AN

OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR

MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR

SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE

IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY

MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION

OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL

OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

Amendment

No. 1

to

Offering

Circular Dated: 06/01/2024

Megola,

Inc.

Maximum

Total Offering $10,000,000

Up to $10,000,000 of Offering Amount Available in

Original Issuance Common Shares (400,000,000 Common Shares)

Megola,

Inc. (the “Company”) is offering the following securities on a “best efforts” basis:

| • | 400,000,000 shares

of common stock originally issued by the Company |

All

of the securities made available in this Offering shall be called the Offering Securities.” Since there is no minimum amount of

securities that must be purchased, all investor funds will be available to the company upon commencement of this Offering and no investor

funds will be returned if an insufficient number of securities are sold to cover the expenses of this Offering and provide net proceeds

to the company.

The

minimum purchase requirement per investor is $1,000; however, the Company can waive the minimum requirement on a case-by-case basis

in its sole discretion. The Company expects to commence the sale of the Offered Securities as of the date on which the Offering Statement

(“Offering Statement”) of which this Offering Circular is a part, is qualified by the United States Securities and Exchange

Commission (the “SEC”). Securities are reasonably expected to be sold within two years of the SEC’s qualification date.”

As of the date of this Offering Circular, the majority of equity in the company is held by a relatively small group of people and entities.

Affiliated entities, managers, officers, and/or directors hold 100,000 Series D Preferred Shares of the company pre-offering, which is

convertible into 1,000,000,000 shares of the Company's common stock. Additionally, the Company has issued 1 share of 2018 Special Series

A Preferred Stock, which carries the right to 51% voting control of the Company.

At

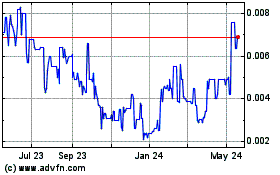

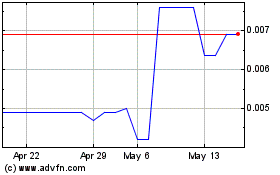

the time of this Offering, the Company’s stock trades under the symbol MGON on the OTC market.

A

maximum of $10,000,000 of Offered Securities will be offered worldwide. No sales of Offered Securities will be made anywhere

in the world prior to the qualification of the Offering Statement by the SEC in the United States. All Offered Securities will be initially

offered in the jurisdiction at the same U.S. dollar price that is set forth in this Offering Circular.

| | |

Price to Public | |

Underwriting Discount and Commissions (1) | |

Proceeds to Issuer | |

Proceeds to Other Persons |

| | Per Common Share | | |

$ | .025 | | |

$ | 0.00 | | |

$ | 0.025 | | |

$ | 0.00 | |

(1)

We are not currently using commissioned sales agents or underwriters.

These

are speculative securities. Investing in our securities involves significant risks. You should purchase these securities only if you

can afford a complete loss of your investment. See “Risk Factors” beginning on page 6.

The

SEC does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon

the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption

from registration with the SEC; however, the SEC has not made an independent determination that the securities offered are exempt from

registration.

TABLE

OF CONTENTS

THIS

OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN

AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY

AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,”

“BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY

FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO

RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING

STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE

ON WHICH THEY ARE MADE.

OFFERING

CIRCULAR SUMMARY

The

following summary highlights selected information contained in this Offering Circular. This summary does not contain all the information

that may be important to you. You should read this entire Offering Circular carefully, including the sections titled “Risk Factors”,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial

statement and the related notes included elsewhere in this Offering Circular, before making an investment decision. Unless the context

otherwise requires, the terms “Megola, Inc.”, “the Company,” “we,” “us” and “our”

in this Offering Circular refer to Megola, Inc.

OUR

COMPANY

Megola,

Inc. is incorporated in Nevada, with R&D in Seattle and corporate headquarters in Florida. The Company is focused on developing

and commercializing its portfolio of intellectual property related to consumer and industrial products. The Company plans to manufacture,

market and sell its products on an international scale.

THE OFFERING

| Issuer: | |

Megola, Inc. |

| Securities Offered: | |

Investors in this Offering will have the opportunity to purchase 400,000,000 shares of common stock originally issued by the Company. |

Common Stock Outstanding

Before the Offering:

| |

291,876,881 Common Shares |

Common Stock Outstanding After the Offering:

| |

691,876,881 Common Shares |

Minimum number of Securities

to be sold in this Offering:

| |

No minimum number of securities to be sold in this offering |

| Market for the Common Securities: | |

The Company’s stock currently trades under the symbol MGON on OTC. |

Term of Offering:

| |

The Company is offering its securities directly to the public on a best-efforts basis |

| Use of proceeds: | |

Proceeds from the sales of Common Stock included in this Offering will be used as set forth below:

This offering is a pivotal step in our strategic plan, designed to enhance various facets of our business.

We plan to allocate funds into each of the categories listed below.

Product Development: $1,100,000

Regulatory Registrations: $920,000

Manufacturing Scale-Up: $300,000

Build-out of Lab Facilities: $250,000

Intellectual Property Protection: $300,000

Marketing: $930,000

Human Resources: $1,500,000

Corporate Expenses: $700,000

Share Buy-Backs: $3,000,000

Working Capital: $1,000,000

|

Risk factors:

| |

Investing in our securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this Offering Circular. |

RISK FACTORS

An

investment in our securities involves a high degree of risk and many uncertainties. You should carefully consider the specific factors

listed below, together with the cautionary statement that follows this section and the other information included in this Offering Circular,

before purchasing our securities in this offering. The risks and uncertainties described below are not the only ones that we face. Additional

risks and uncertainties that we are unaware of may also become important factors that adversely affect our business. If one or more of

the possibilities described as risks below actually occur, our operating results and financial condition would likely suffer and the

trading price, if any, of our shares could fall, causing you to lose some or all of your investment. The following is a description of

what we consider the key challenges and material risks to our business and an investment in our securities.

We may not successfully execute our business plan to generate revenue and create a sustainable growth

trajectory

We have not generated significant revenues to date. Our ability to generate revenue and grow our revenue

will depend, in part, on our ability to execute on our business plan, and expand our client base and business model in a timely manner.

We may fail to do so. A variety of factors outside of our control could affect our ability to generate revenue and our revenue growth.

We may encounter unanticipated obstacles in the execution of our business plan

The Company’s business plans may change significantly. Many of the Company’s potential business

endeavors are capital intensive and may be subject to statutory or regulatory requirements. Management believes that the Company’s

chosen activities and strategies are achievable in light of current economic and legal conditions with the skills, background, and knowledge

of the Company’s principals and advisors. Management reserves the right to make significant modifications to the Company’s

stated strategies depending on future events.

We may experience quarterly fluctuations in our operating results due to a number of factors which make

our future results difficult to predict and could cause our operating results to fall below expectations

Our quarterly operating results may fluctuate due to a variety of factors, many of which are outside of

our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. Factors that may affect

our quarterly results include but not limited to: operating costs, our ability to hire, train and retain key personnel, developing new

products/services and expanding new market. Based upon all the factors described above, we have a limited ability to forecast our future

revenue, costs and expenses, and as a result, our operating results may fall below our estimates from time to time.

Our operation depends significantly on key personnel and management

The Company’s success will be particularly dependent upon our executive management. Our dependence

upon key personnel to operate our business puts us at risk of a loss of expertise if they leave us. If we are not able to retain the

existing highly qualified management, we may not be able to successfully execute our business strategy. Effective management of targeted

growth shall require expanding the company’s management and financial controls, hiring additional appropriate personnel.

We

may continue to be controlled by a small number of securities holders with interests that differ from other securities holders

As of the date of this Offering Circular, the majority of equity in the company is held by a relatively

small group of people and entities. Affiliated entities, managers, officers, and/or directors hold 100,000 Series D Preferred Shares

of the company pre-offering, which is convertible into 1,000,000,000 shares of the Company's common stock. Additionally, the Company

has issued 1 share of 2018 Special Series A Preferred Stock, which carries the right to 51% voting control of the Company. Therefore,

the current affiliated entities, managers, officers and/or directors, by nature of their ownership, now and potentially in the future

could be in a position to control Megola’s business and affairs including certain significant corporate actions. Their interests

may differ from the interests of other shareholders.

We will likely face significant competition

We will compete with other large well-established companies with greater financial resources and well-established

marketing and sales teams to promote business and drive sales. With technology and compliance costs on the rise, running any type of

business similar to ours is very costly. The competition may prevent the Company from effectively becoming engaged in certain markets.

Market risks and general economic conditions might cause significant risks and uncertainties

The financial success of the Company may be sensitive to adverse changes in general economic conditions

in the United States, such as recession, inflation, unemployment, and interest rates. The management believes that certain catalysts

such as economic slowdowns, uncertain energy prices, and/or accelerating inflation could hurt the Company’s prospects. A global

economic slowdown will create further obstacles for our Company.

We may not raise sufficient funds to execute our business model

If the gross offering proceeds of $10,000,000 is realized, the Company believes that such proceeds

will capitalize and sustain the Company sufficiently to allow for the implementation of the Company’s business plans. If only a

fraction of this Offering is sold, or if certain assumptions contained in management’s business plans prove to be incorrect, the

Company may have inadequate funds to fully develop its business and may need additional financing or other capital investment to fully

implement the Company’s business plans.

We may encounter risks associated with our expansion

As we expand, we will likely need to reconstruct our financial allocations, and potentially divert funds

from our core business. Any errors or lapses in this process could adversely affect our position in the market. All of the risks associated

with the expansion of operations may be have an adverse effect on the company’s present and prospective business activities.

Compliance with current and future regulations could affect our business

Our industry is subject to a vast array of rules and regulations from a wide variety of regulatory agencies,

and they apply not only to the Company but also the companies with which we do business. Failure to comply with applicable laws and regulations

could harm our business and financial results. In addition to potential damage to our reputation and our clients’ confidence, failure

to comply with the various laws and regulations, as well as changes in laws and regulations or the manner in which they are interpreted

or applied, may result in civil and criminal liability, damages, fines and penalties, increased cost of regulatory compliance and restatements

of our financial statements. Additionally, future changes to laws or regulations, or the cost of complying with such laws, regulations

or requirements, could also adversely affect our business and results of operations.

We may encounter certain risks associated with website security

Protection of customers’ information is a key responsibility of the Company. We have been dedicated

to constantly improving our website security to address the protection of our customers’ information and records. This includes

protecting against any possible threats or hazards to the security as well as against any unauthorized access to our customers’

information. Any breach in the Company’s website security, whether international or unintentional, could cause our customers to

lose their confidence in our website and hurt our company’s reputation. Additionally, breaches of our users’ personal information

could lead to regulatory fines for noncompliance or even possible lawsuit.

As we do not have an escrow or trust account with this subscription, if we file for or are forced into

bankruptcy protection, investors will lose their entire investment.

Invested

funds for this offering will not be placed in an escrow or trust account and if we file for bankruptcy protection or a petition for involuntary

bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy

laws. As such, you will lose your investment and your funds will be used to pay creditors.

There is limited liquidity in the public market for our securities

Our shares currently trade in the Over The Counter Market and not on a major exchange. As a result, there

is limited liquidity in the second market for our shares. At any time, there may cease to be any buyers for our shares in the second

market. It can be difficult for prospective purchasers of our shares to invest in the second market due to broker dealer restrictions

and investor suitability requirements. Our goal is to eventually qualify to have our shares traded on the NYSE or NASDAQ, but there can

be no guarantee of this occurring.

In the event that our shares remain publicly traded, our shares may trade under $5.00 per share, and thus will be considered a penny

stock. Trading penny stocks has many restrictions and these restrictions could severely affect the price and liquidity of our shares.

The U.S. Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define a “penny stock”

to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations,

our Common Stock could be considered to be a “penny stock”. A penny stock is subject to rules that impose additional sales

practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors.

For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities.

In addition, the broker/dealer must receive the purchaser’s written consent to the transaction prior to the purchase. The broker/dealer

must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability

of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our Common Stock to resell them.

These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb

the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently,

the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to.

We have established no minimum offering of our securities

Because there is no minimum offering of our securities, purchasers in this offering may be one of a few

to purchase our securities and management’s plans for the offering proceeds may not be met in which case the purchasers may lose

their entire investment.

We do not anticipate paying dividends in the foreseeable future, so there will be less ways in which

you can make a gain on any investment in the Company

We do not intend to pay any dividends for the foreseeable future. Further, to the extent that we may require

additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because

we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our Common Stock.

We expect to encounter specific industry risks

These risks can be summarized as set forth below.

Health and safety risks: These risks are related to the manufacturing and use of our products. The products that we develop

may be hazardous if not handled properly.

Regulatory compliance risks: These risks may result in financial liability to our Company if we are unable to keep up with regulatory

changes.

Market Acceptance Risks: These risks may cause financial loss to our Company if the public fails to be willing to use the products we

develop due to concerns over how they are produced.

Material Dependency Risks: We are risk of being unable to produce our products if certain raw materials become too difficult to source.

We expect to encounter specific risks related to our position in the market

Specifically, the risks we expect to encounter as a result of our position include capital and funding risks,

operational risks, and technology risks.

Capital and Funding Risks: We currently rely on external funding for growth. If we are unable to continue to raise funds, we may not

be able to continue as a going concern.

Operational Risks: We may not be able to scale operations, manage costs, and develop a customer base as we expect due to changing market

conditions. If we are not able to meet our targeted milestones as planned, we will need to raise additional capital and run the risk

of not being able to continue operations.

Competitive

Landscape Risks: We will face intense competition from larger, more established companies with greater resources. As a result, it may

be difficult to capture market share.

Technological Risks: We are at risk of not being able to develop products that are as technologically advances as other larger companies

that have greater resources. As a result, our products could become obsolete quickly after development.

DILUTION

The

price of the current offering is set as follows:

| • | $0.025 per

Share of common stock for common stock to be originally issued by the Company |

If

you invest in our securities, your interest will be diluted.

Dilution represents the difference between the offering price and the net tangible book value per Common Share immediately

after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible

assets from total assets. Dilution arises mainly as a result of the Company’s arbitrary determination of the offering price of

the Common Shares being offered. Dilution of the value of the securities you purchase is also a result of the lower book

value of the Common Shares held by our existing securities holders.

Megola has 291,876,881

Common Shares outstanding as of 12/31/2023. The following table demonstrates the dilution that new investors will experience

relative to the company’s net tangible book value of $-237,677 based on 291,876,881 Common Shares as of 04/01/2024.

The

table represents three scenarios: $2,500,000 raised from this offering, $5,000,000 raised from this offering and

a fully subscribed $10,000,000 raised from this offering. This table assumes that in each scenario the same percentage of securities

being made available directly from the issuer as those securities being offered by existing securities holders are sold relative to the

overall number of securities being made available in each of these respective groups.

Dilution

Per Share

| | |

If 25% of

Securities Sold | |

If 50% of

Securities Sold | |

If 100% of

Securities Sold |

| Average Price Per Newly Issued Common Share in this Offering | |

$ | .025 | | |

$ | .025 | | |

$ | .025 | |

| Net Tangible Book Value Per Common Share 12/31/2023 | |

$ | -0.00081 | | |

$ | -0.00081 | | |

$ | -0.00081 | |

| Net Tangible Book Value After Giving Effect to the Offering | |

$ | 0.01411 | | |

$ | 0.01227 | | |

$ | 0.00968 | |

| Proceeds Total | |

$ | 10,000,000 | | |

$ | 7,500,000 | | |

$ | 5,000,000 | |

| Current Issued and Outstanding Shares | |

| 291,976,881 | | |

| 291,976,881 | | |

| 291,976,881 | |

| Total Shares Post Offering | |

| 691,876,881 | | |

| 591,876,881 | | |

| 376,876,881 | |

| Total Book Value Post Offering | |

$ | 9,762,323 | | |

$ | 7,262,323 | | |

$ | 4,762,323 | |

| Increase (Decrease) in Book Value Per Common Share | |

$ | 0.01492 | | |

$ | 0.01308 | | |

$ | 0.01050 | |

| Dilution Per Common Share to New Investors | |

$ | 0.011 | | |

$ | -0.013 | | |

$ | -0.015 | |

| Dilution Per Common Share by Percentage | |

| 44 | % | |

| 51 | % | |

| 61 | % |

The following table summarizes the difference between the existing securities holders and the new investors with respect to the number

of Common Shares of common stock purchased, the total consideration paid, and the average price per share paid, if maximum

offering price of reached.

Average

Price Per Common Share

| | |

Common Shares Issued | |

Total Consideration |

| | |

Number of Common Shares | |

Percent | |

Amount | |

Percent | |

Average Price Per Share |

| Existing Shareholders | |

| 291,876,881 | | |

| 42.19 | % | |

$ | 791,838 | * | |

| 7.34 | % | |

$ | 0.0027 | |

| New Investors | |

| 400,000,000 | | |

| 57.81 | % | |

$ | 10,000,000 | | |

| 92.66 | % | |

$ | 0.0250 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL | |

| 691,876,881 | | |

| 100 | % | |

$ | 12,766,838 | | |

| 100 | % | |

$ | 0.0156 | |

*Includes paid in capital receiving

from shareholders after initial subscription.

PLAN

DISTRIBUTION

We

are offering the following securities:

| • | 400,000,000 shares

of common stock originally issued by the Company |

All

of the above securities are being offered on a “best efforts” basis.

Further,

the collective securities mentioned are being offered directly by the Company to investors who meet the suitability standards set forth

herein and on the terms and conditions set forth in this Offering Circular. All subscribers will be instructed by the company or its

agents to transfer funds by wire or ACH transfer directly to the company account established for this Offering or deliver checks made

payable to Megola, Inc.

The

offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) the date at which the

offering is terminated by us in our sole discretion, but in no event for more than one year from the date that the Offering is qualified

with SEC. We may undertake one of more closings on a “rolling” basis. After each closing, funds tendered by investors will

be available to the Company. Upon closing, funds tendered by investors will be made available to us for our use.

We

will use our existing website, www.megolacorp.com, to provide notification of the Offering. Persons who desire information may be

directed to a website owned and operated by an unaffiliated third party (www.glassboxlaw.com) that provides technology support to issuers

engaging in Regulation A offerings.

No

dividends to purchasers of our offered securities are assured, nor are any returns on, or of, a purchaser’s investment guaranteed.

Dividends are subject to our ability to generate positive cash flow from operations. All dividends are further subject to the discretion

of our board of directors. It is possible that we may have cash available for dividends, but our board of directors could determine that

the reservation, and not distribution, of such cash by our Company would be in our best interest.

You

will be required to complete a subscription agreement in order to invest. We may be required to rely on pursuing private financing options

in order to continue operations if it takes some time for us to raise funds in this offering

SELLING

SECURITY HOLDERS

The

table below represents all of the Officers, Directors and 5%+ Owners of the Company that have included Common Shares for sale

in this Offering.

| Security Holder Name | |

Type and Class of Securities Held | |

Total Number of Securities Held Pre-Offering | |

Total Securities Included for Sale in This Offering | |

Total Securities Held Post-Offering If All Available Securities Are Sold | |

Total Value of Securities Included in Offering | |

Total Number of Securities Acquirable In Class |

| N/A | |

N/A | |

| 0 | | |

| 0 | | |

| 0 | | |

$ | 0 | | |

| 0 | |

Total Securities Being Offered by the Selling Security Holders designated above in This Offering: 0 Common Shares

Percentage

of Pre-Offering Securities Being Offered by Selling Securities Holders in This Offering: NA

USE

OF PROCEEDS TO ISSUER

The

Company estimates that the net proceeds after all offering expenses will be approximately $10,000,000 if:

| • | We

can sell 400,000,000 shares of common stock originally issued by the Company |

General

Proposed Use of Funds:

This

offering is a pivotal step in our strategic plan, designed to enhance various facets of our business.

We plan to allocate funds into each of the categories listed below.

Product Development:

We plan to invest $1,100,000 in product development. These funds will be used for rigorous product testing to ensuring that each our

products not only meets but exceeds industry standards in terms of quality and efficacy. Our commitment to product testing is intended

to differentiate us in a competitive market.

Regulatory Registrations:

We plan to invest $920,000 in regulatory registrations. These funds will be used to meet compliance and safety requirements and continue

to build trust with our customers and stakeholders.

Manufacturing Scale-Up:

We plan to invest $300,000 to scale our manufacturing capabilities. These funds will be used in conjunction with contract manufacturers

to build manufacturing capacity to meet projected market demand. We plan to not only scale our ability to produce more products, but

also our ability to produce higher quality products.

Build-out of Lab Facilities:

We plan to invest $250,000 in the development of lab facilities. These funds will be used to further our R&D efforts and pave the

way for new products.

Intellectual Property Protection:

We plan to invest $300,000 in intellectual property protection. These funds will be used to protect our broad portfolio with global potential

to sustain a competitive edge in the market.

Marketing:

We plan to invest $930,000 in marketing. These funds will be used to effectively communicate our value proposition to our target audiences.

Our comprehensive marketing plan will encompass digital marketing, participation in industry events, and the development of strategic

partnerships, all aimed at building brand awareness and establishing a strong market presence.

Human Resources:

We plan to invest $1,500,000 in human resources. These funds will be used for wages and consulting fees. By attracting and retaining

top talent, we aim to ensure that our company will be powered by skilled professionals who are not only experts in their respective fields

but are also aligned with our vision and goals.

Corporate Expenses:

We plan to invest $700,000 in corporate expenses such as business insurance, legal, travel, and accounting. These funds ensure that we

have the necessary safeguards and resources in place to manage our day-to-day operations effectively and maintain financial discipline.

Share Buy-Backs:

We plan to deploy 30% of the offering proceeds ($3,000,000) to buy back some of our Series D Preferred shares. These shares will be bought

back at a 50% discount to the offering price, resulting in a price of $0.0125 per common share equivalent. We expect this investment

will illustrate our commitment to minimizing dilution and delivering value to our shareholders.

Working Capital:

We plan to invest $1,000,000 in working capital. These funds will be used to optimize our cash flow through inventory builds and managing

short-term liabilities and receivables.

Objectives

Targeted:

The

strategic deployment of these funds is a comprehensive approach aimed at enhancing every aspect of our business – from product

development to market penetration, operational efficiency to financial stability. This holistic strategy is crucial in positioning our

company as a leader in our field, driving sustainable growth, and achieving long-term success in the marketplace.

Targeted Impact on Profitability and/or Enterprise Value:

The

strategic allocation of our recent fundraising proceeds is set to significantly enhance our profitability and increase the overall enterprise

value of our company. By investing in product development, including rigorous testing and regulatory registrations, we ensure that our

products not only adhere to the highest standards of quality and safety but also stand out in the competitive market. This focus on developing

superior products will likely lead to increased customer satisfaction and loyalty, translating into higher sales and market share. Moreover,

scaling up manufacturing capabilities allows us to meet the growing demand efficiently. By boosting production volume while maintaining

quality, we can achieve economies of scale, resulting in lower production costs and higher profit margins. Protecting our intellectual

property and innovations further secures our unique market position and opens avenues for future revenue streams, enhancing long-term

profitability.

In addition to product-focused investments, the allocation of funds towards marketing, sales efforts, and building a robust operational

framework directly contributes to an increase in our enterprise value. Effective marketing strategies and brand-building initiatives

will drive market awareness and customer acquisition, leading to an increase in sales and revenue growth. Investing in human resources

ensures that we have the expertise and talent to execute our strategic plans effectively, fostering innovation and operational excellence.

This, coupled with investments in infrastructure like labs and equipment, strengthens our capacity for innovation and efficient production.

Furthermore, by maintaining a strong balance sheet through prudent financial management, we expect to enhance shareholder confidence

and financial stability. All these factors collectively contribute to a stronger, more valuable enterprise, poised for sustained growth

and high profitability in the long run.

The

distribution of our use of net proceeds is listed as follows if the maximum offering amount is raised,

| USE NAMES | |

If 100% of Common Shares Sold | |

Percentage |

| Product Development | |

$ | 1,100,000 | |

| 11.00 | % |

| Regulatory Registrations | |

$ | 920,000 | |

| 9.20 | % |

| Preferred Stock Buybacks | |

$ | 3,000,000 | |

| 30.00 | % |

| Marketing and Advertising | |

$ | 930,000 | |

| 9.30 | % |

| Manufacturing Scale Up | |

$ | 300,000 | |

| 3.00 | % |

| Working Capital | |

$ | 1,000,000 | |

| 10.00 | % |

| Corporate Expenses | |

$ | 700,000 | |

| 7.00 | % |

| Human Resources | |

$ | 1,500,000 | |

| 15.00 | % |

| Build Out of Lab | |

$ | 250,000 | |

| 2.50 | % |

| Intellectual Property Protection | |

$ | 300,000 | |

| 3.00 | % |

| TOTAL | |

$ | 10,000,000 | |

| 100 | % |

1

See the accompanying notes to the Use of Proceeds Table.

Notes

to the Use of Proceeds Table

1.

The foregoing information is an estimate based on our current business plan. We may find it necessary or advisable to reallocate portions

of the net proceeds reserved for one category to another category, and we will have broad discretion in doing so. Pending these uses,

we may invest the net proceeds of this offering in short-term, interest-bearing securities.

2.

The Company, without limitation, may hold cash or invest in cash equivalents for short-term investments. Among the cash equivalents in

which the Company may invest are: (i) obligations of the U.S. Government, its agencies or instrumentalities or governmental agencies

of other developed nations; (ii) commercial paper; and (iii) repurchase agreements, money market mutual funds, any certificates of deposit

and bankers’ acceptances issued by domestic branches of U.S. banks that are members of the Federal Deposit Insurance Corporation

or other similar banks.

3.

While not presently contemplated, the Company may also enter into repurchase and reverse repurchase agreements involving any preceding

instruments, as well as invest in money market mutual funds.

4.

The Company also expects to use the net proceeds from this Offering for working capital, capital expenditures, the repayment of outstanding

debt, estimated memorandum and/or offing portal preparation, filing, printing, legal, accounting and other fees and expenses related

to the Offering, marketing, sales and product development.

5.

No amount of the proceeds are currently assigned to acquire assets outside of the ordinary course of business; however, asset acquisition

is planned as part of our growth strategy. If we acquire assets in the future, we may use a material amount of the proceeds for the acquisition.

DESCRIPTION

OF BUSINESS

Overview

Megola Inc., with R&D based in Seattle, WA and corporate headquarters in Bonita Springs, FL, is a Nevada Corporation and

publicly traded as MGON on the OTC Market.

The company has built a revolutionary portfolio of effective and environmentally friendly products

poised to transform industries. The keystone of our innovation lies in crafting compounds and formulations that defy the norms prevalent

in chemical industries over the past six decades. Driven by a team of daring scientists, we embrace risk and challenge traditional views.

With diverse backgrounds and a collaborative approach, our scientists catalyze innovation through cross-pollination and unconventional

thinking. Rooted in deep product development expertise, we understand that true success lies not only in novel concepts but also in scalability

and market acceptance.

Business Lines

Our technology can be deployed to many sectors including

transportation, sanitation, personal healthcare, protection of buildings and furnishings, crop yield improvement, and solar panel

efficiency improvement.

Collaboration is key to our creativity and success. We engage with a diverse group of scientists whose

expertise complements ours. By fostering a supportive community of scientists and providing them necessary resources, we develop,

test, and bring to market pioneering chemical technologies.

There is a central dynamic underpinning our success in integrating novel

chemistry product applications and discovering and nurturing future breakthroughs. This dynamic is understanding the crucial

connections between chemical reactions, structural design, and market needs, emphasizing cost-effectiveness, simplicity, and public

and environmental safety. Grounded in scientific rigor, our approach has led and will continue to lead to breakthroughs that address

society's needs.

Development

History & Primary Products/Services

Over

the past three years, the Company has made significant strides in laying the groundwork for its future revenue and profitability through

the licensing of three major technology platforms. The first of these is a comprehensive technology package encompassing a diverse range

of products including Fire Inhibitors DF21 - DF31, Fire Extinguishant Additive DF11E, Fire-Gel Lithium Batteries, a Fire/Stain Fabric

Resistance Blend, a 24-hour Hand Purifier (non-alcohol based), a Bedbug/Dust Mite/Microbial Blend, Antimicrobials for Surface and Air

Protection, Cassava Powder Fire Extinguisher, Fire Media Pellets, and a Fire Blanket/Smoke Hood.

Further enhancing the company's portfolio, the second platform involves SiO2 liquid glass products, capable of coating and protecting

various substrates such as metal, stone, plastic, glass (including mobile device screens), seeds, and textiles.

The third platform encompasses stabilized halogen technology, which includes an array of products ranging from household care and disinfectants

(requiring EPA registration) to food preservation, pet care, automotive products, commercial and industrial odor control, air filtration,

formaldehyde inactivators, solutions for toxic and infectious spill remediation, textile modifications for odor control, persistent mold

protection on environmental surfaces, non-woven textile modifications for airplane toilet odor control floor coverings, and personal

hygiene products (including those for underarm and foot odor, baby diapers, adult incontinence, and feminine hygiene products).

To fully realize the commercial potential of these innovative products, the company is committed to investing in a combination of manufacturing

scale-up, testing, regulatory compliance, and marketing. This strategic investment is poised to propel the company towards significant

growth and establish it as a leader in its field.

Prior

Financial Impairment

NA

Prior

Restructuring and/or Major Asset Sales

NA

Potential

Changes to Special Characteristics

One

characteristic of the Company that could have a material impact on the future financial performance is the technology portfolio is large

and can be developed into products in many different markets. If the company tries to develop too many potential products simultaneously

it could face risks primarily stemming from resource dilution and strategic misalignment. Spreading resources too thin across multiple

projects can lead to inadequate development, testing, and marketing of each product, potentially compromising quality and innovation.

This overextension can result in a workforce that is overstretched and potentially less productive, as employees may struggle to maintain

focus and momentum when juggling numerous projects. Financial resources also suffer; with capital divided across various initiatives,

there may be insufficient funding to fully realize the potential of each product, leading to suboptimal outcomes or even project failures.

Additionally, this approach can lead to a lack of strategic focus, as the company might struggle to align its product development efforts

with its core competencies and market needs. In the absence of a clear and concentrated strategy, the company risks losing sight of its

competitive advantages and market position, ultimately affecting its long-term sustainability and growth. We plan to approach the commercialization

of our large technology portfolio in a systematic way to prioritize the opportunities to mitigates this risk as much as possible.

Additionally, some applications of our technology platforms are subject to regulation by the US Environmental Protection Agency (EPA)

and the US Food and Drug Administration. The primary risk involves compliance with regulations, which can be stringent and complex. The

guidelines are designed to ensure that products do not harm the environment or public health, and failure to comply can result in significant

legal and financial repercussions. This includes costly fines, mandatory recalls, and potential lawsuits. Moreover, the regulations are

subject to change, requiring companies to be vigilant and adaptive, ensuring their products continually meet current standards. In addition

to compliance risks, there is the challenge of time-to-market. The process of obtaining regulatory approval can be time-consuming, involving

extensive testing and review periods. This delay can be problematic, especially in fast-moving markets, as it can hinder a company's

ability to capitalize on new technologies or market trends.

The Company has also licensed a pending patent application for a key component of the technology platform and while patents offer legal

protection for innovations, they also pose risks, especially during the application phase. Until a patent is granted, the innovation

is not fully protected, which can lead to issues of intellectual property theft or infringement. Competitors may develop similar products,

leading to patent disputes or the need for litigation to defend the intellectual property rights. This can be both costly and damaging

to the company's reputation. Additionally, the process of obtaining a patent is not only expensive but also uncertain. There is no guarantee

that a patent will be granted, and the process can take several years, during which competitors might leapfrog the technology or find

alternative solutions. Furthermore, if the product needs to be altered to comply with updated agency regulations, it might also affect

the scope or validity of the pending patent, adding another layer of complexity and risk.

Marketing

and Sales Strategies

The

Company's business strategy is designed to maximize the commercial potential of its three core technology platforms through a diversified

approach to product distribution and market engagement. Our first model focuses on manufacturing end products and selling them directly

to consumers via online channels. This approach allows us to maintain a direct relationship with our customer base, providing valuable

insights into consumer preferences and behavior. By leveraging the power of e-commerce, we aim to establish a strong online presence,

facilitating the global reach of our products while optimizing operational efficiency. This direct-to-consumer model also enables us

to rapidly adapt to market trends and consumer feedback, ensuring that our products consistently meet the evolving needs of our customers.

Secondly, the company plans to manufacture end products for sale through distribution channels. This strategy aims to broaden our market

reach by tapping into established distribution networks, thereby gaining access to various retail and specialty outlets. By partnering

with distributors, we can leverage their expertise and relationships to efficiently penetrate diverse markets, both domestically and

internationally. This approach not only extends our geographic reach but also enhances brand visibility and recognition across a wider

consumer base. Distributors provide a vital link in reaching customers who may not be accessible through online platforms, thereby ensuring

our products are available to a more diverse audience.

Finally, our strategy includes manufacturing value-added ingredients for incorporation into other companies' end products, as well as

licensing our technology to other companies for manufacturing and sales. These collaborative approaches allow us to tap into the existing

market presence and production capabilities of established companies, leading to a rapid scale-up in production and distribution. Through

such partnerships, we can access new customer segments and industries, further diversifying our revenue streams. Licensing our technology

offers an additional avenue for revenue generation, allowing other companies to benefit from our innovations while providing us with

a steady stream of licensing fees. This multipronged strategy not only maximizes the commercial potential of our technology platforms

but also positions the company for robust growth and sustainability in the competitive marketplace. As we embark on this ambitious journey,

we seek partners and investors who share our vision and commitment to innovation and excellence.

Industry

Analysis and Trends

The

Company possesses a diverse array of potential product applications spanning many markets and industries. The following four exemplars

from our technology portfolio serve as a testament to the myriad opportunities available for the company to leverage and capitalize upon.

This broad spectrum of applications not only highlights the versatility and adaptability of our technological innovations but also underscores

our potential for significant growth and expansion across various sectors.

1. Fire Inhibition. In the current market landscape, the fire inhibition technology sector is witnessing a significant surge in demand,

driven by heightened awareness of fire safety and increasingly stringent regulatory standards globally. Companies like ours, which specialize

in advanced fire inhibition products, are strategically positioned to capitalize on this growing market. Innovations in fire-resistant

materials and chemicals, particularly those that are environmentally friendly and comply with international safety standards, are in

high demand. This industry is not only propelled by the construction and manufacturing sectors but also by the residential market, as

homeowners become more conscious of fire safety. The challenge for manufacturers in this space lies in balancing technological innovation

with cost-effectiveness and regulatory compliance, ensuring that their products remain accessible while meeting the highest safety standards.

2. Odor and VOC Remediation. In the realm of odor and VOC remediation, the market is evolving rapidly, with increasing consumer demand

for more effective and environmentally sustainable solutions. This sector, which encompasses everything from household care products

to industrial applications, is ripe for companies that can offer innovative, safe, and eco-friendly solutions. The growing focus on indoor

air quality, particularly in the wake of heightened health and hygiene awareness post-pandemic, has bolstered the demand for advanced

remediation technologies. Companies that can integrate natural and organic components, reducing reliance on harsh chemicals without compromising

efficacy, are likely to gain a competitive edge. Moreover, the sector offers substantial opportunities for growth in diverse industries,

including janitorial, waste management, and automotive, each requiring specialized solutions.

3. Odor Control Adult Incontinence Products. The market for adult incontinence products is another area experiencing notable growth,

primarily driven by an aging global population. As societal stigmas surrounding incontinence continue to diminish, there is still an

increasing demand for products that offer not just functionality, but the discretion offered by advanced odor control technology. The

challenge for manufacturers in this space is to innovate in material science and product design to enhance user comfort and convenience

while ensuring environmental sustainability. Companies that can successfully innovate in this domain while keeping products affordable

will likely see increased market share. Additionally, as online retail continues to grow, companies with strong e-commerce strategies

will be better positioned to reach and serve a wider, global customer base.

4. Mobile Phone Screen Protection. Lastly, the mobile phone accessories market is highly dynamic and competitive, characterized by rapid

technological advancements and changing consumer preferences. As smartphones continue to permeate every aspect of daily life, the demand

for accessories that enhance functionality, protect the device, and reflect personal style is booming. The challenge in this market lies

in continually innovating and keeping pace with the fast-evolving technology of mobile devices. Companies need to focus on creating high-quality,

durable products that align with the latest smartphone models and consumer trends. Additionally, there's a growing trend towards sustainability

in this sector, with consumers increasingly favoring products made from eco-friendly materials. Manufacturers who can agilely navigate

these trends, offering cutting-edge, sustainable, and aesthetically pleasing accessories, are likely to capture and retain consumer interest

in this highly competitive market.

The

Competition

The

Company is on the cusp of commercializing its innovative technology platform, targeting a variety of markets and industries, each characterized

by its unique set of competitive dynamics. This section will first outline some examples of the industry-specific risks associated with

these diverse markets. Following this, we will explore the broader competitive landscape at the corporate level, highlighting the challenges

and opportunities we face in our expansion and market penetration efforts.

In the realm of consumer-level odor control, our offerings are positioned against established brands such as Febreze, Glade, and Poo

Pourri. These competitors predominantly focus on masking fragrances rather than directly neutralizing malodorants, presenting a significant

point of differentiation for our products.

Turning to environmental odor control, we encounter traditional rivals in the form of chlorine dioxide and hydrogen peroxide solutions.

However, it's noteworthy that these substances pose considerable safety risks due to their hazardous nature. Additionally, we face competition

from Granular Activated Carbon (GAC) absorbent granules, which, while initially effective, gradually lose efficacy and can eventually

foster the growth of odor-causing microbes within filters.

In the air filter segment, our products contend with treatments like nanosilver and quats, which are touted for their contamination protection

capabilities. Nevertheless, these treatments often fall short in combating a wide array of odors and microbes, a limitation our products

aim to overcome.

The hydrophobic fire protection spray market presents another competitive arena, where we are up against products like 3M Scotchgard.

Scotchgard, while known for its hydrophobic properties, does not offer fire protection claims. Moreover, its use of controversial 'forever

chemicals' has cast a shadow over its market reputation. In contrast, conventional fire retardants, which typically contain organic bromine

compounds, are known for their toxicity, alongside other non-bromine toxic retardants. This offers a unique opportunity for our safer

and more effective solutions.

In the liquid glass coatings sector, our products stand out amidst a market saturated with temporary solutions like RainX. These alternatives

are generally less effective and offer only short-term results, in stark contrast to the durability and efficacy of our coatings.

In

seed coatings, we are competing with industry giants such as Bayer and Syngenta. These companies primarily focus on soaking seeds in

anti-fungal chemicals, a conventional approach that we aim to innovate and improve upon.

Lastly, in the personal deodorants market, we observe a high incidence of allergic reactions, affecting approximately 10% of the US population,

to existing products. This scenario presents a substantial opportunity for our hypoallergenic and skin-friendly formulations to make

a meaningful impact.

At the corporate level, we compete in the high-performance additives marketplace, featuring several leading global companies. These companies

stand out due to their extensive product lines, innovation in chemical technology, and significant market presence. The top players in

this field are known for their contributions to various industries, including automotive, construction, plastics, and coatings. While

the ranking can vary based on different criteria like revenue, market share, or innovation, some of the top companies in the high-performance

chemical additives sector include:

1. BASF: Headquartered in Germany, BASF is one of the largest chemical producers in the world and has a significant portfolio in high-performance

additives. Their additives are used in a multitude of applications, including plastics, coatings, and lubricants.

2. Dow Chemical Company: Based in the United States, Dow is a major player in the chemical industry and offers a wide range of high-performance

additives. Their products serve diverse markets such as plastics, coatings, and industrial applications.

3. Evonik Industries: A German company, Evonik is known for its specialty chemicals, including high-performance additives. They cater

to various sectors, including automotive, paints, coatings, and construction, with a focus on sustainability and innovation.

4. Clariant: Headquartered in Switzerland, Clariant is a leading specialty chemical company with a strong presence in the high-performance

additives market. They offer innovative solutions for a variety of applications, including plastics, coatings, and consumer products.

These companies are recognized for their commitment to research and development, which drives their ability to offer innovative and efficient

solutions across various industries. They continually adapt to changing market needs and environmental standards, setting the bar high

in the high-performance chemical additives sector.

In

order to effectively contend with the formidable presence of these type of industry leaders, our strategy will be centered on the commercialization

of products within niche market segments. These segments are currently underserved by existing technological solutions and exhibit a

substantial unmet need that aligns with the unique value propositions our technology is poised to offer. This targeted approach will

enable us to carve out a distinctive position in the market, addressing specific needs that have not been adequately met by current industry

offerings.

Company Management and Employees

Senior

Management

At

the present time, the individuals below are actively involved in the management of the Company.

(i) Robert

Gardiner, President and CEO whose key responsibilities are making major corporate decisions, managing the overall operations of

our company, creating and implementing strategies to grow the business and communicating between the corporate operations.

(ii) Joshua

Johnston, COO/CFO/Treasurer/Secretary whose key responsibilities are overseeing our company’s financial condition and capital structure,

presenting and reporting financial information, and implementing the company’s financial forecasting, ,and

overseeing the manufacturing and product development activities.

Employees

As

of the date of publication of this offering Circular, our company had 0 full time employees and 0 part time employees.

The company is being operated by our two officers, who are not currently receiving a salary. Our company believes that its relationship

with its employees is good. Over the next couple years, we are planning to recruit more high-qualified candidates to meet the needs to

our business expansion, and we have access to a large pool of qualified candidates.

Government

Regulation

We

are unaware of and do not anticipate having to expend significant resources to comply with any local, state and governmental regulations, beyond

those specific to certain products described elsewhere in this document. We are subject to the laws and regulations of those jurisdictions

in which we plan to offer our products and services, which are generally applicable to business operations, such as business licensing

requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory

and/or supervisory requirements.

Intellectual

Property

We

do not currently directly hold rights to any intellectual property, but our licensors have certain patent applications, trade secrets

and know-how that we have exclusive rights to commercialize. We plan to file additional patent applications jointly with our licensors

in the future as applicable. We have filed a trademark for Breakthrough Chemistry and intend to trademark any of our future product or

service names, our company logo and any other logo we create.

Description of Property

The

Company does not own any real property such as land, buildings, physical plants or other material physical properties.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You

should read the following discussion and analysis of our financial condition and results of operations together with our consolidated

financial statements and the related notes and other financial information included elsewhere in this Offering Circular (“prospectus”).

Some of the information contained in this discussion and analysis or set forth elsewhere in this prospectus, including information with

respect to our plans and strategy for our business and related financing, includes forward-looking statements that reflect our current

views with respect to future events and financial performance, which involve risks and uncertainties. Forward-looking statements are

often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”,

“project” and similar expressions, or words that, by their nature, refer to future events. You should not place undue certainty

on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject

to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions. You

should review the “Risk Factors” section of this prospectus for a discussion of important factors that could cause actual

results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion

and analysis.

Description

of Financial Condition

To

date, our company has concentrated its efforts on acquiring and licensing cutting-edge chemical technologies to build a comprehensive

and robust technology portfolio. Reflecting this strategic focus, our financial performance over the past three years has been characterized

by limited revenue generation and relatively low expenditure levels. This financial pattern is primarily due to our strategic decision

to invest primarily in core technology licenses, a process predominantly financed through the issuance of Preferred Stock to the technology

licensors. The infusion of capital from this offering will mark a pivotal shift in our business model, enabling us to move beyond the

development phase and into the realm of commercialization. This transition is critical for realizing the potential of our technological

innovations and translating them into tangible, marketable products that meet the evolving needs of our target industries.

Factors

Affecting Income

At

present, the income generated from our operations remains minimal, a reflection of the company's early stage in its business lifecycle.

This income primarily stems from a limited number of product trials and the sale of inventory that was initially acquired through strategic

acquisitions and licensing deals. These early efforts, while not significantly contributing to our revenue stream, have been instrumental

in validating our product concepts and providing valuable insights into market needs and preferences. They serve as a foundational step

in our journey towards larger-scale commercialization and market penetration.

Looking ahead, our company is poised for a significant transformation in its financial trajectory, thanks to our strategic plan to commercialize

our innovative technology platforms. We are targeting diverse and lucrative industries such as odor control, fire protection, and mobile

device screen protection - sectors that not only have a substantial market demand but also present opportunities for technological innovation

and differentiation. By tapping into these industries, we aim to unlock new revenue streams and drive substantial profits. Our focus

will be on leveraging the unique aspects of our technology to meet specific market needs, thereby creating a competitive edge in these

sectors.

The potential for profit generation in these areas is substantial. Odor control technology, for instance, has applications ranging from

household products to industrial waste management, presenting a wide market scope. Fire protection technology, on the other hand, is

critical in various sectors including construction, manufacturing, and consumer goods, offering opportunities for both B2B and B2C engagement.

Similarly, the market for mobile device screen protection is continuously expanding, driven by the global increase in smartphone usage

and the consumer's growing interest in protecting their investments. Our company’s innovative solutions in these areas are expected

to resonate well with the market, driving significant sales and profitability. This shift from minimal operational income to significant

profit generation will mark a pivotal phase in our company's growth and development.

Material

Changes in Sales or Revenues

The

income statements of our company accurately mirror its early stage, with working capital predominantly sourced through shareholder advances.

However, a notable transformation in our financial structure was observed in the fiscal year 2023, primarily attributed to the acquisition

of three major technology licenses. These licenses form the cornerstone of our newly established technology platforms and are pivotal

to our anticipated future profitability. The acquisitions not only augmented our inventory with essential raw materials but also led

to the creation of substantial intangible assets. The funding for these acquisitions was primarily secured through the issuance of Series

D Preferred Stock, supplemented by a portion of cash.

Specifically, the technology license for our fire safety technology contributed an intangible asset valued at $500,000 to our balance

sheet. Additionally, two strategic acquisitions, one for SiO2 coatings and the other for halogen coatings, collectively resulted in intangible

assets amounting to $396,113. These assets, integral to our technology portfolio, are currently being amortized over a 20-year period,

reflecting our long-term commitment to and confidence in the value they bring to our company. This strategic investment in intellectual

property underlines our dedication to fostering innovative technologies and our focus on long-term growth and profitability.

Liquidity

and Company Resources

Current

Liquidity

The

company is currently experiencing a deficit in immediate financial resources. This situation stems from its focus on technology development

in its initial phases, rather than on commercial pursuits. However, considering the intangible assets obtained in the fiscal year 2023,

the company's long-term financial health appears favorable. The ongoing capital-raising efforts are intended to fund commercial activities,

which are expected to enhance both short-term liquidity and profitability.

Capital

Commitments

The

company currently holds no substantial commitments regarding capital expenditures. This indicates that, at present, there are no significant

financial obligations tied to the acquisition of assets or large-scale investments.

However, this situation is likely to change following the conclusion of the fundraising efforts. It is anticipated that the company will

engage in certain capital investments, such as manufacturing and R&D capabilities, once the fundraising is successfully completed.

This will mark a new phase of financial planning and asset development for the company.

Plan

of Operations for Non-Revenue-Generating

The

primary use of the capital over the next 12 months will be to establish and scale up manufacturing capabilities. This is a critical step

in commercializing our technology, as it will enable us to produce at a volume necessary to meet market demand. Additionally, the funding

will be allocated towards obtaining necessary performance testing, certifications, and regulatory approvals, which are crucial for market

entry, especially in industries that are heavily regulated. This process will ensure that our products not only meet the highest standards

of quality and safety but also comply with industry-specific regulations. Furthermore, a portion of the capital will be dedicated to

strengthening our supply chain and logistics framework, ensuring that we can deliver our products efficiently and reliably to our customers.

Finally, a significant portion of the raised capital will be invested in marketing and sales efforts. Building brand awareness and establishing

a market presence are essential for the successful launch of our products. We plan to implement a comprehensive marketing strategy that

includes digital marketing, industry events, and strategic partnerships. Sales efforts will be focused on both direct-to-consumer channels

and building relationships with distributors and retailers, which are key to accessing broader markets. This dual approach will allow

us to not only reach our end-users directly but also tap into established distribution networks, thereby maximizing our market reach.

In summary, the capital from this offering will be the catalyst that transforms our extensive intellectual property portfolio into a

suite of commercially viable products, setting the stage for revenue growth and long-term success in the market. We do not believe it

will be necessary to raise additional funds within the next six months to implement this strategic plan.

Impact

of Trends on Capital Requirements

Currently,

the sales figures presented in the financial statements are relatively low. This minimal sales performance, however, does not fully reflect

the company's ongoing efforts in business development. The team has been actively involved in various initiatives aimed at expanding

the company's reach and enhancing its market presence. These efforts, though not immediately apparent in current financial outcomes,

are laying the groundwork for future growth and revenue generation.

On a promising note, the company has recently entered into a distribution agreement with a firm specializing in odor remediation and

another for food security. These partnerships are expected to yield positive financial results in upcoming periods, especially with planned

investments in sales and marketing strategies. Additionally, there are multiple potential distribution opportunities being explored in

other markets, such as food preservation and adult incontinence. These markets are showing encouraging trends, driven by factors such

as the aging population fueling the adult incontinence market and increasing concerns over food shortages. These industry dynamics present

significant opportunities for growth and are aligned with the company's strategic direction.

The company's investigations and conversations about pricing so far indicate that in our intended markets, there is sufficient flexibility

in how much customers are willing to pay for our added benefits. This suggests that we can achieve profitability at our current cost

projections.

Plan of Operations

We

anticipate that the capital we intend to raise in this offering will be sufficient to enable us to execute our business plan, including,

but not limited to hiring a strong management team and key personnel; promoting sales by conducting more marketing; executing on the

milestones described in this Offering Circular; and achieving growth by way of strategic partnerships.

It

is the opinion of Company management that the proceeds from this proposed offering will satisfy the Company’s need for liquidity

and cash requirements and put the Company in a position to grow its business in accordance with its business plan. Please refer to Use

of Proceeds, Part II for the Company’s planned use of proceeds to be generated from this proposed offering.

Milestone

1: Month 1

In

the month following the successful closure of our fundraising efforts, we have outlined a series of key milestones that are pivotal to

the growth and expansion of our business. A primary focus will be on enhancing our organizational structure; this includes building out

our management team and staffing to adequately support and drive our business objectives. Concurrently, we plan to initiate the distribution

of samples of our mobile device protection product in key markets, specifically India and China. This step is crucial in our strategy

to establish local partnerships, thereby extending our global reach and reinforcing our market presence in these significant regions.

Additionally, we are set to implement a comprehensive Customer Relationship Management (CRM) solution. This system will be instrumental

in efficiently managing leads and orchestrating our marketing initiatives, thereby streamlining our customer engagement and outreach

efforts. On the production front, we are gearing up to initiate the scale-up of our SAP (Super Absorbent Polymer) technology, in collaboration

with a contract blender. This move is aimed at enhancing our production capabilities to meet increasing market demands. Moreover, we

are on track to complete critical human skin contact studies with SAP, as well as with diaper swatches. These studies are vital in ensuring

the safety and effectiveness of our products, fortifying our commitment to delivering quality and reliable solutions to our customers.

Milestone

2: Month 2 to Month 6

During

the second to sixth months following the closure of our fundraising, The company is set to accomplish several

significant milestones that will propel our company's growth and innovation. One of the foremost achievements will be receiving the

first batch of test results and certifications for our fire safety, bedbug, and hand purifier products, a critical step in

validating their effectiveness and market readiness. In tandem, we plan to submit a Food and Drug Administration (FDA) food contact

notification for our food security products, ensuring compliance and safety for consumer use. Additionally, we will complete human

smell perception studies for our incontinence products, furthering

our

commitment to understanding and meeting consumer needs. Parallel to these product developments, we will be making substantial advancements

in our operational capabilities. This includes leasing space for a new laboratory and acquiring the necessary equipment to bolster our

research and development efforts. A major corporate milestone will be the completion of our rebranding to Breakthrough Chemistry, including

a change in our company name and symbol, symbolizing a new chapter in our journey. We will also be actively engaged in securing intellectual

property rights, including filing patents for certain technological applications, and pursuing pharmaceutical removal certification.

The creation of product demonstration videos will be another key focus, enhancing our marketing and customer engagement strategies. Moreover,

we will file trademarks for various products while continuing to prosecute existing patents, ensuring robust protection of our innovations.

Notably, we will also confirm the safety of contact and inhalation of our OdorSol product and validate the efficacy of our SiO2 coating

on solar panels. Finally, we aim to execute between two to three licensing or distribution agreements, marking a significant stride in

the commercialization and sale of our diverse product portfolio.

Milestone

3: Month 7 to Month 12

In

the latter half of the year, spanning months 7 to 12 post-fundraising, we are geared to achieve a series of milestones that will significantly

enhance our product portfolio and market positioning. A key initiative will be to submit an EPA sanitizer claim for our odor remediation

product, marking a crucial step in expanding its applications and market appeal. Concurrently, we will complete ethylene inactivation