Quest Oil Inc. Announces up to 4 Billion Shares Buyback in Open Market and $2.4 Million in Revenue Projections for 2013

06 December 2012 - 12:30AM

Marketwired

Quest Oil Corp. (PINKSHEETS: QOIL), an independent oil production

and technology company, is pleased to share with the public the

estimated 2013 revenue projections for the company's business

activities.

Based on the current company's presence on the Venezuela Oil

production market, namely the current pending contracts and

contract negotiations, the management estimates the projected

revenues to reach between $1.5 to $2.4 million in 2013. In addition

the company will also start a share buyback in the open market

immediately.

Company VP of Operations Ken To stated, "We are very pleased to

present our preliminary estimated numbers. We will continue working

hard to increase shareholders value. Concurrently, we will set

aside a portion of our earnings for a share buyback program of up

to 4 billion shares. We believe in this company going forward, and

want to give our shareholders an early Christmas present."

About Quest Oil Inc.

Quest Oil Inc. is an aggressive, well-managed independent oil

production and technology company. The Company is an aggressively

managed energy exploration, development and production company in

the process of building oil & gas reserves and production. The

Company specializes in the profitable business of employing

Enhanced Oil Recovery technologies in the reworking &

re-completing "marginal" oil & gas wells located in the

thousands of mature oil & gas producing fields, across much of

the United States. The Company intends to foster rapid corporate

growth through its ability to identify, acquire interests in, and

rework oilfields that offer exceptionally attractive risk/reward

parameters.

The Company seeks to acquire and develop economically attractive

and geologically sound properties that have, in management's view,

significant upside development and revenue potential, as well as

related technologies that will both increase production of its

properties and provide licensing revenue through the use of its

technology by third-party producers. The Company operates its

business as a central hub, utilizing our strengths in M&A,

capital and resource management. We proactively minimize risk by

teaming with experienced exploration companies and project

operators, leveraging their experience and knowledge. Quest Oil's

development strategy includes the implementation of state of the

art technologies that are deployed to enhance and rework existing,

highly predictable wells, within proven oil and gas plays. By

focusing on domestic, mature oil fields and proven gas reserves,

Quest Oil can reduce exploration risks and better manage logistics.

In turn, we provide access to public company management and

funding, creating greater value for our business partners and

stakeholders alike. The Company is currently assessing additional

business strategies and opportunities to augment and strengthen its

core holdings.

Safe-Harbor Statement

This release contains statements or projections regarding future

performance that are forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995. Actual results

may differ materially from those projected as a result of certain

risks and uncertainties. The company's filings contain various RISK

FACTORS (and are incorporated on the Company's website "Investors"

section by reference) and should be read before any investment

decision.

Contact: Ken To (949) 209-8843 info@questoilcorp.com

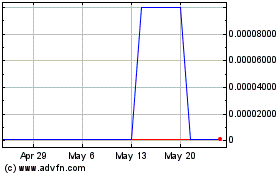

Quest Oil (PK) (USOTC:QOIL)

Historical Stock Chart

From Oct 2024 to Nov 2024

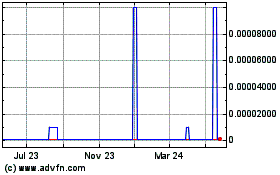

Quest Oil (PK) (USOTC:QOIL)

Historical Stock Chart

From Nov 2023 to Nov 2024