Vedanta Shares Fall On Several Factors; Rights Issue A Concern

06 May 2011 - 2:36AM

Dow Jones News

Shares in U.K-listed, India-focused Vedanta Resources PLC

(VED.LN) fell more than 4% Thursday with analysts blaming a

combination of factors, including that the company is prepared to

sell equity to partly fund a proposed acquisition of Cairn India

Ltd (532792.BY) if needed.

Shares in the FTSE-100 miner fell as much as 5% to a five-month

low before paring back some of its losses later in the day. At 1532

GMT, Vedanta's shares were down 89 pence or 4% at 2131p.

Vedanta aims to purchase a 58.5% stake in Cairn India for $9.4

billion and already secured an 18.5% stake through its Sesa Goa Ltd

(500295.BY) unit, which acquired an 8.1% stake via an open offer

and a 10.4% stake from Malaysia's Petroliam Nasional Berhad, or

Petronas. It is now waiting for government approval to complete the

purchase of a 40% stake in Cairn India from U.K.-listed Cairn

Energy PLC (CNE.LN).

The company's chief financial officer DD Jalan told analysts in

a conference call that Vedanta has secured $6 billion in loans to

finance the Cairn India acquisition. The financing for the purchase

includes $3.5 billion in bank loans, a $1.5 billion loan

collateralized by a promise to issue bonds, and a $1 billion loan

collateralized by a promise to sell shares if needed.

Jalan told analysts that the $1 billion bridge loan to equity

could be covered with proceeds from "primary and secondary

offerings" from Vedanta and Konkola Copper Mines PLC, the Zambian

copper unit of Vedanta which Vedanta plans to list publicly this

year.

In an interview with Dow Jones Newswires, Jalan refuted the

likelihood of a rights issue. "There won't be a rights (issue) at

Vedanta," he said, adding that a rights issue was a resource of

last resort.

The company has 18 months to find an alternative to pay the loan

before having to resort to selling shares, Jalan told analysts

earlier in the day.

Vedanta may be able to raise enough funding to cover the bridge

loan to equity from a listing of Konkola's shares alone or by using

its free cash flow, a London-based analyst said. Last year Vedanta

said it planned to raise $1.1 billion in proceeds by listing KCM's

shares in London.

Other factors contributing to the share price decline include a

mining-sector sell-off due to risk aversion and falling metal

prices, two London-based analysts said.

The FTSE-350 mining sector index was down 1.9% while London

Metal Exchange benchmark copper, aluminum, zinc and lead--all

products sold by Vedanta--were down more than 3.4%.

Liberum Capital also said Vedanta's full year net profit missed

expectations after the company earlier Thursday reported

exceptional costs arising primarily from the full write down of an

Orissa iron ore mine lease that wasn't renewed ($118.3 million) and

acquisition costs of $32.6 million related to the purchase of Anglo

American PLC's (AAL.LN) zinc assets and Cairn India.

-By Alex MacDonald, Dow Jones Newswires; +44 (0)20 7842 9328;

alex.macdonald@dowjones.com

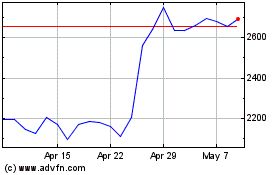

Anglo American (LSE:AAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

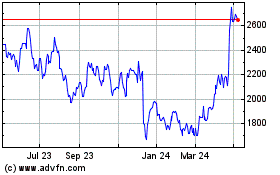

Anglo American (LSE:AAL)

Historical Stock Chart

From Feb 2024 to Feb 2025