As filed with the Securities and Exchange Commission

on December 21, 2022

Registration No. 333-267263

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

QDM

International Inc.

(Exact name of registrant as specified in its

charter)

| Florida |

6411 |

59-3564984 |

(State

or other jurisdiction of

incorporation

or organization) |

(Primary

Standard Industrial

Classification

Code Number) |

(I.R.S.

Employer

Identification

No.) |

Room 715, 7F, The Place Tower C, No. 150

Zunyi Road

Changning District, Shanghai, China 200051

+86 (21) 22183083

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Huihe Zheng

President and Chief Executive Officer

Room 715, 7F, The Place Tower C, No. 150 Zunyi Road

Changning District, Shanghai, China 200051

+86 (21) 22183083

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Wei Wang, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105

Phone: (212) 370-1300

Fax: (212) 370-7889

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission acting pursuant

to said Section 8(a) may determine.

The information in this preliminary prospectus is

not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and

Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an

offer to buy these securities in any state where the offer or sale is not permitted.

| Preliminary Prospectus |

Subject

to Completion, dated December 21, 2022 |

QDM International

Inc.

Up to 30,000,000 Shares of Common

Stock

We are offering up to 30,000,000

shares of our common stock, par value $0.0001 per share, of QDM International Inc., a Florida holding company with substantially all

of its operations conducted in Hong Kong (referred to herein as “QDM” or the “Company”), without an underwriter

or placement agent at a fixed price of $0.081 per share. There is a material disparity between the offering price of the shares of our

common stock being offered under this prospectus and the market price of the common stock as of the date of this prospectus. For a detailed

description of the principal factors considered by us in determining the final public offering price, see “Plan of Distribution.”

Throughout this prospectus, unless the context indicates otherwise, all references to “we,” “us,” “our”

or similar terms used in this prospectus refer to QDM and/or its consolidated subsidiaries, including 24/7 Kid Doc, Inc., QDM Holdings

Limited, QDM Group Limited, YeeTah Insurance Consultant Limited, Lutter Global Limited and QDMI Software Group Limited.

This offering is being conducted on a “best

efforts/no minimum” basis, meaning that no aggregate minimum offering amount is required to be raised by us in this offering.

As such, the actual public offering amount and proceeds to us, if any, are not presently determinable and net proceeds may be substantially

less than the total maximum offering set forth above.

This offering will terminate three months after

the effective date of the registration statement of which this prospectus forms a part unless the offering is fully subscribed

before that date or we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We

may conduct multiple closings of the offering until the offering is fully subscribed or terminated. In either event, the offering

may be closed without further notice to you. All costs associated with the registration will be borne by us. All net proceeds will

be available to us for use as set forth in “Use of Proceeds” herein. Offering proceeds will not be held in escrow and

may be utilized by us immediately on a subscription-by-subscription basis upon satisfaction of the closing conditions set forth

in the securities purchase agreement to be entered into between us and the investors in this offering.

This

prospectus will permit our officers and directors to offer and sell on our behalf the shares

of common stock offered hereby directly to the public, with no commission or other remuneration

payable to them for any shares sold. In offering the securities on our behalf, our officers

and directors will rely on the safe harbor from broker-dealer registration set out in Rule

3a4-1 under the Securities Exchange Act of 1934, as amended (which we refer to herein as

the Exchange Act). Notwithstanding the foregoing, we reserve the right to engage FINRA member

broker-dealers as finders in connection with this offering.

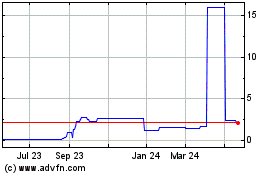

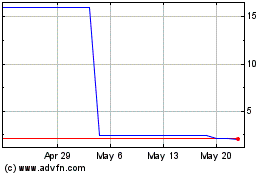

Our

common stock is currently traded on the OTCQB Marketplace operated by the OTC Markets under

the symbol “QDMI.” On December 16, 2022, the last reported sales price for our

common stock was $0.81 per share. The over-the-counter market quotations reflect inter-dealer

prices, without retail mark-up, mark-down or commission and may not necessarily represent

actual transactions.

We conduct substantially all of our operations in

Hong Kong. Although we conduct limited administrative activities in our principal executive offices located in China, we currently do

not have or intend to set up any subsidiary or enter into any contractual arrangements to establish a variable interest entity (“VIE”)

with any entity in mainland China. Hong Kong is a special administrative region of the PRC and the basic policies of the PRC regarding

Hong Kong are reflected in the Basic Law, namely, Hong Kong’s constitutional document, which provides Hong Kong with a high degree

of autonomy and executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one

country, two systems”. Accordingly, we believe the laws and regulations of the PRC do not currently have any material impact on

our business, financial condition or results of operations. However, there is no assurance that there will not be any changes in the economic,

political and legal environment in Hong Kong in the future. If there is significant change to current political arrangements between mainland

China and Hong Kong, companies operated in Hong Kong may face similar regulatory risks as those operated in the PRC, including its ability

to offer securities to investors, list its securities on a U.S. or other foreign exchange, conduct its business or accept foreign investment.

In light of China’s recent expansion of authority in Hong Kong, there are risks and uncertainties which we cannot foresee for the

time being, and rules and regulations in China can change quickly with little or no advance notice. The Chinese government may intervene

or influence our current and future operations in Hong Kong at any time, or may exert more control over offerings conducted overseas and/or

foreign investment in issuers likes ourselves. See “Risk Factors – Risks Related to Doing Business in Hong Kong.”

We are aware that the PRC government recently initiated

a series of statements and regulatory developments to regulate business operations in China with little advance notice, including cracking

down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a VIE structure,

adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We do not

believe these statements and regulatory developments would apply to us, however, should these statements or regulatory actions apply to

us, including our Hong Kong operations, in the future, or if we expand our business operations into Mainland China in some ways such that

we become subject to them to a greater extent, our ability to conduct our business, invest into Mainland China as foreign investments

or accept foreign investments, or list on a U.S. or other overseas exchange may be restricted. The failure to comply with these PRC regulations

could result in penalties and other regulatory actions against us and may materially and adversely affect our business and results of

operations. In addition, the PRC government has significant authority to intervene or influence the China or Hong Kong operations of

an offshore holding company, such as ours, at any time. These risks, together with uncertainties in the PRC legal system and the interpretation

and enforcement of PRC laws, regulations, and policies, could hinder our ability to offer or continue to offer the shares of our common

stock, result in a material adverse change to our business operations, and damage our reputation, which could cause our common stock to

significantly decline in value or become worthless. For a detailed description of risks relating to doing business in China, see “Risk

Factors—Risks Relating to Doing Business in Hong Kong.”

Furthermore, as more stringent criteria have been imposed by the SEC

and the Public Company Accounting Oversight Board (the “PCAOB”) recently, our securities may be prohibited from trading if

our auditor cannot be fully inspected. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determinations that it

is unable to inspect or investigate completely registered public accounting firms headquartered in Mainland China and Hong Kong, respectively,

and identifies the registered public accounting firms in Mainland China and Hong Kong that are subject to such determinations. On August

26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “Statement of Protocol”) with the China Securities

Regulatory Commission and the Ministry of Finance of China. The terms of the Statement of Protocol would grant the PCAOB complete access

to audit work papers and other information so that it may inspect and investigate PCAOB-registered accounting firms headquartered in China

and Hong Kong. According to the PCAOB, its December 2021 determinations under the Holding Foreign Companies Accountable Act (the “HFCA

Act”) remain in effect. The PCAOB is required to reassess these determinations by the end of 2022. Under the PCAOB’s rules,

a reassessment of a determination under the HFCA Act may result in the PCAOB reaffirming, modifying or vacating the determination. As

of the date of the prospectus, ZH CPA, LLC, our auditor, is not on the list. While our auditor is based in the U.S. and is registered

with PCAOB and subject to PCAOB inspection, in the event it is later determined that the PCAOB is unable to inspect or investigate completely

our auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause our shares

of our common stock to be delisted from the OTCQB. See “Risk Factors – Risks Related to Doing Business in Hong Kong

- Under the HFCA Act, our securities may be prohibited from being traded on any U.S. securities exchange, including the New York Stock

Exchange and Nasdaq, or through any other trading method within the SEC’s regulatory jurisdiction, including the OTC markets if

our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately could result in trading in our securities being

prohibited. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if

enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges

or the OTC markets if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.”

QDM is a holding company incorporated in Florida

with no material operations, and we conduct our insurance brokerage business through our wholly-owned subsidiary in Hong Kong. Investors

in our shares of our common stock thus are purchasing equity interest in QDM, a Florida holding company and may never directly own any

equity interest in our operating subsidiary in Hong Kong. This structure involves unique risks to investors. As a holding company, QDM

relies on dividends from our subsidiaries for its cash requirements, including any payment of dividends to its stockholders. The ability

of our subsidiaries to pay dividends to QDM may be restricted by the debt they incur on their own behalf or laws and regulations applicable

to them.

As of the date of

this prospectus, no transfer of cash or other types of assets has been made between our Florida holding company and subsidiaries.

Our Florida holding company has not declared or paid dividends to our investors given the early development stage of our businesses,

nor any dividends or distributions were made by a subsidiary to the Florida holding company. Our board of directors has complete

discretion on whether to distribute dividends, subject to applicable laws. For a detailed description of the transfers from the

Company to its subsidiaries and from its subsidiaries to the Company, see “Summary Financial Data—Cash Transfers and

Dividend Distribution.” in the Prospectus Summary

section and condensed consolidated schedule and consolidated financial statements starting from page F-1 of this prospectus. See

also “Risk Factors—Risks Relating to This Offering and Our Common Stock— We do not foresee paying cash

dividends in the foreseeable future and, as a result, our investors’ sole source of gain, if any, will depend on capital

appreciation, if any.” If needed, cash can be transferred between our holding company and subsidiaries through intercompany

fund advances, and there are currently no restrictions of transferring funds between our Florida holding company and our subsidiary

in Hong Kong. There are no significant restrictions on foreign exchange or our ability to transfer cash between entities within our

group, across borders, or to U.S. investors. See “Summary Financial Data—Cash Transfers and Dividend

Distribution.”

Investing in our securities is highly speculative

and involves a significant degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a

discussion of information that should be considered before making a decision to purchase our securities.

| | |

| Per

Share | | |

| Total(1) | |

| Public offering price | |

| $0.081 | | |

| $2,430,000 | |

| Proceeds, before expenses, to us | |

| $0.081 | | |

| $2,430,000 | |

| |

(1) |

Assumes the maximum number of shares in this offering are sold. |

Certain

of our existing stockholders and entities that are affiliated with our officers and directors, including HW FUND, a Cayman Islands exempted

company, of which Huihe Zheng, our President and Chief Executive Officer is the controlling

shareholder, and Willington Capital Limited, a Hong Kong limited company, of which Huili

Shen, our director, is the sole shareholder and director, have indicated their interests in purchasing up to an aggregate of approximately

$1.377 million worth of shares of common stock in this offering at the public offering price. However, because indications of interest

are not binding agreements or commitments to purchase, the existing stockholders and their affiliated entities could determine to purchase

more, less or no shares of common stock in this offering.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________,

2022.

TABLE OF CONTENTS

Please

read this prospectus carefully. It describes our business, our financial condition, and our results of operations. We have prepared

this prospectus so that you will have the information necessary to make an informed investment decision. You should rely only

on the information contained in this prospectus. We have not authorized anyone to provide you with any information or to make

any representations about us, the securities being offered pursuant to this prospectus or any other matter discussed in this prospectus,

other than the information and representations contained in this prospectus. If any other information or representation is given

or made, such information or representation may not be relied upon as having been authorized by us.

The

information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery

of this prospectus or of any sale of our common stock. Neither the delivery of this prospectus nor any distribution of securities

in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the

date of this prospectus. This prospectus will be updated and made available for delivery to the extent required by the federal

securities laws.

This

prospectus includes estimates, statistics and other industry data that we obtained from industry publications, research, surveys

and studies conducted by third parties and publicly available information. Such data involves a number of assumptions and limitations

and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high

degree of uncertainty. This prospectus also includes data based on our own internal estimates. We caution you not to give undue

weight to such projections, assumptions and estimates.

For

investors outside the United States: We have not done anything that would permit this offering or possession or distribution

of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where

action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe

any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside

of the United States.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. To understand this offering fully, you should

read the entire prospectus carefully, including the “Risk Factors” section, the financial statements and the notes

to the financial statements.

Unless otherwise indicated or the context otherwise

requires, references in this prospectus to:

| |

● |

“24/7 Kid” are to 24/7 Kid Doc, Inc., a Florida corporation

and wholly-owned subsidiary of the Company; |

| |

● |

“BVI” are to the British Virgin Islands; |

| |

● |

“common stock” are to the common stock of the Company,

par value $0.0001 per share; |

| |

● |

“EUR,” “€” and “Euro”

are to the legal currency of those member states of the European Union that have adopted the single currency; |

| |

● |

“HKD,” “HK$” and “Hong Kong dollars”

are to the legal currency of Hong Kong; |

| |

● |

“QDM BVI” are to QDM Holdings Limited, a BVI company

and a wholly-owned subsidiary of the Company; |

| |

● |

“QDM HK”

are to QDM Group Limited, a Hong Kong corporation and a wholly-owned subsidiary of QDM BVI; |

| |

● |

“QDM”

and the “Company” refer to QDM International Inc. a Florida corporation; and |

| |

● |

“Series

C Preferred Stock” are to the Series C Convertible Preferred Stock, par value $0.0001 per share, each 30 shares of Series C

Preferred Stock convertible into 11 shares of common stock (each Series C Preferred Stock initially convertible into 11 shares of

common stock before the Reverse Stock Split (as defined below)); |

| |

● |

the “Group” are to QDM BVI, QDM HK and YeeTah, collectively; |

| |

● |

“technical representatives”

are to licensed individuals who provide advice to an insurance policy holder or potential policy holder on insurance matters

on behalf of an insurance agent or broker, or arrange contracts of insurance in or from Hong Kong on behalf of that insurance

agent or broker; |

| |

● |

“US$,” “U.S. dollars,” “$,”

and “USD” are to the legal currency of the United States; |

| |

● |

“we,” “us,”

and “our” refer to QDM International Inc. and/or its consolidated subsidiaries, unless the context suggests otherwise;

and |

| |

● |

“YeeTah” are to YeeTah Insurance Consultant Limited,

a Hong Kong corporation and wholly-owned subsidiary of QDM HK. |

The

Company, 24/7 Kid, and QDM BVI maintain their books and records in U.S. dollars and in accordance with generally accepted accounting

principles of the United States. QDM HK and YeeTah maintain their books and records either in U.S. dollars or Hong Kong dollars.

This prospectus also contains translations of Hong Kong dollars into U.S. dollars for the convenience of the reader. The Hong

Kong dollar is freely convertible into other currencies (including the U.S. dollar). Since 1983, the Hong Kong dollar has effectively

been officially linked to the U.S. dollar at the rate of approximately HK$7.80 = US$1.00. However, the market exchange rate of

the Hong Kong dollar against the U.S. dollar continues to be influenced by the forces of supply and demand in the foreign exchange

market.

Unless

otherwise stated, all translations of Hong Kong dollars into U.S. dollars were made at a pegged rate of HK$7.80 = US$1.00. We

make no representation that the Hong Kong dollar or U.S. dollar amounts referred to in this prospectus could have been or could

be converted into U.S. dollars or Hong Kong dollars, as the case may be, at any particular rate or at all.

Overview

QDM

is a holding company incorporated in Florida with no material operations of its own, and we conduct our insurance brokerage business

through our wholly-owned subsidiary, YeeTah, primarily in Hong Kong.

YeeTah

sells a wide range of insurance products, consisting of two major categories: (1) life and medical insurance, such as individual

life insurance; and (2) general insurance, such as automobile insurance, commercial property insurance, liability insurance and

homeowner insurance. In addition, as a Mandatory Provident Fund (“MPF”) Intermediary, YeeTah also provides its customers

with assistance on account opening and related services under the MPF and the Occupational Retirement Schemes Ordinance schemes

(“ORSO”) in Hong Kong, both of which are mandatory retirement protection schemes set up for employees who are Hong

Kong residents.

YeeTah

sells insurance products underwritten by insurance companies operating in Hong Kong to individual customers who are either Hong

Kong residents or visitors from Mainland China and are compensated for its services by commissions paid by insurance companies,

typically based on a percentage of the premium paid by the insured. Commissions generally depend on the type, term of insurance

products and the particular insurance company and they are usually paid by the insurance companies the next month after the cooling

off period of the policies sold, which is generally 21 days after the earlier of the delivery of the policy or a cooling off notice

to the policy holder.

As

of the date of this prospectus, YeeTah is a party to agreements with 19 insurance companies

in Hong Kong, and offers approximately 431 insurance products to its customers. As of September

30, 2022, YeeTah had serviced an aggregate of 625 customers in connection with the purchase

of an aggregate of 698 insurance products as well as a total of 44 customers for MPF related

services. For the three months ended September 30, 2022 and 2021, an aggregate of 66.9% and

80.0% of YeeTah’s total commissions were attributable to its top two insurance companies,

respectively. For the fiscal year ended March 31, 2022, an aggregate of 81.4% of YeeTah’s

total commissions was attributable to its top two insurance companies, which accounted for

47.7% and 33.7% its total commissions, respectively. For the fiscal year ended March 31,

2021, an aggregate of 88.8% of YeeTah’s total commissions was attributable to its top

two insurance companies, which accounted for 49.8% and 39.0% of its total commissions, respectively.

As an independent insurance

agency, YeeTah offers not only a broad range of insurance products underwritten by multiple insurance companies to address the needs of

increasingly sophisticated customers with diverse needs and preferences, but also quality services covering the policy application, customer

information collection, analysis of policy selection, and after-sale services.

We

focus on offering long-term life insurance products including endowment life and annuity life insurance and distribute general insurance

products including automobile insurance, individual accident insurance, homeowner insurance, liability insurance and travel insurance.

All of YeeTah’s sales of life and medical insurance products and general insurance products are conducted through its licensed

salespersons (known in Hong Kong as technical representatives).

Hong Kong’s independent

insurance intermediary market is experiencing rapid growth due to increasing demands for insurance products by the Chinese population,

especially visitors from mainland China. We intend to grow our business by offering premium services and recruiting talent to join our

professional team and sales force, expanding our distribution network through building more connections with business partners in Hong

Kong and mainland China, such as wealth management companies, funds, trust companies, and overseas immigration agencies.

Holding Company Structure

QDM

is not an operating company but a Florida holding company with operations primarily conducted through its wholly-owned subsidiary

based in Hong Kong. Our investors hold shares of common stock in QDM, the Florida holding company.

We do not have or intend to

set up any subsidiary or enter into any contractual arrangements to establish a VIE structure with any entity in China. 24/7 Kid, Lutter

Global Limited (“LGL”) and QDMI Software Group Limited (“QDMS”) currently have no operations. Our corporate organizational

structure is as follows as of the date of this prospectus:

Our

holding company structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong operating

subsidiary and will be dependent upon dividends and other distributions from our subsidiaries to finance our cash flow needs.

Our ability to receive dividends and other contributions from our subsidiaries are significantly affected by regulations promulgated

by Hong Kong and PRC authorities. Any change in the interpretation of existing rules and regulations or the promulgation of new

rules and regulations may materially affect our operations and or the value of our securities, including causing the value of

our securities to significantly decline or become worthless. For a detailed description of the risks facing the Company associated

with our structure, please refer to “Risk Factors – Risks Related to Doing Business in Hong Kong.”

Currently, PRC laws and regulations

do not prohibit direct foreign investment in our Hong Kong operating subsidiary. Nonetheless, in light of the recent statements and regulatory

actions by the PRC government, such as those related to Hong Kong’s national security, the promulgation of regulations prohibiting

foreign ownership of Chinese companies operating in certain industries, which are constantly evolving, and anti-monopoly concerns, we

may be subject to the risks of uncertainty of any future actions of the PRC government in this regard, which would likely result in a

material change in our operations, including our ability to continue our existing holding company structure, carry on our current business,

accept foreign investments, and offer or continue to offer securities to our investors, and the resulting adverse change in value to our

common stock. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the China Securities

Regulatory Commission (the “CSRC”), if we fail to comply with such rules and regulations, which would likely adversely affect

the ability of the Company’s securities to continue to trade on the OTCQB, which would likely cause the value of our securities

to significantly decline or become worthless.

Transfers

of Cash to and from Our Subsidiaries

QDM

is a holding company incorporated in Florida with no material operations of its own, and we conduct our insurance brokerage business

through our wholly-owned subsidiary, YeeTah, primarily in Hong Kong. We may rely on dividends and other distributions on equity

to be paid by our Hong Kong subsidiary to fund our cash and financing requirements, including the funds necessary to pay dividends

and other cash distributions to our stockholders, to service any debt we may incur and to pay our operating expenses. Currently,

substantially all of our operations are in Hong Kong. Hong Kong is a special administrative region of the PRC and the basic policies

of the PRC regarding Hong Kong are reflected in the Basic Law of the Hong Kong Special Administrative Region of the People’s

Republic of China (the “Basic Law”), providing Hong Kong with a high degree of autonomy and executive, legislative

and independent judicial powers, including that of final adjudication under the principle of “one country, two systems”.

The laws and regulations of the PRC do not currently have any material impact on transfer of cash from us to YeeTah or from YeeTah

to us and the investors in the U.S. In addition, there are no restrictions or limitations under the laws of Hong Kong imposed

on the conversion of Hong Kong dollar into foreign currencies and the remittance of currencies out of Hong Kong or across borders

and to U.S investors.

We are permitted under the

Florida law to provide funding to our subsidiaries, including YeeTah, through loans or capital contributions without restrictions on the

amount of the funds. There are no restrictions or limitations on our ability to distribute earnings from our businesses, including our

subsidiaries, to the U.S. investors. YeeTah is permitted under the laws of Hong Kong to provide funding to QDM HK and QDM BVI, the holding

company incorporated in Hong Kong and the British Virgin Islands, respectively, through dividend or other distribution without restrictions

on the amount of the funds. As of the date of this prospectus, there has been no dividends or distributions between our holding company

and our subsidiaries nor do we expect such dividends or distributions to occur in the foreseeable future among our holding company and

its subsidiaries.

YeeTah

currently intends to retain all available funds and future earnings, if any, for the operation and expansion of its business and

does not anticipate declaring or paying any dividends in the foreseeable future. There are

no significant restrictions and limitations on our ability to distribute earnings from our businesses, including our subsidiaries,

to the parent company and U.S. investors or our ability to settle amounts owed. There are no restrictions on foreign exchange

or our ability to transfer cash between entities within our group, across borders, or to U.S. investors. However, the PRC government

has significant authority to intervene or influence the China operations of an offshore holding company at any time, and such

oversight may also extend to our Hong Kong operating company. We cannot assure you that the PRC government will not prevent us

from transferring the cash we maintain in Hong Kong outside of Hong Kong, or restrict our ability to deploy our cash into business

or to pay dividends. We could also be subject to limitations on the transfer or the use of our cash if we expand our business

operations into China or conduct our operations in some other ways such that we become subject to PRC laws that regulate these

activities. In addition, if YeeTah incurs debt on its own behalf in the future, the instruments governing the debt may

restrict its ability to pay dividends or make other distributions to us. Any limitation

on our ability to transfer or use our cash could materially and adversely limit our ability to grow, make investments or acquisitions

that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

We

have never paid or declared any cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future.

The declaration of dividends on any class of shares is within the discretion of our board of directors, subject to the Florida law, out

of legally available funds, and will depend on the assessment of, among other factors, earnings, capital requirements and our operating

and financial condition. If we determine to pay dividends on any of our capital stock in the future to our stockholders, we will be dependent

on receipt of funds from our Hong Kong subsidiary, YeeTah. None of our subsidiaries has made any dividends or distributions to us. Under

the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us.

See “Risk Factors – Risks Related to Our Business and Industry – We rely on dividends and other distributions on

equity paid by our subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our subsidiaries

to make payments to us could have a material adverse effect on our ability to conduct our business.” on page 12.

Competitive

Advantages

We

believe that the following competitive strengths contribute to our growth and differentiate us from our competitors:

| |

● |

premium customer service experience; |

| |

|

|

| |

● |

concentrated insurance product offerings; |

| |

|

|

| |

● |

good relationships with insurance companies; |

| |

|

|

| |

● |

experienced management team; and |

| |

|

|

| |

● |

strong commitment to rigorous training and development. |

Growth

Strategy

Our

goal is to further expand our distribution network. To achieve this goal, we intend to capitalize on the growth potential of Hong

Kong’s insurance industry and the insurance intermediary sector, leverage our competitive strengths and pursue the following

strategy:

| |

● |

Pursue acquisitions of other insurance intermediaries. |

| |

|

|

| |

● |

Further participation in the growing life-insurance sector in Hong Kong |

| |

|

|

| |

● |

Further expand our distribution network through building relationships with strategic partners. |

| |

|

|

| |

● |

Continue to strengthen our relationships with leading insurance companies. |

Recent

Developments

Impact

of COVID-19

An outbreak of a novel strain

of the coronavirus, COVID-19, was identified in China and has subsequently been recognized as a pandemic by the World Health Organization.

The COVID-19 pandemic has severely restricted the level of economic activity around the world. In response to the pandemic, the governments

of many countries, states, cities and other geographic regions, including Hong Kong, have taken preventative or protective actions, such

as imposing restrictions on travel and business operations and advising or requiring individuals to limit or forego their time outside

of their homes.

Due to the COVID-19 pandemic,

insurance brokers in Hong Kong have been greatly affected by the implementation of travel restrictions and social distancing measures.

These restrictions and measures have resulted in a significant decrease in new business for insurance brokers, such as YeeTah, that rely

on in-person consultations and storefronts for customer acquisition. Customers from mainland China contributed to a substantial part

of YeeTah’s commissions. Regulations require their physical presence in Hong Kong to complete the policy contract. However, due

to the political turmoil and travel restrictions related to the COVID-19 epidemic, mainland Chinese customers have dropped sharply. As

a result, YeeTah’s revenue from commissions on new business has decreased significantly. YeeTah’s commissions from renewal

premiums have also been materially affected since the mainland Chinese customers have been late in making the renewal payments due to

the inability to visit Hong Kong to make the payments. Most of YeeTah’s mainland customers do not have Hong Kong bank account and

used to pay their premiums through credit card or in cash in person.

While Hong Kong has recently

lifted most of its quarantine measures, tourists from mainland China who visit Hong Kong may still face restrictions on their travel

and be required to undergo quarantine upon returning to mainland China, which continues to present a significant challenge to YeeTah

to restore and grow its business. We do not expect a significant improvement over our business and results of operations until the mainland

visitors are permitted to enter Hong Kong and return to mainland China without COVID-19 related restrictions. As such, we presently focus

on servicing Hong Kong residents.

The extent to which the COVID-19

epidemic affects our business will depend on future developments in Hong Kong and around the world, which are highly uncertain and cannot

be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions required to contain

and treat it, among others. The duration of such business disruption and the resulting operational and financial impact on us have negatively

affected our financial results for the fiscal years ended March 31, 2022 and 2021 and may continue to adversely affect our business operations

for the year ended March 31, 2023. See “Management’s Discussion and Analysis of Results of Operations and Financial Conditions”

for more information on the impact of COVID-19 on our business operations and financial conditions. The global spread of COVID-19 pandemic

in a significant number of countries around the world has resulted in, and may intensify, global economic distress, and the extent to

which it may affect our results of operations will depend on future developments, which are highly uncertain and cannot be predicted.

See “Risk Factors—Risks Related to Our Business and Industry— Our business, financial condition and results of operations

have been and may continue to be adversely affected by the COVID-19 epidemic in China and Hong Kong.”

The

Holding Foreign Companies Accountable Act (the “HFCA Act”)

As

more stringent criteria applying to emerging market companies upon assessing the qualification of their auditors have been imposed

by the SEC and the PCAOB recently, and under the HFCA Act, our securities may be prohibited from being traded on the over-the-counter

(the “OTC”) markets if our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately

could result in trading in our securities being prohibited.

The

HFCA Act was enacted on December 18, 2020. The HFCA Act states that if the SEC determines that an issuer’s audit reports

issued by a registered public accounting firm have not been subject to inspection by the PCAOB for three consecutive years beginning

in 2021, the SEC shall prohibit such issuer’s securities from being traded on a national securities exchange or in the over-the-counter

trading market in the United States. On March 24, 2021, the SEC adopted interim final rules relating to the implementation of

certain disclosure and documentation requirements of the HFCA Act. We will be required to comply with these rules if the SEC identifies

us as having a “non-inspection” year under a process to be subsequently established by the SEC. If we fail to meet

the new rules before the deadline specified thereunder, we could face possible prohibition from trading on the OTCQB, deregistration

from the SEC and/or other risks, which may materially and adversely affect, or effectively terminate, our securities trading in

the United States. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure

requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an

audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable

to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

Furthermore,

on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would

amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges or the

OTC markets if its auditor is not subject to PCAOB inspections for two consecutive years instead of three thus reducing the time

before our securities may be prohibited from trading or being delisted.

On December

16, 2021, the PCAOB issued a Determination Report which found that the PCAOB is unable to inspect or investigate completely registered

public accounting firms headquartered in: (i) China, and (ii) Hong Kong. Our auditor, ZH CPA, LLC, is an independent registered public

accounting firm with the PCAOB and has been inspected by the PCAOB on a regular basis. The PCAOB currently has access to inspect the working

papers of our auditor. Our auditor is not headquartered in China or Hong Kong and was not identified in this report as a firm subject

to the PCAOB’s determination.

On August

26, 2022, the PCAOB announced that it had signed the Statement of Protocol with the CSRC and the Ministry of Finance of China. The terms

of the Statement of Protocol would grant the PCAOB complete access to audit work papers and other information so that it may inspect and

investigate PCAOB-registered accounting firms headquartered in China and Hong Kong. According to the PCAOB, its December 2021 determinations

under the HFCA Act remain in effect. The PCAOB is required to reassess these determinations by the end of 2022. Under the PCAOB’s

rules, a reassessment of a determination under the HFCA Act may result in the PCAOB reaffirming, modifying or vacating the determination.

See “Risk Factors – Risks Related to Doing Business in Hong Kong — Under the HFCA Act, our securities may

be prohibited from being traded on any U.S. securities exchange, including the New York Stock Exchange and Nasdaq, or through any other

trading method within the SEC’s regulatory jurisdiction, including the OTC markets if our auditor is not inspected by the PCAOB

for three consecutive years, and this ultimately could result in trading in our securities being prohibited. Furthermore, on June 22,

2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and

require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges or the OTC markets if its auditor is

not subject to PCAOB inspections for two consecutive years instead of three.” on page 12.

Regulatory

Permissions and Developments

Our

counsel as to PRC law has advised us that the laws and regulations of the PRC do not currently have any material impact on our

business, financial condition or results of operations. However, there is no assurance that there will not be any changes in the

economic, political and legal environment in Hong Kong in the future. If there is significant change to current political arrangements

between mainland China and Hong Kong, companies operated in Hong Kong such as us may face similar regulatory risks as those operated

in PRC, including their ability to offer securities to investors, list their securities on a U.S. or other foreign exchange, conduct

their business or accept foreign investment. In light of China’s recent expansion of authority in Hong Kong, there are risks

and uncertainties which we cannot foresee for the time being, and rules and regulations in China can change quickly with little

or no advance notice. The Chinese government may intervene or influence our current and future operations in Hong Kong at any

time, or may exert more control over offerings conducted overseas and/or foreign investment in issuers likes ourselves. See “Risk

Factors – Risks Related to Doing Business in Hong Kong.”

We

are aware that, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market,

enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures

to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6,

2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly

issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the

capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight

of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish

and improve the system of extraterritorial application of the PRC securities laws. Also, on July 10, 2021, the Cyberspace Administration

of China (the “CAC”) issued a revised draft of the Measures for Cybersecurity Review for public comments, or the Revised

Draft, which required that, among others, in addition to “operator of critical information infrastructure”, any “data

processor” controlling personal information of no less than one million users (which to be further specified) which seeks

to list in a foreign stock exchange should also be subject to cybersecurity review, and further elaborated the factors to be considered

when assessing the national security risks of the relevant activities.

Except

for the Basic Law, national laws of the PRC do not apply in Hong Kong unless they are listed in Annex III of the Basic Law and

applied locally by promulgation or local legislation. National laws that may be listed in Annex III are currently limited under

the Basic Law to those which fall within the scope of defense and foreign affairs as well as other matters outside the limits

of the autonomy of Hong Kong. National laws and regulations relating to data protection, cybersecurity and anti-monopoly have

not been listed in Annex III and do not apply directly to Hong Kong and, as such, we are advised by our counsel as to PRC law

that that the CAC and CSRC do not currently have jurisdiction over companies operating in Hong Kong.

Our

counsel as to PRC law has advised us that that we are not currently required to obtain any permission or approval from the CSRC,

the CAC or any other regulatory authority in the PRC for our operations, the trading of our securities on the OTCQB and the offering

of our securities to foreign investors. The business of our subsidiary is not subject to cybersecurity review with the CAC, given

that PRC laws on data protection and cybersecurity do not currently apply to Hong Kong. To the extent that if we become subject

to such PRC laws in the future, we do not believe we are required to conduct a cybersecurity review because (i) we do not possess

a large amount of personal information in our business operations; and (ii) data processed in our business does not have a bearing

on national security and thus may not be classified as core or important data by the authorities. In addition, we are not subject

to merger control review by China’s anti-monopoly enforcement agency as such PRC enforcement agency does not currently have

jurisdiction over our Hong Kong operating subsidiary. However, our operations could be adversely affected, directly or indirectly,

by existing or future laws and regulations relating to our business or industry, if we inadvertently conclude that such approvals

are not required when they are, or applicable laws, regulations, or interpretations change and we are required to obtain approval

in the future. We may be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the CSRC, if we

fail to comply with such rules and regulations, which could adversely affect the ability of the Company’s securities to

continue to trade on the OTCQB, which may cause the value of our securities to significantly decline or become worthless.

In

addition, in light of the recent statements and regulatory actions by the PRC government, such as those related to Hong Kong’s

national security, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries,

which are constantly evolving, and anti-monopoly concerns, we may be subject to the risks of uncertainty of any future actions

of the PRC government in this regard including the risk that the PRC government could disallow our holding company structure,

which may result in a material change in our operations, including our ability to continue our existing holding company structure,

carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. These adverse

actions could cause the value of our securities to significantly decline or become worthless.

There

may be prominent risks associated with our operations being in Hong Kong. For example, as a U.S.-listed public company operating

primarily in Hong Kong, we may face heightened scrutiny, criticism and negative publicity, which could result in a material change

in our operations and the value of our common stock. Additionally, we are subject to certain legal and operational risks associated

with our business operations in Hong Kong, which is subject to political and economic influence from China. PRC laws and regulations

governing our current business operations are sometimes vague and uncertain, and we may face the risk that changes in the policies

of the PRC government could have a significant impact upon the business we conduct in Hong Kong and the profitability of such

business. Therefore, these risks associated with being based in or having the majority of our operations in Hong Kong could likely

cause the value of our securities to significantly decline or be worthless. Furthermore, these risks would likely result in a

material change in our business operations or a complete hinderance of our ability to offer or continue to offer our securities

to investors. Furthermore, changes in Chinese internal regulatory mandates, such as the Regulations on Mergers and Acquisitions

of Domestic Enterprises by Foreign Investors (the “M&A Rules”), the Anti-Monopoly Law, the Cybersecurity Law and

the Data Security Law, may target the Company’s corporate structure and impact our ability to conduct business in Hong Kong,

accept foreign investments, or list on an U.S. or other foreign exchange.

The

U.S. government, including the SEC, has recently made statements and taken certain actions that may lead to significant changes

to U.S. and international relations, and will impact companies with connections to the United States or China (including Hong

Kong). The SEC has issued statements primarily focused on companies with significant China-based operations. For example, on July

30, 2021, Gary Gensler, Chairman of the SEC, issued a Statement on Investor Protection Related to Recent Developments in China,

pursuant to which Chairman Gensler stated that he has asked the SEC staff to engage in targeted additional reviews of filings

for companies with significant China-based operations.

For

a detailed description of the risks facing the Company and the risks associated with having our operations in Hong Kong, please

refer to “Risk Factors – Risks Related to Doing Business in Hong Kong.”

Recent

PCAOB Developments

The

PCAOB is currently unable to conduct inspections on accounting firms in the PRC or Hong Kong without the approval of the relevant

government authorities. The auditor and its audit work in the PRC or Hong Kong may not be inspected fully by the PCAOB. Inspections

of other auditors conducted by the PCAOB outside China have at times identified deficiencies in those auditors’ audit procedures

and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The

lack of PCAOB inspections of audit work undertaken in China or Hong Kong prevents the PCAOB from regularly evaluating the PRC

auditor’s audits and its quality control procedures. As a result, investor may be deprived of the benefits of such inspection.

The

documentation we may be required to submit to the SEC proving certain beneficial ownership requirements and establishing that

we are not owned or controlled by a foreign government in the event that we use a foreign public accounting firm not subject to

inspection by the PCAOB or where the PCAOB is unable to completely inspect or investigate our accounting practices or financial

statements because of a position taken by an authority in the foreign jurisdiction could be onerous and time consuming to prepare.

The HFCA Act mandates the SEC to identify issuers of SEC-registered securities whose audited financial reports are prepared by

an accounting firm that the PCAOB is unable to inspect due to restrictions imposed by an authority in the foreign jurisdiction

where the audits are performed. If such identified issuer’s auditor cannot be inspected by the PCAOB for three consecutive

years, the trading of such issuer’s securities on any U.S. national securities exchanges, as well as any over-the-counter

trading in the U.S., will be prohibited.

On

March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements

of the HFCA Act. An identified issuer will be required to comply with these rules if the SEC identifies it as having a “non-inspection”

year under a process to be subsequently established by the SEC.

On

November 5, 2021, the SEC approved the PCAOB’s Rule 6100, Board Determinations Under the Holding Foreign Companies Accountable

Act. Rule 6100 provides a framework for the PCAOB to use when determining, as contemplated under the HFCA Act, whether it is unable

to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position

taken by one or more authorities in that jurisdiction.

On

December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA

Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a

registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate

completely because of a position taken by an authority in foreign jurisdictions.

On

December 16, 2021, the PCAOB issued a Determination Report which found that the PCAOB is unable to inspect or investigate completely

registered public accounting firms headquartered in: (i) China, and (ii) Hong Kong. Our auditor, ZH CPA, LLC, is an independent

registered public accounting firm with the PCAOB and has been inspected by the PCAOB on a regular basis. The PCAOB currently has

access to inspect the working papers of our auditor. Our auditor is not headquartered in China or Hong Kong and was not identified

in this report as a firm subject to the PCAOB’s determination.

On

August 26, 2022, the PCAOB announced that it had signed the Statement of Protocol with the CSRC and the Ministry of Finance of

China. The terms of the Statement of Protocol would grant the PCAOB complete access to audit work papers and other information so

that it may inspect and investigate PCAOB-registered accounting firms headquartered in China and Hong Kong. According to the PCAOB,

its December 2021 determinations under the HFCA Act remain in effect. The PCAOB is required to reassess these determinations by the

end of 2022. Under the PCAOB’s rules, a reassessment of a determination under the HFCA Act may result in the PCAOB

reaffirming, modifying or vacating the determination.

As

a firm registered with the PCAOB, ZH CPA, LLC is subject to laws in the United States which provide that the PCAOB shall conduct

regular inspections to assess the auditor’s compliance with the applicable professional standards. We have no intention

of dismissing ZH CPA, LLC in the future or engaging any auditor not based in the U.S. and not subject to regular inspection by

the PCAOB. There is no guarantee, however, that any future auditor engaged by the Company would remain subject to full PCAOB inspection

during the entire term of our engagement. If it is later determined that the PCAOB is unable to inspect or investigate our auditor

completely, investor may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely

inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China or Hong Kong that prevents the PCAOB

from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance

that our financial statements and disclosures are adequate and accurate.

Future

developments in respect of increased U.S. regulatory access to audit information are uncertain, as the legislative developments

are subject to the legislative process and the regulatory developments are subject to the rule-making process and other administrative

procedures.

See

also “Risk Factors – Risks Related to Doing Business in Hong Kong — Under the HFCA Act, our securities

may be prohibited from being traded on any U.S. securities exchange, including the New York Stock Exchange and Nasdaq, or through

any other trading method within the SEC’s regulatory jurisdiction, including the OTC markets if our auditor is not inspected

by the PCAOB for three consecutive years, and this ultimately could result in trading in our securities being prohibited. Furthermore,

on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would

amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges or the

OTC markets if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.”

Corporate

History

QDM

was incorporated in Florida in March 2020 and are the successor to 24/7 Kid, which was incorporated in Florida in November 1998.

24/7 Kid was a telemedicine company that provided Connect-a-Doc telemedicine kits to schools and its services aimed at providing

an alternative to schools that desire to provide a higher level of healthcare to their students but are unable to keep a full-time

school nurse available.

On

October 21, 2020, we entered into a share exchange agreement (the “Share Exchange Agreement”) with QDM BVI, and Huihe Zheng,

the sole shareholder of QDM BVI (the “QDM BVI Shareholder”), who is also our principal stockholder and serves as our President

and Chief Executive Officer, to acquire all the issued and outstanding capital stock of QDM BVI in exchange for the issuance to the QDM

BVI Shareholder 900,000 shares of a newly designated Series C Preferred Stock, with each share of Series C Preferred Stock initially

being convertible into 11 shares of our common stock, subject to certain adjustments and limitations (the transaction, the “Share

Exchange”). The Share Exchange closed on October 21, 2020. As a result of the consummation of the Share Exchange, we acquired QDM

BVI, QDM HK and YeeTah, which is an insurance brokerage company primarily engaged in the sales and distribution of insurance products

in Hong Kong. Since the consummation of the Share Exchange, we have assumed the business operations of the Group as our own.

On November 3, 2021, we acquired 100% of the issued

and outstanding shares of QDMS, a company incorporated on February 6, 2020 in Cyprus. We acquired QDMS through an intermediary holding

company, LGL, which was incorporated on July 29, 2021 in the BVI. Before the acquisition, Huihe Zheng was the sole shareholder of QDMS.

As part of the acquisition, Mr. Zheng sold all the shares of QDMS to LGL for a consideration of EUR5,000 in November 2021 and at the same

time the sole shareholder of LGL, Mengting Xu, transferred all her shares in LGL to us for a consideration of US$1.00. As a result, we

acquired a 100% ownership of LGL, which, in turn, owns 100% of QDMS. Although QDMS has no operation as of the date of this prospectus,

QDMS plans to engage in the research and development of customer relationship management (“CRM”) software as a service (“SaaS”),

with a business model derived from “customer-centered” CRM concept to improve enterprise-customers relationship. We plan to

market QDMS’ SaaS services to our network of banks, securities companies, insurance companies and other financial services providers

in Hong Kong and China.

Summary

of Risk Factors

Our

business is subject to many significant risks, as more fully described in the section entitled “Risk Factors” immediately

following this prospectus summary. You should read and carefully consider these risks, together with the risks set forth under

the section entitled “Risk Factors” and all of the other information in this prospectus, including the financial statements

and the related notes included elsewhere in this prospectus, before deciding whether to invest in our common stock. If any of

the risks discussed in this prospectus actually occur, our business, financial condition or operating results could be materially

and adversely affected. In particular, our risks include, but are not limited to, the following:

Risks Related to Our Business and Industry

| |

● |

Our operating subsidiary derives a significant portion of revenues from selling insurance products supplied by our major insurance company partners and our business is subject to concentration risks arising from dependence on a single or limited number of insurance company partners. |

| |

|

|

| |

● |

We incurred net losses in the past and there can be no assurance that we will be able to become profitable in the future. |

| |

|

|

| |

● |

Our business, financial condition and results of operations have been and may continue to be materially adversely affected by the COVID-19 epidemic in China and Hong Kong. |

| |

|

|

| |

● |

Our independent auditor has expressed substantial doubt about our ability to continue as a going concern. |

| |

|

|

| |

● |

All of our sales of life and medical insurance products and general insurance products are conducted through our licensed technical representatives. If we are unable to attract and retain highly productive technical representatives, our business could be materially and adversely affected. Misconduct of the technical representatives may also have a material adverse effect on our business, results of operations or financial condition. |

| |

|

|

| |

● |

We are subject to extensive regulations for our insurance brokerage business and operations in Hong Kong. Failure to obtain, renew, or retain licenses, permits or approvals may affect our ability to conduct or expand our business. |

| |

● |

We face intense competition in the insurance intermediary industry in Hong Kong. If we are unable to compete effectively with both existing and new market participants, we may lose customers and our financial results may be negatively affected. |

| |

|

|

| |

● |

Our commission revenue is subject to both quarterly and annual fluctuations as a result of the seasonality of our business, the timing of policy renewals and the net effect of new and lost business. The factors that cause the quarterly and annual variations are not within our control. |

| |

|

|

| |

● |

Our disclosure controls and procedures are not effective and we have identified material weaknesses in our internal control over financial reporting. |

Risks Related to Doing Business in Hong

Kong

| |

● |

Adverse changes in economic and political

policies of the PRC government could have a material and adverse effect on overall economic growth in China and Hong Kong,

which could materially and adversely affect our business. |

| |

|

|

| |

● |

In light of China’s extension

of its authority into Hong Kong, the Chinese government can change Hong Kong’s rules and regulations at any time with

little to no advance notice, and can intervene and influence our operations and business activities in Hong Kong. We are currently

not required to obtain approval from Chinese authorities (including the CSRC and the CAC) to operate or to list on U.S. exchanges.

However, to the extent that the Chinese government exerts more control over offerings conducted overseas and/or foreign investment

in Hong Kong-based issuers over time and if our subsidiary or the holding company were required to obtain approvals in the

future, or we inadvertently conclude that that approvals were not required, or were denied permission from Chinese authorities

to list on U.S. exchanges, our operations may materially change, our ability to offer or continue to offer securities to our

investors or to continue listing on a U.S. exchange may be adversely affected, and the value of our common stock may significantly

decline or become worthless, which would materially affect the interest of the investors. There is a risk that the Chinese

government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas

and/or foreign investment in Hong Kong-based issuers, which could result in a material change in our operations and/or the

value of our securities. Further, any actions by the Chinese government to exert more oversight and control over offerings

that are conducted overseas and/or foreign investment in China-based issuers would likely significantly limit or completely

hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly

decline or be worthless. |

| |

|

|

| |

● |

We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. We may be liable for improper use or appropriation of personal information provided by our customers. |

| |

|

|

| |

● |

The recent joint statement by the SEC and PCAOB, and the HFCA Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering. Trading in our securities may be prohibited under the HFCA Act if the PCAOB determines that it cannot inspect or investigate completely our auditor, and that as a result an exchange may determine to delist our securities. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act which would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two thus reducing the time before our securities may be prohibited from trading or being delisted. On December 2, 2021, the SEC adopted rules to implement the HFCA Act. Pursuant to the HFCA Act, the PCAOB issued its report notifying the Commission that it is unable to inspect or investigate completely accounting firms headquartered in mainland China or Hong Kong due to positions taken by authorities in mainland China and Hong Kong. Our auditor is not subject to the determinations announced by the PCAOB on December 16, 2021. However, in the event the Hong Kong authorities subsequently take a position disallowing the PCAOB to inspect our auditor, then we would need to change our auditor to avoid having our securities delisted. |

| |

● |

QDM is a holding company with operations conducted through its wholly-owned subsidiary based in Hong Kong. This structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong subsidiary and will be dependent upon contributions from our subsidiary to finance our cash flow needs. Any limitation on the ability of our subsidiary to make payments to us could have a material adverse effect on our ability to conduct business. We do not anticipate paying dividends in the foreseeable future; you should not buy our stock if you expect dividends. |

| |

|

|

| |

● |

You may be subject to PRC income tax on dividends from us or on any gain realized on the transfer of shares of our common stock. |

| |

|

|

| |

● |

QDM is organized under the laws of the State of Florida as a holding company that conducts its business through a number of subsidiaries organized under the laws of foreign jurisdictions such as Hong Kong and the British Virgin Islands. This may have an adverse impact on the ability of U.S. investors to enforce a judgment obtained in U.S. Courts against these entities, bring actions in Hong Kong against us or our management or to effect service of process on the officers and directors managing the foreign subsidiaries. |

| |

|

|

| |

● |

U.S. regulatory bodies may be limited in their ability to conduct investigations or inspections if our operations are based in China. |

| |

|

|

| |

● |

The market price for our securities could be adversely affected by increased tensions between the United States and China. |

| |

|

|

| |

● |

Our business, financial condition and results of operations, and/or the value of our common stock or our ability to offer or continue to offer securities to investors may be materially and adversely affected to the extent the laws and regulations of the PRC become applicable to a company such as us. |

| |

|

|

| |

● |

The future development of national security laws and regulations in Hong Kong could materially impact our business by possibly triggering sanctions and other measures which can cause economic harm to our business. |

Risks Related to this Offering and Our

Securities

| |

● |

The Series

B and Series C Preferred Stock, which are controlled by Mr. Huihe Zheng, our Chairman of

the Board, President and Chief Executive Officer, have super voting rights that may adversely

affect our holders of common stock; in addition, Mr. Zheng, as our controlling stockholder,

may exercise significant influence over us and may be subject to conflicts of interest. |

| |

|

|

| |

● |

The limited public trading market may cause volatility in our

stock price. |

| |

|

|

| |

● |

The public offering price is set by our board of directors and does not necessarily indicate

the actual or market value of our common stock. |

| |

|

|

| |

● |

An active and visible trading market for our common stock may

not develop. |

Principal Offices

Our current principal offices are located at

Room 715, 7F, The Place Tower C, No. 150 Zunyi Road, Changning District, Shanghai, China 200051. Our phone number is +86 (21) 22183083.

QDM is organized under the

laws of the State of Florida as a holding company that conducts its business through a number of subsidiaries organized under the laws

of foreign jurisdictions such as Hong Kong, the BVI and Cyprus.

The Offering

| Securities

Offered: |

Up

to 30,000,000 shares of our common stock, par value $0.0001 per share. The shares of common stock are being offered directly by us on

a “best efforts/no minimum” basis, meaning we are not required to sell any aggregate minimum amount in this offering. The

price per share in this offering to investors will be $0.081. |

| |

|

Common Stock Outstanding

Before this Offering: (1) |

209,993

shares. |

| |

|

| Common Stock

to be Outstanding After this Offering: (1) |

30,209,993

shares, assuming the maximum amount of shares sold. |

| |

|

| Series

B Preferred Stock Outstanding |

13,500

shares of Series B Preferred Stock, par value $0.0001 per share, convertible into 1,350,000 shares of our common stock. |

| |

|

| Series