Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-132929

3,225,645

Shares

SEARCHLIGHT

MINERALS CORP.

Common

Stock

We are

registering 3,225,645 shares of our common stock for sale by our stockholders

issuable, from time to time, upon the exercise of outstanding common stock

purchase warrants.

The

selling stockholders identified in this prospectus, or their pledgees, donees,

transferees or other successors-in-interest, may offer the shares from time to

time through public or private transactions at prevailing market prices, at

prices related to prevailing market prices or at privately negotiated

prices. We will not receive any proceeds from the sale of the

shares. We may receive proceeds in connection with the exercise of

warrants for the underlying shares of our common stock, which may in turn be

sold by the selling stockholders under this prospectus. The selling

stockholders may resell the common stock to or through underwriters,

broker-dealers or agents, who may receive compensation in the form of discounts,

concessions or commissions. The selling stockholders will bear all

commissions and discounts, if any, attributable to the sales of

shares. We will bear all costs, expenses and fees in connection with

the registration of the shares.

Investing

in our common stock involves a high degree of risk. See “Risk

Factors” beginning on page 6 for certain risks and uncertainties that you should

consider.

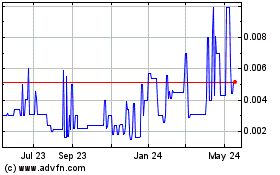

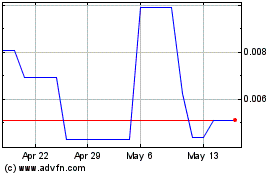

Our

common stock is quoted on the OTC Bulletin Board under the symbol

“SRCH.” The last reported sale price of our common stock on December

11, 2009 was $1.85 per share.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a

criminal offense.

The date

of this prospectus is December 14, 2009

TABLE

OF CONTENTS

|

|

Page

|

|

|

|

|

Summary

|

2

|

|

Special

Note Regarding Forward-Looking Statements

|

6

|

|

Risk

Factors

|

6

|

|

Use

of Proceeds

|

23

|

|

Selling

Stockholders

|

24

|

|

Plan

of Distribution

|

31

|

|

Legal

Matters

|

33

|

|

Experts

|

33

|

|

Incorporation

of Certain Information By Reference

|

33

|

|

Where

You Can Find Additional Information

|

34

|

You

should rely only on the information contained in this prospectus. We

have not authorized anyone to provide you with information that is different

from that contained in this prospectus. This prospectus is not an

offer to sell these securities and is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

The information in this

prospectus is complete and accurate only as of the date of the front cover

regardless of the time of delivery of this prospectus or of any sale of

shares. Except where the context requires otherwise, in this

prospectus, the words “Company,” “Searchlight,” “we,” “us” and “our” refer to

Searchlight Minerals Corp., a Nevada corporation.

This

summary highlights selected information from this prospectus. It does

not contain all of the information that is important to you. We

encourage you to carefully read this entire prospectus and the documents to

which we refer you. The following summary is qualified in its

entirety by reference to the detailed information appearing elsewhere in this

prospectus.

Our

Company

Exploration Stage

Company

. We are an exploration stage company engaged in the

acquisition and exploration of mineral properties and slag reprocessing

projects. Our business is presently focused on our two mineral

projects in which we hold interests:

|

|

·

|

the

Clarkdale Slag Project, located in Clarkdale, Arizona, is a reclamation

project to recover precious and base metals from the reprocessing of slag

produced from the smelting of copper ore mined at the United Verde Copper

Mine in Jerome, Arizona; and

|

|

|

·

|

the

Searchlight Gold Project, which involves exploration for precious metals

on mining claims near Searchlight,

Nevada.

|

Clarkdale Slag

Project

. The Clarkdale Slag Project, located in Clarkdale,

Arizona, is a reclamation project to recover precious and base metals from the

reprocessing of slag produced from the smelting of copper ore mined at the

United Verde Copper Mine in Jerome, Arizona. Metallurgical testing

and project construction on the Clarkdale Slag Project have been ongoing since

2005, initially under the direction of the prior owners, thereafter with our

participation in a joint venture with the prior owners in 2005, and currently

solely by us since we acquired 100% of the Clarkdale Slag Project in

2007.

Since our

acquisition of 100% of the Clarkdale Slag Project in 2007, we have devoted

considerable effort to the designing and engineering of our first production

module, which included finalizing the production flow sheet, sourcing and

purchasing equipment as well as refurbishing the module building and

constructing the electrowinning building. The module and

electrowinning buildings house the first production module, which has been

designed to allow for the grinding, leaching, filtering and extraction of

precious and base metals from the slag material and is expected to process

between 100 and 250 tons of slag material per day. During 2008, we

completed the refurbishing and construction of the module and electrowinning

buildings, respectively, and we installed all the necessary equipment in the two

buildings for the operation of the first production module. During

2009, we have been executing our plan of operation on the Clarkdale Slag

Project, which includes the start-up and operation of the first production

module, in an effort to achieve consistent levels of gold and silver extraction

that would support the economic feasibility of a commercial production

facility.

Searchlight Gold

Project

. The Searchlight Gold Project involves exploration for

precious metals on mining claims near Searchlight, Nevada. We have

been engaged in an exploration program on our Searchlight Gold Project since

2005. Our Searchlight Claims are comprised of non-patented placer

mining claims located on federal land administered by the United States Bureau

of Land Management (“BLM”). Drilling and mining activities on the

Searchlight Claims must be carried out in accordance with a Plan of Operations

or permit issued by the BLM.

The

former Searchlight Claim owners had previously obtained a BLM approved Plan of

Operations, which included permission to drill eighteen holes on the 3,200 acre

project area and to mine a 36-acre pit on our RR304 claim. We had

anticipated conducting our early stage exploratory work on the Searchlight

Claims property by utilizing the Plan of Operations issued to the former

Searchlight Claim owners, until such time as we would obtain a permit for

exploration and development in our own name or the former Searchlight Claim

holder’s permit was transferred to us.

Although

the Plan of Operations was accepted and registered in the name of a former

Searchlight Claim owner, which is an affiliate of K. Ian Matheson, one of our

principal stockholders and a former officer and director, in September 2007, we

learned that the BLM had issued an order (the “BLM Order”) for “Immediate

Suspension of All Activities” notice on May 12, 2006 against Mr. Matheson and

certain of his affiliates with respect to a dispute with the BLM on a project

unrelated to the Searchlight Gold Project. The issuance of the BLM

Order restricted our ability to rely upon the Plan of Operations to conduct our

early stage exploratory work on the Searchlight Claims property until such time

that we may obtain our own Plan of Operations. The BLM Order

effectively covered all projects tied to Mr. Matheson.

As a

result of the BLM Order, we have been delayed in our ability to drill on the

Searchlight Gold Project property. However, we have anticipated that

regulatory and other delays would take place, which are typical in our

industry. We have applied for a new Plan of Operations in our name

and are currently in the course of the BLM’s review process. In

addition, we have continued and will continue with our surface sampling and

metallurgical testing program while awaiting approval of a new Plan of

Operations.

After a

series of correspondence between us and the BLM, on December 15, 2008, we

received a letter from the BLM advising us that the BLM had closed our Notice of

Intent from consideration and that a new Plan of Operations would be required

based on two issues relating to the Desert Tortoise (Gopherus asassizii), a

Federally listed Threatened Species: (i) the proximity of the project area to a

nearby “Areas of Critical Environmental Concern” (ACEC); and (ii) the future

likelihood of tortoises being present on the land within the project area which

is involved in the application.

We

conformed the new Plan of Operations with the previously approved Environmental

Assessment and, after a further series of correspondence between us and the BLM,

on October 13, 2009, we received a letter from the BLM regarding our Plan of

Operations confirming that the BLM considers our Plan of Operations to conduct

drilling complete and that the BLM will conduct a final review of the previously

approved Environmental Assessment to determine its adequacy. The

BLM’s letter also advised that they would be sending letters addressing the

Conditions of Approval and the bond determination under separate

cover.

There is

no regulatory time frame for the BLM to review our Plan of

Operations. We understand that the average time frame for approval of

a plan of operation by the Las Vegas, Nevada branch office of the BLM since

January 1, 2000 has been approximately four years and five

months. Although we understand that the average time frame of the

application process by the Las Vegas branch office of the BLM relating to an

environmental assessment in connection with a plan of operations is

approximately eleven months, the “threatened species” issue raised by the BLM

requires the BLM to consult with the U.S. Fish and Wildlife Service of the

Department of Interior, and the BLM has no control over the length of this

consultation process in order to develop any necessary environmental mitigation

measures.

Our work

on the project site will be limited to the scope within the Plan of

Operations. However, the Plan of Operations approval process will

delay the start of our drilling program for an undetermined period of

time. To perform any additional drilling or mining on the project, we

would be required to submit a new application to the BLM for approval prior to

the commencement of any such additional activities.

We do not

believe these added requirements will have a material adverse impact on our

overall business plan for the Searchlight Gold Project, given that we have

received no indication from the BLM, at this time, that the BLM will ultimately

deny our request for approval of our Plan of Operations. However,

there is no assurance of the timeline for approval by the BLM or that the BLM

will grant approval. Our drilling and mining program on this project

is dependent on obtaining the necessary approval from the

BLM. Therefore, if approval ultimately is not obtained, we may have

to scale back or abandon exploration efforts on the project. If

management determines, based on any factors including the foregoing, that

capitalized costs associated with any of our mineral interests are not likely to

be recovered, we would incur a significant impairment of our investment in such

property interests on our financial statements.

We have

not been profitable since inception and there is no assurance that we will

develop profitable operations in the future. Our net loss for the

nine months ended September 30, 2009 and 2008 was $3,194,874 and $2,363,475,

respectively. Our net loss for the years ended December 31, 2008,

2007 and 2006 was $3,128,386, $2,221,818 and $2,540,978,

respectively. As of September 30, 2009, we had an accumulated deficit

of $16,551,356. As of December 31, 2008, we had an accumulated

deficit of $13,356,482. We cannot assure you that we will have

profitable operations in the future.

Corporate

Information

. Our principal executive offices are located at

2441 W. Horizon Ridge Pkwy., Suite 120, Henderson, Nevada, 89052. Our

telephone number is (702) 939-5247. Our Internet address is

www.searchlightminerals.com

. Through

a link on the “Recent Filings” section of our website, we make available the

following filings as soon as reasonably practicable after they are

electronically filed with or furnished to the Securities and Exchange Commission

(“SEC”): our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K, and any amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”). All such filings are available free of

charge. Information contained on our website or that is accessible

through our website should not be considered to be part of this

prospectus.

|

Securities

offered by the selling stockholders

|

|

3,225,645

shares of common stock

(1)

|

|

|

|

|

|

Common

stock outstanding as of December 11, 2009

|

|

118,657,123

shares

|

|

|

|

|

|

Warrants

|

|

Each

warrant is exercisable for shares of our common stock at an initial

exercise price of $1.85 per share, subject to adjustment upon certain

events. The warrants were exercisable upon issuance and will

expire on November 12, 2012. The common stock underlying the

warrants is being registered for resale hereunder. The warrants

themselves have not been, are not hereby being, and are not expected to be

registered under the Securities Act of 1933, as amended, or the Securities

Act. Currently, there is no public market for the warrants, and

we do not expect that any such market will develop. The

warrants will not be listed on any securities exchange or included in any

automated quotation system.

|

|

|

|

|

|

Use

of Proceeds

|

|

We

will not receive any of the proceeds from the sale of the securities owned

by the selling stockholders. We may receive proceeds in

connection with the exercise of warrants for the underlying shares of our

common stock, which may in turn be sold by the selling stockholders under

this prospectus. We intend to use any proceeds from the

exercise of warrants for working capital and other general corporate

purposes. There is no assurance that any of the warrants will

ever be exercised for cash, if at all.

|

|

|

|

|

|

Risk

Factors

|

|

An

investment in our securities involves a high degree of risk and could

result in a loss of your entire investment. Prior to making an

investment decision, you should carefully consider all of the information

in this prospectus and, in particular, you should evaluate the risk

factors set forth under the caption “Risk Factors” beginning on page

6.

|

|

|

|

|

|

OTC

Bulletin Board Symbol

|

|

SRCH

|

|

(1)

|

Consists

of 3,225,645 shares of our common stock issuable upon the exercise of our

outstanding common stock purchase

warrants.

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. Forward-looking

statements provide our current expectations or forecasts of future

events. Forward-looking statements include statements about our

expectations, beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts. Words or phrases such as

“anticipate,” “believe,” “continue,” “ongoing,” “estimate,” “expect,” “intend,”

“may,” “plan,” “potential,” “predict,” “project” or similar words or phrases, or

the negatives of those words or phrases, may identify forward-looking

statements, but the absence of these words does not necessarily mean that a

statement is not forward-looking.

The risk

factors referred to in this prospectus could materially and adversely affect our

business, financial conditions and results of operations and cause actual

results or outcomes to differ materially from those expressed in any

forward-looking statements made by us, and you should not place undue reliance

on any such forward-looking statements. Any forward-looking statement

speaks only as of the date on which it is made and we do not undertake any

obligation to update any forward-looking statement or statements to reflect

events or circumstances after the date on which such statement is made or to

reflect the occurrence of unanticipated events. The risks and

uncertainties described below are not the only ones we face. New

factors emerge from time to time, and it is not possible for us to predict which

will arise. There may be additional risks not presently known to us

or that we currently believe are immaterial to our business. In

addition, we cannot assess the impact of each factor on our business or the

extent to which any factor, or combination of factors, may cause actual results

to differ materially from those contained in any forward-looking statements

.

If any such

risks occur, our business, operating results, liquidity and financial condition

could be materially affected in an adverse manner. Under such

circumstances, you may lose all or part of your investment.

The

industry and market data contained in this prospectus are based either on our

management’s own estimates or, where indicated, independent industry

publications, reports by governmental agencies or market research firms or other

published independent sources and, in each case, are believed by our management

to be reasonable estimates. However, industry and market data is

subject to change and cannot always be verified with complete certainty due to

limits on the availability and reliability of raw data, the voluntary nature of

the data gathering process and other limitations and uncertainties inherent in

any statistical survey of market shares. We have not independently

verified market and industry data from third-party sources. In

addition, consumption patterns and customer preferences can and do

change. As a result, you should be aware that market share, ranking

and other similar data set forth herein, and estimates and beliefs based on such

data, may not be verifiable or reliable.

RISK

FACTORS

An

investment in our common stock is very risky. Our financial condition

is unsound. You should not invest in our common stock unless you can

afford to lose your entire investment. You should carefully consider

the risk factors described below, together with all other information in this

prospectus and incorporated by reference herein, before making an investment

decision. If an active market is ever established for our common

stock, the trading price of our common stock could decline due to any of these

risks, and you could lose all or part of your investment. You also

should refer to the other information set forth, and incorporated by reference,

in this prospectus, including our financial statements and the related

notes.

Risks

Relating to Our Business

We

lack an operating history and have losses which we expect to continue into the

future. As a result, we may have to suspend or cease exploration activities if

we do not obtain additional financing, and our business will fail.

We were

incorporated on January 12, 1999 and initially were engaged in the business of

biotechnology research and development. In February, 2005, we changed

our business to mineral exploration. We have a limited history upon

which we may make an evaluation of the future success or failure of our current

business plan.

We have a

history of operating losses and have an accumulated deficit. Our net

loss for the nine months ended September 30, 2009 and 2008 was $3,194,874 and

$2,363,475, respectively. We recorded a net loss of $3,128,386,

$2,221,818 and $2,540,978 for the years ended December 31, 2008, 2007 and 2006,

respectively, and have incurred cumulative net losses from operations of

$16,551,356, $13,356,482, $10,228,096 and $8,006,278, as of September 30, 2009,

December 31, 2008, 2007 and 2006, respectively. In addition, we had

cash reserves of approximately $13,690,278, $7,055,591 and $12,007,344 at

November 30, 2009, December 31, 2008 and 2007, respectively. We have

not commenced our proposed mineral processing and mining operations and are

still in the exploration stages of our proposed operations. Prior to

completion of our exploration stage, we anticipate that we will incur increased

operating expenses without realizing any revenues. We therefore

expect to incur significant losses into the foreseeable future.

We have

not attained profitable operations and are dependent upon obtaining financing to

pursue our plan of operation. Our ability to achieve and maintain

profitability and positive cash flow will be dependent upon, among other

things:

|

|

·

|

our

ability to locate a profitable mineral

property;

|

|

|

·

|

positive

results from our feasibility studies on the Searchlight Gold Project and

the Clarkdale Slag Project;

|

|

|

·

|

positive

results from the operation of our initial test module on the Clarkdale

Slag Project; and

|

|

|

·

|

our

ability to generate revenues.

|

We may

not generate sufficient revenues from our proposed business plan in the future

to achieve profitable operations. If we are not able to achieve

profitable operations at some point in the future, we eventually may have

insufficient working capital to maintain our operations as we presently intend

to conduct them or to fund our expansion plans. In addition, our

losses may increase in the future as we expand our business

plan. These losses, among other things, have had and will continue to

have an adverse effect on our working capital, total assets and stockholders’

equity. If we are unable to achieve profitability, the market value

of our common stock will decline and there would be a material adverse effect on

our financial condition.

Our

exploration and evaluation plan calls for significant expenses in connection

with the Clarkdale Slag Project and the Searchlight Gold

Project. Over the next twelve months, our management anticipates that

the minimum cash requirements for funding our proposed exploration, testing and

construction program and our continued operations will be approximately

$9,000,000. On November 12, 2009, we completed a private placement of

12,078,596 units of our securities at a purchase price of $1.25 per unit,

resulting in aggregate gross proceeds to us of $15,098,245. Based on

the net proceeds received by us from the private placement, we estimate that our

current financial resources are sufficient to allow us to meet the anticipated

costs of our exploration, testing and construction programs for the 2010 fiscal

year. However, if actual costs are greater than we have anticipated,

we will require additional financing in order to fund our exploration, testing

and construction plans for 2010. We do not currently have any

financing arrangements in place for such additional financing, and there are no

assurances that we will be able to obtain additional financing in an amount

sufficient to meet our needs or on terms that are acceptable to us.

Obtaining

additional financing is subject to a number of factors, including the market

prices for the mineral property and base and precious metals. These

factors may make the timing, amount, terms or conditions of additional financing

unavailable to us. If adequate funds are not available or if they are

not available on acceptable terms, our ability to fund our business plan could

be significantly limited and we may be required to suspend our business

operations. We cannot assure you that additional financing will be

available on terms favorable to us, or at all. The failure to obtain

such a financing would have a material, adverse effect on our business, results

of operations and financial condition.

If

additional funds are raised through the issuance of equity or convertible debt

securities, the percentage ownership of current stockholders will be reduced and

these securities may have rights and preferences superior to that of current

stockholders. If we raise capital through debt financing, we may be

forced to accept restrictions affecting our liquidity, including restrictions on

our ability to incur additional indebtedness or pay dividends.

For these

reasons, the report of our auditor accompanying our financial statements filed

herewith includes a statement that these factors raise substantial doubt about

our ability to continue as a going concern. Our ability to continue

as a going concern will be dependent on our raising of additional capital and

the success of our business plan.

Actual

capital costs, operating costs and economic returns may differ significantly

from our estimates and there are no assurances that any future activities will

result in profitable mining operations.

We are an

exploration stage company and are still in the process of exploring and testing

our mineral projects. We do not have any historical mineral

operations upon which to base our estimates of costs. Decisions about

the exploration, testing and construction of our mineral properties will

ultimately be based upon feasibility studies. Feasibility studies

derive cost estimates based primarily upon:

|

|

·

|

anticipated

tonnage, grades and metallurgical characteristics of the ore to be mined

and processed;

|

|

|

·

|

anticipated

recovery rates of gold and other metals from the

ore;

|

|

|

·

|

cash

operating costs of comparable facilities and equipment;

and

|

|

|

·

|

anticipated

weather/climate conditions.

|

To date,

we have only conducted an internal pre-feasibility study of the Clarkdale Slag

Project. In particular:

|

|

·

|

we

have conducted limited amounts of drilling at the

site;

|

|

|

·

|

process

testing has been limited to smaller scale pilot plants and bench scale

testing;

|

|

|

·

|

our

mine plans, slag processing concepts, metallurgical flow sheets and

estimated recoveries are still in exploration stages;

and

|

|

|

·

|

actual

metallurgical recoveries may fail to meet preliminary estimates when

scaled up from pilot plant scale to production

scale.

|

We

incurred delays during the construction of our production module, including

delays in receiving large pieces of equipment from manufacturers, engineering

related delays due to the complexity of installing the production module

equipment in a World War I era module building and the decision to construct a

separate building to house the electrowinning equipment after it was determined

that the electrowinning equipment would not adequately fit in the module

building. Consequently, the construction timeline for completing the

production module was extended by approximately twelve months from what we

originally anticipated and there was an approximately 55% increase in costs from

what we had originally projected.

In order

to demonstrate the large scale viability of the project, we will need to

complete final feasibility studies that address the economic viability of the

project. Capital and operating costs and economic returns, and other

estimates contained in our final feasibility studies may differ significantly

from our current estimates. There is no assurance that our actual

capital and operating costs will not exceed our current estimates. In

addition, delays to construction schedules may negatively impact the net present

value and internal rates of return for our mineral properties. There

are no assurances that actual recoveries of base and precious metals or other

minerals processed from our mineral projects will be economically feasible or

that actual costs will match our pre-feasibility estimates.

Feasibility

estimates typically underestimate future capital needs and operating

costs. Our projected operating and capital cost estimates are in

preliminary stages and may be subject to significant, upward adjustment based on

future events, including the results of any final feasibility study which we may

develop.

If

the results from our feasibility studies and the results from the operation of

our first proposed production module are not sufficiently positive for us to

proceed with the construction of our processing facility we will have to scale

back or abandon our proposed operations on the Clarkdale Slag

Project.

We intend

to continue the exploration, testing and construction of our production module

at the Clarkdale Slag Project site, which is anticipated to consist of a full

scale production and processing cycle. This first production module

is expected to be used to conduct a final test of the economic feasibility of

the Clarkdale Slag Project. However, if the results of our

pre-feasibility studies on the Clarkdale Slag Project and the results from the

operation of the first production module are not positive, we will have to scale

back or abandon our proposed operations of the Clarkdale Slag

Project. There is no assurance that actual recoveries of base and

precious metals or other minerals re-processed from the slag pile will be

economically feasible. If metal recoveries are less than projected,

then our metal sales will be less than anticipated and may not equal or exceed

the cost of mining and recovery. In such event, we will have

difficulty in raising additional capital to maintain operations and that would

result in a material adverse effect on our operating results, financial

condition and our ability to remain in business.

If

we are unable to achieve projected mineral recoveries from our exploration

mining activities at the Clarkdale Slag Project and Searchlight Gold Project,

then our financial condition will be adversely affected.

As we

have not established any reserves on either our Clarkdale Slag Project or

Searchlight Gold Project to date, there is no assurance that actual recoveries

of minerals from material mined during exploration mining activities will equal

or exceed our exploration costs on our mineral properties. To date,

we have completed only a limited amount of drilling and sampling on the

Clarkdale Slag Project site and the process testing of results has been limited

to small pilot plants and bench scale testing. There is no assurance

that if we move to production scale from pilot plant scale that our actual

results will match pre-feasibility estimates. If mineral recoveries

are less than projected, then our sales of minerals will be less than

anticipated and may not equal or exceed the cost of exploration and recovery, in

which case our operating results and financial condition will be materially,

adversely affected.

We

have no known mineral reserves and if we cannot find any, we will have to cease

operations.

We have

no known mineral reserves. Mineral exploration is highly

speculative. It involves many risks and is often

non-productive. Even if we are able to find mineral reserves on our

property our production capability is subject to further risks

including:

|

|

·

|

costs

of bringing the property into production including exploration work,

preparation of production feasibility studies, and construction of

production facilities;

|

|

|

·

|

availability

and costs of financing;

|

|

|

·

|

ongoing

costs of production; and

|

|

|

·

|

environmental

compliance regulations and

restraints.

|

The

marketability of any minerals acquired or discovered may be affected by numerous

factors which are beyond our control and which cannot be accurately predicted,

such as market fluctuations, the lack of milling facilities and processing

equipment near the Searchlight Gold Project, the success of our drilling and

sampling activities on the Clarkdale Slag Project and such other factors as

government regulations, including regulations relating to allowable production,

exporting of minerals, and environmental protection. If we do not

find a mineral reserve or if we cannot explore the mineral reserve, either

because we cannot obtain an approved Plan of Operations, do not have the money

to do so or because it will not be economically feasible to do so, we will have

to cease operations.

Our

rights under the Searchlight Claims may be difficult to retain and may not apply

to all metals and minerals located on the Searchlight property.

Our

rights in the 20 placer mineral claims with respect to a contiguous,

approximately 3,200-acre site located (the “Searchlight Claims”) on Federal land

administered by the BLM near Searchlight, Nevada are the subject of unpatented

mining claims (mining claims to which the deeds from the U.S. Government have

not been received) made under the General Mining Law of 1872. The

Searchlight Claims were assigned to us in June 2008 by the original locators

(those persons who locate, or are entitled to locate, land or mining claims, and

fix the boundaries of land claims) of such claims under an Option Agreement for

the Searchlight Claims. Legal title to the Searchlight property is

held by the United States and there are numerous conditions that must be met for

a mining claimant to obtain and retain legal rights in the land and minerals

claimed. Because title to unpatented mining claims is subject to

inherent uncertainties, it is difficult to determine conclusively the ownership

of such claims. These uncertainties relate to such things as

sufficiency of mineral discovery, proper posting and marking of boundaries and

possible conflicts with other claims not determinable from descriptions of

record. Since a substantial portion of all mineral exploration,

development and mining in the United States now occurs on unpatented mining

claims, this uncertainty is inherent in the mining industry.

The

present status of our unpatented mining claims located on public lands allows us

the exclusive right to mine and remove valuable metals, such as precious and

base metals, that are in placer form (mineral which has been separated from its

host rock by natural processes). We also are allowed to use the

surface of the land solely for purposes related to mining and processing the

metal-bearing ores. However, legal ownership of the land remains with

the United States. Placer mining claims (ground with defined

boundaries that contains metals in the earth, sand, or gravel, and is not fixed

in the rock) are not sufficient to claim lode mineralization (a deposit in

consolidated rock as opposed to a placer deposit), and any metals in veins or in

bedrock need to be separately claimed by lode claims. Therefore, we

may not have legal rights with respect to any lode deposits within the property

that is the subject of the Searchlight Claims.

In order

for us to assert a valid right in the 160 acre Searchlight Claims which we

acquired in June 2008, there must have been a discovery with respect to the

Searchlight Claims prior to their transfer. The concept of the

validity of the “discovery” of a mining claim is a legal

standard. Generally, the BLM considers a discovery to be the

identification of adequate amounts of minerals such that a reasonable person

would seek to develop the claim as a commercial enterprise. Based on

the results of our testing and sampling on the properties prior to transfer of

title to the related Searchlight Claims to us, we believe that we have a valid

basis to assert that we have made a discovery with respect to the claims located

on the contiguous property that is the subject of the Searchlight

Claims. Further, we are working to explore the Searchlight property

and to evaluate and plan for the exploration of the Searchlight

Claims. However, if the BLM was to determine that a discovery was not

made on any of the 20 (160 acre) association placer claims (a placer location

made by an association of persons in one location covering up to 160 acres)

before any of such claims were conveyed by the related group of locators of a

particular claim to us, any of such claims could implode to a 20-acre parcel

surrounding the point of discovery and potentially result in the loss of our

rights in the surrounding 140 acres of the particular claim. Further,

placer mining claims ultimately are required to have discovery on each 10-acre

portion in order to be considered valid in their entirety. Therefore,

if the BLM was to determine that a discovery was not made on any of the 10-acre

portions of the association placer claims before any of such claims were

conveyed to us, any of such claims could implode to a 10-acre parcel and

potentially result in the loss of our rights in the surrounding 150 acres of the

particular claim. At this time, there are no adversarial proceedings

by the BLM to challenge any of the 20 association placer

claims. However, there can be no assurances that adversarial

proceedings will not occur in the future, and if such proceedings occur, the BLM

will not successfully challenge these claims, which could have a material

adverse effect on the Searchlight Project and our operations.

During

the second quarter of 2008, we “double staked” the Searchlight property by

filing, with the BLM and the Clark County, Nevada Recorder, 142 new and separate

20-acre placer claims overtop of the twenty existing 160-acre

claims. We were only able to “double stake” 2,840 acres out of the

3,200 acre site due to various regulatory restrictions on staking of certain of

the smaller land parcels on the site. We have maintained the twenty

prior 160-acre claims to provide us with a basis to retain the priority of and

defend our existing 160-acre mining claims. However, we are subject

to the risk that when we, a single entity, acquire title to association placer

claims from an association of prior, multiple locators, there could be potential

problems for us in the future:

|

|

·

|

First,

the validity of the association of the prior locators could always be

challenged by the BLM if the BLM believed that the association was not

properly assembled or if there were any “dummy locators” (place-holder

locators who did not contribute to the association). A

“properly assembled” placer association is comprised of 2–8 individuals or

companies who each may claim 20 acres and each owns a full interest in the

claim. The individuals may not be employees of one of the

companies. These individuals and/or entities must be involved

actively in the business of developing the claim. Use of an

uninvolved individual or entity as a locator for the purpose of acquiring

additional acreage may constitute fraud, and the entire claim could be

declared void. A “dummy locator” is an individual or entity who

is not actively involved with the development of the claims, and whose

name has been used for the purpose of acquiring additional

acreage. The action of using dummy locator(s) may constitute

fraud, and under existing laws, the claim located by use of dummy

locator(s) can be declared void from its

inception.

|

|

|

·

|

Second,

if there was deemed to be a discovery on any 160-acre claim following the

transfer to us, the claims could implode to a 20-acre parcel surrounding

the point of discovery of each claim and potentially leave the surrounding

140 acres unavailable for re-staking, and potentially to a 10-acre parcel

and leave the surrounding 150 acres unavailable for

re-staking.

|

|

|

·

|

Third,

the location of the 20-acre claims may cause an implied abandonment of the

older claims. Should a problem occur in the future with the

160-acre claims, we could revert to the 20-acre or 10-acre claims, if

necessary. Also, we will incur additional costs because we have

to maintain two sets of claims.

|

We

believe that “double staking” the property enhances our existing claims because

“double staking” with 20-acre claims provides a more secure basis for asserting

our claim rights than our existing 160-acre claims because they were located and

are held solely by us, as a single entity and not as an association of two or

more entities. Holding 20-acre claims as a single entity reduces the

likelihood that the BLM will challenge the validity of the claims based on the

existence of “dummy locators.” If the BLM challenges the validity of

the 160-acre claims or we are forced to abandon such claims, we would revert to

the 20-acre claims covering only the 2,840 acres. Any regulatory

permits that we have applied or may apply for (i.e., drilling, and mining) would

have to be conducted within the related 2,840 acres. However, if the

BLM was to determine that a discovery was not made on any of the 10-acre

portions of the 20-acre association placer claims, any of such claims could

implode to a 10-acre parcel and potentially result in the loss of our rights in

the adjoining 10 acres of the particular claim.

Further,

we are required to make annual rental payments to the Federal government in

connection with our claims. If we fail to make our required payments

in the future, the related claims would be void.

In

addition, the BLM has been excluding significant amounts of land in southern

Nevada from mining and development over the past few decades. The BLM

has designated this excluded land as an ACEC. Any person that wishes

to stake mining claims would not be able to do so in these affected

areas. However, if a person already owns valid claims before the land

is designated as an ACEC, the claimant would have those claims grandfathered

in. In the case of the Searchlight Claims, the Searchlight Project

has not been designated as an ACEC and our 160-acre claims were originally

located between 1990 and 2003. The BLM has advised us, however, that

due to the proximity of our claims to an ACEC we would be required to file a

Plan of Operations for our desired drilling program. We do not

believe these added requirements will have a material adverse impact on our Plan

of Operations for the Searchlight Gold Project. However, the Plan of

Operations approval process will delay the start of our drilling program for an

undetermined period of time. If the BLM decides in the future to

designate the Searchlight Project site as an ACEC, and also challenges our

160-acre claims, we would have to rely on our “double staked” claims to preserve

the Searchlight Claims. Although we believe that, in such event, our

“double staked” claims would survive a challenge by the BLM, there can be no

assurances to that effect and the successful challenge of some or all of the

Searchlight Claims would have a material adverse effect on the Searchlight

Project and our operations.

We do not currently have a government

approved Plan of Operations for our Searchlight Gold Project, and if we are not

able to obtain an approved Plan of Operations, we will not be able to fulfill

our business plan with respect to the Searchlight Gold

Project

.

The

former Searchlight Claim owners had previously obtained a BLM approved Plan of

Operations, which included permission to drill eighteen holes on the 3,200 acre

project area and to mine a 36-acre pit on our RR304 claim. We had

anticipated conducting our early stage exploratory work on the Searchlight

Claims property by utilizing the Plan of Operations issued to the former

Searchlight Claim owners, until such time as we would obtain a permit for

exploration and development in our own name or the former Searchlight Claim

holder’s permit was transferred to us. Although we did not acquire

the Searchlight Claims with a written agreement to purchase the Plan of

Operations, the prior owners verbally agreed to cooperate with us in attempting

to transfer their Plan of Operations into our name.

Although

the Plan of Operations was accepted and registered in the name of a former

Searchlight Claim owner, which is an affiliate of K. Ian Matheson, one of our

principal stockholders and a former officer and director, in September 2007, we

learned that the BLM had issued the BLM Order on May 12, 2006 against Mr.

Matheson and certain of his affiliates (Pass Minerals, Inc., Kiminco, Inc. and

Pilot Plant Inc., which also were prior Searchlight Claim owners and are our

stockholders) with respect to a dispute with the BLM on a project unrelated to

the Searchlight Gold Project. The dispute between the BLM and Mr.

Matheson arose due to the BLM’s determination that Mr. Matheson and his

affiliates had engaged in willful mineral trespass for the unauthorized removal

of sand and gravel from public lands by Mr. Matheson and his affiliates or their

predecessors. The BLM had demanded payment of approximately

$2,530,000 for the willful trespass. After failure by Mr. Matheson

and his affiliates to pay the amount, the BLM issued the BLM

Order. The issuance of the BLM Order restricted our ability to rely

upon the Plan of Operations to conduct our early stage exploratory work on the

Searchlight Claims property until such time that we may obtain our own Plan of

Operations. An appeal by Mr. Matheson of the BLM Order with the

Interior Board of Land Appeals affirmed the BLM’s decision, keeping the BLM

Order in effect. The BLM Order effectively covered all projects tied

to Mr. Matheson.

As a

result of the BLM Order, we have been delayed in our ability to drill on the

Searchlight Gold Project property. However, we have anticipated that

regulatory and other delays would take place, which are typical in our

industry. We have applied for a new Plan of Operations in our name

and are currently in the course of the BLM’s review process. In

addition, we have continued and will continue with our surface sampling and

metallurgical testing program while awaiting approval of a new Plan of

Operations.

In the

third quarter of 2008, we submitted a Plan of Operations to the BLM in our name,

substantially similar to the original Plan of Operations, which included a

request to drill eighteen holes on the project area and to mine a 36-acre mining

pit. On August 27, 2008, the BLM responded, in part, by advising that

the previous bond that we posted of $180,500 for the previous Plan of Operations

would not be transferrable to the new one and that a new bond would have to be

posted. At the time, we considered the recovery of the reclamation

bond to be uncertain and, therefore, we have established a full allowance

against the reclamation bond with the offsetting expense to project exploration

costs. Based on continued discussions with the BLM, we may be able to

recover the bond upon request, however, we have not chosen to make such a

request at this time.

In

September 2008, we decided that we would only continue to pursue the permits to

drill on the project area and forgo the 36-acre pit until a later date since we

believed that by keeping the pit area in the Plan of Operations, it might delay

the BLM’s approval process for our Plan of Operations. Although the 36-acre pit

had been part of the Plan of Operations obtained by the prior owners of the

Searchlight Claims, we do not believe that digging and mining a 36-acre pit

would be a material aspect of the Plan of Operations at this stage of the

Searchlight Gold Project. Therefore, we decided to remove the 36-acre pit from

the Plan of Operations. Further, by reducing the scope of the permit, we decided

that we could submit the application in the form of a Notice of Intent, a

shorter and less complex application form than a Plan of Operations.

Consequently, on September 24, 2008, we withdrew the Plan of Operations and

submitted a Notice of Intent with the BLM, pursuant to which we sought

permission to drill eighteen 500-foot drill holes on the Searchlight project

area.

After a

series of correspondence between us and the BLM, on December 15, 2008, we

received a letter from the BLM advising us that the BLM had closed our Notice of

Intent from consideration and that a new Plan of Operations would be required

based on two issues relating to the Desert Tortoise (

Gopherus asassizii

), a

Federally listed Threatened Species: (i) the proximity of the project area to a

nearby ACEC; and (ii) the future likelihood of tortoises being present on the

land within the project area which is involved in the application.

On

January 13, 2009, we filed a Notice of Appeal of the BLM’s decision regarding

the closing of our Notice of Intent. However, the BLM’s decision was

upheld on appeal by the U.S. Department of Interior on September 9,

2009.

During

the course of the appeal, we determined that, due to the standard lengthy time

required to have a Plan of Operations approved by the BLM and should we be

unsuccessful with our appeal, it would be prudent to begin the approval process

immediately by filing for our Plan of Operations. Thus, on March 23,

2009, we submitted a new Plan of Operations to the BLM, taking into account the

Desert Tortoise issue. In our Plan of Operations, we have requested

permission to drill eighteen drill holes on the project area. In the

event of the approval of our Plan of Operations, we will be required to post a

new reclamation bond with the BLM, which we anticipate will be approximately

$16,000. After a further series of correspondence between us and the

BLM, on September 15, 2009, we received a comment letter from the BLM regarding

our Plan of Operations. We have reached an understanding with the BLM

that we will use the Environmental Assessment previously approved by the BLM

under the prior Plan of Operations in connection with the new Plan of

Operations, and the BLM has requested that we conform certain aspects of the new

Plan of Operations with the previously approved Environmental

Assessment.

There is

no regulatory time frame for the BLM to review our Plan of

Operations. We understand that the average time frame for approval of

a plan of operation by the Las Vegas, Nevada branch office of the BLM since

January 1, 2000 has been approximately four years and five

months. Although we understand that the average time frame of the

application process by the Las Vegas branch office of the BLM relating to an

environmental assessment in connection with a plan of operations is

approximately eleven months, the “threatened species” issue raised by the BLM

requires the BLM to consult with the U.S. Fish and Wildlife Service of the

Department of Interior, and the BLM has no control over the length of this

consultation process in order to develop any necessary environmental mitigation

measures.

Our work

on the project site will be limited to the scope within the Plan of

Operations. However, the Plan of Operations approval process will

delay the start of our drilling program for an undetermined period of

time. To perform any additional drilling or mining on the project, we

would be required to submit a new application to the BLM for approval prior to

the commencement of any such additional activities.

We do not

believe these added requirements will have a material adverse impact on our

overall business plan for the Searchlight Gold Project, given that we have

received no indication from the BLM, at this time, that the BLM will ultimately

deny our request for approval of our Plan of Operations. However,

there is no assurance of the timeline for approval by the BLM or that the BLM

will grant approval. Our drilling and mining program on this project

is dependent on obtaining the necessary approval from the

BLM. Therefore, if approval ultimately is not obtained, we may have

to scale back or abandon exploration efforts on the project. If

management determines, based on any factors including the foregoing, that

capitalized costs associated with any of our mineral interests are not likely to

be recovered, we would incur a significant impairment of our investment in such

property interests on our financial statements.

If

we do not complete the construction of an Industrial Collector Road pursuant to

an agreement with the Town of Clarkdale, Arizona by January 2011, we may lose

our conditional use permit from the Town of Clarkdale with respect to the

Clarkdale Slag Project, and we do not currently have sufficient funds to

complete construction of the road. The loss of the permit would have

a material adverse effect on the Clarkdale Slag Project and our

operations.

In

January 2009, we submitted a development agreement to the Town of Clarkdale for

the construction of an Industrial Collector Road. The purpose of the

road is to provide us with the capability to enhance the flow of industrial

traffic to and from the Clarkdale Slag Project. The construction of

the road is a required infrastructure improvement under the terms of our

conditional use permit with the Town of Clarkdale. The Town of

Clarkdale approved the development agreement on January 9, 2009.

The

development agreement provides that its effective date will be the later of (i)

30 days from the approving resolution of the agreement by the Clarkdale Town

Council; or (ii) the date on which the Town of Clarkdale obtains a connection

dedication from separate property owners who have land that will be utilized in

construction of the road; or (iii) the date on which the Town of Clarkdale

receives the proper effluent permit. The Town of Clarkdale has

approved the development agreement, and the remaining two contingencies with

respect to the effectiveness of the development agreement are beyond our

control.

Under the

development agreement, we are obligated to complete the construction of the road

within two years after the effective date of the agreement. If we do not

complete the road within the two year period, we may lose our conditional use

permit from the Town of Clarkdale. Further, as a condition of our developing any

of our property that is adjacent to the Clarkdale Slag Project, we will be

required to construct additional enhancements to the road. We will have ten

years from the start of construction on the road in which to complete the

additional enhancements. However, we do not currently have any defined plans for

the development of the adjacent property.

We

estimate that the initial cost of construction of the road will be approximately

$3,500,000 and that the cost of the additional enhancements will be

approximately $1,200,000. We will be required to fund the costs of

this construction. Based on the uncertainty of the timing of these

contingencies, we have not included these costs in our current operating plans

or budgets. However, we will require additional project financing or

other financing in order to fund the construction of the road and the additional

enhancements. There are no assurances that we will be able to obtain

additional financing in an amount sufficient to meet our needs or on terms that

are acceptable to us. The failure to complete the road and the

additional enhancements in a timely manner under the development agreement would

have a material adverse effect on the Clarkdale Slag Project and our

operations.

The

nature of mineral exploration and production activities involves a high degree

of risk; we could incur a write-down on our investment in any

project.

Exploration

for minerals is highly speculative and involves greater risk than many other

businesses. Investors should be aware of the difficulties normally

encountered by new mineral exploration companies and the high rate of failure of

such enterprises. The likelihood of success must be considered in

light of the problems, expenses, difficulties, complications and delays

encountered in connection with the exploration of the mineral properties that we

plan to undertake. These potential problems include, but are not

limited to, unanticipated problems relating to exploration, and additional costs

and expenses that may exceed current estimates. The expenditures to

be made by us in the exploration of the mineral claim may not result in the

discovery of mineral deposits. If funding is not available, we may be

forced to abandon our operations.

Many

exploration programs do not result in the discovery of mineralization and any

mineralization discovered may not be of sufficient quantity or quality to be

profitably mined. Uncertainties as to the metallurgical amenability

of any minerals discovered may not warrant the mining of these minerals on the

basis of available technology. Our operations are subject to all of

the operating hazards and risks normally incident to exploring for and

developing mineral properties, such as:

|

|

·

|

encountering

unusual or unexpected formations;

|

|

|

·

|

environmental

pollution;

|

|

|

·

|

personal

injury and flooding;

|

|

|

·

|

decrease

in recoverable reserves due to lower precious and base metal prices;

and

|

|

|

·

|

changing

environmental laws and regulations.

|

If

management determines, based on any factors including the foregoing, that

capitalized costs associated with any of our mineral interests are not likely to

be recovered, we would incur a write-down on our investment in such property

interests on our financial statements. Further, we may become subject

to liability for such hazards, including pollution and other hazards against

which we cannot insure or against which we may elect not to

insure. At the present time, we have no coverage to insure against

these hazards. Such a write-down or the payment of such liabilities

may have a material adverse effect on our financial position.

Our

industry is highly competitive, mineral lands are scarce and we may not be able

to obtain quality properties.

In

addition to us, many companies and individuals engage in the mining business,

including large, established mining companies with substantial capabilities and

long earnings records. There is a limited supply of desirable mineral

lands available for claim staking, lease, or acquisition in the United States

and other areas where we may conduct exploration activities. We may

be at a competitive disadvantage in acquiring mining properties since we must

compete with these individuals and companies, many of which have greater

financial resources and larger technical staffs. Mineral properties

in specific areas which may be of interest or of strategic importance to us may

be unavailable for exploration or acquisition due to their high cost or they may

be controlled by other companies who may not want to sell or option their

interests at reasonable prices. In addition, the Clarkdale slag pile

is a finite, depleting asset. Therefore, the life of the Clarkdale

Slag Project will be finite, if it is ever developed to the point of economic

feasibility. Our long-term viability depends upon finding and

acquiring new resources from different sites or properties. There can

be no assurances that the Clarkdale Slag Project will become economically

viable, and if so, that we will achieve or obtain additional successful economic

opportunities.

As

we undertake exploration of our mineral claims, we will be subject to compliance

with government regulation that may increase the anticipated cost of our

exploration program.

There are

several governmental regulations that materially restrict mineral

exploration. We will be subject to the laws of the State of Nevada

and applicable federal laws as we carry out our exploration program on the

Searchlight Gold Project. We are required to obtain work permits,

post bonds and perform remediation work for any physical disturbance to the land

in order to comply with these laws. Further, the United States

Congress is actively considering amendment of the federal mining

laws. Among the amendments being considered are imposition of

significant royalties payable to the United States and more stringent

environmental and reclamation standards, either of which would increase the cost

of operations of mining projects. While our planned exploration

program budgets for regulatory compliance, there is a risk that new regulations

could increase our costs of doing business and prevent us from carrying out our

exploration program.

We are

required to obtain work permits, post bonds and perform remediation work for any

physical disturbance to the land in order to comply with these

laws. If we enter the production phase, the cost of complying with

permit and regulatory environment laws will be greater because the impact on the

project area is greater. Permits and regulations will control all

aspects of the production program if the project continues to that stage.

Examples of regulatory requirements include:

|

|

·

|

water

discharge will have to meet drinking water

standards;

|

|

|

·

|

dust

generation will have to be minimal or otherwise

remediated;

|

|

|

·

|

dumping

of material on the surface will have to be re-contoured and re-vegetated

with natural vegetation;

|

|

|

·

|

an

assessment of all material to be left on the surface will need to be

environmentally benign;

|

|

|

·

|

ground

water will have to be monitored for any potential

contaminants;

|

|

|

·

|

the

socio-economic impact of the project will have to be evaluated and if

deemed negative, will have to be remediated;

and

|

|

|

·

|

there

will have to be an impact report of the work on the local fauna and flora

including a study of potentially endangered

species.

|

There is

a risk that new regulations could increase our costs of doing business and

prevent us from carrying out our exploration program. We will also

have to sustain the cost of reclamation and environmental remediation for all

exploration work undertaken. Both reclamation and environmental

remediation refer to putting disturbed ground back as close to its original

state as possible. Other potential pollution or damage must be

cleaned-up and renewed along standard guidelines outlined in the usual

permits. Reclamation is the process of bringing the land back to its

natural state after completion of exploration

activities. Environmental remediation refers to the physical activity

of taking steps to remediate, or remedy, any environmental damage

caused. The amount of these costs is not known at this time as we do

not know the extent of the exploration program that will be undertaken beyond

completion of the recommended work program. If remediation costs

exceed our cash reserves we may be unable to complete our exploration program

and have to abandon our operations.

We

must comply with complex environmental regulations which are increasing and

costly.

Our

exploration operations are regulated by both Federal and State environmental

laws that relate to the protection of air and water quality, hazardous waste

management and mine reclamation. These regulations will impose

operating costs on us. If the regulatory environment for our

operations changes in a manner that increases the costs of compliance and

reclamation, then our operating expenses may increase. This would

result in an adverse effect on our financial condition and operating

results.

Compliance

with environmental quality requirements and reclamation laws imposed by Federal,

State and local governmental authorities may:

|

|

·

|

require

significant capital outlays;

|

|

|

·

|

materially

affect the economics of a given

property;

|

|

|

·

|

cause

material changes or delays in our intended activities;

and

|

These

authorities may require us to prepare and present data pertaining to the effect

or impact that any proposed exploration for or production of minerals may have

upon the environment. The requirements imposed by any such

authorities may be costly, time consuming, and may delay

operations. Future legislation and regulations designed to protect

the environment, as well as future interpretations of existing laws and

regulations, may require substantial increases in equipment and operating costs

and delays, interruptions, or a termination of operations. We cannot

accurately predict or estimate the impact of any such future laws or

regulations, or future interpretations of existing laws and regulations, on our

operations.

Affiliates of our management and

principal stockholders have conflicts of interest which may differ from those of

ours and yours and we only have one independent board

member

.

We have

ongoing business relationships with affiliates of our management and principal

stockholders. In particular, we have continuing obligations under the

agreements under which we acquired the assets relating to our Clarkdale Slag

Project. We remain obligated to pay a royalty which may be generated

from the operations of the Clarkdale Slag Project to Nanominerals Corp.

(“Nanominerals”), one of our principal stockholders, which is an affiliate of

two members of our executive management and board of directors, Carl S. Ager and

Ian R. McNeil. We also have engaged Nanominerals as a paid consultant

to provide technical services to us. In addition, we have a similar

royalty arrangement with Verde River Iron Company (“VRIC”), an affiliate of

another member of our board of directors, Harry B. Crockett. Further,

one of our board members, Robert D. McDougal, serves as the chief financial

officer and a director of Ireland Inc., a publicly traded, mining related

company, which is an affiliate of Nanominerals. For these reasons,

Martin B. Oring is the sole independent member of our board of

directors. We had negotiated the revenue sharing agreements with each

of Nanominerals and VRIC prior to the time that Messrs. Ager, McNeil and

Crockett, as applicable, became board members. These persons are

subject to a fiduciary duty to exercise good faith and integrity in handling our

affairs. However, the existence of these continuing obligations may

create a conflict of interest between us and our board members and senior

executive management, and any disputes between us and such persons over the

terms and conditions of these agreements that may arise in the future may raise

the risk that the negotiations over such disputes may not be subject to being

resolved in an arms’ length manner. In addition, Nanominerals’

interest in Ireland Inc. and its other mining related business interests may

create a conflict of interest between us and our board members and senior

executive management who are affiliates of Nanominerals. Further, the

interests of K. Ian Matheson, one of our principal stockholders (and a former

officer and director), in Royal Mines and Minerals Corp., a publicly traded

mining company based in Nevada, of which Mr. Matheson is an affiliate, and other

mining related business interests may create a conflict of interest between us

and Mr. Matheson.

Although

our management intends to avoid situations involving conflicts of interest and

is subject to a Code of Ethics, there may be situations in which our interests

may conflict with the interests of those of our management or their

affiliates. These could include:

|

|

·

|

competing

for the time and attention of

management;

|

|

|

·

|

potential

interests of management in competing investment ventures;

and

|

|

|

·

|

the

lack of independent representation of the interests of the other

stockholders in connection with potential disputes or negotiations over

ongoing business relationships.

|

Although

we only have one independent director, the board of directors has adopted a

written Related Person Transactions Policy, that describes the procedures used

to identify, review, approve and disclose, if necessary, any transaction or

series of transactions in which: (i) we were, are or will be a participant; (ii)

the amount involved exceeds $120,000; and (iii) a related person had, has or

will have a direct or indirect material interest. There can be no

assurance that the above conflicts will not result in adverse consequences to us

and the interests of the other stockholders.

We

may suffer adverse consequences as a result of our reliance on outside

contractors to conduct our operations.

A

significant portion of our operations are currently conducted by outside

contractors. As a result, our operations are subject to a number of

risks, some of which are outside our control, including:

|

|

·

|

negotiating

agreements with contractors on acceptable

terms;

|

|

|

·

|

the

inability to replace a contractor and its operating equipment in the event

that either party terminates the

agreement;

|

|

|

·

|

reduced

control over those aspects of operations which are the responsibility of

the contractor;

|

|

|

·

|

failure

of a contractor to perform under its agreement with

us;

|

|

|

·

|

interruption

of operations in the event that a contractor ceases its business due to

insolvency or other unforeseen

events;

|

|

|

·

|

failure

of a contractor to comply with applicable legal and regulatory

requirements, to the extent it is responsible for such compliance;

and

|

|

|

·

|

problems

of a contractor with managing its workforce, labor unrest or other

employment issues.

|

In

addition, we may incur liability to third parties as a result of the actions of

our contractors. The occurrence of one or more of these risks could

have a material adverse effect on our business, results of operations and

financial condition.

Because

our management does not have formal training specific to the technicalities of

mineral exploration, there may be a higher risk that our business will

fail.

Our

executive officers and directors do not have any formal training as geologists

or in the technical aspects of management of a mineral exploration

company. With no direct training or experience in these areas, our

management may not be fully aware of the specific requirements related to

working within this industry. Our management's decisions and choices

may not take into account standard engineering or managerial approaches mineral

exploration companies commonly use. Consequently, our operations,

earnings, and ultimate financial success could suffer irreparable harm due to

management's lack of experience in this industry.

Mineral,

and base and precious metal prices are volatile and declines may have an adverse

effect on our share price and business plan.

The

market price of minerals is extremely volatile and beyond our

control. Basic supply/demand fundamentals generally influence gold

prices. The market dynamics of supply/demand can be heavily

influenced by economic policy. Fluctuating metal prices will have a

significant impact on our results of operations and operating cash

flow. Furthermore, if the price of a mineral should drop

dramatically, the value of our properties which are being explored or developed

for that mineral could also drop dramatically and we might not be able to

recover our investment in those properties. The decision and