TIDMADA

RNS Number : 6575T

Adams PLC

26 November 2021

Adams plc

("Adams" or the "Company")

Interim Results for the Six Months ended 30 September 2021

Results

Adams Plc ("Adams" or the "Company") reported a loss after tax

of GBP0.648 million for the six months to 30 September 2021

compared to a profit of GBP1.091 million in the six months ended 30

September 2020. The reduction in profitability is principally due

to investment return losses of GBP0.567 million compared to

investment return gains of GBP1.162 million in the previous

September 2020 half year.

In April 2021, Adams raised net cash proceeds of GBP4.057

million under a placing and open offer which significantly

increased the Company's net asset base and cash balances.

During the six months ended 30 September 2021, the Company spent

GBP2.948 million on equity investments, of which four were new

investments and one was a follow-on investment. There were no

investment realisations for cash during the period but its newly

acquired listed investment in Telit Communications Plc ("Telit")

was acquired by Trieste Acquisitions Holding Limited ("Trieste") in

August 2021. The 380,000 shares in Telit acquired by the Company on

8 July 2021 were rolled over into the unlisted holding company of

Trieste, Notano Midco Limited ("Notano"), under the terms of a

recommended share offer alternative announced by Trieste on 21 May

2021.

Adams held eleven investments as at 30 September 2021, of which

nine were listed and two were un-listed, and for which the total

investment carrying value was GBP7.49 million (31 March 2021:

GBP5.11 million, represented by six listed and one un-listed

investment holdings).

The Company held cash balances of GBP1.09 million as at 30

September 2021, compared to cash balances of GBP0.05 million at the

previous 31 March 2021 year end.

Net assets increased to GBP8.56 million (equivalent to 5.87p per

share) at the 30 September 2021 balance sheet date, compared with

GBP5.15 million (equivalent to 6.24p per share) at 31 March 2021.

The GBP3.41 million increase in net assets reflects the GBP4.06

million share issue fund raise in April 2021 less the GBP0.65

million loss reported for the period.

Business model and investing policy

Adams is an investing company with an investing policy under

which the Board is seeking to acquire interests in special

situation investment opportunities that have an element of

distress, dislocation, dysfunction or other special situation

attributes and that the Board perceives to be undervalued. The

principal focus is in the small to middle-market capitalisation

sectors in the UK or Europe, but the Directors will also consider

possible special situation opportunities anywhere in the world if

they believe there is an opportunity to generate added value for

shareholders.

Investment Portfolio

The principal listed investments held by the Company at 30

September 2021 comprised C4X Discovery Holdings Plc ("C4XD"),

Circassia Pharmaceuticals plc ("Circassia"), Access Intelligence

Plc ("Access Intelligence"), Seeing Machines Limited ("Seeing

Machines") and Griffin Mining Limited ("Griffin") and Adams also

holds Oxehealth Limited ("Oxehealth") and Notano Midco Limited

("Notano") as principal unquoted investments.

C4XD is a pioneering drug discovery company combining scientific

expertise with cutting-edge drug discovery technologies to

efficiently deliver world--leading medicines which are developed by

licensing partners. The company applies its enhanced DNA-based

target identification and candidate molecule design capabilities to

generate small molecule drug candidates across multiple disease

areas including inflammation, oncology, neurodegeneration and

addictive disorders. To date C4XD has successfully out-licensed two

programmes with one candidate in clinical development. C4XD

reported a loss after tax of GBP3.6 million in the six months

ending 31 January 2021 inclusive of R&D investment of GBP3.3

million and with no revenues. Cash balances at 31 January 2021

amounted to GBP15.4 million. Post that period end, the company

received a EUR7 million upfront payment in relation to an exclusive

worldwide licensing agreement signed with Sanofi in April 2021 for

C4XD's IL-17A oral inhibitor programme worth up to EUR414 million

including the EUR7 million upfront payment and EUR407 million in

potential development, regulatory and commercialisation milestones.

There is also potential for single--digit Sanofi royalties. The

shareholding of Adams in C4XD at 30 September 2021 was, and

continues to be, 2.19 per cent of the C4XD shares in issue.

Circassia is an AIM listed global medical device company focused

on respiratory diagnostics and monitoring. Following a major

restructuring and the transfer of the Tudorza and Duaklir products

back to AstraZeneca in March 2021, Circassia has now been

transformed into a debt-free business with a strong NIOX(R) asthma

management products based continuing operations business. For the

six months ended 30 June 2021, NIOX sales increased 28% to GBP14.6

million , due in part to a post Covid-19 peak recovery. The NIOX

business generated an EBITDA profit for the first time of GBP0.6

million (excluding corporate overheads of GBP0.7 million) in this

half year period and which reflected a substantial reduction in the

cost base. Net cash as of 30 June 2021 amounted to GBP11.3 million

inclusive of gross cash proceeds of GBP5.0 million raised through a

share subscription in March 2021. The shareholding of Adams at 30

September 2021 was, and continues to be, 0.74 per cent of the

Circassia shares in issue.

Access Intelligence is an AIM listed London based technology

innovator delivering Artificial Intelligence/ AI software and

service solutions that address the fundamental business needs of

customers in the PR, marketing and communications industries. The

company combines AI technologies with human expertise to analyse

data and provide strategic insights as a single, real time view of

what is important. On 1 September 2021, Access Intelligence c

ompleted the acquisition of Isentia Group Limited, a market leading

Asia Pacific focused media intelligence and award winning insights

company for the corporate communications market, headquartered in

Sydney, Australia. For the six months ended 31 May 2021, Access

Intelligence's first half revenue increased by approximately 17 per

cent. to GBP11.0 million and delivered an EBITDA loss in the period

of GBP0.13 million reflecting additional investment in sales and

marketing to drive global expansion. Insentia reported revenues of

A$42.9 million for the six months ended 31 December 2020 and

delivered an EBITDA profit in the period of A$5.5 million. The

enlarged group intends to invest in and drive further innovation to

deliver its strategic vision of building the leading intelligence

provider for the global marketing and communications industry.

Adams acquired 667,000 ordinary shares in Access Intelligence at

GBP1.20 per share on 19 August 2021 for a total consideration of

approximately GBP0.80 million. The shareholding of Adams in Access

Intelligence as at 30 September 2021 was, and continues to be, 0.52

per cent of the Access Intelligence shares in issue.

Seeing Machines is headquartered in Australia and is an AIM

listed industry leader in advanced computer vision technologies.

The company designs Artificial Intelligence/ AI powered operator

monitoring systems to improve transport safety in automotive,

commercial fleet, aviation, rail and off-road markets. The company

has pioneered such technology through algorithm development,

extensive behavioural research and data, expertise in camera-based

optics and embedded processing to deliver true AI driven human

machine interaction. The technology in corporates warnings when

human state attention impairment, distraction and other measures

are identified, in order to re-engage the operator or driver.

Seeing Machines continues to grow as an automotive leader in such

technology, having now won contracts with a total of seven

automotive Tier 1 global customers. In the year to 30 June 2021,

Seeing Machines reported underlying revenue growth of 30 per cent

when using constant currency to give total revenues of A$47.2

million and a loss for the period of A$17.4 million. Seeing

Machines's cash and cash equivalent balances at 30 June 2021

amounted to A$47.4 million and have subsequently been strengthened

by a successful fundraise completed on 23 November 2021 of US$41m

to finance accelerated growth in the rapidly expanding driver

monitoring system technology market, across all transport sectors

globally. The shareholding of Adams in Seeing Machines as at 30

September 2021 was 0.21 per cent of the Seeing Machines shares in

issue but has subsequently been diluted to 0.20 per cent following

the fundraise referred to above.

Griffin is an AIM listed mining and investment company that has

been the leader in foreign investment in mining in China having

been engaged in developing the Caijiaying zinc and gold project

since 1997. In January 2021, Griffin announced a major achievement

in finally securing a significant new mining license from the

Chinese Ministry of Land and Natural Resources which elevates

Griffin to being one of the largest zinc producers in China.

Revenues increased by 154% to US$54.1 million for the six months to

30 June 2021 and generated a profit after tax of US$10.3 million.

The results benefitted from the new mining license as well as a

significant improvement in the market price for zinc and lower

smelter treatment charges and in addition the 2020 first half year

results were adversely affected by the suspension in operations to

contain the Covid-19 pandemic. The shareholding of Adams in Griffin

as at 30 September 2021 was, and continues to be, 0.27 per cent of

the Griffin shares in issue.

Oxehealth is a private company which is involved in vision-based

patient monitoring and management, using proprietary signal

processing and computer vision to process normal digital video

camera data to measure the vital signs and activity of patients in

a number of different markets, primarily in Mental Health, Acute

Hospital settings, Primary Care settings, Care Home, and Custodial

facilities in both the UK and also in Sweden. This is achieved

through the deployment of its Oxevision platform which enables

clinicians to take non-contact cardiorespiratory measurements of a

patient's pulse and breathing rate, generates alerts to potentially

risky activity and reports on a patient's vital signs and

behaviour, all without the clinician entering the patient's room.

At 30 September 2021, the investment holding by Adams in Oxehealth

represents 2.98 per cent of Oxehealth's issued share capital at

that date.

Notano is a private company which has Telit Communications as

its principal operating subsidiary and which is a global leader in

Internet of Things (IoT) enablement. Telit has over twenty years of

experience designing, building, and executing the most complex

solutions that are redefining the rules of digital business. Telit

has an extensive portfolio of wireless connectivity modules,

software platforms and global IoT connectivity services, empowering

hundreds of millions of connected 'things' to date, and trusted by

thousands of direct and indirect customers, globally. The company

offers the largest portfolio of specialty IoT communications

modules as well as a comprehensive platform for collecting,

managing and analysing critical device data and is available as a

subscription-based cloud service or as an on premise installation.

Telit also offers its own IoT SIM cards and global data plans to

meet a variety of applications and bandwidth requirements. In the

year ended 31 December 2020, Telit generated an operating profit of

US$13.2 million on revenues of US$343.6 million. Adams acquired

380,000 shares in Telit at GBP2.256 per share on 8 July 2021 for a

total consideration of approximately GBP0.85 million. On 31 August

2021, the acquisition of Telit by Trieste was completed, and Adams

received 380,000 ordinary shares in Notano in consideration for its

380,000 Telit shares. At 30 September 2021, the investment holding

by Adams in Notano represents 0.48 per cent of Notano's issued

share capital at that date.

In addition to the above investments, at 30 September 2021 Adams

held quoted holdings in four other listed companies comprising 4D

Pharma Plc, which is a pioneer in harnessing bacteria of the gut

microbiome as a novel and revolutionary class of medicines, known

as live biotherapeutics; Source Bioscience International Plc ,

which is an international provider of state-of-the art laboratory

services, clinical diagnostics and analytical testing services;

Euromax Resources Ltd, which is a Canadian development company,

focused on building and operating the Ilovica-Shtuka copper and

gold project in Macedonia ; and Afentra Plc, which has a strategic

imperative of capitalising on opportunities resulting from the

accelerating energy transition on the African continent .

Outlook

Whilst the arrival of a number of Covid-19 vaccines and the

associated roll-out of the global vaccination programmes has now

provided a pathway for easing of the social and economic

restrictions previously in force, the full economic fallout from

this pandemic remains uncertain. In addition, economic threats

remain including from the unprecedented levels of worldwide public

debt and continued volatility in financial markets can, therefore,

be expected.

In view of these uncertainties and economic threats, your Board

will continue to maintain a rigorous and highly selective

investment approach which is committed to delivering additional

value for shareholders going forward. We remain confident in the

underlying fundamentals, technologies and long-term potential for

growth at the companies within our investment portfolio, many of

which are in sectors that are regarded as defensive stocks in the

current environment.

Michael Bretherton

Chairman

26 November 2021

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this announcement.

The Directors of the Company take responsibility for this

announcement.

Enquiries:

Adams plc

Mike Bretherton Tel: +44 1534 719 761

Nomad

Cairn Financial Advisers LLP

Sandy Jamieson, James Caithie Tel: +44 207 213 0880

Broker

Peterhouse Corporate Finance Limited

Lucy Williams, Duncan Vasey Tel: +44 207 469 0930

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIOD TO 30 SEPTEMBER 2021

6 months 6 months

ended Year ended ended

30 Sep 2021 31 Mar 2021 30 Sep 2020

Note (Unaudited) (Audited) (Unaudited)

GBP'000 GBP'000 GBP'000

(Loss)/gain on investments 5 (567) 3,234 1,159

Dividend income - 3 3

-------------- ------------- --------------

Investment return (567) 3,237 1,162

Expenses and other income

Administrative expenses (81) (153) (77)

Operating (loss)/profit (81) 3,084 1,085

Interest income - 6 6

(Loss)/profit before income tax (648) 3,090 1,091

Income tax expense - - -

(Loss)/profit and total comprehensive

-------------- ------------- --------------

(loss)/income for the period (648) 3,090 1,091

============== ============= ==============

Basic and diluted (loss)/earnings

per share 10 (0.46)p 3.74p 1.32p

-------------- ------------- --------------

STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2021

As at As at As at

30 Sep 2021 31 Mar 2021 30 Sep 2020

(Unaudited) (Audited) (Unaudited)

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Investments 6 7,486 5,105 2,187

Current assets

Trade and other receivables 7 3 22 3

Cash and cash equivalents 1,089 49 972

------------- ------------- -------------

Total current assets 1,092 71 975

------------- ------------- -------------

Total assets 8,578 5,176 3,162

------------- ------------- -------------

Liabilities

Current liabilities

Trade and other payables 8 (16) (23) (8)

------------- ------------- -------------

Total liabilities (16) (23) (8)

------------- ------------- -------------

Net current assets 1,076 48 967

------------- ------------- -------------

Net assets 8,562 5,153 3,154

============= ============= =============

Equity

Called up share capital 9 1,459 826 826

Share premium 9 3,424 - -

Accumulated gains 3,679 4,327 2,328

Total shareholder equity 8,562 5,153 3,154

============= ============= =============

STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIOD TO 30 SEPTEMBER 2021

Share Accumulated

Capital Share Premium Gains Total

GBP'000 GBP'000 GBP'000

At 31 March 2020 (audited) 826 - 1,237 2,063

--------- -------------- ------------ --------

Total comprehensive gain

for period - - 1,091 1,091

At 30 September 2020 (unaudited) 826 - 2,328 3,154

--------- -------------- ------------ --------

Total comprehensive gain

for period - - 1,999 1,999

At 31 March 2021 (audited) 826 - 4,327 5,153

--------- -------------- ------------ --------

Issue of shares 633 3,482 - 4,115

Share issue costs - (58) - (58)

Total comprehensive loss

for period - - (648) (648)

At 30 September 2021 (unaudited) 1,459 3,424 3,679 8,562

========= ============== ============ ========

STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIOD TO 30 SEPTEMBER 2021

6 months Year 6 months

ended ended ended

30 Sep 2021 31 Mar 2021 30 Sep 2020

(Unaudited) (Audited) (Unaudited)

GBP'000 GBP'000 GBP'000

(Loss)/profit for the period (648) 3,090 1,091

Unrealised loss/(gain) on revaluation

of investments 567 (2,644) (736)

Realised gain on disposal of investments - (590) (423)

Decrease/(Increase) in trade and

other receivables 19 (13) 6

Decrease in trade and other payables (7) (5) (20)

Net cash outflows from operating

activities (69) (162) (82)

-------------- ------------- --------------

Cash flows from investing activities

Proceeds from sales of investments - 1,207 602

Purchase of investments (2,948) (1,900) (451)

Net cash (outflows)/inflows from

investing activities (2,948) (693) 151

-------------- ------------- --------------

Cash flows from financing activities

Issue of share capital net of costs 4,057 - -

Net cash inflows from financing

activities 4,057 - -

-------------- ------------- --------------

Net increase/(decrease) in cash

and cash equivalents 1,040 (855) 69

Cash and cash equivalents at beginning

of period 49 904 903

Cash and cash equivalents at end

of period 1,089 49 972

============== ============= ==============

NOTES TO THE FINANCIAL STATEMENTS

FOR THE SIX MONTH PERIOD TO 30 SEPTEMBER 2021

1 General information

Adams Plc ("the Company") is a company incorporated in the Isle

of Man and is listed on the AIM market of the London Stock

Exchange.

2 Basis of preparation

The interim financial statements of Adams Plc are unaudited

condensed financial statements for the six months ended 30

September 2021. These include unaudited comparatives for the six

months ended 30 September 2020 together with audited comparatives

for the year ended 31 March 2021.

These interim condensed financial statements have been prepared

on the basis of the accounting policies expected to apply for the

financial year to 31 March 2022 which are based on the recognition

and measurement principles of International Financial Reporting

Standards (IFRS) as adopted by the European Union (EU). The

financial statements have been prepared under the historical cost

convention. The Company's presentation and functional currency is

GBP Pounds Sterling.

The interim financial statements do not include all of the

information required for full annual financial statements and do

not comply with all the disclosures in IAS 34 'Interim Financial

Reporting', and should be read in conjunction with the Company's

annual financial statements to 31 March 2021. Accordingly, whilst

the interim statements have been prepared in accordance with IFRS,

they cannot be construed as being in full compliance with IFRS.

The preparation of financial statements in conformity with IFRS

as adopted by the EU requires the use of certain critical

accounting estimates. It also requires management to exercise its

judgement in the process of applying the Company's accounting

policies.

3 Going concern

Information on the business environment, financial position and

the factors underpinning the Company's future prospects and

portfolio are included in the Chairman's Statement. The Directors

have considered their obligation in relation to the assessment of

the going concern of the Company and have reviewed the current cash

forecasts and assumptions as well as the main risk factors facing

the Company. The Directors acknowledge the ongoing Coronavirus

pandemic ("Covid-19") and the adverse impact it, and the measures

taken to tackle it, continue to have on the global economy. The

Directors will continue to closely monitor the ongoing impact of

Covid-19 on the Company's operations. The Directors consider that

the Company has adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the going

concern basis has been adopted in the preparation of the financial

statements.

4 Significant accounting policies

The accounting policies adopted are consistent with those

followed in the preparation of the annual financial statements of

Adams Plc for the year ended 31 March 2021 which received an

unqualified audit opinion. A copy of these financial statements is

available on the Company website at www.adamsplc.co.uk.

5 Segment reporting

Operating segments for Adams Plc are reported based on the

financial information provided to the Board, which is used to make

strategic decisions. The Directors are of the opinion that under

IFRS 8 'Operating segments' the Company has only one reportable

segment, being Investment Return. The Board assesses the

performance of the operating segment based on financial information

which is measured and presented in a manner consistent with that in

the financial statements.

The principal sources of revenue for the Company in the period

to 30 September 2021 were as follows:

6 months Year ended 6 months

ended 30 31 Mar ended 30

Sep 2021 2021 Sep 2020

GBP'000 GBP'000 GBP'000

Unrealised (loss)/gain on

investments (567) 2,644 736

Realised gains on investments - 590 423

------------------- ------------------- -------------------

Total (loss)/gain on investments (567) 3,234 1,159

=================== =================== ===================

6 Investments

An analysis of movements in the value of the Company's

investments is as follows:

Quoted Unquoted Derivative

Equity Equity Trading Unquoted

Shares Shares Asset Loan Notes Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Fair value at 31 March

2020 1,049 5 - 124 1,178

Additions at cost 445 - - 6 451

Disposals (178) - - - (178)

Unrealised revaluation

gains 736 - - - 736

Fair value at 30 September

2020 2,052 5 - 130 2,187

Additions at cost 883 566 - - 1,449

Disposals (304) (5) - (130) (439)

Unrealised revaluation

losses 1,351 - 557 - 1,908

-------- --------- ----------- ------------ --------

Fair value at 31 March

2021 3,982 566 557 - 5,105

Additions at cost* 2,624 1,196 - - 3,820

Disposals* (872) - - - (872)

Unrealised revaluation

gains (198) 18 (387) - (567)

-------- --------- ----------- ------------ --------

Fair value at 30 September

2021 5,536 1,780 170 - 7,486

======== ========= =========== ============ ========

* The additions at cost comprise cash outflows of GBP2,948,000

on investment additions, including for shares purchased in Telit

Communications Plc ("Telit") in July 2021, together with a non-cash

addition of GBP872,000 in relation to the investment, by way of

rollover of Adams' listed shareholding in Telit, into the unlisted

holding company, Notano Midco Limited, of Trieste Acquisitions

Holdings Limited, under a recommended share offer alternative

completed in August 2021. The corresponding GBP872,000 disposal of

the listed Telit investment also represents a non-cash disposal

transaction.

7 Trade and other receivables

As at As at As at

30 Sep 2021 31 Mar 2021 30 Sep 2020

GBP'000 GBP'000 GBP'000

Prepayments 3 22 3

------------------- ------------------- -------------------

3 22 3

=================== =================== ===================

The carrying amount of prepayments is approximate to their fair

value.

8 Trade and other payables

As at As at As at

30 Sep 2021 31 Mar 2021 30 Sep 2020

GBP'000 GBP'000 GBP'000

Trade payables 8 8 1

Accruals and other creditors 8 15 7

16 23 8

============= =================== ===================

The carrying amount of trade and other payables approximates to

their fair value.

9 Share capital

Share capital Share premium

Ordinary shares Number of shares issued and fully paid up GBP'000 GBP000

------------------------------------------ -------------- --------------

At 30 September 2020 82,553,232 826 -

------------------------------------------ -------------- --------------

Issue of shares - - -

At 31 March 2021 82,553,232 826 -

------------------------------------------ -------------- --------------

Issue of shares 63,305,999 633 3,424

At 30 September 2021 145,859,231 1,459 3,424

------------------------------------------ -------------- --------------

On 1 April 2021, the Company placed 8,650,000 new GBP0.01

ordinary shares at a price of 6.5p per share. In addition, on 15

April 2021 a further 54,655,999 GBP0.01 new ordinary shares were

issued by way of an open offer at a price of 6.5p per share.

The authorised Ordinary share capital of the Company at 30

September 2021, 31 March 2021 and 30 September 2021 was 350,000,000

Ordinary Shares with a nominal value of GBP0.01 per share.

10 Earnings/(loss) per share

The basic earnings or loss per share is calculated by dividing

the profit or loss after tax attributable to equity shareholders by

the weighted average number of Ordinary Shares in issue during the

period:

6 months Year 6 months

ended ended ended

30 Sep 2021 31 Mar 2021 30 Sep 2020

(Loss)/profit after tax attributable

to equity holders of the Company

(GBP'000) (648) 3,090 1,091

Weighted average number of Ordinary

Shares 141,379,226 82,553,232 82,553,232

Basic and diluted (loss)/earnings

per share (0.46) 3.74 1.32

There were no potentially dilutive shares in issue as at 30

September 2021, 31 March 2021 or 30 September 2020.

11 Half year interim report

A copy of this half year interim report, as well as the annual

statutory accounts to 31 March 2021, are available on the Company's

website at www.adamsplc.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DELFLFFLZFBK

(END) Dow Jones Newswires

November 26, 2021 02:00 ET (07:00 GMT)

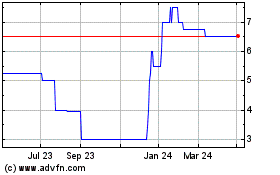

Adams (LSE:ADA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adams (LSE:ADA)

Historical Stock Chart

From Apr 2023 to Apr 2024