MOL Second-Quarter Results Beat Forecasts

05 August 2016 - 9:47AM

Dow Jones News

By Margit Feher

BUDAPEST--Second-quarter earnings of Budapest-based integrated

oil-and-gas company MOL Nyrt. beat analysts' forecasts as a result

of rising fuel demand in central Europe and the acquisition of gas

stations, making the company confident it will be able to meet its

full-year profitability goal of over $2 billion.

Clean earnings before interest, tax, depreciation and

amortization, a major indicator of profitability in the oil

industry that investors watch closely, was 160.1 billion forints

($575.6 million) for the period, up 11% from the previous quarter

but down 10% from a year earlier. Still, it beat analysts'

expectations of HUF158.8 billion for April-June, according to a

poll of nine independent analysts conducted by the company. Clean

earnings don't include the revaluation of inventories and one-off

items.

As a result of its second-quarter performance, MOL, Hungary's

largest firm by revenue, "remains fully on track to deliver" its

over $2 billion clean Ebitda target for 2016, Chairman and Chief

Executive Zsolt Hernadi said in a filing with the Budapest Stock

Exchange. Clean Ebitda already totaled half that in the first six

months, coming in at $1.09 billion for the period.

In the second quarter, downstream operations managed to offset a

normalization foreseen in refinery and petrochemicals margins with

increased processing, rising sales volumes and considerable growth

in retail Ebitda year-on-year, the company said.

Downstream--or refining and marketing--clean Ebitda was HUF116.2

billion, down 8% from a year earlier "on a softening of the

macroeconomic environment," the company said. That was, however,

higher than analysts' forecast for HUF110.8 billion.

The clean Ebitda of the upstream--or exploration and

production--segment was HUF48.6 billion, down 9% from a year

earlier and in line with analysts' expectations for HUF48.1

billion. Rising 15% from the previous quarter, upstream operations

returned to quarterly growth on the back of rising oil prices, MOL

said.

Average oil and gas production fell 1.2% from the previous

quarter and increased 6.9% from a year earlier to 110,800 barrels

of oil equivalent per day, on higher oil production in Kurdistan

and rising onshore production in central and Eastern Europe while

Croatian offshore production declined and crude output in the U.K.

also fell.

The downstream and upstream results highlight "the resilience of

the integrated business model, the proof of which is that we are

continuously generating strong cash flow," Mr. Hernadi said, citing

also a recent credit-rating upgrade and a new EUR615 million

($688.4 million) syndicated credit facility.

In the second quarter of this year, the company generated a net

profit of HUF83.5 billion, up by a sharp 45% from HUF57.5 billion a

year earlier. That was also higher than analysts' expectation for

HUF76.4 billion. It translated to earnings of HUF908.2 a share, up

from HUF604.0 a share a year ago.

Write to Margit Feher at margit.feher@wsj.com

(END) Dow Jones Newswires

August 04, 2016 19:32 ET (23:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

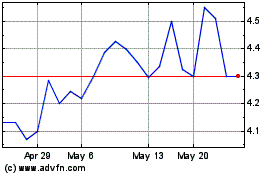

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Jan 2025 to Feb 2025

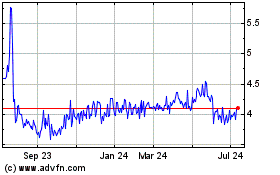

Mol Magyar Olay Es Gazip... (PK) (USOTC:MGYOY)

Historical Stock Chart

From Feb 2024 to Feb 2025