TIDMNHY

Hydro's underlying earnings before financial items and tax rose to NOK

2,284 million in the first quarter, from NOK 1,829 million in the fourth

quarter. The increase mainly reflected higher realized all-in metal and

alumina prices, somewhat offset by higher raw material costs.

-- Underlying EBIT of NOK 2 284 million

-- Higher realized all-in aluminium and alumina prices

-- Raw material cost pressure

-- Rolled Products result affected by operational issues

-- Better program on schedule for 2017 target of NOK 500 million

-- Karmøy Technology Pilot on time and budget for Q4 2017

start-up

-- Product qualification at Automotive Line 3 in progress - ramp-up

during 2017

-- 2017 global primary demand growth outlook of 4-6%, global market

largely balanced

"We are raising our expected 2017 global primary demand growth outlook

from 3-5 percent to 4-6 percent, and we expect a largely balanced global

market. Hydro is well positioned in this marketplace," says President

and CEO, Svein Richard Brandtzæg.

"Demand for aluminium in lightweighting and sustainable solutions

continues to grow, confirming our confidence in Hydro's integrated value

chain, based on low-carbon aluminium production," Brandtzæg says.

"Good financial and operational performance do not stand alone. It has

to go hand in hand with safety performance. In April, we experienced the

most tragic kind of accident - a fatality. We must never lose focus on

our most important task: to ensure that everyone comes home safely every

day."

Underlying EBIT for Bauxite & Alumina increased compared to the fourth

quarter. Higher realized alumina prices, driven by a higher alumina

index and LME were partly offset by lower sales volumes, an increase in

fuel oil and caustic prices, and negative currency effects as the BRL

strengthened against the USD. Planned maintenance programs at

Paragominas and Alunorte reduced the bauxite and alumina production

volume for the quarter. The fourth quarter was positively influenced by

NOK 151 million relating to outstanding contractual arrangements with

Vale.

Underlying EBIT for Primary Metal increased in the first quarter due to

higher realized all-in metal prices and higher volumes. This was partly

offset by significantly higher alumina costs.

Underlying EBIT for Metal Markets declined significantly in the first

quarter due to lower results from sourcing and trading activities in

addition to negative inventory valuation effects and currency effects.

Underlying EBIT for Rolled Products increased compared with the fourth

quarter 2016. Seasonally higher sales volumes were partly offset by

various operational issues primarily related to the start-up of

production after year end maintenance and implementation of new

equipment.

"We are opening our new 150,000 tonnes per year, state-of-the-art

production line for automotive products in Germany on May 4, raising

Hydro's total automotive capacity to 200,000 tonnes per year. Aluminium

parts for the automotive industry will lightweight millions of new cars,

helping the manufacturers to meet the lower emission targets and

reducing global climate emissions," says Brandtzæg.

Underlying EBIT for Energy increased compared to the previous quarter.

Higher production and lower area cost were somewhat offset by lower

prices and higher production cost. Production costs increased mainly due

to seasonally higher property taxes, these costs were partly offset by

lower transmission cost.

Underlying EBIT for Sapa increased compared to the previous quarter, in

line with general seasonality in the industry.

Hydro made progress on its "Better" improvement program, while slightly

behind plan, Hydro still expects to reach both the year-end target of

NOK 500 million and the 2019 target NOK 2.9 billion.

Hydro's net cash position decreased during the first quarter by NOK 0.1

billion to NOK 5.9 billion at the end of the quarter. Net cash provided

by operating activities amounted to NOK 0.7 billion, impacted by

operating capital build-up due to seasonality and higher prices. Net

cash used in investment activities, excluding short term investments,

amounted to NOK 1.2 billion.

Reported earnings before financial items and tax amounted to NOK 2,410

million in the first quarter. In addition to the factors discussed above,

reported EBIT included net unrealized derivative losses of NOK 192

million and positive metal effects of NOK 286 million. Reported earnings

also included a net gain of NOK 32 million in Sapa (Hydro's share net of

tax) relating to unrealized derivative gains, and net foreign exchange

gains.

In the previous quarter reported earnings before financial items and tax

amounted to NOK 1,964 million including net unrealized derivative gains

of NOK 106 million and positive metal effects of NOK 68 million.

Reported earnings also included a charge of NOK 285 million reflecting

partial write-down of capitalized costs due to a design review of the

part-owned projected CAP alumina refinery and a compensation of NOK 254

million relating to the completion of outstanding contractual

arrangements with Vale, both within Bauxite & Alumina. In addition,

reported earnings included a charge of NOK 32 million relating to a

change in interest rate used in the calculation of environmental

liabilities linked to idled sites in Germany, and a net gain of NOK 23

million in Sapa (Hydro's share net of tax) relating to unrealized

derivative gains, rationalization charges and net foreign exchange

gains.

Net income amounted to NOK 1,838 million in the first quarter. This

includes a net foreign exchange gain of NOK 218 million mainly

reflecting the strengthening of BRL against USD affecting USD debt in

Brazil, while the weakening of EUR forward rates against NOK gives an

unrealized gain on the embedded derivatives in power contracts

denominated in EUR.

In the previous quarter net income was NOK 1,008 million including a net

foreign exchange loss of NOK 26 million mainly reflecting the

strengthening Euro versus Norwegian kroner affecting liabilities in Euro

in Norway and embedded currency derivatives in power contracts.

Change

First Fourth Change First prior

Key financial information quarter quarter prior quarter year Year

NOK million, except per share data 2017 2016 quarter 2016 quarter 2016

Revenue 23,026 21,250 8 % 20,138 14 % 81,953

Earnings before financial items and tax (EBIT) 2,410 1,964 23 % 1,693 42 % 7,011

Items excluded from underlying EBIT (126) (135) 7 % (192) 35 % (586)

Underlying EBIT 2,284 1,829 25 % 1,501 52 % 6,425

Underlying EBIT :

Bauxite & Alumina 756 711 6 % 189 >100 % 1,227

Primary Metal 900 601 50 % 318 >100 % 2,258

Metal Markets 24 152 (84) % 167 (85) % 510

Rolled Products 106 6 >100 % 248 (57) % 708

Energy 423 359 18 % 398 6 % 1,343

Other and eliminations 74 (1) >100 % 181 (59) % 380

Underlying EBIT 2,284 1,829 25 % 1,501 52 % 6,425

Earnings before financial items, tax, depreciation

and amortization (EBITDA) 3,762 3,563 6 % 2,908 29 % 12,485

Underlying EBITDA 3,637 3,143 16 % 2,716 34 % 11,474

Net income (loss) 1,838 1,008 82 % 2,382 (23) % 6,586

Underlying net income (loss) 1,580 968 63 % 822 92 % 3,875

Earnings per share 0.86 0.52 66 % 1.12 (23) % 3.13

Underlying earnings per share 0.75 0.47 60 % 0.39 92 % 1.83

Financial data:

Investments 1,372 3,541 (61) % 1,970 (30) % 9,137

Adjusted net cash (debt) (5,358) (5,598) 4 % (9,206) 42 % (5,598)

Underlying Return on average Capital Employed (RoaCE) 5.3 %

Key Operational information

Bauxite production (kmt) 2,400 3,063 (22) % 2,682 (11) % 11,132

Alumina production (kmt) 1,523 1,635 (7) % 1,517 0 % 6,341

Primary aluminium production (kmt) 516 526 (2) % 514 0 % 2,085

Realized aluminium price LME (USD/mt) 1,757 1,647 7 % 1,497 17 % 1,574

Realized aluminium price LME (NOK/mt) 14,798 13,659 8 % 12,950 14 % 13,193

Realized USD/NOK exchange rate 8.42 8.29 2 % 8.65 (3) % 8.38

Rolled Products sales volumes to external market

(kmt) 241 213 13 % 229 5 % 911

Sapa sales volumes (kmt) 178 155 15 % 174 2 % 682

Power production (GWh) 2,869 2,551 12 % 3,160 (9) % 11,332

Investor contact

Contact Stian Hasle

Cellular +47 97736022

E-mail Stian.Hasle@hydro.com

Press contact

Contact Halvor Molland

Cellular +47 92979797

E-mail Halvor.Molland@hydro.com

Cautionary note

Certain statements included in this announcement contain forward-looking

information, including, without limitation, information relating to (a)

forecasts, projections and estimates, (b) statements of Hydro management

concerning plans, objectives and strategies, such as planned expansions,

investments, divestments, curtailments or other projects, (c) targeted

production volumes and costs, capacities or rates, start-up costs, cost

reductions and profit objectives, (d) various expectations about future

developments in Hydro's markets, particularly prices, supply and demand

and competition, (e) results of operations, (f) margins, (g) growth

rates, (h) risk management, and (i) qualified statements such as

"expected", "scheduled", "targeted", "planned", "proposed", "intended"

or similar.

Although we believe that the expectations reflected in such

forward-looking statements are reasonable, these forward-looking

statements are based on a number of assumptions and forecasts that, by

their nature, involve risk and uncertainty. Various factors could cause

our actual results to differ materially from those projected in a

forward-looking statement or affect the extent to which a particular

projection is realized. Factors that could cause these differences

include, but are not limited to: our continued ability to reposition and

restructure our upstream and downstream businesses; changes in

availability and cost of energy and raw materials; global supply and

demand for aluminium and aluminium products; world economic growth,

including rates of inflation and industrial production; changes in the

relative value of currencies and the value of commodity contracts;

trends in Hydro's key markets and competition; and legislative,

regulatory and political factors.

No assurance can be given that such expectations will prove to have been

correct. Hydro disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

This information is subject to the disclosure requirements pursuant to

section 5-12 of the Norwegian Securities Trading Act.

Q1 2017 Presentation: http://hugin.info/106/R/2099881/795851.pdf

Q1 2017 Report : http://hugin.info/106/R/2099881/795823.pdf

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Norsk Hydro via Globenewswire

http://www.hydro.com/en/?WT.mc_id=Pressrelease

(END) Dow Jones Newswires

April 28, 2017 01:15 ET (05:15 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

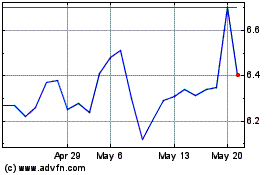

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Nov 2024 to Dec 2024

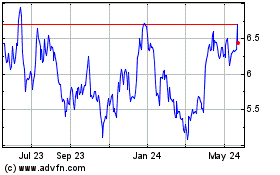

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Dec 2023 to Dec 2024