Nighthawk Systems, Inc. (OTCBB: NIHK) (�Nighthawk�), a leading

provider of wireless and IP-based control devices and solutions,

today reported financial results for three and six months ended

June 30, 2008. Revenues continued to grow as compared to previous

years and the Company implemented initiatives to lower the

production costs of both its set top box and power control products

which it feels will allow it to generate positive cash flows and

income from operations. The Company reported revenues for the

second quarter of $736,356, a 117% increase over the second quarter

of 2007 revenue of $339,684 and reported revenues for the six

months ended June 30, 2008 of approximately $1.6 million, a 183%

increase over revenues for the six months ended June 30, 2007 of

approximately $552,000. These increases could have been

substantially larger, as the Company shifted the production of

3,911 set top box units from the second quarter to the third

quarter of 2008 in order to implement cost savings reductions in

the production of set top boxes. As a result, the Company expects a

significant increase in revenues, margins and cash flows associated

with the production of set top boxes beginning in the third quarter

of 2008 and continuing for the foreseeable future. Despite the

shift in production of set top boxes to the third quarter of 2008,

overall revenues still more than doubled from the second quarter of

2007 to the second quarter of 2008, and nearly tripled from the

first six months of 2007 to the first six months of 2008. The

Company experienced significant growth in its general power control

products as it completed the remaining 410 units from an order of

600 power control units by a provider of photo traffic and

electronic toll enforcement services. Sales of the Company�s

utility products decreased slightly as the Company began marketing

new utility products capable of 2-way communications capabilities

and additional functionality. The Company expects to begin

producing these products during the third or fourth quarter of this

year. Due to the increase in overall revenues generated, the

Company produced approximately twice the gross profit in the three

and six-month periods ending in 2008 than in the comparable periods

in 2007. Gross margins declined from 2007 to 2008 due to the

addition of previously lower margin set top box revenues to the

overall product mix, but as mentioned previously, going forward the

Company expects margins on set top boxes to improve significantly

and more closely match those of its traditional power control

products. Selling, general and administrative expenses declined

slightly from the 2007 periods to the 2008 periods. Improvements in

gross profit were offset by increases in depreciation and

amortization expense recognized during 2008 related to the

acquisition of the set top box business in October 2007. As a

result, and also as a result of the recognition of approximately

$200,000 in noncash interest expense associated with the early

payoff of debt during the second quarter of 2008, the net loss

increased from $592,651 during the second quarter of 2007 to

$732,110 during the second quarter of 2008. However, the net loss

for the six months periods improved from $1,709,953 in 2007 to

$1,502,308 in 2008. �As the latter half of 2008 unfolds, we believe

that many of the initiatives identified and in some cases, achieved

during the first six months of the year, will have a significant

positive impact on our financial results going forward. We were

successful in finding alternative cost structures for the set top

box product and this should accelerate the improvement not only to

the Company�s top line going forward, but to the bottom line and to

cash flows as well,� commented H. Douglas Saathoff, CEO of

Nighthawk Systems, Inc. Mr. Saathoff, added, �The commitment we

made during the second quarter of this year slowed down the

production, and therefore the revenue growth, that I expected to

realize during the quarter and as a result, the Company will not

reach some of the revenue targets that I anticipated we would reach

during 2008. However, I feel the changes provide the Company with a

much more realistic opportunity to achieve profitable near term

growth earlier than expected.� About Nighthawk Systems, Inc.

Nighthawk is a leading provider of intelligent devices and systems

that allow for the centralized, on-demand management of assets and

processes. Nighthawk products are used throughout the United States

in a variety of mission critical applications, including remotely

turning on and off and rebooting devices, activating alarms, and

emergency notification, including the display of custom messages.

Nighthawk�s IPTV set top boxes are utilized by the hospitality

industry to provide in-room standard and high definition television

and video on demand. Individuals interested in Nighthawk Systems

can sign up to receive email alerts by visiting the Company�s

website at www.nighthawksystems.com. Statements contained in this

release, which are not historical facts, including statements about

plans and expectations regarding business areas and opportunities,

acceptance of new or existing businesses, capital resources and

future business or financial results are "forward-looking"

statements. You should not place undue reliance on these

forward-looking statements. Such forward-looking statements are

subject to risks and uncertainties, including, but not limited to,

customer acceptance of our products, our ability to raise capital

to fund our operations, our ability to develop and protect

proprietary technology, government regulation, competition in our

industry, general economic conditions and other risk factors which

could cause actual results to differ materially from those

projected or implied in the forward-looking statements. Although we

believe the expectations reflected in the forward-looking

statements are reasonable, they relate only to events as of the

date on which the statements are made, and our future results,

levels of activity, performance or achievements may not meet these

expectations. We do not intend to update any of the forward-looking

statements after the date of this press release to conform these

statements to actual results or to changes in our expectations,

except as required by law. **** Financial Statements Follow****

Nighthawk Systems, Inc. Condensed Consolidated Statements of

Operations � � Three Months Ended June 30, � Six Months Ended June

30, 2008 � 2007 2008 � 2007 (unaudited) (unaudited) � Revenue $

736,356 $ 339,684 $ 1,562,677 $ 551,705 � Cost of revenue 527,716

238,260 1,196,213 364,364 � Gross profit 208,640 101,424 366,464

187,341 � Selling, general and administrative expenses 510,134

526,383 1,139,424 1,235,181 Depreciation and amortization 109,888

2,588 217,276 5,123 620,022 528,971 1,356,700 1,240,304 Loss from

operations (411,382) (427,547) (990,236) (1,052,963) � Interest

expense 320,728 165,104 512,072 656,990 � Net loss (732,110)

(592,651) (1,502,308) (1,709,953) � Accumulated dividends on

preferred stock (179,507) - (359,014) - � Net loss applicable to

common stockholders $ (911,617) $ (592,651) $ (1,861,322) $

(1,709,953) � Net loss per basic and diluted common share $ (0.01)

$ (0.01) $ (0.01) $ (0.02) � Weighted average number of common

shares outstanding, basic and diluted 143,521,470 101,335,005

142,655,598 96,602,429 NIGHTHAWK SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS � � June 30, December 31, 2008 2007

(unaudited) ASSETS � CURRENT ASSETS Cash and cash equivalents $

30,280 $ 428,484 Accounts receivable, net 248,324 313,644

Inventories 331,717 359,636 Prepaid expenses 188,248 93,683 TOTAL

CURRENT ASSETS 798,569 1,195,447 � FIXED ASSETS Furniture, fixtures

and equipment, net 243,208 269,619 Debt issuance cost 263,429

310,428 Intangible assets, net 1,035,875 1,218,677 Goodwill

3,397,537 3,397,537 NET FIXED ASSETS $ 4,940,049 $ 5,196,261 �

TOTAL ASSETS $ 5,738,618 $ 6,391,708 � LIABILITIES AND

STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable $ 449,514

$ 327,668 Accrued expenses 623,520 502,822 Deposits and other

293,245 218,148 Line of credit and notes Payable: Line of credit

18,392 18,892 Convertible notes, net of discount of $566,157 in

2008 And $883,117 in 2007 1,398,717 1,135,061 Other notes 686,801

558,320 TOTAL CURRENT LIABILITIES 3,470,189 2,760,911 � �

STOCKHOLDERS' EQUITY (DEFICIT) Series A Preferred stock; $0.001 par

value; 5,000,000 shares authorized; no shares issued and

outstanding - Series B Preferred stock; $0.001 par value; 1,000,000

shares authorized; 600,000 shares issued and outstanding at June

30, 2008 and December 31, 2007; liquidation preference of

$6,000,000 5,776,713 5,417,699 Common stock; $0.001 par value;

200,000,000 shares authorized; 137,413,727 issued and outstanding

at June 30, 2008 and 134,433,060 issued and outstanding at December

31, 2007 137,414 134,433 Additional paid in capital 12,869,658

13,091,713 Accumulated deficit (16,515,356) (15,013,048) TOTAL

STOCKHOLDERS' EQUITY 2,268,429 3,630,797 � � TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 5,738,618 $ 6,391,708

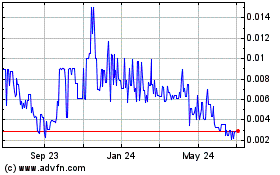

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Jan 2025 to Feb 2025

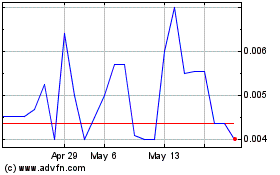

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Feb 2024 to Feb 2025