TIDMAET

RNS Number : 4785V

Afentra PLC

10 August 2022

This announcement contains inside information for the purposes

of article 7 of Regulation 2014/596/EU (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018) ('UK MAR'). Upon publication of this announcement, this

inside information (as defined in UK MAR) is now considered to be

in the public domain. For the purposes of UK MAR, the person

responsible for arranging for the release of this announcement on

behalf of Afentra is Paul McDade, Chief Executive Officer.

10 August 2022

AFENTRA PLC

Publication of Admission Document and Notice of General

Meeting

Afentra plc ('Afentra' or the 'Company'), an upstream oil and

gas company listed on AIM and focused on acquiring production and

development assets in Africa, is pleased to announce that further

to the announcement made on 28 April 2022 regarding the proposed

acquisition of interests in Block 3/05 and Block 23 (the

'Acquisition') from Sonangol Pesquisa e Produço S.A. ('Sonangol'),

an Admission Document in relation to the Acquisition and Notice of

General Meeting to approve the Acquisition will be posted to

shareholders today and is available to download from the Company's

website.

Following the publication of the Admission Document, the Company

anticipates that the suspension of the trading in the Company's

shares will be lifted and that trading in the Company's Ordinary

Shares will recommence at 8.00am BST this morning.

The General Meeting will be held electronically on

https://web.lumiagm.com/ at 2pm on 30(th) August 2022.

Afentra Strategy Overview

-- Launched in May 2021 with strategic intent to:

o support a responsible oil & gas industry transition in

Africa

o capitalise on opportunities resulting from the energy

transition in Africa

o create long-term value for all stakeholders

-- Announced two strategically consistent and complementary transactions in Angola that:

o deliver a balanced cash flow generative portfolio of assets

with significant opportunities for future reserves and production

growth

o provide an opportunity to establish a long-term relationship

with Sonangol

o enable Afentra to influence a broad and positive ESG

impact

o creates a strong foundation for future transactions in

Angola

-- Continue to pursue its material growth strategy by:

o actively screening multiple opportunities across the

region

o supporting the increasingly pragmatic narrative for a just and

responsible energy transition for the African continent

Angolan Acquisitions

-- Provide a foundation for Afentra's strategy to deliver

material value from mature long-life assets with opportunities for

low-cost incremental investment

-- Competent Persons Report published, gross 2P reserves increased to 115 million barrels

o Net 2P reserves of 27.7 million barrels

o Net 1H 2022 production of c.4,700 bbl/day net to Afentra

o Core 2P reserves valuation of c.$185 million(1) with

significant upside potential

-- Attractive low-cost entry into a positive cash flow asset:

o Implied acquisition cost of c.$3.6/2P bbl(2)

o Average annual FCF net to Afentra of c.$36 million @ $75/bbl

over next 5 years

-- Transactions will be financed through cash on balance sheet

and committed five-year RBL and working capital facility with

Trafigura

o Up to $75 million RBL facility(3) ; 8% margin over 3-month

SOFR

o Up to $30 million revolving working capital facility; 4.75%

margin over 1-month SOFR

Re-admission process and key timings

-- Resumption of trading, and commencement of dealings on AIM of

the Company's existing Ordinary Shares expected to become effective

at 8:00am

-- Admission Document available to download from the Company's

website in accordance with the AIM Rules:

https://afentraplc.com/wp-content/uploads/2022/08/Admission-Document-and-Notice-of-General-Meeting.pdf

-- General meeting to approve the Acquisition will be held on 30(th) August 2022

-- INA deal completion expected Q4 2022 post Government approvals

-- Sonangol deal completion expected Q4 2022 post Block 3/05

licence extension and Government approvals

-- Admission of enlarged group to trading on AIM expected Q4 2022

1) Valuation is based on NPV10%

2) Based on the initial consideration

3) RBL facility is up to $110million of which up to $75million

is available for the Sonangol and INA transactions

Management Presentation - 10am Wednesday 10(th) August

Afentra's management team will host a live audiocast

presentation today at 10am to provide further details on the

Acquisition and the assets. The live audiocast can be accessed via

the Investor Meet Company platform at the following link:

https://www.investormeetcompany.com/afentra-plc/register-investor

and the presentation can be accessed on the company website via the

following link:

https://afentraplc.com/wp-content/uploads/2022/08/Angolan-Acquisitions-Resumption-of-Trading.pdf

Analysts and investors wishing to participate in the Q&A

session can do so by pre-submitting questions via the Investor Meet

Company platform or via the chat function of the live presentation,

and these will be addressed by management during the audiocast.

A playback of the audiocast and the presentation will be also be

made available on the website: www.afentraplc.com

Commenting on the update, CEO Paul McDade said:

"We are very pleased to have Afentra's shares re-admitted to

trading after the lengthy suspension period associated with the RTO

process. We are emerging from suspension with two complementary

transactions that provide a strong growth platform underpinned by

robust cash flow and significant upside value.

Since launching just over a year ago, Afentra has been focused

on establishing a profile as a credible and responsible independent

oil and gas company with a clear vision to support an effective and

just energy transition in Africa. In parallel we have been actively

screening opportunities against the strict criteria we established

at the outset in terms of asset type, geography and valuation

metrics. To support our business development activities, we have

also engaged in preliminary discussions with both debt and equity

capital markets to ensure we have supportive investors for the

deals we bring to market. These transactions are the culmination of

all of those aspects and we look forward to demonstrating the value

accretive nature as we complete them both in the coming months.

The market drivers that support Afentra's purpose and long-term

growth strategy remain compelling, despite the current impact of a

volatile commodity price environment, and we remain highly active

and disciplined in our assessment of the opportunity landscape. We

view these inaugural deals in Angola as the early building blocks

in our long-term growth ambitions and look forward to rewarding our

shareholders for their trust and patience."

All capitalised terms, unless otherwise defined, shall have the

meanings ascribed to them in the announcement titled Afentra signs

Sale and Purchase Agreement with Sonangol for Blocks 3/05 & 23

offshore Angola (RNS Number: 6159J) and released by the Company at

7:00 am on 28 April 2022.

For further information contact:

Afentra plc +44 (0)20 7405 4133

Paul McDade, CEO

Anastasia Deulina, CFO

Buchanan (Financial PR) +44 (0)20 7466 5000

Ben Romney

Jon Krinks

Chris Judd

Peel Hunt LLP (Nominated Advisor and Joint Broker) +44 (0)20

7418 8900

Richard Crichton

Paul Gillam

David McKeown

Tennyson Securities (Joint Broker) +44 (0)20 7186 9033

Peter Krens

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUKRARUNUWRUR

(END) Dow Jones Newswires

August 10, 2022 02:00 ET (06:00 GMT)

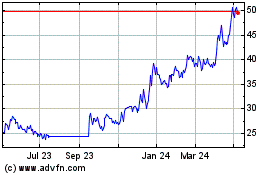

Afentra (LSE:AET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afentra (LSE:AET)

Historical Stock Chart

From Apr 2023 to Apr 2024