TIDMARB

RNS Number : 9297H

Argo Blockchain PLC

09 August 2021

Press release

09 August 2021

Argo Blockchain PLC

("Argo" or "the Company")

Interim Half Year Results 2021

Update on Mining Infrastructure

Argo Blockchain, a global leader in cryptocurrency mining (LSE:

ARB), is pleased to announce its results for the six months to 30

June 2021.

Financial highlights

-- Revenues increase by 180% to GBP31.1m reflecting increase in

production coupled with an increase in Bitcoin prices (H1 2020:

GBP11.1m)

-- EBITDA* increased by 332% to GBP16.0m (H1 2020: GBP3.7m)

despite a GBP6.2m downward revaluation of digital assets and a

GBP1.6m share based payment charge

-- M ining margin of 81% (H1 2020: 39%)

-- Pre-tax profit of GBP10.7m (H1 2020: GBP0.5m)

-- To tal number of Bitcoin and Bitcoin Equivalent mined during

H1 2020 was 883 BTC (2020: 1,669). The change from the previous

period was mainly due to the halving of May 2020

-- To tal number of Bitcoin and Bitcoin Equivalent held as at 30

June 2021 were 1,268 BTC, an increase from 127 Bitcoin and Bitcoin

Equivalent as at 30 June 2020

*Earnings before interest, tax, depreciation and

amortisation

Operating highlights

-- Mining capacity increased from 685 petahash as at 31 December

2020 to 1,075 petahash as at 30 June 2021

Post period end

-- Broken ground at the Texas facility

-- In late June and July, significant changes in mining

difficulty led to a substantial decrease in the global hashrate,

resulting in an increase in the number of Bitcoin Argo mines with

the same hashpower

-- New board appointments

Commenting on the results, Peter Wall, chief executive and

interim chairman, said: " We have capitalised on a change in market

conditions in the first half of 2021 to deliver strong growth in

both revenues and profits, demonstrating that our smart growth

strategy is delivering value to shareholders."

Update on Mining Infrastructure

The Company announces an update to its 22 February 2021

announcement relating to the expansion of the Company's mining

capacity in Q4 2021 and 2022. As previously announced, Argo

committed to an initial purchase of US$8 million of mining rigs

from ePIC Blockchain Technologies ("ePIC"), with delivery expected

to begin in Q4 2021. However, based on limitations of technology,

Argo and ePIC have agreed to amend the agreement. Under the amended

agreement, the initial purchase order was cancelled and, at Argo's

option, $5 million deposited with ePIC, in whole or in part, can be

applied to the purchase of ePIC mining machines or ePIC common

stock or repaid in full.

This announcement contains inside information.

For further information please contact:

Argo Blockchain

Peter Wall via Tancredi +44 203 434 2334

Chief Executive

------------------------------

finnCap Ltd

------------------------------

Corporate Finance

Jonny Franklin-Adams

Tim Harper

Joint Corporate Broker

Sunila de Silva +44 207 220 0500

------------------------------

Tennyson Securities

------------------------------

Joint Corporate Broker

Peter Krens +44 207 186 9030

------------------------------

OTC Markets

------------------------------

Jonathan Dickson +44 204 526 4581

jonathan@otcmarkets.com +44 7731 815 896

------------------------------

Tancredi Intelligent Communication

UK & Europe Media Relations

------------------------------

Emma Valgimigli

Emma Hodges +44 7727 180 873

Salamander Davoudi +44 7861 995 628

argoblock@tancredigroup.com +44 7957 549 906

------------------------------

About Argo:

Argo Blockchain plc is a global leader in cryptocurrency mining

with one of the largest and most efficient operations powered by

clean energy. The Company is headquartered in London, UK and its

shares are listed on the Main Market of the London Stock Exchange

under the ticker: ARB and on the OTCQX Best Market in the United

States under the ticker: ARBKF.

Interim Management Report

Argo entered 2021 with a clear business strategy of "smart

growth" and its mining operations continue to gain momentum as new

production capacity was brought onstream. The Group's mining margin

has remained strong during the first half of 2021, averaging 81 per

cent over the period.

In the first quarter, the Group conducted two fundraisings which

together generated GBP49.2m in new equity. These fundraisings

enabled the Group to invest in new machines and fund working

capital requirements as well as a strategic investment in Pluto

Digital PLC ("Pluto") and an acquisition of DPN LLC to acquire the

Helios project and land in West Texas, as described below. The

Group has been able to grow its crypto holding to 1,268 Bitcoin and

equivalents at the end of June 2021 as a result of the cash

generated from these placements and the monies collected from

options and warrants exercises, which helped to fund working

capital.

In March, the Group acquired the Helios project - 160 acres of

land in West Texas primed for the development of a cryptocurrency

data centre - through the acquisition of DPN LLC. The land has

access to up to 800 megawatts (MW) of power, primarily from

renewable sources. Post period end, the Group has broken ground at

this facility and expects the first stage of this development, a

200MW Facility, to be completed in the first half of 2022.

The Group is mindful of its carbon footprint and has previously

committed to announce its climate action plan to achieve the

Group's goal of becoming a net zero greenhouse gas (GHG) company.

Alongside this plan, in March the Group announced "Terra Pool", a

Bitcoin mining pool powered by clean energy, with the aim of

expediting the shift from conventional power to clean energy and

reducing the impact of Bitcoin mining on the environment. The

mining pool will provide a platform for cryptocurrency miners to

produce Bitcoin and other cryptocurrencies in a sustainable

way.

In two separate investment rounds completed in early 2021 Argo

invested a total of GBP8.4m in Pluto. Pluto is a crypto technology

company that is exploring solutions to connect Web 3.0 technologies

to the global economy. Pluto is investing in, incubating and

advising digital asset projects based on decentralised technologies

(DeTech), decentralised finance (DeFi) and networks such as

Ethereum and Polkadot. Pluto also plans to support the operation of

proof-of-stake networks by staking and operating validator

nodes.

Having successfully completed a major expansion, the Group's

strategic focus is to optimise operations by further increasing

efficiency and reducing operating costs and executing the build out

of Argo's Texas facility in line with the timeline the Group set

out in the first quarter of 2021.

Outlook

I am delighted to report that the shift to profitability we

reported in 2020 has continued into 2021 with the Group recording a

record profit.

The Group increased EBITDA from GBP3.7m in H1 2020 to GBP16.0m

in H1 2021. Profit before tax amounted to GBP10.7m against GBP0.5m

in the comparable period while earnings attributable to

shareholders amounted to GBP7.21m, up from GBP523,000 in 2020.

The results also reflect Argo's strategy to pursue "smart

growth", which entailed considered investment in its mining

infrastructure when hardware prices were competitive, while

enhancing mining efficiency through optimisation of machine

performance and energy costs. These factors enabled the Group to

manage its cash resources through a highly volatile pricing

environment for Bitcoin, which impacted mining margins and

difficulty rates across the sector for much of the period. As we

move to an owned and operated model, we expect hosting costs to

reduce and provide the potential to enhance margins further.

We believe the gains that began late last year mark an important

milestone in the cryptocurrency and blockchain industry due to a

series of positive developments that point to increasing acceptance

of cryptocurrencies, in particular Bitcoin, as a new asset class, a

means of exchange and store of value by corporate and institutional

investors as well as consumers.

During the period, the cryptocurrency mining sector has also

experienced a significant shock due to a change in the regulation

of mining in China, leading to an unprecedented drop in global

hashrate and mining difficulty. We believe Argo is well positioned

to capitalise on the emerging trends in the market through its

large and highly efficient mining infrastructure and experience.

The Group will also continue to manage growth through the expansion

of the size and quality of its mining infrastructure, as well as

strategic opportunities that leverage its leading market

position.

In March 2021, we acquired 160 acres of land in west Texas,

where we are building a new hosting facility with up to 200MW of

clean energy at low prices, which will give us the capacity to

establish our flagship mining centre in the United States by the

first quarter of 2022 and access to up to a further 600MW of power

for future development.

Our strategic priority in 2021 remains to focus on continued

"smart growth", to further expand our mining capacity and our

facilities whilst investigating new and innovative opportunities in

emerging cryptocurrencies and addressing our environmental

responsibilities. We will focus on increasing returns from our

installed base by optimising hardware performance to reduce power

consumption from clean power, improve machine uptime and maintain

among the best mining margins in the sector.

On behalf of the Board, I would like to thank all shareholders

for their support and take this opportunity to welcome those from

North America who have become Argo investors following our hugely

successful commencement of trading on the OTC market in early

2021.

Post the period end, we announced the board appointments of

Colleen Sullivan, Maria Parella and Sarah Gow as independent

non-executive directors, and of Alex Appleton as an executive

director. We also announced the resignation of executive chairman,

Ian Macleod, and non-executive directors, James Savage and Marco

D'Attanasio. I would like to thank them for their contribution

during the period and look forward to welcoming Argo's new board

members for the period ahead. Their experience within the

cryptocurrency, technology and finance sectors will be invaluable

as Argo continues to progress as a global leader in cryptocurrency

mining.

Peter Wall

CEO & Interim Executive Chairman

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with

International Accounting Standards 34, Interim Financial Reporting,

as adopted by the EU; and

-- gives a true and fair view of the assets, liabilities,

financial position and profit/loss of the Group; and

-- the Interim Report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year.

-- the Interim Report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Peter Wall

CEO & Interim Executive Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Period ended Period ended

30 June 30 June

2021 2020

(unaudited) (unaudited)

Note GBP GBP

------------------------------------------ ----- ------------- -------------

Revenues 5 31,085,716 11,124,455

Direct costs 11 (10,364,842) (9,697,116)

Crypto asset fair value movement 14 (6,188,438) (244,827)

Gross profit 14,532,436 1,182,512

------------------------------------------ ----- ------------- -------------

Operating costs and expenses

Consulting fees (304,379) (177,328)

Professional fees (415,066) (171,514)

General and administrative (1,136,755) (183,708)

Share based payment (1,567,608) -

Operating profit 11,108,628 649,962

------------------------------------------ ----- ------------- -------------

Interest expense (410,804) (126,914)

Interest income - 26

Profit before taxation 10,697,824 523,074

------------------------------------------ ----- ------------- -------------

Income tax expense 7 (3,483,827) -

Profit after taxation 7,213,997 523,074

------------------------------------------ ----- ------------- -------------

Other comprehensive income

Items which may be subsequently

reclassified to profit or loss:

* Currency translation reserve (361,029) (431,746)

Total other comprehensive income,

net of tax (361,029) (431,746)

------------------------------------------ ----- ------------- -------------

Total comprehensive income attributable

to the equity holders of the

Company 6,852,968 91,328

------------------------------------------ ----- ------------- -------------

Earnings per share attributable

to equity owners (pence)

Basic earnings per share 6 1.9p 0.2p

Diluted earnings per share 6 1.8p 0.2p

The income statement has been prepared on the basis that all

operations are continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at

30 June 31 December

2021 2020

(unaudited) (audited)

Note GBP GBP

-------------------------------------- ----------- ------------- ------------

ASSETS

Non-current assets

Investments at fair value through

profit or loss 0 219,360 1,393,303

Investments accounted for using the

equity method 9 8,444,820 -

Intangible fixed assets 291,270 367,768

Property, plant and equipment 11 35,795,266 10,524,232

Right of use assets 11 6,355,192 7,379,387

Other receivables 12 - 4,114,726

Total non-current assets 51,105,908 23,779,416

-------------------------------------- ----------- ------------- ------------

Current assets

Investments at fair value through

profit or loss 0 1,411,376 -

Trade and other receivables 13 39,246,333 2,175,319

Digital assets 14 31,896,437 4,637,438

Cash and cash equivalents 16,047,609 2,050,761

Total current assets 88,601,755 8,863,518

-------------------------------------- ----------- ------------- ------------

Total assets 139,707,663 32,642,934

-------------------------------------- ----------- ------------- ------------

LIABILITIES STOCKHOLDERS EQUITY

Equity

Error!

Reference

source

not

Share capital found. 381,832 303,436

Error!

Reference

source

not

Share premium found. 55,317,447 1,540,497

Share based payment reserve 16 992,324 75,233

Foreign currency translation reserve 16 81,823 442,852

Accumulated surplus 16 29,178,867 21,964,870

-------------------------------------- ----------- ------------- ------------

Total equity 85,952,293 24,326,888

-------------------------------------- ----------- ------------- ------------

Current liabilities

Trade and other payables 17 25,210,780 936,659

Loans and borrowings 18 15,383,111 -

Income tax 3,483,827 -

Lease liability 3,990,370 3,469,672

-------------------------------------- ----------- ------------- ------------

Total current liabilities 48,068,088 4,406,331

-------------------------------------- ----------- ------------- ------------

Non-current liabilities

Lease liability 1,654,918 3,909,715

Loans and borrowings 18 4,032,364 -

Total liabilities 53,755,370 8,316,046

-------------------------------------- ----------- ------------- ------------

Total equity and liabilities 139,707,663 32,642,934

-------------------------------------- ----------- ------------- ------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share premium Foreign currency Accumulated Total

capital translation surplus/

reserve (deficit)

GBP GBP GBP GBP GBP

--------------------- --------- -------------- ----------------- ------------ -----------

Balance at

1 January

2020 293,750 25,252,288 178,240 (4,986,336) 20,737,942

Total comprehensive

profit for

the period:

Profit for

the period - - - 523,074 523,074

Other comprehensive

income - - (431,746) - (431,746)

--------------------- --------- -------------- ----------------- ------------ -----------

Total comprehensive

income for

the period - - (431,746) 523,074 91,328

--------------------- --------- -------------- ----------------- ------------ -----------

Transactions

with equity

owners:

Issue of share - - - - -

capital net

of issue costs

--------------------- --------- -------------- ----------------- ------------ -----------

Balance at

30 June 2020 293,750 25,252,288 (253,506) (4,463,262) 20,829,270

--------------------- --------- -------------- ----------------- ------------ -----------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share premium Foreign currency Share based Accumulated Total

capital translation payment surplus/

reserve reserve (deficit)

GBP GBP GBP GBP GBP GBP

--------------------- --------- -------------- ----------------- ------------ ------------ -----------

Balance at

1 January 2021 303,436 1,540,497 442,852 75,233 21,964,870 24,326,888

Total comprehensive

income for

the period:

Profit for

the period - - - - 7,213,997 7,213,997

Other comprehensive

income - - (361,029) - - (361,029)

--------------------- --------- -------------- ----------------- ------------ ------------ -----------

Total comprehensive

income for

the period - - (361,029) - 7,213,997 6,852,968

--------------------- --------- -------------- ----------------- ------------ ------------ -----------

Transactions

with equity

owners:

Common stock

to be issued* 71 11,296 - - - 11,367

Issue of common

stock net of

issue costs 78,235 53,765,654 - - - 53,843,889

Stock based

compensation

charge - - - 1,567,608 - 1,567,608

Common stock

options/warrants

exercised - - - (567,523) 567,523 -

Common stock

options/warrants

lapsed/expired - - - (82,994) 82,994 -

--------------------- --------- -------------- ----------------- ------------ ------------ -----------

Total transactions

with equity

owners 78,306 53,776,950 - 917,091 650,517 55,422,864

--------------------- --------- -------------- ----------------- ------------ ------------ -----------

Balance at

30 June 2021 381,832 55,317,447 81,823 992,324 29,178,867 85,952,293

--------------------- --------- -------------- ----------------- ------------ ------------ -----------

*Shares to be issued relate to share options exercised and paid

up pre period end, however the shares were formally issued post

period end.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Period ended Period ended

30 June 30 June

2021 2020

(unaudited) (unaudited)

Note GBP GBP

-------------------------------------------- ----- ------------- -------------

Cash flows from operating activities

Operating profit 11,108,628 649,962

Adjustments for:

Depreciation/Amortisation 4,869,638 3,012,462

Foreign exchange movements 25,087 (431,746)

Share based payment expense 1,567,608 -

Working capital changes:

(Increase)/decrease in trade and other

receivables 13 (2,092,532) 534,947

Increase/(decrease) in trade and other

payables 17 15,245,263 (167,503)

(Increase)/decrease in digital assets 14 (34,758,295) 203,045

Fair value change in digital assets 14 6,407,446 (104,781)

-------------------------------------------- ----- ------------- -------------

Net cash flow from operating activities 2,372,843 3,696,386

-------------------------------------------- ----- ------------- -------------

Investing activities

Acquisition of subsidiaries, net of cash (271,732) -

acquired

Investment in associate 9 (7,352,970) -

Other investments 8 (219,361) -

Purchase of tangible fixed assets 11 (6,883,195) (1,617,024)

Mining equipment prepayments 13 (35,471,499) -

Interest received - 27

-------------------------------------------- ----- ------------- -------------

Net cash used in investing activities (50,198,757) (1,619,997)

-------------------------------------------- ----- ------------- -------------

Financing activities

Increase/(decrease) in loans 8 14,375,021 (797,455)

Lease payments (1,734,098) -

Interest paid (410,803) (126,914)

Proceeds from shares issued 49,592,641 -

-------------------------------------------- ----- ------------- -------------

Net cash generated from/used in) financing

activities 61,822,761 (924,369)

-------------------------------------------- ----- ------------- -------------

Net increase in cash and cash equivalents 13,996,847 1,155,020

-------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at beginning

of period 2,050,761 161,342

Cash and cash equivalents at end of period 16,047,608 1,316,362

-------------------------------------------- ----- ------------- -------------

Material non-cash movements:

-- During the period, the Company assumed the mortgages on two

properties from GPUone with a value of GBP5,040,454. Consideration

of the acquisition was made from a forgiveness of prepayments made

totalling GBP4,664,113. Additionally, the Company used common stock

as payment to acquire DPN LLC, part of which was issued during the

period amounting to GBP3,261,990, and a further GBP9,025,857 which

is due to be paid in common stock and included within

liabilities.

-- During the period, the Company paid a total of 75,000

Polkadot, which had a value of GBP1,091,850, in respect of the

acquisition of shares in Pluto Digital PLC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. COMPANY INFORMATION

Argo Blockchain PLC ("the Company") is a public company, limited

by shares, and incorporated in England and Wales. The registered

office is Room 4, 1st Floor 50 Jermyn Street, London, United

Kingdom, SW1Y 6LX.

On 4 March 2021 the Group acquired 100% of the share capital of

DPN LLC Inc.

On 11 May 2021 the Group acquired 100% of the share capital of

9377-2556 Quebec Inc and 9366-5230 Quebec Inc.

The principal activity of the group is that of crypto asset

mining.

2. BASIS OF PREPARATION

The condensed consolidated interim financial statements for the

six months ended 30 June 2021 have been prepared in accordance with

IAS 34 'Interim Financial Reporting' and presented in sterling.

They do not include all of the information required in annual

financial statements in accordance with IFRS, and should be read in

conjunction with the consolidated financial statements for the year

ended 31 December 2020, which have been prepared in accordance with

International Financial Reporting Standards endorsed by the

European Union as issued by the IASB. The report of the auditors on

those financial statements was unqualified.

The financial statements have been prepared under the historical

cost convention, except for the measurement to fair value certain

financial and digital assets and financial instruments.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates. In preparing these

condensed consolidated interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the financial statements for

the year ended 31 December 2020.

The Group has reclassified the 2020 comparative for the fair

value movement in digital assets. This is now included in the

calculation of gross profit, whereas previously in 2020 this was

included in operating profit/(loss). The reclassification into

gross profit in 2021 more accurately reflects the nature and

management of these assets as inventory for commodity

broker-traders.

3. ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these condensed consolidated interim financial statements are

consistent with those of the previous financial year except as set

out below.

Associates

Associates are entities over which the Group has significant

influence but not control, generally accompanying a shareholding of

between 20% and 50% of the voting rights. Investments in associates

are accounted for using the equity method of accounting. Under the

equity method, the investment is initially recognised at cost, and

the carrying amount is increased or decreased to recognise the

investor's share of the profit or loss of the investee after the

date of acquisition. The Group's investment in associates includes

goodwill identified on acquisition.

The Group's share of post-acquisition profit or loss is

recognised in the income statement, and its share of

post-acquisition movements in other comprehensive income is

recognised in other comprehensive income with a corresponding

adjustment to the carrying amount of the investment. Dilution gains

and losses arising in investments in associates are recognised in

the income statement.

Business Combinations

The Group applies the acquisition method to account for business

combinations. The consideration transferred for the acquisition of

a subsidiary is the fair values of the assets transferred, the

liabilities incurred to the former owners of the acquiree and the

equity interests issued by the Group. Identifiable assets acquired

and liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date.

Acquisition-related costs are expensed as incurred.

Borrowings

Borrowings are recognised initially at fair value, net of

transaction costs incurred. Borrowings are subsequently carried at

amortised cost; any difference between the proceeds and the

redemption value is recognised in the income statement over the

period of the borrowings, using the effective interest method.

Borrowings are removed from the statement of financial position

when the obligation specified in the contract is discharged,

cancelled or expired. Borrowings are classified as current

liabilities unless the Group has an unconditional right to defer

settlement of a liability for at least 12 months after the end of

the reporting period.

Revenue recognition - Management fees

The Group recognised management fees on the services provided to

third parties to management mining machines on their behalf,

ensuring the machines are optimised and mining as efficiently as

possible. The performance obligation is identified to be the as the

services are performed, and thus revenue is recorded over time.

Segmental reporting

The directors consider that the Group has only one significant

reporting segment being crypto mining which is fully earned by a

Canadian subsidiary.

Tangible fixed assets

Depreciation on the land and buildings is recognised so as to

write off the cost or valuation of assets less their residual

values over their estimated useful lives of 25 years on a straight

line basis. Depreciation is recorded in the Income Statement within

general administrative expenses once the asset is brought into

use.

Management assesses the useful lives based on historical

experience with similar assets as well as anticipation of future

events which may impact their useful life.

4. ADOPTION OF NEW AND REVISED STANDARDS AND INTERPRETATIONS

The Group has adopted all recognition, measurement and

disclosure requirements of IFRS, including any new and revised

standards and Interpretations of IFRS, in effect for annual periods

commencing on or after 1 January 2021. The adoption of these

standards and amendments did not have any material impact on the

financial result of position of the Group.

Standards which are in issue but not yet effective:

At the date of authorisation of these financial statements, the

following Standards and Interpretation, which have not yet been

applied in these financial statements, were in issue but not yet

effective.

Standard Description Effective date for annual

or Interpretation accounting period beginning

on or after

------------------ -------------------------------------------- ----------------------------

IAS 1 Amendments - Presentation and Classification 1 January 2023

of Liabilities as Current or Non-current

IAS 16 Amendments - Property, Plant and Equipment 1 January 2022

IAS 37 Provisions, Contingent Liabilities 1 January 2022

and Contingent Assets

IAS 8 Amendments - Definition of Accounting 1 January 2023

Estimates

IAS 1 Amendments - Disclosure of Accounting 1 January 2013

Policies

IFRS 3 Amendments - Business Combinations 1 January 2022

- Conceptual Framework

IFRS Annual Improvements to IFRS Standards 1 January 2022

2018-2020

------------------ -------------------------------------------- ----------------------------

The Group has not early adopted any of the above standards and

intends to adopt them when they become effective.

5. REVENUES

Period ended Period ended

30 June 30 June

2021 (unaudited) 2020 (unaudited)

GBP GBP

------------------------------------------ ------------------ ------------------

Crypto currency mining - worldwide 29,937,270 11,124,455

Crypto currency management fees - United 1,148,446 -

States

Total revenue 31,085,716 11,124,455

------------------------------------------- ------------------ ------------------

Due to the nature of Crypto currency mining, it is not possible

to provide a geographical split of the revenue stream.

Crypto currency mining revenues are recognised at a point in

time.

Crypto currency management fees are services recognised over

time.

6. EARNINGS PER SHARE

The basic earnings per share is calculated by dividing the

profit attributable to equity shareholders by the weighted average

number of shares in issue.

Period ended Period ended

30 June 30 June

2021 (unaudited) 2020

(unaudited)

Net profit for the period attributable to

ordinary equity holders from continuing operations

(GBP) 7,213,997 523,074

Weighted average number of ordinary shares

in issue 381,832,335 293,750,000

Basic earnings per share for continuing operations

(pence) 1.9 0.2

----------------------------------------------------- ------------------- -------------

Net profit for the period attributable to

ordinary equity holders for continuing operations

(GBP) 7,213,997 523,074

Diluted number of ordinary shares in issue 393,091,232 350,098,603

----------------------------------------------------- ------------------- -------------

Diluted earnings per share for continuing

operations (pence) 1.8 0.2

----------------------------------------------------- ------------------- -------------

The Group has in issue 11,258,897 warrants and options at 30 June

2021 (2020: 51,462,453).

7. TAXATION

Period ended Period ended

30 June 2021 30 June

(unaudited) 2020

(unaudited)

GBP GBP

-------------------------------------------- -------------- -------------

Income tax expense - foreign tax 3,483,827 -

Deferred tax expense - -

-------------------------------------------- -------------- -------------

Taxation charge in the financial statements 3,483,827 -

-------------------------------------------- -------------- -------------

No deferred tax asset has been recognised in respect of UK tax

losses carried forward on the basis that there is insufficient

certainty over the level of future profits to utilise against this

amount.

8. INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS

Non-current As at 30 June As at 31 December

2021 2020

(unaudited) (audited)

------------------------------------------ -------------- ------------------

At 1 January 2021 and 1 January 2020 1,393,303 58,140

Additions 219,360 1,335,676

Foreign exchange movement 18,073 (513)

Transferred to current investments (1,411,376) -

------------------------------------------ -------------- ------------------

At 30 June 2021 and 31 December 2020 219,360 1,393,303

------------------------------------------ -------------- ------------------

Current

------------------------------------------ -------------- ------------------

At 1 January 2021 and 1 January 2020 - -

Transferred from non-current investments 1,411,376 -

------------------------------------------ -------------- ------------------

At 30 June 2021 and 31 December 2020 1,411,376 -

------------------------------------------ -------------- ------------------

Non-current investments include:

Luxor Technology Corporation

On 7 December 2020 the Group entered into an agreement to

acquire GBP73,427 (USD$100,000) of shares in Luxor Technology

Corporation. On 7 May 2021, following a second round of funding

which the Group did not participate in, this prepayment became an

investment representing less than 1% of the Series A-1 Preferred

Stock and voting rights.

WonderFi Technologies Inc.

On 3 June 2021 the Group invested GBP145,933 (CDN$250,000) of

WonderFi Technologies Inc. (formerly DeFi Ventures Inc.) an

investment representing less than 1% of the Ordinary shares and

voting rights.

Current investments include:

GPUone Holding Inc investment in Class A shares. This investment

represents an interest of approximately 10% of GPUone Holding Inc.

as at 30 June 2021.

9. INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD

As at 30 As at 31

June 2021 December

(unaudited) 2020 (audited)

GBP GBP

--------------------------- ------------- ----------------

Opening balance - -

Acquired during the period 8,444,820 -

Total Associates 8,444,820 -

--------------------------- ------------- ----------------

Set out below are the associates of the Group as at 30 June

2021, which, in the opinion of the Directors, significant influence

is held. The associate as listed below has share capital consisting

solely of ordinary shares, which are held directly by the Group.

The country of incorporation or registration is also their

principal place of business.

Nature of investment in associates 2021 and 2020:

Name of entity Address of the % of ownership Nature of relationship Measurement

registered office interest method

Pluto Digital Hill Dickinson 24.65% Refer below Equity

PLC LLP, 8th Floor

The Broadgate

Tower, 20 Primrose

Street, London,

United Kingdom,

EC2A 2EW

On 3 February 2021 Argo invested in Pluto Digital PLC ("Pluto"),

a crypto venture capital and technology company. The investment was

satisfied with 75,000 Polkadot with a fair value at that date of

GBP1,091,850. Further to this in a second round of funding the

Group invested an additional GBP7,352,970 on 8 March 2021.

Argo owns 24.65% of the total share capital and voting rights of

the business and is entitled to nominate one director to the Pluto

Board of Directors..

Pluto is a crypto technology company that is exploring solutions

to connect Web 3.0 technologies to the global economy. Pluto plans

to invest in, incubate and advise digital asset projects based on

decentralised technologies (DeTech), decentralised finance (DeFi)

and networks such as Ethereum and Polkadot. Pluto also plans to

support the operation of proof-of-stake networks by staking and

operating validator nodes. Pluto represents a strategic partnership

for the Group as it diversifies its activities in the crypto

space.

Pluto Digital PLC is a private company and there is no quoted

market price available for its shares.

There are no contingent liabilities relating to the Group's

interest in the associates.

No summarised financial information for the period ended 30 June

2021 has been made available by Pluto to the Group and therefore no

share of the profit or loss of the associate has been recognised.

The directors do not believe their share of profit or loss for the

period would be material to the Group.

10. BUSINESS COMBINATION

GPUone subsidiaries acquired from GPUone Holding Inc.

On 11 May 2021, the Group acquired 100% of the share capital of

GPUone 9377-2556 and GPUone 9366-5230 from its shareholder GPUone

Holding Inc. for a fair value of GBP4,955,980 consisting of

GBP291,867 being satisfied in cash and the balance satisfied by the

cancellation of certain prepayments and deposits previously paid by

Argo to the vendor. Each of these acquired entities owned and

operated a data centre within which Argo was the lead tenant.

The acquisition was performed to enable the Group to obtain

control of its hosting facility and power costs across its

facilities in Canada. From acquisition on 11 May 2021 to 30 June

2021 the GPUone subsidiaries loss amounted to GBP494,508 which is

fully consolidated . No revenue has been generated from these

entities since acquisition. Both GPUone entities were dormant up

until the date of acquisition, when the relevant assets and

liabilities acquired were transferred by GPUone Holding Inc. to

these entities immediately prior to acquisition. There is no

difference between the amount consolidated within profit and loss

and the amount which would have been consolidated if the

acquisition happened on 1 January 2021.

The consideration was negotiated on an arm's length basis and

primarily on the basis of the valuation of the land and buildings

being acquired. The directors attribute the consideration as fair

value of the land and buildings with no goodwill being recognised

as currently Argo does not anticipate hosting any third parties at

these sites in the medium term.

The fair values of the acquisition date assets and liabilities,

together with any separately identifiable intangible assets, have

been provisionally determined at 30 June 2021 because the

acquisition was completed late in the period. The Group is

currently obtaining the information necessary to finalise its

valuation.

On a GBP1 for GBP1 basis certain deposits and other receivables

totalling GBP666,845 were acquired. The directors consider these

amounts fully recoverable and as such these receivables have not

been impaired.

The following table summarises the consideration paid for the

GPUone subsidiaries and the fair value of assets acquired and

liabilities assumed at the acquisition date:

Consideration at 11 May 2021

GBP

Cash 291,867

Payment for deposits 666,845

Cancellation of prepayment and deposits 4,664,113

----------

Total consideration 5,622,825

----------

Recognised amounts of identifiable assets acquired, and

liabilities assumed

GBP

Cash and cash equivalents 20,135

Property, plant and equipment (Note 11) 10,159,851

Trade and other receivables 483,294

Property mortgages (5,040,455)

------------

Total 5,622,825

------------

If new information obtained within one year from the acquisition

date about the facts and circumstances that existed at the

acquisition date identifies adjustment to the above amounts, or any

additional provisions identified that existed at the acquisition

date, then the acquisition accounting will be revised.

Acquisition of DPN LLC

The acquisition of DPN LLC, effectively comprising the land

acquisition in west Texas, has been treated as an asset acquisition

in these condensed consolidated financial statements.

11. TANGIBLE FIXED ASSETS

Group Right Mining Land & buildings Improvement Total

of use and Computer to Datacentre

Assets Equipment

GBP GBP GBP GBP GBP

----------------------- ----------- -------------- ----------------- --------------- ------------

Cost

At 1 January 2021 7,379,387 17,864,347 - 84,927 25,328,661

Foreign exchange

movement - (132,458) - - (132,457)

Acquisition through

business combination - 163,416 9,996,435 10,159,851

Additions - - 19,012,587 - 19,012,587

At 30 June 2021 7,379,387 17,895,305 29,009,022 84,927 54,368,642

----------------------- ----------- -------------- ----------------- --------------- ------------

Depreciation and

impairment

At 1 January 2021 - 7,377,050 - 47,992 7,425,042

Depreciation charged

during the period 1,024,915 3,723,527 35,155 9,544 4,793,141

At 30 June 2021 1,024,195 11,101,297 35,155 57,536 12,218,183

----------------------- ----------- -------------- ----------------- --------------- ------------

Carrying amount

----------------------- ----------- -------------- ----------------- --------------- ------------

At 1 January 2021 7,379,387 10,487,297 - 36,935 17,903,619

----------------------- ----------- -------------- ----------------- --------------- ------------

At 30 June 2021 6,355,192 6,794,008 28,973,867 27,391 42,150,459

----------------------- ----------- -------------- ----------------- --------------- ------------

No depreciation has been charged on the Texas land and buildings

additions as they are yet to come into use.

12. OTHER RECEIVABLES (NON-CURRENT)

As at 30 As at 31 December

June 2021 2020 (audited)

(unaudited)

GBP GBP

-------------------------------- ------------- ------------------

Deposits

Brought forward 4,114,726 4,151,400

Exchange movement - (36,674)

Cancelled on acquisition of (4,114,726) -

GPUone subsidiaries

-------------------------------- ------------- ------------------

Total carrying amount of other

receivables - 4,114,726

---------------------------------- ------------- ------------------

This deposit was used as part of the acquisition of the GPUone

Holding Inc subsidiaries detailed in note 10.

13. TRADE AND OTHER RECEIVABLES

As at 30 As at 31

June 2021 December

(unaudited) 2020 (audited)

GBP GBP

----------------------------------- ------------- ----------------

Mining equipment prepayments 35,471,499 -

Prepayments and other receivables 1,957,977 811,684

Other taxation and social

security 1,816,857 1,363,635

Total trade and other receivables 39,246,333 23,227,957

------------------------------------- ------------- ----------------

Mining equipment prepayments consist of payments made and due on

mining equipment due to arrive in Q3 and Q4 2021. Payments to ePIC

ASIC Asia Limited comprise GBP3,429,826 and the balance of

GBP32,041,673 was paid to Core Scientific Inc in advance of machine

purchases to be received after the period end.

In February 2021, the Group entered into an agreement with ePIC

(a designer and manufacturer of mining machines), which gives us

priority access to next generation mining machines on a

non-exclusive basis. As part of the agreement, the Group will

assist in the development and testing of future products and will

provide space and capacity at our Mirabel facility for ePIC's

research and innovation engineering teams to assist in the

development of future mining machines. In August 2021, based on

limitations of technology, the Group and ePIC agreed to amend their

agreement. Under the amended agreement, the initial purchase order

was cancelled and, at the Group's option, $5million deposited with

ePIC, in whole or part, can be applied to the purchase of ePIC

mining machines or ePIC common stock or repaid in full.

Other taxation and social security consist of purchase tax

recoverable in the UK and Canada. GST and QST debtors are greater

than 90 days as at 30 June 2021.

The directors consider that the carrying amount of trade and

other receivables is equal to their fair value.

14. DIGITAL ASSETS

Group Period ended Year ended

30 June 2021 31 December

2020

(unaudited) (audited)

GBP

GBP

------------------------------------- ---- ---- -------------- -------------

At 1 January 2021 and 2020 4,637,438 1,040,964

Additions

Crypto assets mined 29,937,270 18,947,908

Crypto asset purchased and received 4,383,010 9,896,641

------------------------------------------------- -------------- -------------

Total additions 34,320,280 28,844,549

Disposals

Crypto assets sold (1,091,850) (27,318,471)

------------------------------------------------- -------------- -------------

Total disposals (1,091,850) (27,318,471)

Fair value movements

Loss on futures - (258,326)

Movements on crypto asset sales 219,008 (13,816)

Movements on crypto assets held

at the period end (6,407,446) 2,342,538

------------------------------------------------- -------------- -------------

Total fair value movements (6,188,439) 2,070,396

At 30 June 2021 & 31 December

2020 31,896,437 4,637,438

------------------------------------------------- -------------- -------------

The Group mined crypto assets during the period, which are

recorded at fair value on the day of acquisition. Movements in fair

value between acquisition (date mined) and disposal (date sold),

and the movement in fair value in crypto assets held at the year

end, are recorded in profit or loss. The Group has used 795 Bitcoin

as collateral for a loan see note 18. Post period end a further 86

Bitcoin were used as collateral for this loan.

At the period end, the Group held crypto assets representing a

fair value of GBP31,896,437. The breakdown of which can be seen

below:

As at 30 June 2021 (unaudited)

Crypto asset name Coins/tokens Fair value

GBP

-------------------------------- ------------- -----------

Bitcoin - Bitcoin 471 11,700,276

Bitcoin - held as collateral 795 19,748,876

Ethereum - ETH 254 394,963

Alternative coins 52,322

At 30 June 2021 31,896,437

--------------------------------- ------------- -----------

As at 31 December 2020 (audited)

Crypto asset name Coins/tokens Fair value

GBP

----------------------------------------- ------------- -----------

Bitcoin - Bitcoin 183 3,937,344

Polkadot - DOT 75,000 515,176

Ethereum - ETH 254 138,257

Binance Coin - BNB 1,243 34,260

USDT,USDC & Tether (stable coin - fixed

to USD) 26,509 19,553

Alternative coins - 496

At 31 December 2020 4,637,438

------------------------------------------ ------------- -----------

15. ORDINARY SHARES

As at 30 As at 31

June 2021 December

(unaudited) 2020 (audited)

GBP GBP

-------------------------------------------- -------------- ----------------

Ordinary share capital

Issued and fully paid

303,435,997 Ordinary Shares of GBP0.001

each 303,436 293,750

Issued in the period

78,325,292 Ordinary Shares of GBP0.001 78,325 -

each

Fully paid not yet issued

71,046 Ordinary Shares of GBP0.001 each 71 9,686

381,832,335 Ordinary Shares of GBP0.001

each 381,832 303,436

--------------------------------------------- -------------- ----------------

Share premium

-------------------------------------------- -------------- ----------------

At beginning of the period 1,540,497 25,252,288

Cancelled during the period - (25,252,288)

Issued in the period 53,765,654 -

Fully paid not yet issued 11,296 1,540,497

--------------------------------------------- -------------- ----------------

At the end of period 55,317,447 1,540,597

--------------------------------------------- -------------- ----------------

On 23 November 2020 the High Court of England and Wales confirmed

the reduction to the Company's equity through cancellation of the

share premium account. This was transferred into retained earnings.

16. RESERVES

The following describes the nature and purpose of each

reserve:

Reserve Description

--------------------- -------------------------------------------------------

Ordinary shares Represents the nominal value of equity shares

Share premium Amount subscribed for share capital in excess

of nominal value

Share based payment Represents the fair value of options and warrants

reserve granted less amounts transferred on exercise,

lapse or expiry

Foreign currency Cumulative effects of translation of opening

translation reserve balances on non-monetary assets between subsidiary

functional currency (Canadian dollars) and Group

functional and presentational currency (Sterling).

Accumulated surplus Cumulative net gains and losses and other transactions

with equity holders not recognised elsewhere.

17. TRADE AND OTHER PAYABLES

As at 30 As at 31

June 2021 December

(unaudited) 2020 (audited)

GBP GBP

----------------------------------- ------------- ----------------

Trade payables 15,233,372 548,293

Accruals and other payables 949,976 271,471

Short term loans - 115,924

Deferred contingent consideration 9,025,857 -

Other taxation and social

security 1,575 972

Total trade and other payables 25,210,780 936,660

------------------------------------- ------------- ----------------

Within trade payables is GBP10,844,312 (2020: GBPnil) for

amounts due for mining equipment not yet received.

The directors consider that the carrying value of trade and

other payables is equal to their fair value.

Deferred contingent consideration relates to the acquisition of

DPN LLC of which up to a further US$12.5m in shares at a

predetermined price being payable if certain contractual milestones

related to the facility are fulfilled.

18. LOANS AND BORROWINGS

Non-current liabilities AS at 30 June 31 December

2021 (unaudited) 2020 (audited)

-------------------------------- -------------------- ------------------

Assumed mortgage on acquisition 4,032,364 -

Total 4,032,364 -

-------------------------------- -------------------- ------------------

Current liabilities

-------------------------------- -------------------- ------------------

Short term loan 14,375,021 -

Assumed mortgage on acquisition 1,008,090 -

-------------------------------- -------------------- ------------------

Total 15,383,111 -

-------------------------------- -------------------- ------------------

The mortgage is secured against the two buildings at Mirabal and

Baie-Comeau is repayable over 60 months at an interest rate of 5%

per annum.

On 29 June 2021 the Group entered into a loan agreement with

Galaxy Digital LP for a facility of US$20 million. The proceeds of

the loan will be used, in conjunction with funds raised previously,

to continue the build-out the West Texas data centre. The

short-term loan is a Bitcoin collateralised loan against 795

Bitcoin initially with a further 86 Bitcoin transferred after the

period end. It has a 6-month term and attracts an interest rate of

12.5% per annum.

19. FINANCIAL INSTRUMENTS

As at 30 As at 31

June 2021 December

(unaudited) 2020 (audited)

GBP GBP

----------------------------------------- ------------- ----------------

Carrying amount of financial

assets

Measured at amortised cost

* Trade and other receivables 209,498 144,607

* Cash and cash equivalents 16,047,608 2,050,761

Measured at fair value through

profit or loss 1,630,736 1,393,303

Total carrying amount of financial

assets 17,887,842 3,588,671

------------------------------------------- ------------- ----------------

Carrying amount of financial

liabilities

Measured at amortised cost

* Trade and other payables 16,105,765 548,293

* Short term loans 15,383,111 115,924

4,032,364 -

* Long term loans

* Lease liabilities 5,645,239 7,409,387

Measured at fair value through 9,025,857 -

profit or loss

Total carrying amount of financial

liabilities 50,192,336 8,073,604

------------------------------------------- ------------- ----------------

Fair Value Estimation

Fair value measurements are disclosed according to the following

fair value measurement hierarchy:

- Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1)

- Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (that

is, as prices), or indirectly (that is, derived from prices) (Level

2)

- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (Level 3).

This is the case for unlisted equity securities.

The following table presents the Group's assets and liabilities

that are measured at fair value at 30 June 2021 and 31 December

2020.

Level Level 2 Level 3 Total

1

Assets GBP GBP GBP GBP

----------------------------------------------- ------- ----------- ---------- -----------

Financial assets

at fair value through

profit or loss

* Equity holdings - - 1,630,736 1,630,736

* Digital assets - 31,896,437 - 31,896,437

Total at 30 June

2021 - 31,896,437 1,630,736 33,527,173

------------------------------------------------ ------ ----------- ---------- -----------

Liabilities

----------------------------------------------- ------- ----------- ---------- -----------

Financial liabilities

at fair value through

profit or loss

* Deferred contingent consideration - - 9,025,857 9,025,857

Total at 30 June

2021 - - 9,025,857 9,025,857

------------------------------------------------ ------ ----------- ---------- -----------

Level Level 2 Level 3 Total

1

Assets GBP GBP GBP GBP

------------------------ ------- ---------- ---------- -----------

Financial assets

at fair value through

profit or loss

Equity holdings - - 1,393,303 1,393,303

Digital assets - 4,637,438 - 4,637,438

Total at 30 December

2020 - 4,637,438 1,393,303 6,030,741-

------------------------- ------ ---------- ---------- -----------

All financial assets are in unlisted securities and digital

assets.

There were no transfers between levels during the period.

The Group recognises the fair value of financial assets at fair

value through profit or loss relating to unlisted investments at

the cost of investment unless:

- There has been a specific change in the circumstances which,

in the Group's opinion, has permanently impaired the value of the

financial asset. The asset will be written down to the impaired

value;

- There has been a significant change in the performance of the

investee compared with budgets, plans or milestones;

- There has been a change in expectation that the investee's

technical product milestones will be achieved or a change in the

economic environment in which the investee operates;

- There has been an equity transaction, subsequent to the

Group's investment, which crystallises a valuation for the

financial asset which is different to the valuation at which the

Group invested. The asset's value will be adjusted to reflect this

revised valuation; or

- An independently prepared valuation report exists for the

investee within close proximity to the reporting date.

20. COMMITMENTS

The Group's material contractual commitments relate to the

master services agreement with Core Scientific, which provides

hosting, power and support services. Whilst management do not

envisage terminating agreements in the immediate future, it is

impracticable to determine monthly commitments due to large

fluctuations in power usage and variations on foreign exchange

rates, and as such a commitment over the contract life has not been

determined.

21. RELATED PARTY TRANSACTIONS

Key management compensation

Key management includes Directors (executive and non-executive)

and senior management. The compensation paid to related parties in

respect of key management for employee services during the period

was made only from Argo Innovation Labs Inc, amounting to:

GBP18,250 paid to POMA Enterprises Limited in respect of fees of

Matthew Shaw (Non-executive director); GBP105,600 paid to Vernon

Blockchain Inc in respect of fees of Peter Wall (CEO); GBP67,649

paid to Tenuous Holdings Ltd in respect of fees of Ian MacLeod

(Executive chairman). During the period, James Savage (NED) was

remunerated a gross salary of GBP15,000, Marco D'Attanasio was

remunerated gross fees of GBP15,000 and Alex Appleton through

Appleton Business Advisors Limited was paid GBP60,000 during the

period.

Total director fees and remuneration, paid directly and

indirectly, totalled GBP221,499 (2020: GBP250,148).

Pluto Digital PLC

On 3 February 2021 Argo invested in Pluto Digital PLC, a crypto

venture capital and technology company. The investment was

satisfied with 75,000 Polkadot with a fair value at the time of

GBP1,091,850. Further to this in a second round of funding Argo

invested a further GBP7,352,970 on 8 March 2021. There have been no

transactions with this associate during the period.

Argo owns 24.65% of the total share capital and voting rights of

the business and is entitled to nominate one director to the Pluto

Board of Directors. In accordance with IAS28 the Group considers

the Pluto Digital PLC investment as an associate.

22. CONTROLLING PARTY

There is no controlling party of the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUUARUPGPGR

(END) Dow Jones Newswires

August 09, 2021 02:00 ET (06:00 GMT)

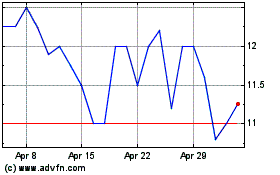

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Apr 2023 to Apr 2024