Singapore Fines Credit Suisse and Local Bank in 1MDB Inquiry

30 May 2017 - 2:03PM

Dow Jones News

By Jake Maxwell Watts and P.R. Venkat

SINGAPORE -- Singapore's financial regulator imposed fines on

two large banks including Credit Suisse AG as it concluded a

two-year investigation into widespread antimoney-laundering

failures throughout its financial system related to alleged

misappropriations from Malaysian state fund 1MDB.

The Monetary Authority of Singapore said Tuesday it had fined

the Swiss bank S$700,000 (US$504,613) and Singapore's United

Overseas Bank Ltd. S$900,000 after it found several breaches of

regulations and inadequate scrutiny of customers' transactions and

activities.

The fines were imposed after two years of investigations into

the role of Singapore's financial institutions and their

interactions with 1MDB, or 1Malaysia Development Bhd.

The MAS's review of Singapore's financial sector has exposed

dozens of failures within banks large and small, sullying the

city-state's reputation as a trusted financial center in a

sensitive case involving large alleged misappropriations from a

neighboring country.

During its extensive review, MAS shut two foreign private banks

and fined six others in addition to UOB and Credit Suisse for

various breaches of antimoney-laundering regulations. It has fined

banks operating in Singapore a combined S$29.1 million for their

roles in handling 1MDB-related fund flows.

Since its investigations began two years ago, MAS has issued

prohibition notices against four former or current employees of

financial institutions and said it intended to issue notices

against three more, including the new ones mentioned today. In its

statement today, MAS said it had made three new bans and served

notices on three more.

Its managing director, Ravi Menon, said in a statement Tuesday

that the regulator's extensive review "holds key lessons" for both

the MAS and financial institutions in Singapore. He said the

country's financial system "is in a better position today" than

when 1MDB-related abuses took place.

Singapore is one of several countries around the world,

including the U.S., probing 1MDB's activities. Swiss investigators

said last year they believe US$4 billion may have disappeared from

the fund, while the U.S. Justice Department has said it believes

that some $1 billion originating with 1MDB was plowed into hotels,

luxury real estate, fine art, a private jet, and the 2013 film "The

Wolf of Wall Street."

1MDB has denied wrongdoing and has not been charged with any

crimes.

While the MAS did not find pervasive control weaknesses at

Credit Suisse and UOB, it said the two banks had breached

regulations several times.

Credit Suisse said that it acknowledges the outcome of the

review and regrets that it has fallen short of MAS and the bank's

own high standards.

UOB said it accepts the findings by the MAS and that it has

instituted measures to address the areas of concern, including

enhancing its training program to raise risk-and-control awareness

among staff.

While the MAS review into financial institutions has concluded,

criminal investigations conducted by Singapore's police force

continue. At least five individuals have been sentenced for various

crimes including fraud and failing to report suspicious

transactions, while one of those awaits trial on additional

charges. Singapore investigators said last year a combined S$240

million in assets had been seized or restricted as part of their

probe.

Former BSI Bank Ltd. employee Yak Yew Chee and former Falcon

Bank branch manager Jens Sturzenegger, both banned for life, were

among the bankers individually sanctioned by MAS on Tuesday. Mr.

Yak's subordinate at BSI, Seah Mei Ying, formerly known as Yvonne

Seah Yew Foong, is banned for 15 years. All three have been

convicted of financial crimes related to their handling of 1MDB

relationships.

MAS said it had also served notice of its intention to serve

shorter prohibitions on Kelvin Ang Keng Wee, a former broker in

Singapore and two employees of research firm NRA Capital Pte Ltd.

in Singapore, for the firm's alleged role in preparing an improper

1MDB-related asset valuation. NRA did not immediately respond to a

request for comment.

Write to Jake Maxwell Watts at jake.watts@wsj.com and P.R.

Venkat at venkat.pr@wsj.com

(END) Dow Jones Newswires

May 29, 2017 23:48 ET (03:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

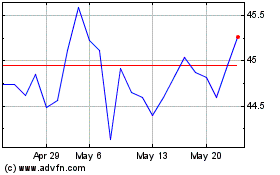

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Jan 2025 to Feb 2025

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Feb 2024 to Feb 2025