ATLAS Mara Limited Strategic Update and Voluntary Delisting (1941Q)

26 October 2021 - 3:50AM

UK Regulatory

TIDMATMA

RNS Number : 1941Q

ATLAS Mara Limited

25 October 2021

October 25, 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Atlas Mara announces voluntary delisting

and provides update on strategic review

Key Highlights:

-- The Company has made substantial progress on strategic initiatives, including:

o completion of the divestiture of BancABC Botswana

o announcement that it has reached agreement with Access Bank

Plc to combine its subsidiary in Zambia and the Zambian subsidiary

of Access Bank in a proposed merger transaction

-- The Company announces it has applied to the UK Financial

Conduct Authority and the London Stock Exchange for a voluntary

delisting and intends to become a privately held company

Update on Strategic Review:

Atlas Mara Limited ("Atlas Mara" or the "Company"), the

sub-Saharan African financial services group, has made substantial

progress on initiatives undertaken as part of its strategic review

that began over a year ago. Specifically, the Company has achieved

several key milestones including:

-- Restructuring of the holding company debt and agreement with

a substantial majority of creditors of the holding companies.

-- Completion of previously announced divestitures of the

Company's banking subsidiaries in Mozambique, Rwanda, and Botswana;

and received conditional regulatory approval for the previously

announced divestiture of its subsidiary in Tanzania with

anticipated completion following satisfaction of other closing

conditions.

-- Completion of the previously announced transaction relating

to its subsidiary in Botswana on October 11, 2021, with Access Bank

assuming ownership and control effective on that date.

-- The Company and ABCH also announce entry into definitive

agreements with Access Bank for a transaction that involves the

proposed merger of its subsidiary in Zambia with Access Bank's

subsidiary in Zambia, (the "Zambia Transaction"). The proposed

Zambia Transaction is subject to regulatory approvals and other

customary conditions precedent.

Voluntary Delisting:

Given the material progress made in the strategic review and the

previously announced requirement by the majority of the Company's

creditors who, pursuant to the Support and Override Agreement

require the Company to consider taking steps to cancel the listing

, the Company has determined to delist from the London Stock

Exchange. This follows the announcement on July 14, 2021 when the

Company informed the market it would inter alia, consider taking

steps to cancel the listing and admission to trading in order to

reduce costs and administrative burden of the public listing, since

the listing does not generate sufficient benefit to the Company

.

The Company has applied to the UK Financial Conduct Authority

("FCA") and the London Stock Exchange to effect a cancellation of

the listing of its ordinary shares from the standard listing

segment of the FCA's Official List and from trading on the Main

Market of the London Stock Exchange ("Delisting"). It is

anticipated that, in accordance with Listing Rule 5.2.8R, the

Delisting will be effective at 8:00 a.m. on 24 November 2021.

Following the Delisting, the Company will no longer be subject to

the regulatory and statutory regime which applies to companies

admitted to the standard segment of the Official List and traded on

the Main Market.

The securities to which the Delisting relates are the ordinary

shares of no par value in the share capital of Atlas Mara with the

ISIN VGG0697K1066 (the "Shares"). Following the Delisting, it will

no longer be possible to trade the Shares on the London Stock

Exchange. However, as a privately held company, Atlas Mara will

retain the registration of its shares in Depository Interest form

(electronic shares). Therefore, shareholders will continue to be

able to hold their ordinary shares in the CREST uncertificated form

and should confirm with their existing stockbroker whether they are

able to trade unquoted shares.

The Company intends, following the Delisting, to put in place a

secondary trading facility to allow shareholders to trade their

ordinary shares. It cannot be guaranteed that any such facility

will offer a comparable degree of liquidity to that currently

available as a result of Atlas Mara's listing. In addition,

following the Delisting, holders of Shares will continue to be

entitled to transfer such Shares in accordance with the

requirements of the Company's articles of association and the law

of the British Virgin Islands. Shareholders should take their own

tax and broking advice to determine whether to hold uncertificated

Depositary Interests or certificated shares.

The Delisting will allow the Company to save costs, reduce its

administrative and regulatory burden, operate as a leaner platform,

and provide the flexibility to pursue other options.

Contact Details:

Investors

Kojo Dufu, +1 212 883 4330

Media

Apella Advisors, +44(0) 7818 036 579

Anthony Silverman

About Atlas Mara

Atlas Mara Limited (LON: ATMA) is a financial institution listed

on the London Stock Exchange. For more information, visit

www.atlasmara.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRPPGBCUUPGGQA

(END) Dow Jones Newswires

October 25, 2021 12:50 ET (16:50 GMT)

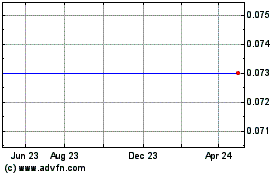

Atlas Mara (LSE:ATMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

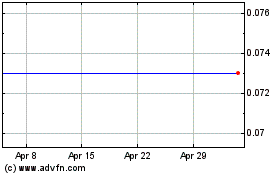

Atlas Mara (LSE:ATMA)

Historical Stock Chart

From Jan 2024 to Jan 2025