TIDMASTO

RNS Number : 6179C

AssetCo PLC

14 June 2023

14 June 2023

AssetCo plc

("AssetCo" or the "Company")

2023 Half-year Report

for the six months ended 31 March 2023

Highlights

-- Acquisition of Ocean Dial Asset Management announced, subject

to regulatory approvals, continuing the expansion of AssetCo's

listed equity platform:

o Brings emerging markets equity asset management capability in

the fast-growing Indian economy (AuM c.GBP139m at end May)

o Adds a third closed end fund client to the Group

o Earnings enhancing from outset (based on run rate revenues of

c.GBP1.6m pa as at end May)

-- Steady progress made in underlying businesses:

o Improvements in assets under management and operating margins

for the active equities businesses despite industry outflows

o Net inflows of GBP28m for Saracen Global Income and Growth

Fund making the Group the 8th largest net asset gatherer out of 36

groups in the Global Income sector

o Net inflows of $21m at Rize ETF over the period

o Improvement in profit, cashflows and balance sheet strength at

Parmenion which also completed its first acquisition in the

period.

o Further cost reductions in active equities business: over

GBP1m identified in addition to those underway at year end, to

deliver annualised cost reductions of over GBP16m in aggregate

since announcement of the acquisition of River & Mercantile in

January 2022

-- Assets under management (AuM) as at 31 March 2023 were

GBP13.8 bn (31 March 2022: GBP9.9bn), including AuM for Parmenion

(GBP10.6bn)

-- 86% of active equity mutual funds AuM in 1(st) or 2(nd)

quartile in investment performance terms, over 3 years when

compared to competitor funds in relevant Investment Association

sectors

Underlying operational loss for the six months ended 31 March

2023 GBP4.1m before exceptionals and other one-off costs,

reflecting the introduction of both River & Mercantile and SVM

businesses since the previous half year report. Overall loss

GBP13.8m (31 March 2022: loss of GBP2.6m).

Campbell Fleming, Chief Executive Officer of AssetCo,

commented:

"The six months to end March 2023 has been one of the toughest

on record for active equities businesses with a backdrop of

relentless outflows across the industry. Given that extremely

challenging operating environment, I am gratified to report a

modest uptick in both assets under management and, importantly,

operating margin for our active equities businesses. At Rize, the

thematic focus of that ETF business has been out of favour in the

market but it is pleasing to report healthy net inflows over the

reporting period. Parmenion has gone from strength to strength over

the period.

We were also delighted, in March, to announce the acquisition of

Ocean Dial Asset Management which is expected to enhance earnings

from the outset and provides welcome and valuable access to the

long-term potential that India offers. We see opportunities to add

value by bringing that business together with the other active

equity businesses we are combining under the River and Mercantile

brand.

The further cost savings we have identified, when taken together

with work done to date and our continued strong investment

performance showing as a Group, make us well placed to benefit from

improvement in investor sentiment. The traction achieved for the

Saracen Global Income and Growth Fund supported by River and

Mercantile's distribution capability demonstrates the potential of

bringing together strong operating companies."

For further information, please contact:

AssetCo plc Numis Securities Limited

Campbell Fleming, CEO Nominated adviser and joint

Gary Marshall, CFOO broker

Tel: +44 (0) 7958 005141 Giles Rolls / Charles Farquhar

Tel: +44 (0) 20 7260 1000

Panmure Gordon (UK) Limited H/Advisors Maitland

Joint corporate broker Neil Bennett

Atholl Tweedie / Gabriel Hamlyn Rachel Cohen

Tel: +44 (0) 20 7886 2906 Tel: +44 (0) 20 7379 5151

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

CHAIRMAN'S STATEMENT

The six months ended 31 March 2023 saw a period of unrelenting

market pressure. Although most stock markets saw some uplift in

value, investor sentiment was weak and the collapse of Silicon

Valley Bank, followed swiftly by the rescue of Credit Suisse, did

nothing to calm the nerves of investors. Fund flows across the

industry were consistently negative for the period, with outflows

from UK Equity funds (currently AssetCo's largest exposure)

actually increasing in Q1 2023 from what were already record levels

in 2022. With overall industry figures negative, the only respite

from the gloom was in Global Equity funds where inflows turned

tentatively positive in Q1 2023.

The AssetCo Group of companies was sadly not immune from these

pressures and the Group generally suffered outflows over the

period, when inflows had been the expectation. The general rise in

markets has cushioned the effect to some extent, but it is fair to

say that we remain behind where we want to be in terms of asset

growth. Thankfully the Global Equity asset class is one where we

have been bucking the trend for some time with the Saracen Global

Income and Growth Fund and the more supportive environment was

welcome.

Progress has been made in delivering cost savings and the

revenue pressures have moved us to go further in this regard.

Savings of over GBP1m have been identified on top of those already

targeted and being actioned at year end, leading us to a projected

run rate costs target of GBP15m for the active equities business at

River and Mercantile ("R&M"), which eliminates more than GBP16m

from the cost base inherited in the River and Mercantile

acquisition. We also reached agreement to sell River and

Mercantile's loss-making US business earlier this year. The deal

completed at the end of May and will result in a modest revenue

share benefit for a period going forward, while eliminating net

losses which amounted to GBP0.4m in this reporting period.

We intend to roll the Saracen business into SVM in the near

future and the ground is being laid for the full-scale integration

of all of our active equities businesses under the River and

Mercantile brand. In the meantime, cost savings at SVM aim to move

that business (considered as a stand-alone) to profitability on a

run rate basis around financial year end, while Saracen is expected

to generate good revenues this year as its flagship Global Income

and Growth Fund continues to gather assets.

It has been encouraging to see net inflows into the Rize ETF

business over the period, which bucks the general trend in

conventional fund markets and points to the on-going potential for

this product set. That said, the business remains materially behind

plan, its thematic focus having been set back by the advent of war

in Ukraine and subsequent market jitters. We have therefore decided

to take the prudent approach of writing down the holding value in

our balance sheet by c.GBP5m to GBP12m. We continue to see real

potential in this business, but it is emerging later and slower

than we had hoped.

The market for infrastructure funds has been particularly

challenging against a backdrop of rising rates and a crisis for UK

pension funds and insurers in the Liability Driven Investment (LDI)

market. This has proven particularly unhelpful for River and

Mercantile's own infrastructure fund as a UK only income vehicle

and new commitments have not been forthcoming as hoped, although a

pipeline of potential commitments is being actively developed.

Recognising this slower and later business development and taking a

conservative position, we have elected to make a provision of

GBP1.7m against assets held on the balance sheet for our

infrastructure business which have been advanced in expectation of

future profits.

Financials

The Income Statement for the six months ended 31 March 2023

shows revenue of GBP8.3m (31 March 2022: GBP1.3m) and a loss before

taxation of GBP13.8m (31 March 2022: loss GBP2.6m).

As was the case with the previous full year's result, it is

difficult to make a direct comparison to the previous six-month

period. The six months to 31 March 2022 did not include the

businesses of River and Mercantile and SVM, whereas (with the

exception of the month of October in the case of SVM which was

acquired at the end of October) both businesses are fully included

in the six months to end March 2023. This brought an additional

GBP11.7m of administrative expenses into account for the current

period, compared to the six months ending 31 March 2022. Some GBP3m

of expenses in the current period were one-off costs, almost half

relating to re-structuring.

We have elected to write down the holding value of Rize ETF (by

GBP5m) and to make a provision (of GBP1.7m) against certain assets

held on the balance sheet for River and Mercantile's infrastructure

business. In both cases this reflects the later and slower

development of these otherwise attractive businesses in the current

market environment.

Total (balance sheet) assets at 31 March 2023 were GBP86.5m (31

March 2022: GBP60.9m) which underlines the strength of our balance

sheet. The Group held cash of GBP27.5m and c.GBP4.8m in treasury

shares at period end.

Continuing to Build the Business

We were pleased, at the beginning of March, to announce the

acquisition of Ocean Dial Asset Management Limited. Ocean Dial was

established in 2005 and is wholly owned by Avendus Capital Asset

Management (UK) Limited. Ocean Dial's current business is the

management of the assets of the India Capital Growth Fund Limited,

which, as at end May 2023, had a net asset value in excess of

GBP139m and an annualised run rate revenue of GBP1.6m. The

Acquisition is expected to be earnings enhancing for the Group and

it is anticipated that further synergies will be achievable

following completion. The acquisition is notable both for the

access it gives us to investment capability in the world's most

populous nation and the partnership it brings with the India

Capital Growth Fund Limited. We look forward to completing the

transaction later in the year (subject to receipt of the required

regulatory approvals) and welcoming the Ocean Dial team to the

AssetCo Group.

The Group was delighted to welcome Michelle Dunne as Head of

Institutional Sales at River and Mercantile where she brings an

outstanding reputation to bear in asset raising, particularly in

the area of private markets and infrastructure, having worked at

BlackRock for over 10 years and after that at Neuberger Berman. We

are pleased to be able to attract such talent to the Group and to

invest in the growth of our business in this way.

Outlook

While market conditions remain challenging, we remain on track

to deliver significant cost savings from the Group by year-end.

This, combined with the strong performance of many of our funds,

our robust balance sheet and the fact that we continue to see

numerous avenues for profitable growth, give us continuing

confidence in the future of the business.

Board

Mark Butcher, previously independent non-executive director,

stood down from the Board at the Company's AGM on 30 March 2023 in

light of his length of service. I must re-iterate my thanks to

Mark, both personally and on behalf of the Board, for his support

and contribution to the Company for over 10 years. We wish him the

very best for the future.

Martin Gilbert

Chairman

14 June 2023

BUSINESS REVIEW

The chart below shows the movement in active equities assets

over the period and includes, for this purpose, SVM assets under

management at 30 September even though the business was not

actually acquired until end October 2022.

The single biggest detractor during the period was the River and

Mercantile loss of a New Zealand institutional mandate (where the

client made an asset allocation call away from the asset class in

question). Otherwise, profit taking in R&M's Global Recovery

funds has been the somewhat frustrating order of the day, together

with unfortunately expected redemptions from the poorly performing

SVM UK Growth fund. On the plus side, additions to another R&M

US client's institutional mandate have been welcome, as has been

the fairly consistent level of net inflows to the Saracen Global

Income and Growth Fund.

Market movements have been helpful over the period, leaving the

business marginally ahead overall, in terms of AuM.

Investment performance for the Group's active equities funds has

been resilient over the period, with particularly strong showings

over 10, 3 and 1 year periods. It is also worth noting that our

flagship UK-domiciled European fund is approaching its important

third anniversary with a favourable track record. All things

continuing well, this should facilitate its wider promotion in the

market.

Assets under management have increased over the period, thanks

mainly to rises in market values, further draw down on

infrastructure commitments and net inflows in ETFs. We have been

particularly encouraged by the rise in weighted average fee rates

for active equities where lower margin outflows have been replaced

by higher margin inflows (for example in institutional mandates and

with the inflows to the higher margin global equities fund in place

of UK equities outflows)

Annualised Revenue Breakdown by Business Type (as at 31 March

2023)

Business Type AuM (GBPm) Weighted average Gross annualised

fee rate, net revenue net

of rebates (bp) of rebates

(GBP000s)

Wholesale (active equities) 2,181 58 12,640

----------- ----------------- -----------------

Institutional (active

equities) 585 37 2,138

----------- ----------------- -----------------

Investment Trust (active

equities) 68 73 501

----------- ----------------- -----------------

Infrastructure 63 68 428

----------- ----------------- -----------------

ETFs 363 47 1,700

----------- ----------------- -----------------

Total 3,261 17,408

----------- ----------------- -----------------

This table excludes the Group's structured 30% interest in

Parmenion which had AuM of GBP10.6bn at 31 March 2023, and

generated revenues of GBP20.6m for the period from 1 October

2022.

-- Wholesale refers to the active equity assets which are held

and managed in mutual funds distributed by the Group.

-- Institutional refers to the active equity assets which are

held and managed in separate accounts on behalf of institutional

clients of the Group.

-- Investment Trust refers to the active equity assets which are

held and managed in investment trusts which are clients of the

Group.

Rize

The period between 1 October 2022 and 31 March 2023 was

particularly tough for the European thematic ETF market as a whole,

with net outflow of USD 314 million across that market.

Notwithstanding the outflow across the wider thematic ETF market,

Rize ETF enjoyed net inflows of $21 million in that period, and

spent much of that time building its next suite of ETFs and

expanding its marketing footprint across Europe. As part of that,

Rize ETF has been working with a number of key clients to develop

its next suite of sustainable thematic (Article 9) ETFs whilst also

expanding the number of target client firms that have onboarded its

ETFs as a way of positioning itself for the next wave of thematic

allocations once interest rates and inflation begin to normalise

and larger allocations into thematic equities begin to return in

meaningful size. The Rize Environmental Impact 100 UCITS ETF has

been one of the top performing environment/climate-themed

sustainable thematic (Article 9) funds during the period with a

return of 24.7 % between 1 October 2022 and 31 March 2023 and

achieving $10 million in net inflows in the period.

Parmenion

The six-month period from 1 October 2022 to 31 March 2023 saw

Parmenion generate revenues of GBP20.6m and an EBITDA of GBP9.1m.

Platform AUM across the group increased from GBP8.5bn to GBP10.6bn.

(Note the numbers include ebi as referenced below).

In December 2022, the business launched a new proposition,

Advisory Models Pro, which allows significantly more flexibility

for adviser firms in building their own models using our fund range

and platform technology. This launch was accompanied by an app

which has streamlined the consent journey for clients, along with

providing more user-friendly reporting.

The platform offering was further enhanced with the addition of

a number of new external discretionary fund managers, to run

alongside our in-house portfolio investment management service.

At the end of the year, Parmenion was strengthened by the

acquisition of ebi Portfolios Limited, a Midlands-based DFM, with a

reputation for strong ESG credentials. Further M&A

opportunities continue to be evaluated as they arise.

Parmenion has improved cash generation in line with increased

EBITDA. Cash held at 31 March 2023 was GBP28.7m compared to

GBP30.8m at the end of September 2022. This decrease reflects the

payment of the initial consideration for ebi, which was paid out of

operational cash. Parmenion has continued to strengthen its balance

sheet with capital held well in excess of regulatory

requirements.

In summary, Parmenion has continued to grow successfully despite

the wider economic challenges and has improved profit, cashflows

and balance sheet strength and completed its first acquisition in

the period.

Key Performance Indicators

The following table summarises key performance indicators for

the business, illustrating the progression of the business over the

period.

End March End Sept End March Movement

2023 2022 2022 March 2022

to March

2023

(Sept 22

to March

23)

Total Assets under Management GBP3,261m GBP2,652m GBP503m +GBP2,758m

(excluding Parmenion) (+GBP609m)

---------- ---------- ---------- ---------------

Active Equities Assets GBP2,766m GBP2,291m GBP113m +GBP2,653m

under Management (+GBP475m)

---------- ---------- ---------- ---------------

Total (balance sheet) GBP86.5m GBP102.1m GBP60.9m +GBP25.6m

assets (-GBP15.6m)

---------- ---------- ---------- ---------------

Annualised revenue(1) GBP17.9m GBP12.9m GBP2.7m +GBP15.2m

(+GBP5m)

---------- ---------- ---------- ---------------

Profit/loss for the -GBP13.8m -GBP9.3m -GBP2.6m -GBP11.2m

period (n/a)

---------- ---------- ---------- ---------------

Investment performance(2) 62% 76% 0%(3) +62% points

(1 year) (-14% points)

---------- ---------- ---------- ---------------

Investment performance(2) 86% 53% 2%(3) +84% points

(3 year) (+33% points)

---------- ---------- ---------- ---------------

(1) Monthly recurring revenue at date shown, annualised (i.e. x

12)

(2) % active equity mutual fund AuM in 1(st) or 2(nd) quartile

when compared to competitor funds in relevant Investment

Association sectors.

(3) Saracen only

Campbell Fleming, Chief Executive Officer

14 June 2023

AssetCo plc

Consolidated Income Statement

for the six months ended 31 March 2023

Six months ended Year ended

Notes Unaudited Unaudited31 Audited

31 March 2023 March 2022 30 Sept

GBP'000 GBP'000 2022

GBP'000

------------------------------------- ----- --------------------- ---------------- ------------

Revenue 3 8,275 1,285 8,062

Cost of sales - (1,767) -

------------------------------------- ----- --------------------- ---------------- ------------

Gross (loss)/profit 8,275 (482) 8,062

Other income 4 1,788 - 1,977

Administrative expenses 5 (17,014) (5,261) (25,051)

Other gains/(losses) 6 (6,718) - (9,732)

------------------------------------- ----- --------------------- ---------------- ------------

Operating (loss) 3 (13,669) (5,743) (24,744)

Gain on bargain purchase 7 - - 3,227

Finance income 8 2 1,590 12,433

Finance costs (136) - (10)

------------------------------------- ----- --------------------- ---------------- ------------

Finance income (net) (134) 1,590 12,423

Share of result of associate 266 1,512 181

------------------------------------- ----- --------------------- ---------------- ------------

(Loss) before income tax (13,537) (2,641) (8,913)

Income tax credit/(expense) 9 148 - 59

------------------------------------- ----- --------------------- ---------------- ------------

Loss after tax from continuing

operations (13,389) (2,641) (8,913)

------------------------------------- ----- --------------------- ---------------- ------------

Loss after tax from discontinued

operation 10 (413) - (401)

------------------------------------- ----- --------------------- ---------------- ------------

(Loss) for the year (13,802) (2,641) (9,255)

------------------------------------- ----- --------------------- ---------------- ------------

(Loss) attributable to:

Owners of the parent (13,434) (2,252) (8,440)

Non-controlling interest (368) (389) (815)

------------------------------------- ----- --------------------- ---------------- ------------

(13,802) (2,641) (9,255)

------------------------------------- ----- --------------------- ---------------- ------------

Loss per Ordinary Share attributable Pence Pence(1) Pence

to the owners of the parent

during the year

------------------------------------- ----- --------------------- ---------------- ------------

From continuing operations

Basic 11 (9.28) (2.67) (7.80)

Diluted 11 (9.28) (2.67) (7.80)

------------------------------------- ----- --------------------- ---------------- ------------

(1) Prior year loss per share has been re-stated to reflect the

10-1 share split carried out by AssetCo in August 2022.

AssetCo plc

Consolidated Statement of Comprehensive Income

for the six months ended 31 March 2023

Six months ended Year ended

Unaudited Unaudited Audited 30

31 March 2023 31 March Sept 2022

GBP'000 2022 GBP'000

GBP'000

----------------------------------- -------------------- ------------- -----------------

(Loss) for the year (13,802) (2,641) (9,255)

Other comprehensive (loss)/income:

Currency translation differences - - -

----------------------------------- -------------------- ------------- -----------------

Other comprehensive income - - -

(net of tax)

----------------------------------- -------------------- ------------- -----------------

Total comprehensive (loss)

for the period (13,802) (2,641) (9,255)

------------------------------------ -------------------- ------------- -----------------

Attributable to:

Owners of the parent (13,434) (2,252) (8,440)

Non-controlling interests (368) (389) (815)

------------------------------------ -------------------- ------------- -----------------

Total comprehensive (loss)

for the year (13,802) (2,641) (9,255)

------------------------------------ -------------------- ------------- -----------------

AssetCo plc

Consolidated Statement of Financial Position

as at 31 March 2023

Notes Unaudited Unaudited Audited

31 March 31 March 2022 30 Sept

2023 GBP'000 2022

GBP'000 GBP'000

-------------------------------- ----- ---------- -------------------- --------------

Assets

Non-current assets

Property, plant and equipment 42 27 32

Right-of-use assets 1,969 - 224

Goodwill and intangible

assets 25,798 20,051 24,600

Investments accounted

for using the equity

method 22,318 23,383 22,052

Long-term receivables - - 1,208

-------------------------------- ----- ---------- -------------------- --------------

Total non-current assets 50,127 43,461 48,116

-------------------------------- ----- ---------- -------------------- --------------

Current assets

Trade and other receivables 7,596 636 9,700

Assets held for sale 10 56 - -

Financial assets at fair

value through profit

and loss 44 13,200 37

Current income tax receivable 1,173 3 1,173

Cash and cash equivalents 27,548 3,634 43,066

-------------------------------- ----- ---------- -------------------- --------------

Total current assets 36,417 17,473 53,976

-------------------------------- ----- ---------- -------------------- --------------

Total assets 86,544 60,934 102,092

-------------------------------- ----- ---------- -------------------- --------------

Liabilities

Non-current liabilities

Deferred tax liabilities 1,000 49 1,070

-------------------------------- ----- ---------- -------------------- --------------

Total non-current liabilities 1,000 49 1,070

-------------------------------- ----- ---------- -------------------- --------------

Current liabilities

Trade and other payables 8,878 2,471 12,750

Liabilities held for

sale 10 52 - -

Lease liability 2,049 - 294

Loan due to related party - 1,000 -

Loan notes 12 6,895 - -

Current income tax liabilities 1,566 1,437 1,437

-------------------------------- ----- ---------- -------------------- --------------

Total current liabilities 19,440 4,908 14,481

-------------------------------- ----- ---------- -------------------- --------------

Total liabilities 20,440 4,957 15,551

-------------------------------- ----- ---------- -------------------- --------------

Equity attributable to owners

of the parent

Share capital 1,493 843 1,493

Share premium 12 209 27,770 -

Capital redemption reserve 653 653 653

Merger reserve 43,063 2,762 43,063

Other reserves - 7,977 -

Retained earnings 22,148 16,640 42,426

-------------------------------- ----- ---------- -------------------- --------------

67,566 56,645 87,635

Non-controlling interest (1,462) (668) (1,094)

-------------------------------- ----- ---------- -------------------- --------------

Total equity 66,104 55,977 86,541

-------------------------------- ----- ---------- -------------------- --------------

Total equity and liabilities 86,544 60,934 102,092

-------------------------------- ----- ---------- -------------------- --------------

AssetCo plc

Consolidated Cash Flows

for the six months ended 31 March 2023

6 months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2023 2022 2022

GBP'000 GBP'000 GBP'000

---------------------------------------- --------- --------- ----------

Cash flows from operating activities

Cash (outflow) from operations

(note 13) (8,759) (2,768) (17,916)

Cash outflows from discontinued

operation (413) - (401)

Corporation tax paid - - (31)

Finance costs (33) - (10)

---------------------------------------- --------- --------- ----------

Net cash (outflow) from operating

activities (9,205) (2,768) (18,358)

---------------------------------------- --------- --------- ----------

Cash flow from investing activities

Net cash received from acquisitions

(note 12) 2,802 - 42,148

Payments to acquire associated

undertakings - (21,871) (21,871)

Interest on loan notes held in

associate - 1,977

Dividends received from financial

assets held at fair value - 390 11,459

Finance income 2 - 974

Proceeds of disposal of investments

at FV through P and L - - 1,017

Additions to right-of-use assets (2,176) - -

Purchase of property, plant and

equipment (22) (14) (15)

Purchase of intangibles (6) (6) (12)

---------------------------------------- --------- --------- ----------

Net cash (outflow)/inflow from

investing activities 600 (21,501) 35,677

---------------------------------------- --------- --------- ----------

Cash flow from financing activities

Costs of share issue - - (1,000)

Dividend paid to AssetCo shareholders (1,798) - -

New lease financing 2,176 - -

Lease payments (454) - (104)

Shares bought for treasury (6,837) - (51)

Short-term loan from related party - 1,000 -

---------------------------------------- --------- --------- ----------

Net cash used in financing activities (6,913) 1,000 (1,155)

---------------------------------------- --------- --------- ----------

Net change in cash and cash equivalents (15,518) (23,269) 16,164

Cash and cash equivalents at beginning

of year 43,066 26,902 26,902

Cash and cash equivalents at

end of year 27,548 3,633 43,066

---------------------------------------- --------- --------- ----------

AssetCo plc

Consolidated Statement of Changes in Equity

for the six months ended 31 March 2023

Share Capital

Share premium redemption Merger Other Retained Non-controlling Total

capital account reserve reserve reserve earnings Total interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

At 1 October

2021 843 27,770 653 2,762 5,496 18,892 56,416 (279) 56,137

Comprehensive

income

Loss for the

period - - - - - (2,252) (2,252) (389) (2,641)

Total

comprehensive

loss - - - - - (2,252) (2,252) (389) (2,641)

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

Share-based

payments

- LTIP - - - - 2,481 - 2,481 - 2,481

At 31 March

2022 843 27,770 653 2,762 7,977 16,640 56,645 (668) 55,977

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

Comprehensive

income

Loss for the

period - - - - - (6,188) (6,188) (426) (6,614)

Other

comprehensive

income

Currency

translation

differences - - - - - - - - -

-------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

Total

comprehensive

(loss) - - - - - (6,188) (6,188) (426) (6,614)

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

Shares issued

on

acquisition 598 - - 41,301 - - 41,899 - 41,899

Costs of share

issue - - - (1,000) - - (1,000) - (1,000)

Share-based

payments

- LTIP 52 4,255 - (7,977) - (3,670) - (3,670)

Share premium

cancellation - (32,025) - - - 32,025 - - -

Shares bought

for

treasury - - - - - (51) (51) - (51)

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

At 30 September

2022 1,493 - 653 43,063 - 42,426 87,635 (1,094) 86,541

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

Comprehensive

income

Loss for the

period - - - - - (13,434) (13,434) (368) (13,802)

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

Total

comprehensive

(loss) - - - - - (13,434) (13,434) (368) (13,802)

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

Shares bought

for

treasury - - - - - (6,837) (6,837) - (6,837)

Treasury shares

used to settle

conversion of

loan

notes - 209 - - - 1,791 2,000 - 2,000

Dividends paid - - - - - (1,798) (1,798) - (1,798)

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

At 31 March

2023 1,493 209 653 43,063 - 22,148 67,566 (1,462) 66,104

--------------- ------- -------- ----------- --------- --------- ---------- ------------ ----------------- -----------

NOTES FORMING PART OF THE INTERIM FINANCIAL STATEMENTS

1. General information and basis of presentation

AssetCo Plc ("AssetCo" or the "Company") is a public limited

company incorporated and domiciled in England and Wales. The

address of its registered office is 30 Coleman Street, London, EC2R

5AL.

AssetCo is the Parent Company of a group of companies ("the

Group") which offers a range of investment services to private and

institutional investors.

The financial information in the Half-year Report has been

prepared using the recognition and measurement principles of the

UK-adopted International Accounting standards and in conformity

with the requirements of the Companies Act 2006. The principal

accounting policies used in preparing the Half-year Report are

those the Company expects to apply in its financial statements for

the year ending 30 September 2023 and are unchanged from those

disclosed in the Annual Report and Financial Statements for the

year ended 30 September 2022.

The financial information for the six months ended 31 March 2023

and the six months ended 31 March 2022 is unaudited and does not

constitute the Group's statutory financial statements for those

periods. The comparative financial information for the full year

ended 30 September 2022 has, however, been derived from the audited

statutory financial statements for that period. A copy of those

statutory financial statements has been delivered to the Registrar

of Companies.

While the financial figures included in this Half-year Report

have been computed in accordance with IFRSs applicable to interim

periods, this Half-year Report does not contain sufficient

information to constitute an interim financial report as that term

is defined in IAS 34.

The financial statements have been presented in sterling to the

nearest thousand pounds (GBP'000), except where otherwise

indicated.

2. Going concern

The directors have considered the going concern assumption of

the Group by assessing the operational and funding requirements of

the Group. The directors have prepared financial projections along

with sensitivity analyses of reasonable plausible alternative

outcomes. The forecasts demonstrate that the directors have a

reasonable expectation that the Group has adequate financial

resources to continue operating for a period of at least 12 months

from the date of signing these Interim Financial Statements.

Therefore the directors continue to adopt the going concern basis

of accounting in preparing the consolidated financial

statements.

3. Segmental reporting

The core principle of IFRS 8 'Operating segments' is to require

an entity to disclose information that enables users of the

financial statements to evaluate the nature and financial effects

of the business activities in which the entity engages and the

economic environments in which it operates. Segment information is

therefore presented in respect of the company's commercial

competencies, Active equities, Infrastructure asset management,

Exchange traded funds, Digital Platform and Head office. It should

be noted that the segment 'Exchange traded funds' was historically

named 'High-growth thematics'. There has been no change in

allocation methodology or accounting for this segment.

Active equities comprise RMG, SVM, Saracen and Revera;

Infrastructure Asset Management is the non-equities investment arm

of RMG; Exchange Traded Funds is Rize ETF and Digital Platforms

represents the Group's investment in the associated company,

Parmenion.

Substantially all revenues are earned in the UK with a small

amount generated in the US. We have included a table below to show

the split. The Directors consider that the chief operating decision

maker is the Board.

The amounts provided to the Board with respect to net assets are

measured in a manner consistent with that of the financial

statements. The Company is domiciled in the UK.

The segment information provided to the Board for the reportable

segments is as follows:

Period ended Exchange

31 March 2023 Active Infrastructure traded Digital

unaudited equities asset management funds platform Head office Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- ----------------- -------- --------- ----------- --------

Revenue

Management fees 7,257 230 - - - 7,487

Marketing fees - - 788 - - 788

------------------------ --------- ----------------- -------- --------- ----------- --------

Total revenue 7,257 230 788 - - 8,275

------------------------ --------- ----------------- -------- --------- ----------- --------

Operating (loss)/profit (5,702) (1,932) (6,245) - 210 (13,669)

Finance income 2 - - - - 2

Finance costs (30) - - - (106) (136)

Share of result

of associate - - - 266 - 266

------------------------ --------- ----------------- -------- --------- ----------- --------

(Loss)/profit

before tax (5,730) (1,932) (6,245) 266 104 (13,537)

Income tax 144 - 4 - - 132

------------------------ --------- ----------------- -------- --------- ----------- --------

(Loss)/profit

for period (5,586) (1,932) (6,241) 266 104 (13,389)

------------------------ --------- ----------------- -------- --------- ----------- --------

Segment assets

Total assets 47,570 645 12,819 - 25,510 86,544

Total liabilities (4,781) (851) (319) - (14,489) (20,440)

------------------------ --------- ----------------- -------- --------- ----------- --------

Total net assets 42,789 (206) 12,500 - 11,021 66,104

------------------------ --------- ----------------- -------- --------- ----------- --------

Depreciation 11 - 3 - - 14

Impairment of

goodwill - - 5,000 - - 5,000

Amortisation of

intangible assets 365 - 6 - - 371

Amortisation of

right-of-use assets 431 - - - - 431

------------------------ --------- ----------------- -------- --------- ----------- --------

Total capital

expenditure 22 - 6 - - 28

------------------------ --------- ----------------- -------- --------- ----------- --------

Period ended Exchange

31 March 2022 Active Infrastructure traded Digital

unaudited equities asset management funds platform Head office Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- ----------------- ---------- --------- ----------- -------

Revenue

Management fees 424 - - - - 424

Marketing fees - - 861 - - 861

------------------- --------- ----------------- ---------- --------- ----------- -------

Total revenue 424 - 861 - - 1,285

------------------- --------- ----------------- ---------- --------- ----------- -------

Operating (loss) (6) - (1,229) - (4,508) (5,743)

Finance income - - - - 1,590 1,590

Finance costs - - - - - -

Share of result

of associate - - - 1,512 - 1,512

(Loss)/profit

before tax (6) - (1,229) 1,512 (2,918) (2,641)

Income tax - - - - - -

------------------- --------- ----------------- ---------- --------- ----------- -------

(Loss)profit

for period (6) - (1,229) 1,512 (2,918) (2,641)

------------------- --------- ----------------- ---------- --------- ----------- -------

Segment assets

Total assets 3,523 - 20,346 - 37,065 60,934

Total liabilities (48) - (304) - (4,605) (4,957)

------------------- --------- ----------------- ---------- --------- ----------- -------

Total net assets 3,475 - 20,042 - 32,460 55,977

------------------- --------- ----------------- ---------- --------- ----------- -------

Depreciation - - 3 - - 3

Amortisation of

intangible assets 2 - 20 - - 22

------------------- --------- ----------------- ---------- --------- ----------- -------

Total capital

expenditure - - 20 - - 20

------------------- --------- ----------------- ---------- --------- ----------- -------

Year ended 30 Exchange

September 2022 Active Infrastructure traded Digital

audited equities asset management funds platform Head office Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- ----------------- -------- --------- ----------- --------

Revenue

Management fees 6,259 79 - - - 6,338

Marketing fees - - 1,724 - - 1,724

------------------------ --------- ----------------- -------- --------- ----------- --------

Total revenue 6,259 79 1,724 - - 8,062

------------------------ --------- ----------------- -------- --------- ----------- --------

Operating (loss)/profit (6,723) (151) (2,794) - (15,076) (24,744)

Gain on bargain

purchase - - - - 3,227 3,227

Finance income 974 - - - 11,459 12,433

Finance costs (10) - - - - (10)

Share of result

of associate - - - 181 - 181

------------------------ --------- ----------------- -------- --------- ----------- --------

(Loss)/profit

before tax (5,759) (151) (2,794) 181 (390) (8,913)

Income tax 59 - - - - 59

------------------------ --------- ----------------- -------- --------- ----------- --------

(Loss)/profit

for the year (5,710) (151) (2,794) 181 (390) (8,854)

------------------------ --------- ----------------- -------- --------- ----------- --------

Segment assets

Total assets 56,826 1,706 19,324 - 24,236 102,092

Total liabilities (12,157) (678) (461) - (2,255) (15,551)

------------------------ --------- ----------------- -------- --------- ----------- --------

Total net assets 44,669 1,028 18,863 - 21,981 86,541

------------------------ --------- ----------------- -------- --------- ----------- --------

Depreciation 9 - 5 - - 14

Amortisation of

intangible assets 187 - 40 - - 227

Amortisation of

right-of-use assets 187 - - - - 187

------------------------ --------- ----------------- -------- --------- ----------- --------

Total capital

expenditure 1 - 26 - - 27

------------------------ --------- ----------------- -------- --------- ----------- --------

Geographical analysis of revenues Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

---------------------------------- --------- ------------ -------------

UK 8,275 1,285 6,905

US - - 1,270

---------------------------------- --------- ------------ -------------

8,275 1,285 8,175

---------------------------------- --------- ------------ -------------

4. Other income

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------------------- --------- ------------ -------------

Interest on loan notes held in associate 1,788 - 1,977

----------------------------------------- --------- ------------ -------------

The Group holds a 30% equity interest in Parmenion Capital

Partners LLP through a corporate entity, Shillay TopCo Limited. A

large part of the Group's total investment is held by way of loan

notes. Shillay has the option to settle interest by payment-in-kind

and they have informed the Company that they will do so for

interest due at 30 June 2023. Accordingly they will issue

additional loan notes to AssetCo plc for the amount of interest due

at that date. We have in the 6 months to 31 March 2023 reflected

GBP1,788,000 as accrued income pending settlement of the full

amount due in loan notes immediately after 30 June. In the prior

year the Group received GBP1,977,000 of interest on those loan

notes in cash.

5. Administrative expenses and exceptional items

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------- ---------- ---------- --------------

Restructuring costs 1,197 - 3,196

Costs of re-admission to AIM - 516 671

------------------------------- ---------- ---------- --------------

Exceptional items 1,197 516 3,867

Acquisition costs 197 530 1,116

Share-based payments - 2,453 3,250

Other administrative expenses 15,620 1,722 16,818

------------------------------- ---------- ---------- --------------

Total administrative expenses 17,014 5,261 25,051

------------------------------- ---------- ---------- --------------

Restructuring costs

RMG sold its UK Solutions business for GBP230 million on 31

January 2022, a transaction which left RMG a much smaller business

with overheads out of step with its reduced size. AssetCo has

usually bought businesses where the strategy has mainly involved

growth in revenue but in this instance a significant project to

right-size the acquired business has been needed following

acquisition by AssetCo on 15 June 2022. As part of the process the

Group has incurred one-off exceptional restructuring costs which

including termination payments, salary costs of those exiting the

business and other charges.

AssetCo completed the purchase of SVM at the end of October 2022

and the Group has incurred some restructuring costs in respect of

the integration of this business as well.

Costs of re-admission to AIM

The Group has in the last two years twice had to apply for

re-admission to AIM; once in April 2021 when shareholders were

asked to approve the change in strategy to asset and wealth

management, and again in June 2022 given the nature and scale of

the acquisition of RMG. These significant costs are in relation to

those exercises and were required because of the unusual nature of

the change in strategy and the relative size of AssetCo compared to

the acquisition target. Our strategy is now settled and, with the

completion of the acquisition of RMG, AssetCo is now at a scale

where re-admission in order to complete an acquisition is unlikely

so the Directors consider that costs such as this are not likely to

recur.

Acquisition costs

Costs incurred in the 6 months to 31 March 2023 relate to the

acquisition of SVM Asset Management Limited. Costs incurred in the

prior periods to 31 March and 30 September 2022 all relate to the

acquisition of RMG.

6. Other gains and losses

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Impairment of goodwill 5,000 - -

Impairment of long-term receivable 1,718 - -

Reduction in fair value of asset

held for resale - - 9,750

Gain on disposal of fair value investments - - (18)

------------------------------------------- --------- ------------ -------------

6,718 - 9,732

------------------------------------------- --------- ------------ -------------

As referred to in the Chairman's statement the Rize ETF business

is not performing as we had hoped. Accordingly the board has

reviewed the carrying value of goodwill attributable to the

business and concluded that an impairment of GBP5 million is

appropriate at 31 March 2023.

The Infrastructure business is still in its early stages and the

Group is committed to paying drawings in advance of profits to the

partners of this venture. In the last few months it has become

clear that the timeline for achieving profitability has slipped

back and the board believe it is prudent to make provision against

the drawings advanced to date. The recoverability of these amounts

will be kept under review.

On 15 June 2022 the Group acquired the entire share capital of

RMG. However the Group had in 2021 bought 5,000,000 shares in RMG

representing 5.85% of the total issued share capital and this

investment was carried on the 2021 balance sheet at a fair value of

GBP12,000,000. When calculating the overall consideration for the

whole of RMG the Group must assess the fair value of the existing

investment at the time of completion of the deal. Given the effect

on the RMG share price of normal market pricing and the significant

return to shareholders arising from the sale of the RMG Solutions

business the fair value was assessed at GBP2,250,000 leading to a

reduction in fair value of GBP9,750,000.

The Group acquired a small number of seed investments with the

acquisition of RMG in June 2022. One of those investments was sold

before 30 September 2022 for sale proceeds of GBP1,017,000

realising a gain on disposal of GBP18,000.

7. Gain on bargain purchase

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30

2023 2022 September

GBP'000 GBP'000 2022

GBP'000

------------------------------ ---------- ------------- ----------

Arising on acquisition of RMG - - 3,227

------------------------------ ---------- ------------- ----------

The calculation of the difference arising on acquisition of

River and Mercantile between the purchase consideration and the

value of net assets acquired gave rise to a negative amount of

goodwill as the value of net assets acquired was larger than the

consideration. In accordance with accounting standards the amount

of GBP3,227,000 is treated as a credit to the income statement.

8. Finance income

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------------------ ---------- ------------ -------------

Dividend income - 390 11,459

Gain on foreign exchange - - 927

Fair value gains on financial instruments

classified as fair value through

profit and loss - 1,200 -

Interest income 2 - 47

------------------------------------------ ---------- ------------ -------------

2 1,590 12,433

----------------------------------------------------- ------------ -------------

9. Income tax (credit)/expense

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 GBP'000 2022 GBP'000 2022 GBP'000

-------------------------------------- ------------- ------------- -------------

Current tax:

Current tax on loss for the period (16) - (13)

-------------------------------------- ------------- ------------- -------------

Total current tax (credit)/expense - - (13)

Deferred tax:

Arising from movement in deferred tax

assets - (228) 16

Arising from movement in deferred tax

liabilities (132) 228 (62)

-------------------------------------- ------------- ------------- -------------

Total deferred tax (credit)/expense (132) - (46)

-------------------------------------- ------------- ------------- -------------

Income tax (credit)/expense (148) - (59)

-------------------------------------- ------------- ------------- -------------

10. Discontinued operations

In January 2023 the Group reached agreement to sell its US-based

ILC business. The deal completed in the last week of May 2023. As

required by IFRS 5 these interim financial statements show the

assets and liabilities of this business as held for sale with the

results of the business shown as discontinued operations. Financial

information relating to the discontinued operation is set out

below:

Statement of comprehensive income Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Revenue 135 - 113

Administration costs (548) - (514)

------------------------------------------ ---------- ------------ --------------

Reported loss on discontinued activities (413) - (401)

------------------------------------------ ---------- ------------ --------------

At 31 March 2023 the carrying amount of assets and liabilities

were reclassified as held for sale. There was no gain or

loss recognised as a result of this reclassification.

Unaudited

31 March

2023

GBP'000

------------------------------------------ ---------- ------------ --------------

Assets

Cash and cash equivalents 6

Other receivables 50

------------------------------------------ ---------- ------------ --------------

Total assets 56

------------------------------------------ ---------- ------------ --------------

Liabilities

Trade and other payables 52

------------------------------------------ ---------- ------------ --------------

Total liabilities 52

Net assets 4

------------------------------------------ ---------- ------------ --------------

11. Loss per share

Basic loss per share is calculated by dividing the loss on

continuing operations attributable to equity owners of the parent

by the weighted average number of Ordinary Shares in issue during

the period.

The weighted average number of shares is calculated by reference

to the length of time shares are in issue taking into account the

issue date of new shares and any buy-backs or usage of treasury

shares.

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022(1) 2022

------------------------------------------- ----------- ---------- -------------

GBP000 GBP000 GBP000

Loss attributable to owners of the

parent (13,434) (2,252) (8,440)

Less: amounts arising from discontinued

operation 413 - 401

------------------------------------------- ----------- ---------- -------------

Loss on continuing operations attributable

to owners of the parent (13,021) (2,252) (8,039)

------------------------------------------- ----------- ---------- -------------

Weighted average number of ordinary

shares in issue before share split

as reported - 8,424,847 -

Basic (loss) per share as reported

- (pence) - (26.73) -

Weighted average number of ordinary

shares in issue post share split 140,307,124 84,248,470 103,017,624

Basic (loss) per share restated -

(pence) (9.28) (2.67) (7.80)

------------------------------------------- ----------- ---------- -------------

(1) In August 2022 the Company effected a 10 for 1 share split.

The prior year share numbers and loss per share have been adjusted

for this.

As the results in the periods under review are all losses

diluted loss per share is the same as basic loss per share. Under

IAS 33 the effects of anti-dilutive potential ordinary shares are

ignored in calculating diluted loss per share.

12. Acquisition of SVM and issue of shares from treasury

At the end of October 2022 AssetCo completed the acquisition of

SVM Asset Management Limited for a total fair value consideration

of GBP11,044,000. Full details of fair value of assets, liabilities

and consideration will be set out in the 2023 Annual Report and

Accounts but the amounts included in these interim financial

statements at the date of acquisition are summarised below:

GBP'000

----------------------------------- ---------

Cash at bank 5,019

Intangible assets 250

Net liabilities (excluding

cash at bank and intangible

assets) (564)

------------------------------------ ---------

Net assets before goodwill

on acquisition 4,705

Consideration 11,044

Goodwill recognised on acquisition 6,339

Consideration

Cash paid 2,217

Convertible loan notes at

fair value 8,827

------------------------------------ ---------

Total consideration 11,044

Cash at bank on acquisition 5,019

Cash paid on acquisition 2,217

------------------------------------ ---------

Net cash on acquisition 2,802

The loan notes have a nominal value of GBP9 million, are

unsecured and carry a coupon of 1%. The first GBP2 million of loan

notes were convertible into AssetCo ordinary shares in certain

circumstances, at market value, up to 31 December 2022 with the

remainder convertible into AssetCo ordinary shares, at GBP1.45 per

share, up to 31 December 2023. If not converted the loan notes are

repayable at nominal value on 31 December 2023.

The reduction in nominal value of the loan notes represents a

fair value adjustment to reflect the difference in the 1% coupon

and a market interest rate. An amount of GBP173,000 will be

amortised over the life of the loan notes with an amount of

GBP68,000 expensed by 31 March 2023.

As announced on 20 March 2023 the SVM vendors, following an

extension of their conversion option date to 28 February 2023, duly

exercised their option to convert the first GBP2 million of loan

notes into AssetCo ordinary shares. The market price agreed was

68.7p per share and led to the issue to the SVM vendors of

2,911,208 AssetCo ordinary shares which were satisfied by the

transfer of shares from those held in treasury. As set out in

Companies Act 2006 the difference between the average purchase

price of these shares and the agreed issue price is taken to share

premium.

At 31 March 2023 following conversion and amortisation of the

fair value interest the balance on convertible loan notes is

GBP6,895,000.

13. Cash generated by operations

Six months ended Year ended

Unaudited Unaudited Audited

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------------------- --------- --------- -------------

(Loss)/profit before tax for the period (13,537) (2,641) (8,913)

Share-based payments - LTIP - 2,481 2,749

Cash effect of LTIP - - (3,938)

Share of profits of associate (266) (1,512) (181)

Interest received from associate - - (1,977)

Increase in investments (7) (1,200) -

Reduction in fair value of investments - - 9,750

Gain on disposal of fair value investments - - (18)

Proceeds of assets held for resale 1,613 - 5,462

Bargain purchase - - (3,227)

Impairment of long-term receivable 1,718 - -

Impairment of goodwill 5,000 - -

Depreciation 14 3 14

Amortisation of intangible assets 386 22 227

Amortisation of right-of-use assets 431 - 187

Finance costs 136 - 10

Finance income (2) (390) (974)

Dividends from investment held at fair

value - - (11,459)

(Increase)/decrease in receivables 612 (29) 928

(Decrease)/increase in payables (4,851) 498 (6,556)

------------------------------------------- --------- --------- -------------

Net cash (outflow)/inflow from operations (8,759) (2,768) (17,916)

------------------------------------------- --------- --------- -------------

14. Electronic communications

This Half-year Report is available on the Company's website

www.assetco.com . News updates, regulatory news and financial

statements can be viewed and downloaded from the Company's website,

www.assetco.com . Copies can also be requested, in writing, from

The Company Secretary, AssetCo plc, 30 Coleman Street, London EC2R

5AL. The Company is not proposing to bulk print and distribute hard

copies of the Half-year Report unless specifically requested by

individual shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKNBDDBKBAAD

(END) Dow Jones Newswires

June 14, 2023 02:00 ET (06:00 GMT)

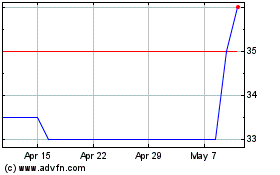

Assetco (LSE:ASTO)

Historical Stock Chart

From Apr 2024 to May 2024

Assetco (LSE:ASTO)

Historical Stock Chart

From May 2023 to May 2024