Vivendi To Price Two-Part Four-Year, Seven-Year Bond

23 November 2011 - 3:56AM

Dow Jones News

French media company, Vivendi S.A. (VIV.FR) is to price its

two-part senior unsecured bond, one of the banks running the deal

said Tuesday.

The EUR500 million four-year part is to price at 215 basis

points over midswaps and the EUR500 million seven-year bond at 265

basis points over midswaps.

The four-year bond is within initial guidance which was set at

210 basis points to 220 basis points over midswaps. The seven-year

part has priced wider than initial price guidance which was set at

250 basis points to 260 basis points over midswaps.

BNP Paribas S.A., Deutsche Bank AG, Bank of Tokyo Mitsubishi,

Lloyds Banking Group PLC, and Banco Santander S.A., are the lead

managers on the deal.

Vivendi is rated Baa2 by Moody's Investors Services Inc., and

BBB by Standard and Poor's Corp.

-By Sarka Halas, Dow Jones Newswires, +44 (0) 207 842 9236;

Sarka.Halasova@dowjones.com

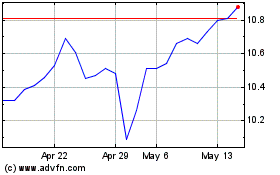

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

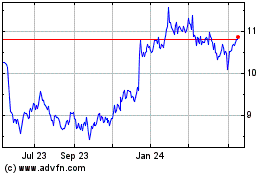

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024