By Avantika Chilkoti and Joanne Chiu

Global stocks recovered ground Wednesday, while crude prices

briefly dropped to multidecade lows before oil markets calmed.

Futures linked to the S&P 500 advanced 1.4%, suggesting U.S.

shares could rally on Wednesday. The benchmark Stoxx Europe 600

index climbed almost 1.2%. In Asia, Japan's Nikkei 225 closed 0.7%

lower, while benchmarks in Hong Kong, South Korea and Shanghai

ended higher.

"The psychology is 'buy on the dip' and that's what's fueling

this bear-market rally," said Gregory Perdon, co-chief investment

officer at private bank Arbuthnot Latham. Some fund managers only

have experience investing in the prolonged bull market of the past

decade, and have grown to expect a quick rebound, he said.

"The disappointment when that wall of unemployment does not

dissipate quickly will be a rude awakening for risk assets,

especially the equity market," Mr. Perdon said.

Investors are looking to corporate earnings to gauge the health

of U.S. businesses as a broad swath of blue-chip companies report

their results.

Ahead of the opening bell, shares in Snap soared almost 20%. The

social-media company reported a surge in the number of users as

people who are homebound turned to its chat app for communicating

with friends and family.

Expedia climbed over 4% in offhours trading after The Wall

Street Journal reported the company is in advanced talks to sell a

stake to private-equity firms as widespread travel bans hit the

online-booking company's business.

Shares in Netflix ticked down 3.2% in offhours trading. The

streaming giant on Tuesday evening said it ended the first quarter

with nearly 16 million new subscribers.

In commodities, Brent crude, the global gauge for oil, was

almost flat at $19.30 a barrel, after briefly plunging earlier in

the day to levels last seen in 1999. The most actively traded U.S.

benchmark for crude ticked down 1.6% to about $11.41 a barrel,

following its lowest close in 21 years.

The ministers of major oil-producing nations didn't reach any

decisions on starting production cuts as soon as possible following

an informal call on Tuesday, according to Warren Patterson, head of

commodities strategy at ING. Meanwhile, forecasts suggest that the

Energy Information Administration's data on Wednesday may show that

the increase in U.S. crude-oil inventories exceeded 10 million

barrels for the fourth consecutive week.

The Trump administration is considering offering federal

stimulus funds to embattled oil-and-gas producers in exchange for

government ownership stakes in the companies or their crude

reserves, The Wall Street Journal reported. But the plan faces long

odds given likely opposition from congressional Democrats to using

stimulus funding for the oil industry. Separately, Texas regulators

on Tuesday deferred a decision on whether to make operators curtail

production for the first time since the 1970s.

Some investors questioned how effective support from the U.S.

government would be in shielding oil producers, or propping up the

price of energy stocks.

"It's not realistic to expect there won't be any casualties from

this type of move in the oil price," said Hugh Gimber, global

market strategist at J.P. Morgan Asset Management. "If you do see

government intervention, the pressure on corporates to avoid

dividends and buybacks for a long period of time will be very

strong."

The yield on the 10-year Treasury note inched up to 0.586%, from

0.571% Tuesday, in a sign that risk appetite may be returning.

In Europe, investors continued to pull assets out of government

bonds from the periphery of the eurozone. Concern has mounted over

recent days that a key meeting of European leaders on Thursday is

unlikely to result in agreement on measures like a common

debt-issuance program, which would have allowed richer nations

share in the cost of shielding struggling economies.

"We would call it a defining moment for the eurozone project,"

said Brian O'Reilly, head of market strategy for Mediolanum

International Funds. "This is a crisis that hit all nations

equally: it is not that any nation did anything to bring this on

itself, unlike the run-up of debt in Spain and Italy in the

eurozone debt crisis."

The yield on 10-year Greek bonds climbed to 2.604%, from 2.434%

Tuesday, and to 1.109% on Spanish bonds, from 1.022% Tuesday.

Confidence is likely to remain fragile while analysts and

investors are still slashing profit forecasts for 2020, according

to Ken Peng, head of Asia investment strategy at Citi Private Bank.

He expects global earnings to fall by about 50% this year, but

consensus forecasts are still far from this figure. "The markets

will have more confidence, and more sustainably rally, once this

revision momentum slows down," he said.

Fresh outbreaks in Asia are a warning that secondary waves of

infection -- and intermittent lockdowns -- could follow initial

successes, a pattern likely to continue absent a medical

breakthrough, according to Min Lan Tan, Asia-Pacific head of the

chief investment office at UBS Global Wealth Management.

"Proper economic functioning is probably going to normalize

sustainably only toward the end of this year," Ms. Tan said.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com and

Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

April 22, 2020 07:36 ET (11:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

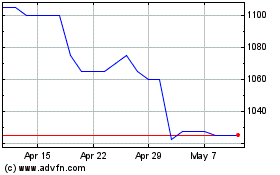

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Apr 2024 to May 2024

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From May 2023 to May 2024