UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

one)

x

ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the fiscal year ended March 31, 2010

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the

transition period from___________ to ___________

Commission

file number: 000-30841

UNITED

ENERGY CORP.

(Name of

registrant as specified in its charter)

|

Nevada

|

|

22-3342379

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

|

|

|

|

600

Meadowlands Parkway, #20

|

|

|

|

Secaucus,

New Jersey

|

|

07094

|

|

(Address

of principal

executive

offices)

|

|

(Zip

Code)

|

(201)-842-0288

(Registrant’s

telephone number, including area code)

Securities

registered Under Section 12(b) of the Act

|

Title of each class

|

|

Name of each exchange on which

registered

|

|

None

|

|

None

|

Securities

registered Under Section 12(g) of the Act:

Title of each

class

Common

Stock, par value

$.01 per

share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes

¨

No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act. Yes

¨

No

x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

x

No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes

¨

No

x

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

¨

|

Accelerated

filer

¨

|

|

|

|

|

Non-accelerated

filer

¨

(Do not check if a smaller reporting company)

|

Smaller

reporting company

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in rule

12b-2 of the Exchange Act. Yes

¨

No

x

The

aggregate market value of approximately 24,267,782 shares held by non-affiliates

of the registrant on September 30, 2009, based on the average bid and asked

price of the common shares on the OTC Bulletin Board of $0.21 per share on

September 30, 2009 was approximately $5,338,912.

As of

July 14, 2010, the registrant had 31,504,449 common shares

outstanding.

UNITED

ENERGY CORP.

2009

FORM 10-K ANNUAL REPORT

TABLE

OF CONTENTS

|

|

|

|

Page

|

|

|

|

|

|

|

|

PART

I

|

|

|

|

|

|

|

|

|

ITEM

1.

|

DESCRIPTION

OF BUSINESS

|

|

1

|

|

ITEM

1A.

|

RISK

FACTORS

|

|

4

|

|

ITEM

1B.

|

UNRESOLVED

STAFF COMMENTS

|

|

9

|

|

ITEM

2.

|

PROPERTIES

|

|

9

|

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

|

10

|

|

ITEM

4.

|

(Removed

and Reserved)

|

|

10

|

|

|

|

|

|

|

|

PART

II

|

|

|

|

|

|

|

|

|

ITEM

5.

|

MARKET

FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

11

|

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

|

13

|

|

ITEM

7.

|

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATION

|

|

13

|

|

ITEM

7A.

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

18

|

|

ITEM

8.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

|

18

|

|

ITEM

9.

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

|

18

|

|

ITEM

9A(T).

|

CONTROLS

AND PROCEDURES

|

|

19

|

|

ITEM

9B.

|

OTHER

INFORMATION

|

|

19

|

|

|

|

|

|

|

|

PART

III

|

|

|

|

|

|

|

|

|

ITEM

10.

|

DIRECTORS,

EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

|

|

20

|

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

|

22

|

|

ITEM

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

|

|

24

|

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

|

27

|

|

ITEM

14.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

|

30

|

|

|

|

|

|

|

|

PART

IV

|

|

|

|

|

|

|

|

|

ITEM

15.

|

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K

|

|

31

|

PART

I

ITEM

1. DESCRIPTION OF BUSINESS

Overview

We

develop and distribute environmentally friendly specialty chemical products with

applications in several industries and markets. Our current line of

products includes our K-Line of Chemical Products for the oil industry and

related products.

Through

our wholly owned subsidiary, Green Globe Industries, Inc. (“Green Globe”), we

provide the U.S. military with a variety of solvents, paint strippers and

cleaners under our trade name “Qualchem.” Green Globe is a qualified supplier

for the U.S. military and has sales contracts currently in place with no minimum

purchase requirements, which are renewable at the option of the U.S.

military.

A key

component of our business strategy is to pursue collaborative joint working and

marketing arrangements with established international oil and oil service

companies. We intend to enter into these relationships to more

rapidly and economically introduce our K-Line of Chemical Products to the

worldwide marketplace for refinery, tank and pipeline cleaning

services. We provide our K-Line of Chemical Products and our Green

Globe Chemical Products to our customers and generated revenues of $1,771,720

for the fiscal year ended March 31, 2010 and $1,206,321 for the fiscal year

ended March 31, 2009.

Organizational

History

We were

originally incorporated in Nevada in 1971 as Aztec Silver Mining Co. We engaged

in the manufacturing and distribution of printing equipment from 1995 through

1998. During that period, we began to develop specialty chemical

products for use in the printing industry. In March 1998, we

discontinued our printing equipment operations and changed our business focus to

the development of specialty chemical products. In March 2007, we discontinued

the sale of our Uniproof proofing paper.

Business

Operations and Principal Products

Our

principal products include our K-Line of Chemical Products for the oil industry

and our Green Globe Chemical Products, which consist of a variety of solvents,

paint strippers and cleaners.

K-Line

of Chemical Products

KH-30 is

a mixture of modified oils, dispersants and oil-based surfactants designed to

control paraffin and asphaltene deposits in oil wells. When applied

in accordance with our recommended procedures, KH-30 has resulted in substantial

production increases in paraffin-affected oil and gas wells by allowing for a

faster penetration of paraffin and asphaltene deposits. KH-30 disperses and

suspends paraffin and asphaltene in a free-flowing state and prevents solids

from sticking to each other or to oil well equipment. KH-30 is

patented in the United States and other major oil producing

countries.

KX-100 is

a proprietary formula where contact time is limited for removal of a plug of

paraffin or asphaltene. It is fast acting and an effective dispersant that can

be used in temperatures as low as –25F. It can be used in nearly any

application.

SR-3

Scale and Rust Remover is a fast acting corrosion inhibited product developed to

remove both calcium carbonate and calcium sulfate salt deposits. SR-3

is a broad spectrum, water-soluble scale remover designed to rapidly alleviate

hard and soft deposits and to restore full flow capacity. The product

is also designed to remove rust while adding protection against further rusting

by providing a phosphatized surface on ferrous metals.

HPD-1

PLUS is specifically formulated to offer prompt and effective remediation of

tough clogging problems with upper medium to high molecular weight paraffin. It

performs multi-functional characteristics to impart wettability,

penetration and

dispersion, and is an exceptional solvency for paraffin rich heavy sludge with

the proper treatment dosage and application.

GSA Gun

& Bore Cleaner is a proprietary formula, which is a safer, and more

effective bore and chamber cleaner. It can be used on everything from small

handguns to 16” guns. Currently, GSA Gun & Bore Cleaner is being marketed

and distributed by TopDuck Products LLC under their trademark “Gunzilla

BC-10”.

Green

Globe Chemical Products

Leak

Detection Compound Type I and II is a gas leak detection compound that is

compatible with oxygen. It is intended for use in detecting leaks in

both high and low-pressure oxygen systems in aircraft and other related oxygen

systems

Corrosion

Inhibitor is an additive intended for use with anti-freeze in water at a

concentration of 3% to retard corrosion.

Corrosion

Removing Compound Type I, II and III are corrosion removing and metal

conditioning compounds, which when diluted with water, will remove rust from

ferrous metal surfaces.

Ethylene

Glycol/Water Coolant is a mixture of Ethylene Glycol and distilled water to

provide a coolant mixture for use in radar domes used by the

military.

NPX

Powder Coating is an effective reusable paint stripper. NPX is a

powerful blend of chemicals which we believe will out perform all other aluminum

safe strippers in the powder coat industry and provide a safe method of

stripping metals, including magnesium, zinc, high strength steel and

titanium. NPX does not contain any methylene chloride, phenol,

chromates or caustics.

Green

Globe products are sold under the trade name Qualchem™. Green Globe is a

qualified supplier for the U.S. military and has sales contracts currently in

place with no minimum purchase requirements, which are renewable at the option

of the U.S. military.

Manufacturing

and Sales

All of

the raw materials necessary for the manufacture of our products are generally

available from multiple sources. Although we have negotiated favorable

arrangements with some of our current suppliers, (which include Pride Solvents

and Chemical Co. of NJ Inc., Hy-Test Packaging Corp, and Air Products and

Chemicals), we would have to negotiate new arrangements if one or more of our

current suppliers were no longer able to supply these raw materials to

us. We do not own any special manufacturing

facilities. Our chemical products are generally manufactured by

contract blenders at a number of different locations. This method of

manufacturing has reduced the need for us to invest in facilities and to hire

the employees to staff them. Chemical blenders are relatively easy to

replace and are bound by confidentiality agreements, where appropriate, which

obligate them not to disclose or use our proprietary information.

We are

not responsible for any environmental expenditure with respect to the

manufacturing of our products. First, the chemical products that we

use are generally “environmentally friendly” products in that they are low in

toxicity and rank high in biodegradability. Further, any

environmental issues involved in manufacturing are the responsibility of the

blending facilities, provided they receive adequate and accurate information

from us as to the components of the chemicals involved, however, there can be no

assurance that we will not be liable as we are subject to various foreign,

federal, state and local law and regulations relating to the protection of the

environment.

In the

fiscal year ending March 31, 2010, Petrobras America Inc., Solarium Oil

Solutions, Facility Solutions LTD. and Ainex Corporation purchased our KX-100

oil cleaning products, which accounted for approximately 68.1% of our total

customer sales. In the fiscal year ending March 31, 2009, Petrobras

America Inc., Nalco Company and United Energy Petroleum Services LTD. purchased

our KX-100 oil cleaning products, which accounted for approximately 50.2% of our

total customer sales.

Except

for these current customers, no other single entity has accounted for more than

10% of our sales during any of the fiscal years ended March 31, 2010 and

2009.

All of

our products are sold in U.S. dollars and, therefore, we have had no foreign

currency fluctuation risk.

Our

current operations do not require a substantial investment in inventory other

than minimum commitments to our distributors. However, we anticipate

that any growth in our business will require us to maintain higher levels of

inventory.

As of

March 31, 2010, the Company’s backlog included $351,494 of chemical sales.

Backlog represents products that the Company’s customers have committed to

purchase. The Company’s backlog is subject to fluctuations and is not

necessarily indicative of future sales.

Marketing

and Distribution

We have

engaged the services of independent contractors to market our K-Line of Chemical

Products. These contractors work under various non-exclusive

commission and distribution agreements and have substantial contacts among oil

well owners and major oil companies in the United States, Mexico, South America,

Africa, Europe and the Middle East. These contractors earn a

commission based upon the sales value of the products that they

sell. These independent contractors use our marketing materials,

brochures and website to interest clients and to describe the attributes of our

products.

Although

we have not achieved the volume of sales we had anticipated for the oil

dispersant products, there have been significant barriers to entry in this

market. Most of these potential customers require substantial testing

of our product to prove its efficacy at cleaning wells, tanks and flow

lines. In many cases, additional laboratory testing is required to

prove that our chemical products are compatible with refinery systems and will

not interfere with certain chemical processes and safety requirements of the

potential clients. This process of testing has taken a great deal

longer than was originally anticipated. We believe that we have made

significant inroads and currently expect a higher volume of sales in the next

fiscal year ending March 31, 2011, although there can be no assurance that sales

will increase in fiscal 2011.

Research

and Development

Our

K-Line of Chemical Products for the oil industry are developed and ready for

market. All of these products are the result of research and

development. Expenditures were paid for research and development

costs in the amounts of $222,476 and $329,186 for the fiscal years ended March

31, 2010 and 2009, respectively. We have had available the services

of one research chemist and one analytical chemist, as well as one petroleum

engineer, to lead in the development of our products. A significant

amount of market adaptation has taken place in the field involving the

development of application procedures for products. We do not

anticipate having to make significant research and development expenditures on

existing products in the future. However, we do expect to continue to

develop new products to complement our existing product lines.

Competition

We

compete directly or indirectly with other producers of specialty chemical

products with similar uses, most of which are more established companies and

have greater resources than we have. Generally, we attempt to compete

by offering what we hope to be lower prices and better

service. However, our KH-30, KX-100, KX-91 and KH-30S products for

the oil industry are often more expensive, and with these products we attempt to

compete by emphasizing product effectiveness and environmental

safety.

Proprietary

Technologies

With

respect to our formulations, which are proprietary, we have patented our KH-30

oil well cleaner in the United States and other major oil producing

countries.

In

addition to applying for patent protection on our KH-30 product, we have also

registered “KH-30” as a trademark.

Employees

As of

March 31, 2010 we employed eight people on a full-time basis and had available

the services of two other individuals under consulting or product/production

cooperation arrangements. The latter arrangement is meant to include

a situation where a chemist, engineer or significant marketing person is engaged

by an organization under contract with us to manufacture or market one or more

of our products. None of our employees are represented by a union. We

consider our relations with our employees to be good.

Available

Information

We file

annual, quarterly and current reports, information statements and other

information with the Securities and Exchange Commission (the “SEC”). The public

may read and copy any materials we file with the SEC at the SEC’s Public

Reference Room at Station Place, 100 F Street, N.E., Washington, D.C.

20549. The public may obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also

maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically

with the SEC. The address of that site is

http://www.sec.gov

.

ITEM

1A. RISK FACTORS

An

investment in our common stock involves a high degree of risk. You should

carefully consider the following material risks, before you decide to buy our

common stock. If any of the following risks actually occur, our business,

results of operations and financial condition would likely suffer. In these

circumstances, the market price of our common stock could decline and you may

lose all or part of your investment.

WE

HAD A CURRENT ACCUMULATED DEFICIT OF $23,546,072 AS OF MARCH 31, 2010 AND IF WE

CONTINUE TO INCUR OPERATING LOSSES, WE MAY BE UNABLE TO SUPPORT OUR BUSINESS

PLAN, WHICH WILL HAVE A DETRIMENTAL EFFECT ON OUR STOCK.

We

have incurred losses in each of our last three fiscal years. As of March 31,

2010, we had an accumulated deficit of $23,546,072. If we continue to

incur operating losses and fail to become a profitable company, we may be unable

to support our business plan, namely to market our K-Line of Chemical Products

for the oil and gas industry, and the Green Globe Chemical Products. We incurred

net losses from continuing operations of $1,464,892 and $1,338,237 in the fiscal

years ended March 31, 2010 and 2009, respectively. Our future profitability

depends in large part on our ability to market and support our Specialty

Chemical Products which we derive the majority of our revenues. We cannot assure

you that we will achieve or sustain significant sales or profitability in the

future.

WE

ARE DEPENDENT ON OUR ABILITY TO RAISE CAPITAL FROM EXTERNAL FUNDING

SOURCES. IF WE ARE UNABLE TO CONTINUE TO OBTAIN NECESSARY CAPITAL

FROM OUTSIDE SOURCES, WE WILL BE FORCED TO REDUCE OR CURTAIL

OPERATIONS.

We have limited financial

resources. As a result we need to obtain additional capital from

outside sources to continue operations and commercialize our business

plan. We cannot assure that adequate additional funding will be

available. If we are unable to continue to obtain needed capital from

outside sources, we will be forced to reduce or curtain our

operations.

Our ability to execute our business

plan depends upon our ability to obtain financing through

|

|

·

|

bank

or other debt financing,

|

|

|

·

|

strategic

relationships and/or

|

OUR

INDEPENDENT AUDITORS HAVE EXPRESSED THAT THERE IS SUBSTANTIAL DOUBT ABOUT OUR

ABILITY TO CONTINUE AS A GOING CONCERN.

Our

independent auditors issued an explanatory paragraph expressing substantial

doubt about our ability to continue as a going concern on our financial

statements for fiscal 2010, based on the significant operating losses and a lack

of external financing. Neither our March 31, 2010 nor March 31, 2009 financial

statements include any adjustments that resulted from the outcome of this

uncertainty. Our inability to continue as a going concern would

require a restatement of assets and liabilities on a liquidation basis, which

would differ materially and adversely from the going concern basis on which our

consolidated financial statements have been prepared.

THERE

ARE SIGNIFICANT OBSTACLES TO ENTERING THE OIL AND GAS PRODUCING INDUSTRY THAT

HAVE CONTRIBUTED TO THE SLOW PACE AT WHICH OUR K-LINE OF CHEMICAL PRODUCTS ARE

BEING INTRODUCED TO THE MARKET.

Our

business plan is focused largely on marketing efforts for our K-Line of Chemical

Products for the oil and gas industry. Although we believe that the application

of our K-Line of Chemical Products for the oil and gas industry on a continuous

basis will result in higher production and lower operating costs, the

introduction of our K-Line of Chemical Products into the oil and gas producing

industry has been extremely difficult. Many entrenched players such as the “hot

oilers” and the major oil service companies that benefit from high markups on

their proprietary products have no incentive to promote the use of our chemical

products. Moreover, oil production engineers are extremely reluctant to risk

damage to a well from a product that does not have the endorsement of a major

enterprise. Consequently, the pace of introduction of our K-Line of Chemical

Products has been much slower than we initially anticipated. If we and our

K-Line of Chemical Products marketing partners are unable to successfully

achieve market acceptance our products, our future results of operations and

financial condition will be adversely affected.

THE

SUCCESS OF OUR K-LINE OF CHEMICAL PRODUCTS WILL BE HIGHLY DEPENDENT UPON THE

LEVEL OF ACTIVITY AND EXPENDITURES IN THE OIL AND NATURAL GAS INDUSTRIES AND A

DECREASE IN THE LEVELS THEREOF WOULD, IN ALL LIKELIHOOD, ADVERSELY IMPACT SALES

OF OUR K-LINE OF CHEMICAL PRODUCTS.

We

anticipate that demand for our oil and gas-cleaning product will depend on the

levels of activity and expenditures in the industry, which are directly affected

by trends in oil and natural gas prices. We anticipate that demand for our

K-Line of Chemical Product sales will be particularly sensitive to the level of

development, production and exploration activity of, and corresponding capital

spending by, oil and natural gas companies. Prices for oil and gas are subject

to large fluctuations in response to relatively minor changes in the supply of

and demand for oil and gas, market uncertainty, political stability and a

variety of other factors that are beyond our control. Any prolonged reduction in

oil and natural gas prices will depress the level of exploration, and

development and production activity. Lower levels of activity are expected to

result in a corresponding decline in the demand for our oil and gas well

products, which could have an adverse impact on our prospects, results of

operations and financial condition. Factors affecting the prices of oil and

natural gas include:

|

•

|

worldwide political, military and

economic conditions, including the ability of OPEC (the Organization of

Petroleum Exporting Countries) to set and maintain production levels and

prices for oil and gas;

|

|

•

|

overall levels of global economic

growth and activity;

|

|

•

|

global weather

conditions;

|

|

•

|

the level of production by

non-OPEC countries;

|

|

•

|

the policies of governments

regarding the exploration for and production and development of their oil

and natural gas reserves;

and

|

|

•

|

actual and perceived changes in

the supply of and demand for oil and natural

gas.

|

WE

MAY NOT BE ABLE TO GENERATE SUBSTANTIAL REVENUES FROM OUR GREEN GLOBE CHEMICAL

PRODUCTS.

Our

sales to date have been substantially dependent on sales of our K-Line of

Chemical Products. Sales of Green Globe Chemical Products accounted for

approximately 11% of revenues for the fiscal year ended March 31,

2010. The U.S. military represented approximately 86% of such

revenues from the sales of our Green Globe Chemical Products for the fiscal year

ended March 31, 2010. If we fail to develop significant revenue from

Green Globe Chemical Products or the U.S. military ceases or decreases its use

of our Green Globe Chemical Products, our business plan and financial condition

will be adversely affected.

IF

OUR STRATEGIC PARTNERS DO NOT EFFECTIVELY MARKET OUR PRODUCTS, WE WILL NOT

GENERATE SIGNIFICANT SALES OR PROFITS AND WE DO NOT CURRENTLY HAVE THE INTERNAL

RESOURCES TO MARKET OUR PRODUCTS DIRECTLY.

We

utilize third parties to assist in marketing, selling and distributing our

products. We believe that the establishment of a network of third party

strategic partners, particularly abroad, with extensive and specific knowledge

of the various applications in the oil and gas industry is important for our

success. We cannot assure you that our current or future strategic partners will

purchase our products at sufficient levels or provide us with adequate support.

If one or more of our partners under performs or if any of our strategic

relationships are terminated or otherwise disrupted, our operating performance,

results of operations and financial condition will be adversely

affected.

WE

DEPEND ON A SMALL NUMBER OF CUSTOMERS FOR A SUBSTANTIAL PORTION OF OUR REVENUES,

BUT WE HAVE NO LONG TERM CONTRACTS OR BINDING PURCHASE COMMITMENTS FROM THESE

CUSTOMERS.

We

currently have a limited number of recurring customers for our products, none of

whom have entered into long-term contracts or binding purchase commitments with

us. Our four largest customers accounted for 68% of our revenues for fiscal year

ended March 31, 2010 and our three largest customers accounted for 50% of our

revenues for the fiscal year ended March 31, 2009.

WE

RELY ON THIRD PARTIES FOR THE RAW MATERIALS NECESSARY TO MAKE OUR PRODUCTS,

LEAVING US POTENTIALLY VULNERABLE TO SUBSTANTIAL COST INCREASES AND

DELAYS.

All

of the raw materials necessary for the manufacture of our products are generally

available from multiple sources. We have negotiated favorable arrangements with

our current suppliers. If one or more of our current suppliers were no longer

able to supply the raw materials that we need, we would be required to negotiate

arrangements with alternate suppliers, which would likely include some cost or

delay and could be substantial. In addition, no assurance can be given that any

alternative arrangements that we secure would be on terms as favorable as our

current arrangements.

WE

DEPEND ON INDEPENDENT MANUFACTURERS OF OUR PRODUCTS; ANY PROLONGED INTERRUPTION

IN THEIR BUSINESS COULD CAUSE US TO LOSE OUR CUSTOMERS.

We

do not own any manufacturing facilities. Our chemical products are generally

manufactured by contract blenders at a number of different facilities. Chemical

blenders are relatively easy to replace. While we believe these facilities have

the capacity to meet our current production needs and also meet applicable

environmental regulations, we cannot be certain that these facilities will

continue to meet our needs or continue to comply with environmental laws. In

addition, these facilities are subject to certain risks of damage, including

fire, which would disrupt production of our products. To the extent we are

forced to find alternate facilities, it would likely involve delays in

manufacturing and potentially significant costs.

The

chemical blenders that manufacture our products are bound by confidentiality

agreements that obligate them not to disclose or use our proprietary

information. A breach of one or more of these agreements could have a

detrimental effect on our business and prospects.

ENVIRONMENTAL

PROBLEMS AND LIABILITIES COULD ARISE AND BE COSTLY FOR US TO CLEAN

UP.

We

are subject to various foreign, federal, state and local laws and regulations

relating to the protection of the environment, including the Industrial Site

Recovery Act, a New Jersey statute requiring clearance by the state prior to the

sale of any industrial facility. These laws provide for retroactive strict

liability for damages to natural resources or threats to public health and

safety, rendering a party liable without regard to its negligence or fault.

Sanctions for noncompliance may include revocation of permits, corrective action

orders, and administrative or civil penalties or even criminal prosecution. We

have not, to date, incurred any serious liabilities under environmental

regulations and believe that we are in substantial compliance therewith.

Nevertheless, we cannot be certain that we will not encounter environmental

problems or incur environmental liabilities in the future that could adversely

affect our business.

BECAUSE

WE ARE SMALLER AND HAVE FEWER FINANCIAL AND MARKETING RESOURCES THAN MANY OF OUR

COMPETITORS, WE MAY NOT BE ABLE TO SUCCESSFULLY COMPETE IN THE EXTREMELY

COMPETITIVE CHEMICAL INDUSTRIES.

We

compete directly or indirectly with other producers of specialty chemical

products, most of which are or have aligned themselves with more established

companies, have greater brand recognition and greater financial and marketing

resources. Generally, we attempt to compete by offering what we hope to be lower

prices and better service. However, the prices for our K-Line of Chemical

Products and Green Globe Chemical Products are higher than competing products;

therefore, we attempt to compete by emphasizing product effectiveness and

environmental safety.

WE

MAY NOT BE ABLE TO RETAIN OUR EXECUTIVE OFFICERS WHO WE NEED TO SUCCEED, AND

ADDITIONAL QUALIFIED PERSONNEL ARE EXTREMELY DIFFICULT TO ATTRACT.

Our

performance depends, to a significant extent, upon the efforts and abilities of

our executive officers. We do not maintain any key man insurance on

their lives for our benefit. The loss of the services of our executive officers

could have a serious and adverse effect on our business, financial condition and

results of operations. Our success will also depend upon our ability to recruit

and retain additional qualified senior management personnel. Competition is

intense for highly skilled personnel in our industry, and accordingly, no

assurance can be given that we will be able to hire or retain sufficient

personnel.

OUR

MANAGEMENT OWNS A SUBSTANTIAL AMOUNT OF OUR STOCK AND IS CAPABLE OF INFLUENCING

OUR BUSINESS AND AFFAIRS.

Our

directors and executive officers beneficially own approximately 46.9% of our

outstanding common stock. As such, they will be able to significantly influence

the election of the members of our board of directors and the outcome of

corporate actions that require shareholder approval, such as mergers and

acquisitions. In addition, Pursuant to the terms of the Company’s Series A

Convertible Preferred Stock (the “Preferred Stock”) and an agreement with

Sherleigh Associates Profit Sharing Plan (“Sherleigh”), as holder of all of the

outstanding shares of Preferred Stock, Sherleigh has the right to and has

designated a majority of the members of our board of directors. Jack

Silver, one of our directors, as the trustee of Sherleigh, has voting control

over the shares of Preferred Stock held by Sherleigh. The level of

ownership by our directors and executive officers, together with particular

provisions of our articles of incorporation, bylaws and Nevada law, may have a

significant effect in delaying, deferring or preventing any change in control

and may adversely affect the voting and other rights of our other

shareholders.

IF

WE CANNOT PROTECT OUR PROPRIETARY RIGHTS AND TRADE SECRETS OR IF WE WERE FOUND

TO BE INFRINGING ON THE PROPRIETARY RIGHTS OF OTHERS, OUR BUSINESS WOULD BE

SUBSTANTIALLY HARMED.

Our

success depends in large part on our ability to protect the proprietary nature

of our products, preserve our trade secrets and operate without infringing the

proprietary rights of third parties. If other companies obtain and copy our

technology or claim that we are making unauthorized use of their proprietary

technology, we may become involved in lengthy and costly disputes. If we are

found to be infringing on the proprietary rights of others, we could be required

to seek licenses to use the necessary technology. We cannot assure you that we

could obtain these licenses on acceptable terms, if at all. In addition, the

laws of some foreign countries may not provide adequate protection for our

proprietary technology.

To

protect our intellectual property, we seek patents and enter into

confidentiality agreements with our employees, manufacturers and marketing and

distribution partners. We cannot assure you that our patent applications will

result in the successful issuance of patents or that any issued patents will

provide significant protection for our technology and products. In addition, we

cannot assure you that other companies will not independently develop competing

technologies that are not covered by our patents. There is also no assurance

that confidentiality agreements will provide adequate protection of our trade

secrets, know-how or other proprietary information. Any unauthorized disclosure

and use of our proprietary technology, whether in breach of an agreement or not,

could have an adverse effect on our business, prospects, results of operations

and financial condition.

THE

PUBLIC MARKET FOR OUR COMMON STOCK HAS BEEN CHARACTERIZED BY A LOW VOLUME OF

TRADING AND OUR STOCKHOLDERS MAY NOT BE ABLE TO RESELL THEIR SHARES AT OR ABOVE

THE PRICE AT WHICH THEY PURCHASED THEIR SHARES, IF AT ALL.

Historically,

the volume of trading in our common stock has been low. A more active public

market for our common stock may not develop or, even if it does in fact develop,

may not be sustainable. The market price of our common stock may fluctuate

significantly in response to factors, some of which are beyond our control.

These factors include:

|

•

|

product liability claims and

other litigation;

|

|

•

|

the announcement of new products

or product enhancements by us or our

competitors;

|

|

•

|

developments concerning

intellectual property rights and regulatory

approvals;

|

|

•

|

quarterly variations in our

competitors’ results of

operations;

|

|

•

|

developments in our industry;

and

|

|

•

|

general market conditions and

other factors, including factors unrelated to our own operating

performance.

|

Recently,

the stock market in general has experienced extreme price and volume

fluctuations. In particular, market prices of securities of specialty chemical

products companies have experienced fluctuations that are often unrelated to or

disproportionate from the operating results of these companies. Continued market

fluctuations could result in extreme volatility in the price of shares of our

common stock, which could cause a decline in the value of our shares. Price

volatility may be worse if the trading volume of our common stock is

low.

WE

HAVE OUTSTANDING WARRANTS AND OPTIONS, AND WE ARE ABLE TO ISSUE “BLANK CHECK”

PREFERRED STOCK, THAT COULD BE ISSUED RESULTING IN THE DILUTION OF COMMON STOCK

OWNERSHIP.

As of June 30, 2010, we had outstanding

Preferred Stock, warrants and options that, when exercised and converted, could

result in the issuance of up to 24,103,363 additional shares of common

stock. In addition, our Articles of Incorporation allow the board of

directors to issue up to 100,000 shares of preferred stock and to fix the

rights, privileges and preferences of those shares without any further vote or

action by the shareholders. We currently have 3 shares of Preferred Stock

outstanding. To the extent that outstanding warrants, options and preferred

stock or similar instruments or convertible preferred stock issued in the future

are exercised or converted, these shares will represent a dilution to the

existing shareholders. The preferred stock could hold dividend

priority and a liquidation preference over shares of our common

stock. Thus, the rights of the holders of common stock are and will

be subject to, and may be adversely affected by, the rights of the holders of

any preferred stock. Any such issuance could be used to discourage an

unsolicited acquisition proposal by a third party.

OUR

COMMON STOCK IS CONSIDERED A “PENNY STOCK” AND MAY BE DIFFICULT TO SELL WHEN

DESIRED.

The

SEC has adopted regulations that define a “penny stock”, generally, to be an

equity security that has a market price of less than $5.00 per share or an

exercise price of less than $5.00 per share, subject to specific exemptions. The

market price of our common stock has been less than $5.00 per share. This

designation requires any broker or dealer selling our securities to disclose

certain information concerning the transaction, obtain a written agreement from

the purchaser and determine that the purchaser is reasonably suitable to

purchase the securities. These rules may restrict the ability of brokers or

dealers to sell our common stock and may affect the ability of stockholders to

sell their shares. In addition, since our common stock is currently quoted on

the OTC Bulletin Board, stockholders may find it difficult to obtain accurate

quotations of our common stock, may experience a lack of buyers to purchase our

shares or a lack of market makers to support the stock price.

A

SIGNIFICANT NUMBER OF OUR SHARES ARE ELIGIBLE FOR SALE AND THEIR SALE OR

POTENTIAL SALE WILL PROBABLY DEPRESS THE MARKET PRICE OF OUR STOCK.

Sales

of a significant number of shares of our common stock in the public market could

harm the market price of our common stock. Some or all of the shares

of our common stock may be offered from time to time in the open market without

registration pursuant to Rule 144, and these sales could have a depressive

effect on the market for our common stock.

WE

DO NOT ANTICIPATE PAYING DIVIDENDS ON OUR COMMON STOCK IN THE FORESEEABLE

FUTURE; THEREFORE, YOU SHOULD NOT BUY THIS STOCK IF YOU WISH TO RECEIVE CASH

DIVIDENDS.

We

currently intend to retain our future earnings in order to support operations

and finance expansion; therefore, we do not anticipate paying any cash dividends

on our common stock in the foreseeable future.

ITEM

1B. UNRESOLVED STAFF COMMENTS

None.

ITEM

2. PROPERTIES

We lease

4,800 square feet of office space at 600 Meadowlands Parkway, #21, Secaucus, New

Jersey 07094. Under the terms of the lease, which runs through June

2013, the monthly rent is $6,400. In addition, we leased office and warehouse

space on a month-to-month basis in Odessa, TX, at a rate of $535 per month

through September 2008.

We use

independent non-affiliated contract chemical blending and manufacturing

facilities in various locations around the United States for the manufacture of

our products. We contract the production of our products to

independent manufacturers and blenders and our products are therefore produced

at the manufacturing facilities of those entities. We do not own any

manufacturing facilities.

ITEM

3. LEGAL PROCEEDINGS

In July

2002, an action was commenced against us in the Court of Common Pleas of South

Carolina, Pickens County, brought by Quantum International Technology, LLC and

Richard J. Barrett. Plaintiffs allege that they were retained as a

sales representative of ours and in that capacity made sales of our products to

the United States government and to commercial entities. Plaintiffs

further allege that we failed to pay to plaintiffs agreed commissions at the

rate of 20% of gross sales of our products made by plaintiffs. The

complaint seeks an accounting, compensatory damages in the amount of all unpaid

commissions plus interest thereon, punitive damages in an amount treble the

compensatory damages, plus legal fees and costs. Plaintiffs maintain that they

are entitled to receive an aggregate of approximately $350,000 in compensatory

and punitive damages, interest and costs. In June 2003, the action

was transferred from the court in Pickens County to a Master in Equity sitting

in Greenville, South Carolina and was removed from the trial

docket. The action, if tried, will be tried without a jury. No trial

date has yet been scheduled. We believe we have meritorious defenses

to the claims asserted in the action and intend to vigorously defend the

case. The outcome of this matter cannot be determined at this

time.

No other

legal proceedings are currently pending or threatened against us.

ITEM 4.

(Removed and

Reserved)

PART

II

|

ITEM

5.

|

MARKET

FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

As of

July 14, 2010 there were approximately 453 record holders of our common stock

and there were 31,504,449 shares of our common stock outstanding. We

have not previously declared or paid any dividends on our common stock and do

not anticipate declaring any dividends in the foreseeable future.

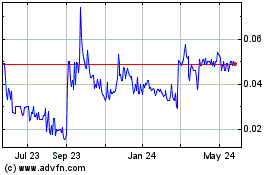

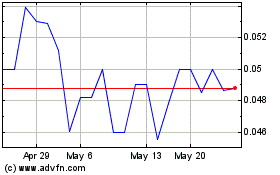

The

following table shows the high and low bid prices of our common stock as quoted

on the OTC Bulletin Board by quarter during each of our last two fiscal years

ended March 31, 2010 and 2009 and for each quarter after March 31,

2010. These quotes reflect inter-dealer prices, without retail

markup, markdown or commissions and may not represent actual transactions. The

information below was obtained from those organizations, for the respective

periods.

|

Fiscal

Year

ended March 31

|

|

Quarter

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

|

|

2009

|

|

First

Quarter (April-June 2008)

|

|

$

|

.42

|

|

|

$

|

.25

|

|

|

|

|

Second

Quarter (July-September 2008)

|

|

|

.38

|

|

|

|

.15

|

|

|

|

|

Third

Quarter (October-December 2008)

|

|

|

.25

|

|

|

|

.05

|

|

|

|

|

Fourth

Quarter (January-March 2009)

|

|

|

.21

|

|

|

|

.06

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010

|

|

First

Quarter (April-June 2009)

|

|

$

|

.20

|

|

|

$

|

.09

|

|

|

|

|

Second

Quarter (July-September 2009)

|

|

|

.48

|

|

|

|

.11

|

|

|

|

|

Third

Quarter (October-December 2009)

|

|

|

.41

|

|

|

|

.21

|

|

|

|

|

Fourth

Quarter (January-March 2010)

|

|

|

.29

|

|

|

|

.08

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011

|

|

First

Quarter (April-June 2010)

|

|

$

|

.22

|

|

|

$

|

.06

|

|

|

|

|

Second

Quarter (through July 12)

|

|

|

.15

|

|

|

|

.08

|

|

The high and low bid prices for shares

of our common stock on July 12, 2010 were $.09 and $.08 per share, respectively,

based upon bids that represent prices quoted by broker-dealers on the OTC

Bulletin Board.

These quotations reflect inter-dealer

prices, without retail mark-up, mark-down or commissions, and may not represent

actual transactions

.

Dividend

Policy

While

there are no restrictions on the payment of dividends, we have not declared or

paid any cash or other dividends on shares of our common stock in the last two

years, and we presently have no intention of paying any cash dividends in the

foreseeable future. Our current policy is to retain earnings, if any,

to finance the expansion of our business. The future payment of

dividends will depend on the results of operations, financial condition, capital

expenditure plans and other factors that we deem relevant and will be at the

sole discretion of our board of directors.

We intend

to pay regular semi-annual dividends on our preferred stock outstanding in an

amount not to exceed $1,440 per year. Any decision to declare and pay dividends

in the future will be made at the discretion of our board of directors and will

depend on, among other things, our results of operations, cash requirements,

financial condition, contractual restrictions and other factors our board of

directors may deem relevant.

On June

30, 2008, December 31, 2008, June 30, 2009 and December 31, 2009 we declared

dividends on our preferred stock at a rate of $480.00 per share. The dividends

were paid for a total amount of $2,160 on July 3, 2008, January 13, 2009 and

September 2, 2009, respectively. Dividends declared on December 31, 2009 for

$720 have been accrued.

Related

Party Loans

In March

2009, Ronald Wilen, a director, the President and the Chief Executive Officer,

Martin Rappaport, a director, and Sherleigh Associates Profit Sharing Plan

(“Sherleigh”), a trust of which Jack Silver, a director, is the trustee,

provided the Company with short term loans in the amount of $50,000 each, and

each received warrants to purchase up to 200,000 shares of common stock at an

exercise price of $.125 per share which warrants are exercisable for a period of

five (5) years.

Subsequently,

in May 2009, the loan by Sherleigh was repaid, and Messrs Wilen and Rappaport

loaned the Company an additional $50,000 each, and Hilltop Holding Company, L.P.

(“Hilltop”), a limited partnership of which Mr. Silver is the managing partner,

loaned the Company $101,017. In addition, the Company amended Messrs

Wilen’s and Rappaport’s March 2009 notes into secured convertible notes (the

“Amended March Loan Notes”) and issued to Messrs Wilen and Rappaport and Hilltop

secured convertible notes (the “May Loan Notes”) for their May 2009 loans to the

Company. The amended notes extended the maturity date of the Amended

March Loan Notes to July 13, 2009. In consideration for agreeing to

extend the maturity date and for making the May 2009 loans, Messrs Wilen,

Rappaport and Hilltop each received warrants to purchase up to 400,000 shares of

common stock at an exercise price of $.12 per share, which warrants are

exercisable for a period of five (5) years.

Thereafter,

in July 2009, Messrs Wilen and Rappaport and Hilltop agreed to extend the

maturity date of the Amended March Loan Notes and the May Loan Notes from July

13, 2009 to August 13, 2009 and as consideration for such extension received

warrants to purchase an aggregate of 611,825 shares of common stock at an

exercise price of $.12 per share, which warrants are exercisable for a period of

five (5) years.

Thereafter,

in July/August 2009, Messrs Wilen and Rappaport and Hilltop each loaned the

Company an additional $50,000. In October 2009, the Company issued to

Messrs Wilen and Rappaport and Hilltop secured convertible notes (the “August

Loan Notes”) for their July/August 2009 loans to the Company. In

connection with the July/August 2009 loans, Messrs Wilen and Rappaport and

Hilltop agreed to extend the maturity date of the Amended March Loan Notes and

the May Loan Notes to January 29, 2010. In consideration for agreeing

to extend the maturity date and for making the July/August 2009 loans, Messrs

Wilen, Rappaport and Hilltop each received warrants to purchase up to 400,000

shares of common stock at an exercise price of $.09 per share, which warrants

are exercisable for a period of five (5) years. In addition, the

conversion price of the Amended March Loan Notes and the May Loan Notes was

lowered from $.12 per share to $.09 per share.

Thereafter,

pursuant to an agreement dated January 29, 2010, Messrs Wilen and Rappaport and

Hilltop agreed to extend the maturity date of the Amended March Loan Notes, the

May Loan Notes and the August Loan Notes to January 31, 2011. In

consideration for agreeing to extend the maturity date, Messrs Wilen, Rappaport

and Hilltop received warrants to purchase an aggregate of 5,414,705 shares of

common stock at an exercise price of $.222 per share, which warrants are

exercisable for a period of five (5) years. As a result of the

foregoing, each of the Amended March Loan Notes, the May Loan Notes and the

August Loan Notes are convertible into common stock of the Company at a

conversion price of $.09 per share, bear interest at 12% per annum, are due

January 31, 2011 and are secured by substantially all the assets of the

Company.

The

issuance of the August Loan Notes and the warrants in October 2009 and the

reduction of the conversion price of the Amended March Loan Notes and the May

Loan Notes triggered the anti-dilution provisions of the Company’s outstanding

Series A Warrants, Series B Warrants, Series C Warrants and Series A Convertible

Preferred Stock. As a result, in October 2009, the Company entered

into an Anti-Dilution Waiver Agreement with the holders of Series A Warrants,

Series B Warrants, Series C Warrants and Series A Convertible Preferred Stock,

including Sherleigh, whereby the exercise price of the Series A Warrants, the

Series B Warrants and the Series C Warrants were reduced from $0.12 to $0.09 per

share; however, such holders agreed to waive any increase in the number of

shares underlying the Series A Warrants, Series B Warrants and Series C Warrants

as a result of such reduction in the exercise price. In addition,

Sherleigh, as the sole holder of the Series A Convertible Preferred Stock,

agreed to waive the anti-dilution provisions of the Series A Convertible

Preferred Stock.

Equity Compensation Plan

Information

Pursuant to the terms of an employment

agreement dated April 17, 2007, with Ronald Wilen, Chief Executive Officer,

President and Secretary, for each of the next five (5) years of the term of the

agreement (commencing with April 17, 2008), Mr. Wilen is to receive an option to

purchase fifty thousand (50,000) shares of common stock of the Company. The

exercise price with respect to any option granted pursuant to the employment

agreement is to be the fair market value of the common stock underlying such

option on the date such option was granted. The initial grant of

50,000 stock options is to be granted out of the 2001 Equity Incentive Plan at

the one-year anniversary. In addition, the stock option to purchase 200,000

shares has been reserved for Mr. Wilen out of the 2001 Equity Incentive

Plan.

On

January 28, 2009, the Company issued a convertible term note in the amount of

$35,000, which accrued interest at 7% per year. Principal and interest is

payable on the maturity date of June 30, 2009. The holder of this term note has

the option to convert all or a portion of the note (including principal and

interest) into shares of common stock at any time at a conversion price of $0.12

per share. The conversion price is subject to adjustment for stock splits, stock

dividends and similar events. On June 2, 2009, the term note was converted. In

consideration for the conversion, the Company issued to the holder of the note,

warrants to acquire 140,000 shares of Common Stock at an exercise price of

$0.12, which warrants are exercisable for a period of five years.

On November 6, 2009, the Company issued

a convertible term note in the amount of $30,000, which accrues interest at 7%

per year. Principal and interest is payable on demand. The holder of this term

note has the option to convert all or a portion of the note (including principal

and interest) into shares of common stock at any time at a conversion price of

$0.21 per share. The conversion price is subject to adjustment for stock splits,

stock dividends and similar events.

In February 2009, the Company awarded

each of the six (6) directors of the Company warrants to purchase up to 150,000

shares of common stock at an exercise price of $.12 per share. The

warrants are exercisable for a period of ten (10) years. Also in

February 2009, the Company issued to an employee warrants to purchase up to

200,000 shares of common stock at an exercise price of $.12 per share, which

warrants are exercisable for a period of five (5) years and to a former employee

in connection with his termination of employment, warrants to purchase up to

100,000 shares of common stock at an exercise price of $.30 per share, which

warrants are exercisable for a period of three (3) years from the date of

termination.

In June

2009, the Company awarded four (4) of the six (6) directors of the Company

warrants to purchase up to 150,000 shares of common stock at an exercise price

of $.12 per share, and awarded one (1) of the directors warrants to purchase up

to 300,00 shares of common stock at an exercise price of $.12 per

share. The warrants are exercisable for a period of ten (10)

years.

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

Because

we are a smaller reporting company, we are not required to provide the

information called for by this item.

|

ITEM

7.

|

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATION

|

You

should read the following description of our financial condition and results of

operations in conjunction with the consolidated financial statements and

accompanying notes included in this Annual Report beginning on page

F-1.

Overview

We develop and distribute

environmentally friendly specialty chemical products with applications in

several industries and markets. Our current line of products includes K-Line of

Chemical Products for the oil industry and related products.

Through

our wholly owned subsidiary, Green Globe Industries, Inc., we provide the U.S.

military with a variety of solvents, paint strippers and cleaners under our

trade name “Qualchem.” Green Globe is a qualified supplier for the U.S. military

and has sales contracts currently in place with no minimum purchase requirements

which are renewable at the option of the U.S. military.

A key component of our business strategy is to pursue collaborative joint

working and marketing arrangements with established international oil and oil

service companies. We intend to enter into these relationships to more rapidly

and economically introduce our K-Line of Chemical Products to the worldwide

marketplace for refinery, tank and pipeline cleaning services.

We

provide our K-Line of Chemical Products and our Green Globe Chemical Products to

our customers and generated revenues of $1,771,720 for the fiscal year ended

March 31, 2010 and $1,206,321 for the fiscal year ended March 31,

2009.

Critical

Accounting Policies and Estimates

The

preparation of consolidated financial statements in accordance with accounting

principles generally accepted in the United States of America requires us to

make estimates and judgments that affect the reported amounts of assets,

liabilities, revenues and expenses, and related disclosure of contingent assets

and liabilities.

On an

ongoing basis, we evaluate our estimates, including those related to product

returns, bad debts, inventories, valuation of options and warrants, intangible

assets, long-lived assets and contingencies and litigation. We base our

estimates on historical experience and on various other assumptions that are

believed to be reasonable under the circumstances, the results of which form the

basis for making judgments about the carrying values of assets and liabilities

that are not readily apparent from other sources. Actual results may

differ from these estimates under different assumptions or

conditions.

Revenue

Recognition

Our

primary source of revenue is from sales of our products. We recognize

revenue upon shipment and transfer of title.

Allowance

for Doubtful Accounts

We

monitor our accounts and note receivable balances on a monthly basis to ensure

they are collectible. On a quarterly basis, we use our historical

experience to determine our accounts receivable reserve. Our

allowance for doubtful accounts is an estimate based on specifically identified

accounts, as well as general reserves. We evaluate specific accounts

where we have information that the customer may have an inability to meet its

financial obligations. In these cases, management uses its judgment,

based upon the best available facts and circumstances, and records a specific

reserve for that customer against amounts due to reduce the receivable to the

amount that is expected to be collected. These specific reserves are

re-evaluated and adjusted as additional information is received that impacts the

amount reserved. We also establish a general reserve for all

customers based upon a range of percentages applied to aging categories. These

percentages are based on historical collection and write-off

experience. If circumstances change, our estimate of the

recoverability of amounts due to us could be reduced or increased by a

significant amount. A change in estimated recoverability would be

accounted for in the period in which the facts that give rise to the change

become known.

Results

of Operations

Comparison

of Fiscal Year Ended March 31, 2010 to Fiscal Year Ended March 31,

2009

Revenues.

Revenues

for the year ended

March 31, 2010 were $1,771,720, a $565,399 or 47% increase from revenues of

$1,206,321 for the year ended March 31, 2009. The increase was primarily related

to a 36% increase in the level of our K-Line of Chemical Products reflecting a

higher level of orders, and by an 817% increase in the level of our Green

Globe/Qualchem military sales during the year. Our four largest customers

accounted for 68% of our revenues for fiscal year ended March 31, 2010 and our

three largest customers accounted for 50% of our revenues for the fiscal year

ended March 31, 2009.

Cost of Goods

Sold.

Cost of goods sold increased to $668,326 or 38% of

sales, for the year ended March 31, 2010 from $567,758, or 47% of sales, for the

year ended March 31, 2009. The increase in cost of goods sold was due to the

increased level of sales compared to the prior year.

Gross Profit.

Gross profit

increased to $1,103,394 or 62% of sales, for the year ended March 31, 2010 from

$638,563, or 53% of sales, for the year ended March 31, 2009. The

increase in gross profit and gross profit percentage reflects the higher level

of sales of Specialty Chemicals and our Green Globe/Qualchem military

sales.

Selling, General and Administrative

Expenses.

Selling, general and administrative expenses

increased to $2,249,047, or 127% of sales, for the year ended March 31, 2010

from $1,586,355, or 132% of sales, for the year ended March 31,

2009. The increase in general and administrative expenses is

primarily related to an increase in the allowance for bad debts and in financing

costs associated with the issuance of warrants, offset by a decrease in

professional fees, salaries, employee benefits and travel and

entertainment.

Research and Development

.

Research and development expenses decrease to $222,476, or 13% of sales for the

year ended March 31, 2010 from $329,186, or 27% of sales for the year ended

March 31, 2009. The decrease in research and development expenses was primarily

related to a decrease in salaries and lab supplies.

Depreciation and

Amortization

. Depreciation and amortization decreased to

$48,499 for the year ended March 31, 2010 from $59,795 for the year ended March

31, 2009, reflecting the Company’s use of an accelerated method of depreciation,

offset by an increase in fixed assets.

Interest

Income

. Interest income decreased to $27 for the year ended

March 31, 2010 from $950 for the year ended March 31, 2009. The decrease was due

to the use of cash received in connection with the private placement completed

in March 2006.

Interest

Expense.

Interest expense increased to $48,291 for the

year ended March 31, 2010 from $2,414 for the year ended March 31,

2009. The increase was due to the indebtedness outstanding on the

loans by directors and their affiliates.

Net Loss.

For the

year ended March 31, 2010, we incurred a net loss of $1,464,892 or $0.05 per

share, as compared to a net loss of $1,338,237 for the year ended March 31,

2009, or $0.04 per share. The average number of shares of common stock used in

calculating earnings per share increased 305,037 shares to 31,335,152 from

31,030,115 shares as a result of 298,472 shares issued in the connection of the

conversion of the convertible note and 175,862 shares issued in the connection

with the exercise of warrants.

Preferred Dividends,

Preferred dividends of $1,440 were paid at a rate of $480.00 per share

for the fiscal years ended March 31, 2010 and 2009.

Liquidity

and Capital Resources

Since

1995, operations have been financed primarily through loans and equity

contributions from directors, executive officers and third parties supplemented,

by funds generated by our business. As of March 31, 2010, we had $311,506 in

cash and cash equivalents.

Net Cash Used in Continuing

Operations.

During the fiscal year ended March 31, 2010, net

cash used in continuing operations was $6,308 compared with $858,846 for the

fiscal year ended March 31, 2009.

Net Cash Used in Investing

Activities

. During the fiscal year ended March 31, 2010, net cash used in

investing activities decreased to $40,899 compared with $91,917 for the year

ended March 31, 2009. The decrease was primarily a result of a

decrease in payments for patents and fixed assets,

offset by

an increase in payments on loans

.

Net Cash Provided by Financing

Activities.

During the fiscal year ended March 31, 2010, net cash

provided by financing activities consisted of related party loans of $303,781,

offset by $1,440 of preferred stock dividends. This compares to net cash

provided in financing activities consisting of related party loans of $150,000,

offset by $1,440 of preferred stock dividends during the fiscal year ended March

31, 2009.

The

accompanying consolidated financial statements have been prepared in conformity

with accounting principles generally accepted in the United States of America

which contemplate continuation of the Company as a going concern. However, the

Company has year-end losses from operations in 2010. For the year ended March

31, 2010 the Company incurred net loss approximating $1,464,892. Further, the

Company has inadequate working capital to maintain or develop its operations,

and is dependent upon funds from private investors and the support of certain

stockholders.

These

factors raise substantial doubt about the ability of the Company to continue as

a going concern. The consolidated financial statements do not include any

adjustments that might result from the outcome of these uncertainties. In this

regard, the Company may need to raise additional funds through loans, additional

sales of its equity securities, increased sales volumes and the ability to

achieve profitability from the sales of our product lines. There is no assurance

that the Company will be successful in raising additional capital.

Concentration

of Credit Risk

Sales to

four of our customers, Petrobras America Inc., Solarium Oil Solutions, Facility

Solutions LTD. and Ainex Corporation accounted for approximately 68.1% of our

sales for the fiscal year ended March 31, 2010 and sales to three of our

customers, Petrobras America Inc., Nalco Company and United Energy Petroleum

Services LTD. accounted for approximately 50.2% of our sales for the fiscal year

ended March 31, 2009.

Contractual

Obligations

Below is

a table, which presents our contractual obligation commitments at March 31,

2010:

|

|

|

|

|

|

Less

than

|

|

|

|

|

|

|

|

|

After

|

|

|

Contractual Obligation

|

|

Total

|

|

|

1 Year

|

|

|

1-3 Years

|

|

|

3-5 Years

|

|

|

5 Years

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term

debt Obligations(1)

|

|

$

|

483,781

|

|

|

$

|

483,781

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Operating

leases

|

|

|

263,693

|

|

|

|

80,823

|

|

|

|

182,870

|

|

|

|

—

|

|

|

|

—

|

|

|

Total

contractual cash obligations

|

|

$

|

747,474

|

|

|

$

|

564,604

|

|

|

$

|

182,870

|

|

|

$

|

—

|

|

|

$

|

—

|

|

(1) Short-term debt

obligations include amounts due to the Hilltop, the President and Chief

Executive Officer, Ron Wilen and one of our directors, Martin Rappaport. The

amount due as of March 31, 2010 is $453,781. The loans bear interest at 12% per

annum, are due January 31, 2011 and are secured by substantially all the assets

of the Company. At March 31, 2008, the Company had a note due to related party

totaling $244,141. During fiscal year 2009, this amount was written

off.

Off-Balance

Sheet Arrangements

We do not

currently have any off-balance sheet arrangements that have or are reasonably

likely to have a current or future effect on our financial condition, changes in

financial condition, revenues or expenses, results of operations, liquidity,

capital expenditures or capital resources that are material to our

stockholders.

Inflation

We do not

believe that inflation in the cost of our raw materials has had in the past or

will have in the future any significant negative impact on our operations.

However, no assurance can be given that we will be able to offset such

inflationary cost increases in the future.

Recent

Accounting Pronouncements

Recent

accounting pronouncements that the Company has adopted or that will be required

to adopt in the future are summarized below.

In April

2010, the FASB issued Accounting Standard Update No. 2010-12. “Income Taxes”

(Topic 740). ASU No.2010-12 amends FASB Accounting Standard Codification

subtopic 740-10 Income Taxes to include paragraph 740-10-S99-4. On March 30,

2010 The President signed the Health Care & Education Affordable Care Act

reconciliation bill that amends its previous Act signed on March 23, 2010. FASB

Codification topic 740, Income Taxes, requires the measurement of current and

deferred tax liabilities and assets to be based on provisions of enacted tax

law. The effects of future changes in tax laws are not anticipated.” Therefore,

the different enactment dates of the Act and reconciliation measure may affect

registrants with a period-end that falls between March 23, 2010 (enactment date

of the Act), and March 30, 2010 (enactment date of the reconciliation measure).

However, the announcement states that the SEC would not object if such

registrants were to account for the enactment of both the Act and the

reconciliation measure in a period ending on or after March 23, 2010, but notes

that the SEC staff “does not believe that it would be appropriate for

registrants to analogize to this view in any other fact patterns.” The adoption

of this standard is not expected to have a material impact on the Company’s

financial position and results of operations.

In April

2010, the FASB issued Accounting Standard Update No. 2010-13 “Stock

Compensation” (Topic 718). ASU No.2010-13 provides amendments to Topic 718 to

clarify that an employee share-based payment award with an exercise price

denominated in the currency of a market in which a substantial portion of the

entity's equity securities trades should not be considered to contain a

condition that is not a market, performance, or service condition. Therefore, an

entity would not classify such an award as a liability if it otherwise qualifies

as equity. The amendments in this Update are effective for fiscal years, and

interim periods within those fiscal years, beginning on or after December 15,

2010. The amendments in this Update should be applied by recording a

cumulative-effect adjustment to the opening balance of retained earnings. The

cumulative-effect adjustment should be calculated for all awards outstanding as

of the beginning of the fiscal year in which the amendments are initially

applied, as if the amendments had been applied consistently since the inception

of the award. The cumulative-effect adjustment should be presented separately.

Earlier application is permitted. The adoption of this standard is not expected