AfriTin Mining Ltd Uis Tin Mine Operational Update (7593O)

01 February 2019 - 6:00PM

UK Regulatory

TIDMATM

RNS Number : 7593O

AfriTin Mining Ltd

01 February 2019

1 February 2019

AfriTin Mining Limited

("AfriTin" or the "Company")

Uis Tin Mine Operational Update

Appointment of Joint Broker

AfriTin Mining Limited (AIM: ATM), a mining company with a

portfolio of near production tin assets in Namibia and South

Africa, with the flagship asset being the Uis Tin Mine in Namibia

("Uis Mine"), is pleased to provide an operational update related

to the development of a mining and processing facility at Uis as

part of the Phase 1 Pilot Plant Project.

Highlights

-- Decision taken to modify the Phase 1 Plant to add production

capacity and also produce a tantalum concentrate which will add to

revenues

-- Maiden tin and tantalum concentrate production from Phase 1 expected in Q2 2019

-- Stock piling of ore proceeding well following first blast in December 2018

-- Confirmation of sufficient process water supply from

hydrogeological study and water drilling programme

-- Electrical grid power to be supplied from existing high-voltage line

-- Mobilisation of mining contractors

-- Enhancements of the concentrator plant design and subsequent construction

-- Further progress on drilling programme in line with the Company target

-- Appointment of H&P Advisory Limited ("Hannam &

Partners") as joint broker and corporate advisor

Following the start of the civil construction works in June

2018, the Company has been preparing and rehabilitating the Uis

Mine site for the commencement of the Phase 1 Pilot Plant

commissioning and production of tin concentrate. As previously

announced, during December 2018 the Company undertook the first

large-scale blast of mining material. The primary crushing circuit

was commissioned and first material was crushed and stockpiled. The

Company is well advanced with the procurement of mining contractor

services for drilling, blasting, loading and hauling and

mobilisation is expected once the contract has been finalised.

In consultation with its engineering consultants, The Company

has decided to implement two additional components to the Phase 1

Pilot Plant. To increase plant throughput capacity and flexibility,

a third dense medium separation ("DMS") section has been procured.

In addition, a magnetic separation circuit will be installed in the

plant. This addition will allow the plant to produce tantalum

concentrate alongside the primary tin concentrate. The improvements

should now result in first concentrate being produced in Q2 2019

but are expected to increase the overall revenue-generation

capability of the Pilot Plant

The Company has made significant progress in addressing the

infrastructure requirements for the Phase 1 Pilot Plant and Phase 1

of production. A geohydrological study, water drilling and test

pumping programme has been completed. The results of the programme

have confirmed the viability of using groundwater sources to supply

the Phase 1 Pilot Plant with the required process water.

Electrical power to the operation will be provided from the

existing high-voltage supply line that currently terminates

approximately one kilometre from the plant processing site. The

Company is now in the process of concluding a supply agreement with

the relevant authorities that will allow the plant to be connected

to the power grid. Backup power, in the form of diesel generating

sets, are also being installed at site.

Accordingly, the Company confirms that as a consequence of the

additional work its target date for full scale concentrate

production is now quarter 2, 2019.

Phase 1 exploration commenced at the start of November 2018 with

the primary goal of validating the existing historic SRK resource

over the V1 and V2 pegmatites. To date, 18 of the required 26 drill

holes have been completed with all finished holes being

geotechnically and geologically logged directly onto a new

cloud-based geodatabase system. The core will be assayed and

prepared for the declaration of an initial JORC resource on the

project, and further announcements will be made in due course as

appropriate.

Appointment of Joint Broker

AfriTin is also pleased to confirm the appointment of Hannam

& Partners as a corporate advisor and joint broker. Together,

we have been working closely on the development strategy of the

Company and the conclusion of a working agreement is a culmination

of this work.

Commenting on the developments CEO Anthony Viljoen stated, "The

additions announced today to the Phase 1 Pilot Plant will allow for

the production of both tin and tantalum concentrates as well as

larger throughput capacity at our Uis Phase 1 Pilot Plant. These

changes will not only improve revenue from Phase 1 but also allow

us to further de-risk the larger Phase 2 production which is

subject to a Bankable Feasibility Study."

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

For further information, please visit www.afritinmining.com or

contact:

AfriTin Limited

Anthony Viljoen, CEO +27 (11) 268 6555

Nominated Adviser and Joint Broker

WH Ireland Limited

Katy Mitchell

James Sinclair-Ford +44 (0) 207 220 1666

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Nilesh Patel +44 (0) 20 7907 8500

Joint Broker

NOVUM Securities Limited

Jon Belliss +44 (0)20 7399 9400

Financial PR (United Kingdom)

Tavistock +44 (0) 207 920 3150

Jos Simson

Barney Hayward

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining is the first pure tin company listed in London

and its vision is to create a portfolio of world-class,

conflict-free, tin producing assets. The Company's flagship asset

is the Uis brownfield tin mine in Namibia, formerly the world's

largest hard-rock tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current two-fold strategy: fast track Uis

brownfield tin mine in Namibia to commercial production in Q2 2019

ramping up to 5,000 tonnes of concentrate, and consolidation of

other quality African tin assets. The Company strives to capitalise

on the solid supply/demand fundamentals of tin by developing a

critical mass of tin resource inventory, achieving production in

the near term and further scaling production by consolidating tin

assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLBBMBTMBBJTAL

(END) Dow Jones Newswires

February 01, 2019 02:00 ET (07:00 GMT)

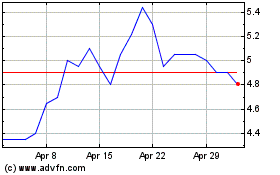

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to May 2024

Andrada Mining (LSE:ATM)

Historical Stock Chart

From May 2023 to May 2024