ReoStar Energy Corp. (OTCBB: REOS) today announced results of

operations for the Fiscal Year (FY) ended March 31, 2009.

Highlights of the Fiscal Year 2009:

-- Secured a $25MM senior secured credit facility in October 2008

-- Twelve Months Oil and gas revenues increased 33% to $6.5 million

versus $4.9 million for the previous year ended March 31, 2008

-- Twelve Months oil and gas production increased 35% to 124,968 BOE

versus 92,193 BOE for the same period in the prior year

Mark Zouvas, CEO of ReoStar, stated, "We are pleased to have

achieved improvements in our oil and gas production over the

previous year, despite the challenging energy environment we faced.

The industry continues to undergo extraordinary changes as pricing

volatility has created a large number of insolvencies during the

last six months. Due to weak pricing, we have shifted our focus

from development drilling to improving operational efficiencies and

cost control by utilizing advanced technologies at down-market

costs to improve current production. Additionally, we are reviewing

distressed E&P opportunities for acquisition. Our Union Bank of

California credit facility has allowed us to withstand the

continued volatility in pricing and we expect to be in position to

seize growth opportunities that have historically followed industry

wide slowdowns."

Fiscal Year 2009 Results Summary

Oil and gas production for the year increased 35% to a total of

124,968 BOE compared with 92,193 BOE for the fiscal year ended

March 31, 2008. Oil and gas revenue for the year increased 33% to a

total of $6.5 million compared to $4.9 million for the fiscal year

ended March 31, 2008.

The Company had a net loss of $2.0 million for the fiscal year

compared to net income of $796,000 for the prior fiscal year. The

fiscal year 2009 net loss included non-cash net expenses totaling

$4.4 million.

During fiscal year ended March 31, 2009, the Company's cash

provided from operations was $825,000 and REOS invested $10 million

in capital expenditures. Financing activities provided net cash of

$9.0 million. The Company entered into a $25 million senior secured

credit facility with an initial borrowing base of $14 million. The

Company borrowed $9.8 million against the borrowing base during the

fiscal year ended March 31, 2009.

On March 31, 2009, REOS had $426,000 in cash and total assets of

$23.0 million. Debt consisted of payables to non-related parties of

$9.1 million, of which $9.0 million were long-term note payables.

REOS also had accounts and notes payables to related parties of

$3.6 million.

Fiscal Year 2009 Operations Summary

-- Barnett Shale. ReoStar's main area of interest in the Barnett Shale

play is located in the "oil window" of the Barnett in southwest Cooke

County, Texas.

-- The Company completed, and began production in the seven wells that

were in process as of March 31, 2008. REOS also drilled, completed,

and began production in six wells. Two other wells were drilled

that are expected to be completed in the second quarter of fiscal

year 2010.

-- Corsicana Enhanced Oil Recovery (EOR) Project. ReoStar began injecting

surfactant polymer in phase I of the project in mid-June 2007 and has

continued injection throughout the current fiscal year. REOS initiated

phase II of the project by drilling 12 wells in June 2008 in an area

immediately south of the injection facility adjacent to the phase I

wells.

-- Corsicana deeper zone exploration. ReoStar drilled four deeper

exploratory wells in the Corsicana acreage. The first two, a Glen Rose

well and a Pecan Gap well were unsuccessful. In December 2008, the

company successfully completed two Pecan Gap wells.

Fiscal Year End 2009 Proven Reserves

At year-end 2009, the independent petroleum-consulting firm of

Forrest Garb and Associates, Inc. reviewed ReoStar's reserves.

These engineers reviewed 100% of the Company's proved reserves.

All estimates of oil and gas reserves are subject to

uncertainty. The following table sets forth the estimated proven

reserves in barrel of oil equivalents and the benchmark prices used

in projecting them (in thousands except prices):

Estimated Proved Reserves Corsicana E. Texas

Barnett Shale Field Field Total

------------- --------- -------- ------

Proved Developed (MBOE) 688 187 13 888

Proved Undeveloped (MBOE) 2,072 10,320 - 12,392

------------- --------- -------- ------

Total Proven Reserves at

March 31, 2009 2,760 10,507 13 13,280

============= ========= ======== ======

Benchmark Pricing

Natural Gas per mmbtu $ 3.58

Crude Oil per barrel $ 49.65

Plans for fiscal year 2010

Barnett Shale

In December 2008, ReoStar suspended its Barnett Shale

development due to the decline in commodity prices. The Company

expects to renew development once commodity prices have stabilized.

The Company has two drilling commitments and expects to drill one

cluster of six wells in order to fulfill those commitments in

fiscal 2010, contingent on some recovery in gas pricing. However,

regardless of commodity volatility, the Company will fulfill their

drilling commitments by year-end. The capital expenditure budget

assumes REOS will retain 100% working interests in the wells. The

Company expects to fund the drilling with the proceeds of a debt

facility and if appropriate, proceeds from the sale of working

interests in the referenced wells, which will reduce its interests

accordingly.

Corsicana

ReoStar has applied for an area wide injection permit, which

when granted will allow the Company to streamline the regulatory

permitting process. Upon approval, REOS expects to begin injection

in Phase II of the polymer flood. REOS expects to begin drilling

Phase III of the surfactant-polymer project in the fourth quarter

of the current fiscal year 2010.

REOS will drill three more Pecan Gap wells in July and August of

2009. If the wells are successful, the company expects to initiate

a Pecan Gap drilling program and will drill up to 5 wells per month

for the balance of the fiscal year. The Pecan Gap lies at about

1,800 feet and has proven to show favorable economics. REOS will,

at its discretion, sell up to 50% working interest in these wells

on a turn-key contract basis. As is our policy, we the Company will

refrain from granting more than one offset well to third-party

working interest owners, which enables us to have 100% working

interest in subsequent wells drilled.

Total capital expenditure budget for fiscal 2010 for the

Corsicana projects is $3.5 million. The budget will be funded

primarily with proceeds from the sale of up to 50% working interest

in the Pecan Gap wells, the credit facility, and cash flow from

current operations.

South Texas

During the first quarter of the fiscal year, REOS signed a

contract to acquire a 100% working interest (75% net revenue

interest) in 13,000 acres in South Texas. The acreage is in the

Edwards trend and contains both Edwards and Eagle Ford Shale

prospects. The technical team will remain in place once the

transaction is complete as they have significant experience in

South Texas and will be the operator of record for this area of

ReoStar's development. The team will provide the technical

expertise required to be successful in the Edwards and Eagle Ford

Shale plays.

"Our position for 2010 is very good as we have remained prudent

in managing our budgets and adjusting to the current economic

conditions. We have avoided entering into long-term contracts with

respect to our drilling operations and therefore have been able to

survive the dramatic downturn and avoid the problems now being

experienced by some of our industry peers. We have significant

infrastructure in place in our core areas, yet our fixed operating

costs are below industry averages. We continue to seek valuable

bolt-on acreage in our perspective target areas, but will remain

conservative with capital expenditures until we feel it is

appropriate to deploy our resources. We have a solid number of high

quality prospects in the Barnett Shale to drill and our expansion

in Corsicana is showing tremendous promise, especially with our

Pecan Gap drilling program. Our new opportunity in Eagle Ford Shale

could prove to be prescient for ReoStar, as we believe it will

provide significant gas and liquid production in anticipation of

rising gas prices. We are very excited by the prospects of our

company and we feel well positioned to capitalize on the

opportunities presented in this environment,'' concluded Mr.

Zouvas.

About ReoStar Energy Corporation

ReoStar Energy Corporation (OTCBB: REOS), headquartered in Fort

Worth, Texas, is an oil and gas company engaged in the acquisition,

development and production of natural gas and oil properties with

operations primarily focused on developmental resource plays and

enhanced oil recovery projects. The Company has vertically

integrated its assets to remove potential obstacles to growth,

which will enable it to develop and produce assets without the

risk, cost and time involved in traditional exploration.

The Company's strategy is to acquire an attractive portfolio of

oil reserves for a low cost, which have a high ratio of possible,

probable or proven undeveloped reserves. By converting these

undeveloped reserves into proved producing reserves, the Company

will continue to realize an increase in the overall value at low

risk and cost.

The Company's assets include approximately 20,000 gross (16,250

net) acres of mineral leasehold located in Texas (Barnett &

Corsicana) and Arkansas (Fayetteville). ReoStar's assemblage of

E&P assets allows for appreciable, unimpeded growth into the

foreseeable future.

Additional information is located on the company's website:

www.reostarenergy.com.

Certain statements in this news release may contain

forward-looking information within the meaning of Rule 175 under

the Securities Act of 1933 and Rule 3b-6 under the Securities

Exchange Act of 1934, and are subject to the safe harbor created by

those rules. All statements, other than statements of fact,

included in this release, including, without limitation, statements

regarding potential future plans and objectives of the company, are

forward-looking statements that involve risks and uncertainties.

There can be no assurance that such statements will prove to be

accurate and actual results and future events could differ

materially from those anticipated in such statements. Technical

complications which may arise could prevent the prompt

implementation of any strategically significant plan(s) outlined

above.

ReoStar Energy Corporation

Consolidated Statements of Operations

Years Ended

---------------------------------

Mar. 31, 2009 Mar. 31, 2008

------------- -------------

Revenues

Oil & Gas Sales $ 6,558,069 $ 4,902,072

Sale of Leases 18,005 307,028

Other Income 458,365 281,231

------------- -------------

7,034,439 5,490,331

------------- -------------

Costs and Expenses

Oil & Gas Lease Operating Expenses 2,598,208 2,125,261

Workover Expenses 114,683 356,342

Severance & Ad Valorem Taxes 427,307 318,785

Geologic & Geophysical - 8,993

Delay Rentals 2,975 52,186

Plugging Costs & Expired Leases 433,976 290,959

Depletion & Depreciation 3,487,440 1,520,406

General & Administrative:

Salaries & Benefits 874,418 1,104,785

Legal & Professional 720,771 584,765

Other General & Administrative 701,687 332,009

Interest, net of capitalized interest

of $537,024 and $488,299 for the

years ended March 31, 2009 and

March 31, 2008, respectively 3,780 -

------------- -------------

9,365,245 6,694,491

------------- -------------

Other Income (Expense)

Interest Income 79,876 210,938

Other Expense (6,745) (16,938)

Loss on Equity Method Investments (206,561) (32,605)

------------- -------------

(Loss) from continuing operations

before income taxes and

discontinued operations (2,464,236) (1,042,765)

------------- -------------

Income Tax Benefit 460,402 364,930

------------- -------------

Loss before discontinued operations (2,003,834) (677,835)

Income from discontinued operations,

net of income taxes:

Pipeline Income - 22,930

Gain on Sale of Pipeline - 1,450,805

------------- -------------

Income from discontinued operations - 1,473,735

------------- -------------

Net Income (Loss) $ (2,003,834) $ 795,900

============= =============

Basic & Diluted (Loss) Income per

Common Share:

Loss from continuing operations $ (0.02) $ (0.01)

Income from discontinued

operations $ - $ 0.02

------------ -------------

Net Income (Loss) per Common

Share $ (0.02) $ 0.01

============ =============

Weighted Average Common

Shares Outstanding 80,300,804 78,800,618

============ =============

Contact: ReoStar Energy Corporation Teresa Wright

817-546-7718

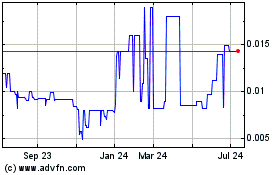

ReoStar Energy (PK) (USOTC:REOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

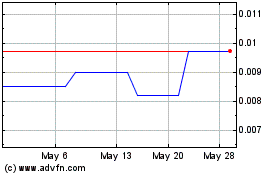

ReoStar Energy (PK) (USOTC:REOS)

Historical Stock Chart

From Jan 2024 to Jan 2025