TIDMANTO

RNS Number : 8179I

Antofagasta PLC

21 April 2022

NEWS RELEASE, 21 APRIL 2022

Q1 2022 PRODUCTION REPORT

PRODUCTION AND COSTS IN LINE WITH GUIDANCE

Antofagasta plc CEO, Iván Arriagada said: "Antofagasta's copper

production of 138,800 tonnes and net cash costs of $1.75/lb in the

first quarter was in line with plan for the period and is

consistent with annual guidance as copper production is expected to

increase quarter-on-quarter during the year. Production reflected

the impact of the ongoing drought at Los Pelambres and the expected

lower grades at Centinela Concentrates.

"The copper, gold and molybdenum markets have been strong

throughout the quarter, and we expect this to continue as

structural supply and demand dynamics support a tight physical

market. In the meantime, we maintain our focus on the safety and

health of our employees and contractors, and on cost control and

disciplined capital allocation.

"With completion of the Los Pelambres desalination plant

expected in H2 2022 and no precipitation until the rainy season,

full year guidance is retained at 660-690,000 tonnes of copper at a

net cash cost of $1.55/lb. Following the completion of the review

of the Los Pelambres Expansion project, total capital expenditure

for the full year is expected to be $1.9 billion, at the top end of

the previously guided range of $1.7-1.9 billion."

HIGHLIGHTS

PRODUCTION

-- Copper production in Q1 2022 at 138,800 tonnes was in line

with guidance and is expected to increase quarter-on-quarter during

the year. Production was 24.2% lower than in the same quarter in

2021 and 22.4% lower than in Q4 2021 mainly due to the expected

temporary reduction in throughput at Los Pelambres because of the

drought and lower grades at Centinela Concentrates. Throughput at

Los Pelambres was 39.9% lower than in Q1 2021 and 27.7% lower than

in Q4 2021, and the grades at Centinela Concentrates were 26.7% and

25.4% lower respectively

-- Gold production was 38,400 ounces in Q1 2022, 35.0% lower

than in the same period in 2021 and 40.8% lower than in 4Q 2021,

mainly due to expected lower grades at Centinela

-- Molybdenum production in the quarter was 2,000 tonnes, a

decrease of 1,000 tonnes compared to the same period in 2021 due to

lower grades and throughput at Los Pelambres, and 100 tonnes lower

than in Q4 2021

CASH COSTS

-- Cash costs before by-product credits in Q1 2022 were

$2.34/lb, in line with expectations and 66c/lb higher than in the

same period last year mainly due to the temporary decrease in

production. Higher input prices, particularly for diesel and

sulphuric acid, and general inflation were largely offset by the

weaker Chilean peso. Compared to the previous quarter, costs

increased by 21.9% on lower copper production due to lower grades

and throughput

-- Net cash costs were $1.75/lb in Q1 2022, compared to $1.16/lb

in Q1 2021 and $1.35/lb in the previous quarter, reflecting the

increase in cash costs before by-product credits, slightly offset

by higher by-product credits

GUIDANCE 2022

-- Guidance for the year is unchanged. Group copper production

for the full year is expected to be 660-690,000 tonnes, reflecting

lower expected grades at Centinela Concentrates and the temporarily

reduced throughput at Los Pelambres. Guidance assumes there is no

precipitation until the rainy season and the desalination plant at

Los Pelambres starts operating in H2 2022. As previously announced,

copper production during the year is expected to be lowest in Q1

and to increase quarter-on-quarter thereafter

-- The drought has continued at Los Pelambres with no

precipitation during the quarter. Strict water management protocols

are in place to optimise water usage and mitigate the impact of low

water availability

-- Cash cost guidance before and after by-product credits is

also unchanged at $2.00/lb and $1.55/lb respectively

-- The review of the Los Pelambres Expansion project has been

completed and Group capital expenditure for the year is expected to

be $1.9 billion. This is at the top end of the original guidance

range of $1.7-1.9 billion

GROWTH PROJECTS UPDATE

-- The Company is making progress on unlocking the embedded

growth options in its portfolio with identified key brownfield

developments and incremental growth within its asset portfolio

-- The Los Pelambres Expansion project was 73% complete as at the end of the quarter

-- A detailed review of the project schedule and costs has

recently been completed. The revised capital cost estimate

resulting from the review is $2.2 billion (up from $1.7 billion).

Of this increase, approximately $220 million is related to the

impact of COVID-19 on costs and the construction schedule, $170

million to general inflation, including increased input prices,

wages, labour incentives and logistics costs, with the balance

reflecting other adjustments to implementation plans and an updated

contingency provision

-- The completion schedule remains unchanged with the

desalination plant expected to be completed in H2 2022 and the

expanded concentrator plant in early 2023

-- The Zaldívar Chloride Leach project was completed in January

2022, on schedule and on budget and is now being commissioned

OTHER

-- As announced on 20 March, the Company, Barrick Gold and the

Governments of Pakistan and Balochistan have reached an agreement

in principle on a framework that provides for the reconstitution of

the Reko Diq project, and a pathway for the Company to exit the

Project. If definitive agreements are executed and the conditions

to closing are satisfied, the project will be reconstituted under

Tethyan Copper Company Pty Limited ("TCC"), a joint venture held

equally by the Company and Barrick, and a consortium comprising

various Pakistani state-owned enterprises will acquire shares in

TCC's subsidiary, which will hold the project, for a consideration

of approximately $900 million and the proceeds will be distributed

to the Company in return for its exit from the TCC holding

structure. If the conditions to closing are satisfied during 2022,

the Company would expect to receive those proceeds during 2023

-- Sales volumes during the quarter were affected by poor

weather conditions at the loading ports at the period end, which

delayed shipments into early April

-- The Company has been informed that the Consejo de Defensa del

Estado (CDE), an independent governmental agency responsible for

the defence of the interests of the State of Chile, has filed a

claim against Minera Escondida, the lithium producer Albermarle and

Zaldívar, alleging that their extraction of water from the

Monturaqui-Negrillar-Tilopozo aquifer over the years has impacted

the underground water level. The Company is currently reviewing the

claim

-- The Constitutional Convention is currently debating the

proposed clauses for the new constitution and the final

constitution must be completed by 4 July. The new constitution will

then be voted on in a national referendum on 4 September

-- The draft mining royalty bill is being reviewed by the

Finance Committee of the Senate. However, the new Government is

developing a proposal for broader tax reform and this may impact or

supersede the progress of the royalty bill

GROUP PRODUCTION AND CASH COSTS Year to Date Q1 Q4

----------------------- ------ ------

2022 2021 % 2022 2021 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

Copper production kt 138.8 183.0 (24.2) 138.8 178.9 (22.4)

Copper sales kt 115.9 182.8 (36.6) 115.9 197.2 (41.2)

Gold production koz 38.4 59.1 (35.0) 38.4 64.9 (40.8)

Molybdenum production kt 2.0 3.0 (33.3) 2.0 2.1 (4.8)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before by-product

credits (1) $/lb 2.34 1.68 39.3 2.34 1.92 21.9

Net cash costs (1) $/lb 1.75 1.16 50.9 1.75 1.35 29.6

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Cash cost is a non-GAAP measure used by the mining industry

to express the cost of production in US dollars per pound of copper

produced.

There will be a Q&A video conference call today at 2:00 pm

(BST) hosted by Iván Arriagada - Chief Executive Officer, Mauricio

Ortiz - Chief Financial Officer and René Aguilar - Vice President

of Corporate Affairs and Sustainability. Participants can register

for the conference call here .

Investors - Media - London

London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Rosario Orchard rorchard@antofagasta.co.uk

Telephone +44 20 7808 0988 Media - Santiago

Pablo Orozco porozco@aminerals.cl

Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

Register on our website to receive our email alerts

http://www.antofagasta.co.uk/investors/email-alerts/

Twitter LinkedIn

MINING OPERATIONS

Los Pelambres

As expected, Los Pelambres produced 54,100 tonnes of copper in

Q1 2022, 36.3% lower than in the same quarter last year and 27.2%

lower than the previous quarter, mainly driven by the reduced

throughput, which was down 39.9% compared with prior year and 27.7%

with the previous quarter due to water restrictions arising from

the drought. Major maintenance was completed during the quarter and

mine movement and development has remained in line with capacity

which will allow added feed flexibility as throughput recovers with

increased water availability following the start-up of the

desalination plant.

Molybdenum production in Q1 2022 decreased to 1,400 tonnes from

2,600 in Q1 2021, due to lower throughput and molybdenum

grades.

Gold production for the quarter was 8,600 ounces, 5,700 ounces

lower than in the same period last year.

Cash costs before by-product credits in Q1 2022 at $1.98/lb were

35.6% higher than in the same quarter in 2021 due to the decrease

in production and higher input prices, mainly energy and diesel.

Compared to the previous quarter, costs increased by 13.8%, also

due to the decrease in production and higher input prices.

Net cash costs in Q1 2022 increased by 43c/lb to $1.27/lb

compared to Q1 2021 reflecting higher cash costs before by-product

credits partially offset by by-product credits increasing from

62c/lb to 71c/lb on higher molybdenum realised prices partially

offset by lower production. Compared to the previous quarter net

cash costs increased by 13.4%.

The Los Pelambres Expansion project was 73% complete

(engineering, procurement and construction) as at the end of the

quarter.

LOS PELAMBRES Year to Date Q1 Q4

----------------------- ------ ------

2022 2021 % 2022 2021 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

Daily ore throughput kt 98.8 164.5 (39.9) 98.8 136.6 (27.7)

Copper grade % 0.68 0.67 1.5 0.68 0.67 1.5

Copper recovery % 92.3 89.1 3.6 92.3 91.8 0.5

Copper production kt 54.1 84.9 (36.3) 54.1 74.3 (27.2)

Copper sales kt 41.9 80.7 (48.1) 41.9 89.9 (53.4)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.016 0.021 (23.8) 0.016 0.018 (11.1)

Molybdenum recovery % 86.5 85.3 1.4 86.5 85.1 1.6

Molybdenum production kt 1.4 2.6 (46.2) 1.4 1.8 (22.2)

Molybdenum sales kt 1.2 2.6 (53.8) 1.2 2.2 (45.5)

Gold grade g/t 0.044 0.048 (8.3) 0.044 0.043 2.3

Gold recovery % 73.5 68.1 7.9 73.5 74.5 (1.3)

Gold production koz 8.6 14.3 (39.9) 8.6 11.8 (27.1)

Gold sales koz 6.4 12.9 (50.4) 6.4 14.2 (54.9)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before by-product

credits (1) $/lb 1.98 1.46 35.6 1.98 1.74 13.8

Net cash costs (1) $/lb 1.27 0.84 51.2 1.27 1.12 13.4

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes tolling charges of $0.16/lb in Q1 2022, $0.15/lb in

Q4 2021, and $0.14/lb Q1 2021

Centinela

Total copper production in Q1 2022 at Centinela was 55,800

tonnes, 16.5% lower than in the same quarter in 2021. Compared to

the previous quarter, copper production decreased by 21.8% on

expected lower grades at Centinela Concentrates and lower

throughput at both Centinela Concentrates and Centinela

Cathodes.

Major maintenance was completed at Centinela Concentrates during

the quarter.

Copper in concentrates production was 32,900 tonnes in Q1 2022,

27.4% lower than in Q1 2021 and 30.6% lower than in the previous

quarter. This decrease was mainly due to expected lower copper

grades of 0.44% compared to 0.60% in Q1 2021, and slightly lower

throughput.

Production of copper in cathodes rose 6.5% compared to Q1 2021.

This was primarily due to expected higher grades and recoveries,

partially offset by lower throughput.

Gold production was 29,800 ounces in Q1 2022, 33.6% lower than

in the same period last year and 43.9% lower than in Q4 2021 as

grades, which are correlated to copper grades, and recoveries

decreased.

Cash costs before by-product credits in Q1 2022 were $2.70/lb,

51.7% higher than in Q1 2021 primarily due to lower production and

higher input costs, particularly for diesel and sulphuric acid.

Compared to the previous quarter costs increased by 35.0% also due

to lower production.

Net cash costs in Q1 2022 were $1.93/lb, 81c/lb higher than in

the same quarter last year reflecting the increase in cash costs

before by-product credits, partly offset by higher by-product

credits of 11c/lb related to increased moly production and higher

realised prices. Compared to the previous quarter net cash costs

increased by 56.9% with by-product credits unchanged.

CENTINELA Year to Date Q1 Q4

----------------------- ------ ------

2022 2021 % 2022 2021 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

CONCENTRATES

Daily ore throughput kt 104.0 106.4 (2.3) 104.0 110.8 (6.1)

Copper grade % 0.44 0.60 (26.7) 0.44 0.59 (25.4)

Copper recovery % 81.4 84.2 (3.3) 81.4 84.9 (4.1)

Copper production kt 32.9 45.3 (27.4) 32.9 47.4 (30.6)

Copper sales kt 22.5 45.1 (50.1) 22.5 50.6 (55.5)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.013 0.010 30.0 0.013 0.010 30.0

Molybdenum recovery % 59.7 39.5 51.1 59.7 46.2 29.2

Molybdenum production kt 0.6 0.4 50.0 0.6 0.4 50.0

Molybdenum sales kt 0.4 0.4 0.0 0.4 0.2 100.0

Gold grade g/t 0.15 0.22 (31.8) 0.15 0.25 (40.0)

Gold recovery % 66.7 71.9 (7.2) 66.7 70.4 (5.3)

Gold production koz 29.8 44.9 (33.6) 29.8 53.1 (43.9)

Gold sales koz 22.2 42.6 (47.9) 22.2 54.2 (59.0)

------ ------ ------- ------ ------ -------

CATHODES

Daily ore throughput kt 55.4 56.9 (2.6) 55.4 57.8 (4.2)

Copper grade % 0.65 0.59 10.2 0.65 0.64 1.6

Copper recovery % 67.8 66.4 2.1 67.8 67.4 0.6

Copper production - heap

leach kt 22.1 20.4 8.3 22.1 23.3 (5.2)

Copper production - total

(1) kt 22.9 21.5 6.5 22.9 24.0 (4.6)

Copper sales kt 22.6 21.8 3.7 22.6 24.8 (8.9)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Total copper production kt 55.8 66.8 (16.5) 55.8 71.4 (21.8)

Cash costs before by-product

credits (2) $/lb 2.70 1.78 51.7 2.70 2.00 35.0

Net cash costs (2) $/lb 1.93 1.12 72.3 1.93 1.23 56.9

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes production from ROM material

(2) Includes tolling charges of $0.14/lb in Q1 2022, $0.13/lb in

Q4 2021, and $0.12/lb Q1 2021

Antucoya

Antucoya produced 17,400 tonnes of copper in Q1 2022, 13.9%

lower than in the same quarter last year on expected lower grades,

partially offset by higher throughput. Production decreased by

16.7% compared to Q4 2021 on lower grades and throughput, due to

lower plant run time related to maintenance.

During the quarter, the cash costs were $2.40/lb, a 22.4%

increase compared to the $1.96/lb in Q1 2021. This was mainly due

to lower production and increased input costs, particularly for

sulphuric acid, diesel and explosives. This was partially offset by

lower energy prices as the operation has been solely using

renewable power since the beginning of the year.

ANTUCOYA Year to Date Q1 Q4

--------------------- ----- -----

2022 2021 % 2022 2021 %

---------------------- ------ ----- ----- ------- ----- ----- -------

Daily ore throughput kt 82.2 80.6 2.0 82.2 91.1 (9.8)

Copper grade % 0.31 0.35 (11.4) 0.31 0.35 (11.4)

Copper recovery % 69.4 69.1 0.4 69.4 71.3 (2.7)

Copper production kt 17.4 20.2 (13.9) 17.4 20.9 (16.7)

Copper sales kt 17.4 22.9 (24.0) 17.4 19.9 (12.6)

---------------------- ------ ----- ----- ------- ----- ----- -------

Cash costs $/lb 2.40 1.96 22.4 2.40 2.02 18.8

---------------------- ------ ----- ----- ------- ----- ----- -------

Zaldívar

Copper production at Zaldívar was 11,500 tonnes in Q1 2022, a

3.6% increase compared with the same period last year on higher

recoveries. Production decreased by 7.3% compared to Q4 2021 due to

lower throughput partially offset by higher grades and

recoveries.

Cash costs at $2.10/lb in Q1 2022 fell by 8.7% compared to Q1

2021 primarily due to maintenance activities scheduled for Q1

postponed for Q2. Compared to the previous quarter costs decreased

by 21c/lb.

ZALDÍVAR Year to Date Q1 Q4

-------------------- ----- -----

2022 2021 % 2022 2021 %

--------------------------- ------ ----- ----- ------ ----- ----- -------

Daily ore throughput kt 39.5 42.2 (6.4) 39.5 48.6 (18.7)

Copper grade % 0.84 0.88 (4.5) 0.84 0.77 9.1

Copper recovery (1) % 56.5 48.8 15.8 56.4 53.5 5.4

Copper production - heap

leach (2) kt 8.2 9.0 (8.9) 8.2 9.1 (9.9)

Copper production - total

(2,3) kt 11.5 11.1 3.6 11.5 12.4 (7.3)

Copper sales (2) kt 11.6 12.4 (6.5) 11.6 12.0 (3.3)

Cash costs $/lb 2.10 2.30 (8.7) 2.10 2.31 (9.1)

----- ----- ----- -----

(1) Restated from average over full leach cycle to 12-month

rolling recoveries

(2) Group's 50% share

(3) Includes production from secondary leaching

Transport Division

Total transport volumes in Q1 2022 were 1.7 million tonnes,

12.7% higher than in the same quarter last year mainly as new rail

transport contracts were in place for the full quarter. Total

transport volumes decreased by 2.3% compared to Q4 2021 mainly due

to customers' lower production and poor weather conditions.

TRANSPORT Year to Date Q1 Q4

--------------------- ------ ------

2022 2021 % 2022 2021 %

--------------------------- ---- ------ ------ ----- ------ ------ ------

Rail kt 1,310 1,216 7.7 1,310 1,338 (2.1)

Road kt 410 309 32.7 410 422 (2.8)

Total tonnage transported kt 1,720 1,526 12.7 1,720 1,760 (2.3)

------ ------ ------ ------

Commodity prices and exchange rates

Year to Date Q1 Q4

--------------------- ------ ------

2022 2021 % 2022 2021 %

------ ------ ----- ------ ------

Copper

Market price $/lb 4.53 3.85 17.7 4.53 4.40 3.0

Realised price $/lb 5.05 4.26 18.5 5.05 4.65 8.6

---------------- ------ ------ ------ ----- ------ ------ ------

Gold

Market price $/oz 1,877 1,800 4.3 1,877 1,795 4.6

Realised price $/oz 2,021 1,708 18.3 2,021 1,812 11.5

---------------- ------ ------ ------ ----- ------ ------ ------

Molybdenum

Market price $/lb 19.1 11.3 69.0 19.1 18.9 1.1

Realised price $/lb 19.9 13.3 49.6 19.9 18.1 9.9

---------------- ------ ------ ------ ----- ------ ------ ------

Exchange rates

per

Chilean peso $ 808 724 11.6 808 826 (2.2)

---------------- ------ ------ ------ ----- ------ ------ ------

Spot commodity prices for copper, gold and molybdenum as at 31

March 2022 were $4.69/lb, $1,933/oz and $19.3/lb respectively,

compared with $4.40/lb, $1,820/oz and $18.7/lb as at 31 December

2021 and $4.01/lb, $1,688/oz and $11.1/lb as at 31 March 2021.

The provisional pricing adjustments for copper, gold and

molybdenum for the quarter were positive $105.9 million, positive

$5.8 million and positive $0.9 million respectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLURUWRUNUSUAR

(END) Dow Jones Newswires

April 21, 2022 02:00 ET (06:00 GMT)

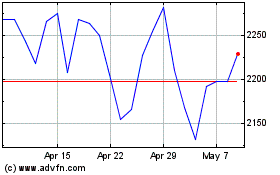

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2024 to May 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From May 2023 to May 2024