions” within the meaning of Rule 13e-3 under the Exchange Act.

Effect

on Convertible Securities

Upon

effectiveness of the Reverse Split, all outstanding securities convertible and/or exercisable into shares of our common stock, including

any convertible notes, preferred stock and warrants (the “Common Stock Equivalents”) will be adjusted to reflect the

Reverse Split. The number of shares of common stock that the holders of Common Stock Equivalents may acquire upon the conversion and/or

exercise of their Common Stock Equivalents may decrease, and the conversion and/or exercise prices of such Common Stock Equivalents will

increase, in proportion to the fractions by which the number of shares of common stock underlying such Common Stock Equivalents are reduced

as a result of the Reverse Split, resulting in the same aggregate price being required to be paid as would have been paid immediately

preceding the Reverse Split.

Registration

and Trading of our Common Stock

Our

common stock is currently registered under Section 12(g) of the Exchange Act, and we are subject to periodic reporting and other requirements

of the Exchange Act. The Reverse Split will not affect the registration of our common stock under the Exchange Act or our obligation

to publicly file financial and other information with the Securities and Exchange Commission (the “SEC”). Our common

stock will begin trading on a post-split basis after the Effective Time (as defined below). We will announce the Effective Time and timing

for post-split trading to commence in a press release at the time of implementation. In connection with the Reverse Split, the Company’s

CUSIP number (which is an identifier used by participants in the securities industry to identify our common stock) will change to a number

that will also be announced in such press release.

Effectiveness

of Amendment

The

Reverse Split will be effective upon filing of the Amendment with the Secretary of State of the State of Nevada or such other time as

specified in such Amendment (the “Effective Time”) without any Actions on the part of our stockholders and without

regard to the date that any stock certificates representing the stock prior to the Reverse Split are physically surrendered. For the

avoidance of doubt, the Amendment will not be filed with the Secretary of State of the State of Nevada on a date that is earlier than

20 days after this Information Statement is first mailed to our stockholders. The Amendment will be in substantially the form attached

to this Information Statement as Appendix A.

Exchange

of Book-Entry Shares

Upon

effectiveness of the Reverse Split, stockholders whose shares are uncertificated and held in “street name” with a broker

or other nominee, either as direct or beneficial owners, will have their holdings automatically exchanged by their brokers to give effect

to the Reverse Split. In addition, stockholders whose shares are held in book-entry form on the books of our transfer agent, Pacific

Stock Transfer, will have their holdings automatically exchanged by Pacific Stock Transfer to give effect to the Reverse Split. Pacific

Stock Transfer will issue new statements of holdings following such exchange upon request.

Shares

held in Certificate Form

Once

we implement the Reverse Split, the share certificates representing the shares of Common Stock will continue to be valid. In the future,

new share certificates will be issued reflecting the Reverse Split, but this in no way will affect the validity of your current share

certificates. The Reverse Split will occur without any further action on the part of our shareholders. After the Effective Date each

share certificate representing the shares prior to the Reverse Split will be deemed to represent the number of shares shown on the certificate,

divided by 25. Certificates representing the shares after the Reverse Split will be issued in due course as share certificates representing

shares prior to the Reverse Split are tendered for exchange or transfer to our transfer agent. We request that shareholders do not send

in any of their stock certificates at this time. As applicable, new share certificates evidencing new shares following the Reverse Split

that are issued in exchange for share certificates issued prior to the Reverse Split representing old shares that are restricted shares

will contain the same restrictive legend as on the old certificates.

Fractional

Shares

Stockholders

will not receive fractional post-Reverse Split shares in connection with the Reverse Split. Instead, all shares will be rounded up to

the next whole share.

Plans

for Newly Available Shares of Common Stock

We

presently have no specific plans, nor have we entered into any agreements, arrangements or understandings with respect to the shares

of authorized Common Stock that will become available for issuance as a result of the Reverse Split.

Federal

Income Tax Consequences of the Reverse Split

The

following discussion is a general summary of certain U.S. federal income tax consequences of the Reverse Split to the holders of our

common stock and/or Preferred Stock and does not describe all of the income tax consequences that may be relevant to U.S. Holders (as

defined herein) in light of their particular circumstances, including alternative minimum tax and Medicare contribution tax consequences.

This discussion applies only to holders of common stock and/or Preferred Stock who hold such common stock and/or Preferred Stock as capital

assets for U.S. federal income tax purposes.

This

discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), administrative pronouncements,

judicial decisions and final, temporary and proposed Treasury regulations each as in effect on the date hereof, all of which are subject

to change (possibly with retroactive effect) and to differing interpretations. This discussion is for general information purposes only

and the tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. In addition,

this discussion does not address all aspects of U.S. federal income taxation that may be relevant to holders in light of their particular

circumstances or to holders who may be subject to special tax treatment, including without limitation, holders who are brokers or dealers

in securities, regulated investment companies, real estate investment trusts, traders in securities that use a mark-to-market method

of tax accounting, persons other than U.S. Holders, U.S. Holders whose functional currency is not the U.S. dollar, insurance companies,

tax-exempt or governmental organizations, banks, financial institutions, U.S. Holders that hold our stock through a non-U.S. entity or

non-U.S. account, or through an individual retirement or other tax-deferred account, U.S. holders who hold stock as part of a hedge,

straddle, wash sale, conversion or constructive sale, or other integrated transactions, U.S. Holders that use the accrual method of accounting

that are required to include certain amounts in income no later than the time such amounts are reflected on certain financial statements,

U.S. expatriates (as defined in the Code), S corporations, partnerships or other pass-through entities for U.S. federal income tax purposes

or a person that holds our stock through such entities, or U.S. Holders who acquired the common stock and/or Preferred Stock pursuant

to the exercise of compensatory stock options or otherwise as compensation.

The

following discussion also does not address the tax consequences of the Reverse Split under foreign, state or local tax laws, or under

any U.S. federal tax laws relating to taxes other than U.S. federal income taxes (such as estate and gift taxes). Accordingly, each stockholder

should consult his or her tax advisor to determine the particular tax consequences to him or her of a reverse stock split, including

the application and effect of U.S. federal, state, local and/or foreign income tax and other laws.

This

disclosure applies to you if you are a U.S. Holder. You are a “U.S. Holder” if, for U.S. federal income tax purposes, you

are a beneficial owner of our common stock or Preferred Stock that is:

|

|

●

|

a

citizen or individual resident of the United States, as defined for U.S. federal income tax purposes;

|

|

|

●

|

a

corporation (including any entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under

the laws of the United States, any state therein or the District of Columbia;

|

|

|

●

|

an

estate the income of which is subject to U.S. federal income taxation regardless of its source; or

|

|

|

●

|

a

trust if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one

or more U.S. persons has the authority to control all substantial decisions of the trust or (ii) it has a valid election in place

under applicable Treasury regulations to be treated as a U.S. person.

|

If

an entity or arrangement treated as a partnership for U.S. federal income tax purposes holds our stock, the tax treatment of the partnership

and a partner in such partnership generally will depend on the status of the partner and the activities of the partnership. Such partner

or partnership should consult its own tax advisor as to its tax consequences of the Reverse Split.

This

summary of certain U.S. federal income tax consequences is for general information only and is not tax advice. Each beneficial owner

of our common stock or Preferred Stock is urged to consult its own tax advisor with respect to the application of U.S. federal income

tax laws to its particular situation, as well as any tax consequences arising under the U.S. federal estate or gift tax laws or the Medicare

tax on net investment income, or under the laws of any state, local, foreign or other taxing jurisdiction or under any applicable tax

treaty.

Generally,

a reverse stock split will not result in the recognition of gain or loss by a U.S. Holder of shares of our common stock for U.S. federal

income tax purposes. The aggregate adjusted basis of the new shares of common stock will be the same as the aggregate adjusted basis

of the common stock exchanged for such new shares. The holding period of the post-Reverse Split shares of the common stock resulting

from implementation of the Reverse Split generally will include the stockholder’s respective holding periods for the pre-Reverse

Split shares of common stock.

The

tax discussion set forth above is included for general information only. U.S. Holders should consult with their own tax advisors to determine

their particular tax consequences with respect to the Offers, including the applicability and effect of state, local and non-U.S. tax

laws.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of the date of this prospectus, information regarding beneficial ownership of our capital stock by:

|

●

|

each

person, or group of affiliated persons, known by us to be the beneficial owner of 5% or more of any class of our voting securities;

|

|

|

|

|

●

|

each

of our current directors and nominees;

|

|

|

|

|

●

|

each

of our current named executive officers; and

|

|

|

|

|

●

|

all

current directors and named executive officers as a group.

|

Beneficial

ownership is determined according to the rules of the SEC. Beneficial ownership means that a person has or shares voting or investment

power of a security and includes any securities that person or group has the right to acquire within 60 days after the measurement date.

This table is based on information supplied by officers, directors and principal shareholders. Except as otherwise indicated, we believe

that each of the beneficial owners of the common stock listed below, based on the information such beneficial owner has given to us,

has sole investment and voting power with respect to such beneficial owner’s shares, except where community property laws may apply.

|

Name and Address of Beneficial Owner

|

|

Common

Stock

Beneficial

Ownership

|

|

|

Percent

of

Class(1)

|

|

|

Series B

Convertible

Preferred

Stock

Beneficial

Ownership

|

|

|

Percent

of

Class(2)

|

|

|

Series E-1

Convertible

Preferred

Stock

Beneficial

Ownership

|

|

|

Percent

of

Class(3)

|

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip A. Falcone(4)

|

|

|

2,577,106,126

|

|

|

|

78.9

|

%

|

|

|

100

|

|

|

|

100

|

%

|

|

|

922,000

|

|

|

|

80

|

%

|

|

Warren Zenna

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Jeffrey Canouse

|

|

|

6,177,000

|

|

|

|

*

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Henry Turner

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

All executive officers and directors as a group (four persons)

|

|

|

2,583,283,126

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other 5% Shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO I Trust(5)

|

|

|

897,555,556

|

|

|

|

44.3

|

|

|

|

100

|

|

|

|

100

|

%

|

|

|

461,000

|

|

|

|

40

|

%

|

|

FFO II Trust(6)

|

|

|

897,555,556

|

|

|

|

44.3

|

|

|

|

-

|

|

|

|

0

|

|

|

|

461,000

|

|

|

|

40

|

%

|

|

KORR Value, LP(7)

|

|

|

448,277,777

|

|

|

|

25.0

|

|

|

|

-

|

|

|

|

-

|

|

|

|

230,500

|

|

|

|

20

|

%

|

|

Arena Special Opportunities Partners I, LP(8)

|

|

|

129,265,140

|

|

|

|

8.26

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Less

than one percent

|

(1)

|

Except

as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of common

stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in

the footnotes to this table. Unless otherwise indicated, the address of the beneficial owner is Madison Technologies, Inc., 450 Park

Avenue, 30th Floor, New York, NY 10022.

|

|

|

|

|

(2)

|

Series

B Convertible Preferred Stock has the right to vote together with the holders of the common stock, as a single class, upon all matters

submitted to holders of common stock for a vote. The shares of Series B Preferred Stock will carry a number of votes equal to 51%

(representing majority voting power) of all voting shares of every class, including 51% of all of the issued and outstanding shares

of common stock on the date of any shareholder vote, such that the holders of Series B Preferred Stock shall always possess the majority

of voting rights, and shall always out vote all holders of common stock.

|

|

(3)

|

Each

share of Series E-1 Convertible Preferred Stock is convertible into 1,000 shares of common stock, and is entitled to vote on an as

converted basis until conversion.

|

|

|

|

|

(4)

|

Includes

(i) 436,555,556 shares of common stock, (ii) 100 shares of Series B Preferred Stock held by FFO 1 Trust, and (iii) 461,500 shares

of Series E-1 Convertible Preferred Stock held by each of FFO 1 Trust and FFO 2 Trust. Philip A. Falcone, the Chief Executive Officer

and a director of the Company, as a trustee of the FFO I Trust, has the sole voting and shared dispositive power over the shares

held by the FFO I Trust, and Lisa Falcone, the wife of Mr. Falcone, as the trustee of the FFO 2 Trust, has shared voting and dispositive

power over the shares held by the FFO 2 Trust.

|

|

|

|

|

(5)

|

Philip

A. Falcone, the Chief Executive Officer and a director of the Company, as trustee of the FFO I Trust, has the sole voting and shared

dispositive power over the shares held by the FFO I Trust. The address for the FFO I Trust is c/o Harbinger Capital, 430 Park Avenue,

30th Floor, New York, NY 10022.

|

|

|

|

|

(6)

|

Includes

461,000 shares of Series E-1 preferred stock. Lisa Falcone, the wife of Philip A. Falcone, the Chief Executive Officer and a

director of the Company. As the trustee of the FFO II Trust, Lisa Falcone has shared voting and dispositive power over the shares

held by the FFO II Trust. The address for each the FFO II Trust is c/o Harbinger Capital, 430 Park Avenue, 30th Floor, New York,

NY 10022.

|

|

|

|

|

(7)

|

Includes

230,500 shares of Series E-1 preferred stock. Kenneth Orr is the president of KORR Value, LP, and in such capacity, may be deemed

to have voting and dispositive power with respect to such shares. KORR Value, LP and Mr. Orr disclaim beneficial ownership of such

shares, except to the extent of their pecuniary interest therein.

|

|

|

|

|

(8)

|

Consists

of shares of Common Stock held by Arena Special Opportunities Partners I, LP (“Partners Fund”). Does not include shares

of common stock issuable upon conversion of the Notes and/or exercise of the Warrants which are subject to the ownership blocker.

Arena Investors, LP is the investment adviser of, and may be deemed to beneficially own securities owned by the Partners Fund (the

“Investment Advisor”). Arena Special Opportunities Partners (Onshore) GP, LLC is the general partner of, and may be deemed

to beneficially own securities owned by, Partners Fund. Arena Investors GP, LLC is the general partner of, and may be deemed to beneficially

own securities owned by the Investment Advisor. By virtue of his position as the chief executive officer of the general partner of

the entity and the Investment Manager, Daniel Zwirn may be deemed to beneficially own securities owned by this selling shareholder.

Each of Mr. Zwirn, the Investment Advisor and the managing member share voting and disposal power over the shares held by the entity

described above. Each of the persons set forth above other than applicable entity holding such shares disclaims beneficial ownership

of the shares beneficially owned by such entity and this disclosure shall not be construed as an admission that any such person or

entity is the beneficial owner of any such securities. The address for the entities set forth above is 405 Lexington Avenue, 59th

Floor, New York, New York 10174.

|

ADDITIONAL

INFORMATION

Householding

Matters

If

you and one or more stockholders share the same address, it is possible that only one Information Statement was delivered to your address.

Any registered stockholder who wishes to receive a separate copy of the Information Statement at the same address now or in the future

may mail a request to receive separate copies to the Company at 450 Park Avenue, 30th Floor, New York, NY 10022, or call the Company

at (212) 339-5888, and the Company will promptly deliver the Information Statement to you upon your request. Stockholders who received

multiple copies of this Information Statement at a shared address and who wish to receive a single copy may direct their request to the

same address.

Available

Information

Please

read all the sections of this Information Statement carefully. The Company is subject to the reporting and informational requirements

of the Exchange Act and in accordance therewith, files reports, proxy statements and other information with the SEC. These reports, proxy

statements and other information filed by the Company with the SEC may be inspected without charge at the SEC’s Public Reference

Room at 100 F Street, N.E., Washington, DC 20549. Copies of this material also may be obtained from the SEC at prescribed rates. The

SEC’s EDGAR reporting system can also be accessed directly at www.sec.gov.

FORWARD-LOOKING

STATEMENTS

This

Information Statement may contain certain “forward-looking” statements as such term is defined by the U.S. Securities and

Exchange Commission in its rules, regulations and releases, which represent our expectations or beliefs, including but not limited to,

statements concerning our operations, economic performance, financial condition, growth and acquisition strategies, investments, and

future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed

to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,”

“expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,”

“might,” or “continue” or the negative or other variations thereof or comparable terminology are intended to

identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain of which

are beyond our control, and actual results may differ materially depending on a variety of important factors, including uncertainty related

to acquisitions, governmental regulation, managing and maintaining growth, volatility of stock prices and any other factors discussed

in this and other of our filings with the Securities and Exchange Commission.

|

|

By

Order of the Board of Directors,

|

|

|

|

|

|

/s/

Philip A. Falcone

|

|

|

Philip

A. Falcone

|

|

|

Chief

Executive Officer

|

|

|

November

18, 2021

|

Appendix

A

Form

of Certificate of Change

Madison Technologies (CE) (USOTC:MDEX)

Historical Stock Chart

From Oct 2024 to Nov 2024

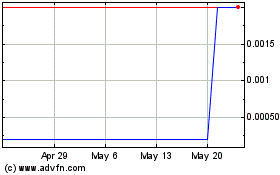

Madison Technologies (CE) (USOTC:MDEX)

Historical Stock Chart

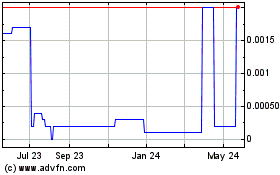

From Nov 2023 to Nov 2024