Nighthawk Systems, Inc. (OTCBB: NIHK) (�Nighthawk�), a leading

provider of wireless and IP-based control devices and solutions,

today reported financial results for its first quarter ended March

31, 2008. The Company accomplished considerable progress during its

first quarter of 2008, achieving growth in its core products,

accelerating growth in its newly acquired set-top box business, and

launching new initiatives in fault-tolerant control systems for

mission critical monitoring applications, while continuing to lower

overall costs. The Company reported revenues for the first quarter

of $826,000, a 290 percent increase over the first quarter of 2007

revenue of $212,000 and an increase of approximately 13 percent

from the fourth quarter 2007 revenue of $735,000. The increase in

first quarter revenues predominately reflects the inclusion of the

set-top box business in 2008, which represented 62 percent of

revenues for the period. The Company shipped 2,239 set-top box

units during the quarter, has a current backlog of approximately

3,300 units and expects to experience an acceleration in the

frequency and magnitude of orders for these units throughout 2008.

The Company also continued its trend of year-over-year growth of

its remote power control business, driven by a 125% increase in

product sales to electric utilities and the Company�s initial

deliveries of custom power control units to a provider of photo

traffic and electronic toll enforcement services. The increase in

production, combined with reductions in operating costs and

interest charges, led to a reduction in the net loss reported from

$1.1 million in the first quarter of 2007 to $770,000 in the first

quarter of 2008. After giving consideration to accumulated

dividends on preferred stock of $180,000, the net loss applicable

to common stockholders was $950,000 ($0.01 per share) in the 2008

period as compared to $1.1 million ($0.01 per share) in the 2007

period. �While Nighthawk has in the past viewed the utility market

as its largest source of revenues and anticipates an acceleration

of the growth from this business in 2008, we also expect

significant revenue contributions in 2008 from a number of

initiatives introduced in 2007. The newly acquired set-top box

product line will be a major contributor to the near-term growth of

the Company, and we expect significant growth this year from sales

of our power control products into new, mission-critical

applications,� commented Doug Saathoff, CEO of Nighthawk Systems,

Inc. �While our operating costs have been right-sized, we

anticipate material improvement in our gross margins during the

remainder of 2008 through both improvements to our manufacturing

process as well as increased contract volumes. Additionally, we

intend to continue making meaningful improvements to our balance

sheet over the remainder of the year as we move towards generating

positive cash flows by year end.� About Nighthawk Systems, Inc.

Nighthawk is a leading provider of intelligent devices and systems

that allow for the centralized, on-demand management of assets and

processes. Nighthawk products are used throughout the United States

in a variety of mission critical applications, including remotely

turning on and off and rebooting devices, activating alarms, and

emergency notification, including the display of custom messages.

Nighthawk�s IPTV set top boxes are utilized by the hospitality

industry to provide in-room standard and high definition television

and video on demand. Individuals interested in Nighthawk Systems

can sign up to receive email alerts by visiting the Company�s

website at www.nighthawksystems.com. Statements contained in this

release, which are not historical facts, including statements about

plans and expectations regarding business areas and opportunities,

acceptance of new or existing businesses, capital resources and

future business or financial results are "forward-looking"

statements. You should not place undue reliance on these

forward-looking statements. Such forward-looking statements are

subject to risks and uncertainties, including, but not limited to,

customer acceptance of our products, our ability to raise capital

to fund our operations, our ability to develop and protect

proprietary technology, government regulation, competition in our

industry, general economic conditions and other risk factors which

could cause actual results to differ materially from those

projected or implied in the forward-looking statements. Although we

believe the expectations reflected in the forward-looking

statements are reasonable, they relate only to events as of the

date on which the statements are made, and our future results,

levels of activity, performance or achievements may not meet these

expectations. We do not intend to update any of the forward-looking

statements after the date of this press release to conform these

statements to actual results or to changes in our expectations,

except as required by law. *** Financial Statements Follow ***

NIGHTHAWK SYSTEMS, INC. AND SUBSIDIARIES � � � CONSOLIDATED BALANCE

SHEETS � March 31, December 31, 2008 2007 ASSETS � CURRENT ASSETS

Cash and cash equivalents $ 74,694 $ 428,484 Accounts receivable,

net 217,417 313,644 Inventories 431,402 359,636 Prepaid expenses

64,754 93,684 TOTAL CURRENT ASSETS 788,267 1,195,447 � FIXED ASSETS

Furniture, fixtures and equipment, net 260,434 269,619 Intangible

assets, net 1,126,017 1,218,677 Debt issuance cost 283,955 310,428

Goodwill 3,397,537 3,397,537 NET FIXED ASSETS $ 5,067,943 $

5,196,261 � � TOTAL ASSETS $ 5,856,210 $ 6,391,708 � LIABILITIES

AND STOCKHOLDERS' EQUITY (DEFICIT) CURRENT LIABILITIES Accounts

payable $ 422,805 $ 327,668 Accrued expenses 570,669 502,822

Deposits and other 263,977 218,148 Line of credit and notes

Payable: Line of credit 18,692 18,892 Convertible notes, net of

discount of $808,446 in 2008 And $883,117 in 2007 1,209,732

1,135,061 Other notes � 558,320 TOTAL CURRENT LIABILITIES 2,988,443

2,760,911 � � � STOCKHOLDERS' EQUITY (DEFICIT) Series A Preferred

stock; $0.001 par value; 5,000,000 shares authorized; no shares

issued and outstanding - Series B Preferred stock; $0.001 par

value; 1,000,000 shares authorized; 600,000 shares issued and

outstanding at March 31, 2008 and December 31, 2007; liquidation

preference of $6,000,000 5,597,206 5,417,699 Common stock; $0.001

par value; 200,000,000 shares authorized; 134,433,060 issued and

outstanding at March 31, 2008 and December 31, 2007 134,433 134,433

Additional paid in capital 12,919,373 13,091,713 Accumulated

deficit (15,783,246) (15,013,048) TOTAL STOCKHOLDERS' EQUITY

(DEFICIT) 2,867,766 3,630,797 � � TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 5,856,210 $ 6,391,708 Nighthawk Systems,

Inc. Condensed Consolidated Statements of Operations Three Months

Ended March 31, (unaudited) � � � 2008 � 2007 � Revenue $ 826,321 $

212,021 � Cost of revenue � 668,497 � 126,104 � Gross profit

157,824 85,917 � Selling, general and administrative expenses

629,289 708,799 Depreciation and amortization � 107,388 � 2,535 �

Loss from operations � (578,853) � (625,417) � Interest expense:

Related parties - 480 Other � 191,344 � 491,405 � 191,344 � 491,885

� Net loss (770,198) (1,117,302) � Accumulated dividends on

preferred stock � (179,507) � - � Net loss applicable to common

stockholders $ (949,705) $ (1,117,302) � Net loss per basic and

diluted common share $ (0.01) $ (0.01) � Weighted average number of

common shares outstanding, basic and diluted � 141,789,726 �

90,083,937

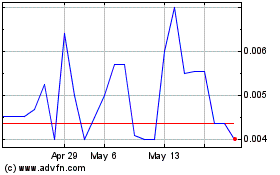

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Jan 2025 to Feb 2025

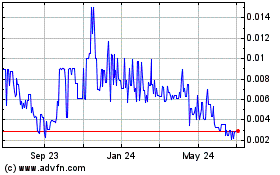

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Feb 2024 to Feb 2025