- Current report filing (8-K)

29 January 2011 - 4:10AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of

report (Date of earliest event reported):

January

21, 2011

UNITED

ENERGY CORP.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

(State

or Other Jurisdiction

of

Incorporation)

|

000-30841

(Commission

File

Number)

|

22-3342379

(IRS

Employer

Identification

No.)

|

|

600

Meadowlands Parkway, Secaucus, New Jersey 07094

(Address

of Principal Executive Offices, including Zip

Code)

|

Registrant's

telephone number, including area code:

(800) 327-3456

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item

1.01.

|

Entry

into a Material Definitive Agreement.

|

|

Item

2.03

|

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangment of a Registrant.

|

On

January 21, 2011, the Company entered into an agreement (“Agreement”) with

Ronald Wilen, a director, the President and Chief Executive Officer, and Hilltop

Holding Company, L.P. (“Hilltop”), a limited partnership of which Jack Silver, a

director, is the managing partner. Pursuant to the Agreement, Mr.

Wilen and Hilltop agreed to extend the maturity date of $151,016.67 and

$301,866.67 of secured convertible notes held by Mr. Wilen and Hilltop,

respectively. The maturity date was extended from January 31, 2011 to

December 20, 2011. In consideration for the agreement to extend the

maturity dates, Mr. Wilen and Hilltop were issued warrants to purchase up to

1,984,939 and 3,959,894 shares of common stock, respectively, at an exercise

price of $.11 per share.

On or about January 3, 2011, Hilltop

loaned the Company an additional $100,000. Pursuant to the Agreement,

the Company issued Hilltop a secured convertible note for the $100,000 loan and

warrants to purchase up to 1,111,111 shares of common stock at an exercise price

of $.11 per share. The agreement also provides that Hilltop may

purchase, at its option, up to $100,000 of additional secured convertible notes

and pro rata portion of 1,111,111 warrants at any time prior to June 30,

2011. The secured convertible note is convertible into Common Stock

at a conversion price of $.09 per share, bears interest at 12% per annum, is due

December 20, 2011 and is secured by substantially all the assets of the Company

on a pari passu basis with the previously issued secured convertible

notes.

|

Item

9.01

|

Financial

Statements and Exhibits

|

|

(d)

|

Exhibits

|

|

|

|

|

10.1

|

Agreement

among the Company, Ronald Wilen and Hilltop Holding Company,

L.P.

|

2

Signatures

Pursuant to the requirements of the

Securities Exchange Act of 1934, as amended, the registrant has caused this

report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

Date: January

27, 2011

|

|

|

|

|

|

|

|

|

UNITED

ENERGY CORP.

|

|

|

|

|

|

|

|

|

|

|

/s/ Ronald

Wilen

|

|

|

Name:

|

Ronald

Wilen

|

|

|

Title:

|

Chief

Executive Officer

|

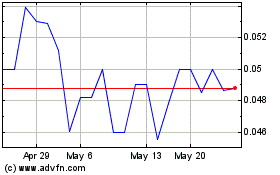

United Energy (PK) (USOTC:UNRG)

Historical Stock Chart

From Oct 2024 to Nov 2024

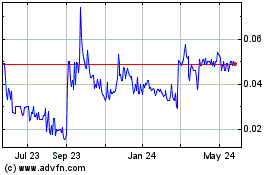

United Energy (PK) (USOTC:UNRG)

Historical Stock Chart

From Nov 2023 to Nov 2024