TIDMATOM

RNS Number : 9664D

ATOME Energy PLC

27 June 2023

27 June 2023

ATOME ENERGY PLC

("ATOME", "the Company", or "the Group")

Audited Results for the year ended 31 December 2022

ATOME (AIM: ATOM), the only international green hydrogen,

ammonia, and fertiliser project development company on the London

Stock Exchange, with current large-scale projects in Latin America

and Europe, as well as hydrogen mobility projects, is pleased to

announce its audited results for the year ended 31 December

2022.

These financial statements presented are the first Annual Report

and Accounts for ATOME following a full year of operations and

project development after joining the London Stock Exchange's AIM

market on 30 December 2021.

The Company's Annual Report will be posted to shareholders on 29

June 2023 together with the Notice for the Annual General

Meeting.

Financial Highlights FY2022

-- The financial results are presented for the Group for the full year ended 31 December 2022, with 2021 results for

the period from 6 January 2021 when the Group started its operations.

-- The comprehensive loss for the year ended 31 December 2022 was US$5.9 million (2021: US$2.2 million).

-- In December 2022, the Group raised gross proceeds of US$4.3 million (2021: US$7.8 million (US$7.0 million net))

from the issue of new shares on AIM to Baker Hughes and other shareholders, in May 2023, providing an additional

US$4.6 million.

Annual General Meeting

The Company intends to hold the Annual General Meeting to

approve the audited financial statements at 11.00am on 25 July 2023

at Carrwood Park, Selby Road, Leeds, LS15 4LG. The Notice will be

sent with the full Annual Report on 29 June 2023.

Peter Levine, Chairman, stated:

"This is the first Annual Report and Accounts for ATOME

following a full year of activity and project development. It was

only on 30 December 2021 that ATOME became the first green

hydrogen, ammonia, and fertiliser project development company to

join the London Stock Exchange's AIM market and today ATOME remains

the only pure play company in the field on the London market.

Since Admission at the end of 2021, the Company has made

material and rapid progress and has expanded its business and

footprint above and beyond what was originally planned. In the

short period since the IPO, whilst not losing focus on our core

projects, we have signed world scale power purchase agreement for

our Phase One 120 MW in Paraguay, progressing our 300 MW Phase Two

Project in that country, created our Mobility Division, ordered its

first electrolyser due for delivery later this year, progressed our

Icelandic project and entered Costa Rica with a substantial local

partner. Further, in May 2023, we welcomed Baker Hughes as a

strategic technological partner and investor in the Company.

Following the success in securing significant baseload renewable

power supply in Paraguay, ATOME commenced FEED studies and

financing negotiations for its first green fertiliser project in

Villeta for which there is a significant market demand. Maintaining

our fast-track schedule, we expect our first phase flagship project

to progress to Final Investment Decision in Q4 2023, with the start

of full industrial scale production targeted to commence in 2025.

Significantly, our target of commencing full production of green

fertiliser places us front and centre at the forefront of the

industry.

We are building projects which will produce globally traded

green commodities whilst increasing food and energy security

locally. We have every confidence that ATOME will go from strength

to strength and in the years ahead become one of the world leaders

in the production of green hydrogen, ammonia, and fertiliser,

delivering capital appreciation to our shareholders from

sustainable growth whilst being an important contributor to the

drive for global net zero in the food and agriculture industries as

well as mobility.

Financial

The financial statements present group results for the ATOME

Energy Group for its first full year of independent operations,

following its debut in 2021 as an independent AIM listed business

focused on producing, marketing, and distributing green hydrogen

and ammonia.

Total comprehensive loss for the year ended 31 December 2022 was

US$5.9 million (2021: US$2.2 million), in line with expectations,

reflecting the increased level of activity and fast track

development throughout ATOME's project portfolio.

Sustainability

ATOME acknowledges and respects the increasing emphasis on

climate change around the world. The Company aims to build a

platform for a cleaner, more sustainable future for our planet in

recognition of the climate change imperative driving nations and

industries around the world to "green" their infrastructure,

operations, and products.

I would like to close by thanking all my colleagues throughout

the company for their contribution to the success of ATOME. We are

looking forward to another year of great achievement and

progress."

Olivier Mussat, Chief Executive Officer, stated:

"Since its foundation and subsequent emergence as an independent

AIM listed business ATOME has made significant operational progress

and is already establishing itself as a leading international

developer in the field of green hydrogen and ammonia. ATOME's

strategy has been clear since day one: accelerate the development

of sustainable and profitable green hydrogen and ammonia by looking

for reasonably sized projects that can leverage existing

infrastructure in order to be first to market producing green

molecules at the lowest cost possible near markets with existing

demand.

We listed in London through our IPO in December 2021 having

become a public company two months earlier. At the time of

Admission to AIM we had our two core projects in Paraguay and

Iceland, both substantive in nature and providing significant

opportunity for significant increases in shareholder value,

extending into the future. Hindsight, together with subsequent

events, has fortuitously shown ATOME to be the right company at the

right time for the green energy and fertiliser markets.

I am pleased to report that since that time, ATOME through its

new Mobility Division in Paraguay, the signing of the Villeta PPA,

and the formation of a new JV in Costa Rica has also exceeded our

original expectations at the time of the IPO both in scale and the

time frame of our business. The market has recognised the delivery

of our strategy with the ATOME share price significantly

outperforming most of our peers since our listing.

A new division, ATOME Mobility was created in February 2022,

dedicated to providing a clean energy solution for heavy road

transport and shipping, two hard-to-abate industries where battery

alternatives cannot provide effective solutions using present

technology. Over the past year, a number of significant technology

milestones have been reached in both hydrogen-based mobility and

shipping. These place ATOME Mobility in a prime position to

leverage its early investments as our initial focus will be on

hydrogen energy supply to the road transport sector in the most

populous areas of Paraguay. This new division runs in parallel with

the planning for ATOME's large scale green hydrogen, ammonia and

fertiliser businesses in Paraguay and Iceland.

The most significant event for ATOME during the year was in May

2022, when we signed a long term 60MW Power Purchase Agreement

("PPA") with ANDE, the national electricity supply and distribution

company of Paraguay, further increased to 120 MW in November 2022.

This is the largest single PPA ever signed between ANDE and an

industrial user. Since then, we have bought the land for the site,

engaged Urbas Energy, one of the leading hydrogen and power EPC

contractors, in co-operation with Casale, one of the world's oldest

ammonia and complex fertiliser technology companies, to lead the

front-end engineering and design (FEED) study for Villeta, with

Natixis Bank and the InterAmerican Development Bank working with us

on structuring the financing package for the project.

In January 2023, we created National Ammonia Corporation S.A

(NAC), a joint venture with Cavendish, the renewable energy arm of

the Quirós family-owned Grupo Purdy S.A., one of the largest

corporations in Costa Rica, to pursue renewable energy generation

and green ammonia production. Similar to Paraguay, Costa Rica is

one of the greenest countries in Latin America with a significant

agricultural sector, presenting a great opportunity to leverage all

the work we are currently doing in Paraguay.

In May 2023, we took the decision to explore the options for

developing Villeta as a producer of green fertiliser (Calcium

Ammonium Nitrate, or CAN) as the most value accretive option for

the production facility, supplying to the fast-growing agricultural

market in Mercosur and worldwide. We have also entered into the

strategic partnership with Baker Hughes who invested in the Company

and with whom we have agreed the right of first offer (ROFO) for

the supply of compressor and other equipment to our projects.

Our Iceland project is also progressing in tandem with our work

elsewhere and is now planned to come on-line mid-decade.

We believe ATOME is ideally placed to help decarbonise energy,

transport, and agriculture. Our projects will contribute

significantly to fulfilling the UN's Sustainable Development Goals

(SDGs), particularly SDG 7, 9, 11, 12 and 13 which cover affordable

and clean energy; industry, innovation, and infrastructure;

sustainable cities and communities; responsible consumption and

production, and: urgently combating climate change.

The increase in hydrocarbon and fertiliser prices, together with

the international emphasis on environmentally necessary green

commodities and security of supply, has provided a very fertile end

market for ATOME's planned production. We have ever increasing

confidence, backed by industry interest in us, that there will be

robust demand for our production which will support strong

economics for our business, with profitability and sustainability

going hand in hand.

We look forward to delivering further material progress during

the balance of 2023 as we move forward with bringing our projects

on-line with FID on Villeta projected for Q4 this year and

production targeted to commence in 2025. We intend to develop a

pipeline of new international projects in other jurisdictions as we

become increasingly recognised as a leading first-mover developer

in green hydrogen and ammonia."

For more information, please visit https://www.atomeplc.com or

contact:

ATOME Energy PLC +44 (0) 113 337 2210

Nikita Levine, Investor Relations info@atomeplc.com

Beaumont Cornish (Nominated Adviser)

Roland Cornish, Michael Cornish +44 (0) 20 7628 3396

Liberum (Joint Broker)

Scott Mathieson, Kane Collings +44 (0) 20 3100 2000

SP Angel (Joint Broker)

Richard Hail, Harry Davies-Ball +44 (0) 20 3490 0470

finnCap (Joint Broker)

Christopher Raggett, George Dollemore +44 (0) 20 7220 0500

Tavistock (Financial PR and IR) +44 (0) 20 7920 3150

Simon Hudson, Rebecca Hislaire, atome@tavistock.co.uk

Charles Baister

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018. Upon

publication of this announcement, this inside information is now

considered to be in the public domain. The person who arranged for

the release of this announcement on behalf of the Company was Peter

Levine, Chairman.

About ATOME

ATOME Energy PLC is an AIM listed company targeting green

hydrogen, ammonia, and fertiliser production with over 500-megawatt

of projects in Paraguay, Iceland and Central America.

Since its admission to AIM in December 2021 ATOME has signed its

first electrolyser purchase order for its hydrogen transport

Mobility Division due to start generating revenue in 2023 and

signed a 120MW power purchase agreement with ANDE, the state energy

company in Paraguay for production of green ammonia to produce

industrial scale premium value green fertiliser in 2025. It has

procured 30 hectares of land in Villeta, Paraguay for that

facility, mandated Natixis Corporate Investment Bank and the

multilateral IDB Invest to lead the project funding and the FEED

study is currently underway with the international companies Urbas

and Casale.

In December 2022, ATOME entered into a joint venture with

Cavendish, the renewable energy arm of the substantial and

well-established Purdy Group based in Costa Rica and formed The

National Ammonia Corporation S.A, which is owned equally by ATOME

and Cavendish.

ATOME is in the process of operational planning, sourcing and

negotiations with green electricity suppliers, equipment providers

and offtake partners, including signed memoranda of understanding

and cooperation agreements in place with key parties, to use

electricity generated from existing geothermal sources in Iceland

and hydroelectric power in Paraguay and Costa Rica. All chosen

sites are located close to the power and water sources and export

facilities to serve significant domestic and then international

demand.

The Company has a green-focused Board which is supported by

major shareholders including Peter Levine, Trafigura, one of the

world's leading commodity and logistics company, and Schroders, a

leading fund manager, and from May 2023, Baker Hughes, a global

energy technology company operating in the energy and industry

sectors.

Financial review

"The consolidated financial statements present the group results

for the year ended 31 December 2022 and period ended 31 December

2021 for ATOME Energy Group, an independent AIM listed business

focused on producing, marketing, and distributing green hydrogen

and ammonia, as well as derivative products including

fertilisers.

Whilst ATOME Energy PLC was only formed in October 2021, to

bring the green energy business established by Molecular Energies

PLC (formerly President Energy PLC) to the market as an independent

entity, the financial results have been prepared adopting merger

accounting for the Group from the beginning of January 2021 as if

it had been operating throughout this period. This follows

established practice and is consistent with the Admission Document

in December 2021.

In December 2022, the Group raised proceeds of US$4.3 million

gross (US$4 million net) from a share placing. Proceeds totalling

US$2.5 million were received as at 31 December 2022, with US$1.6

million net receivable to be paid in due course. In addition, the

Group raised US$5.1 million and fully received US$4.6 million in

May 2023 in a placing to Baker Hughes and some other institutional

and private investors.

Additional financial support is available to the Group in the

form of a Standby Equity Facility Agreement. Under this agreement,

PLLG Investments Limited and Peter Levine, Non-Executive Chairman

have agreed to subscribe for shares at the placing price at the

option of the Company for 18 months from December 2021. This

facility was further extended to 30 June 2024 in December 2022.

This makes an additional GBP3.0 million facility available to the

Group.

In December 2022, the Group entered into a loan agreement with

Sudameris Bank in Paraguay to finance acquisition of the land plot

designated for its Villeta project. The loan agreement is for the

period of eight years, with principal repayments due in equal

quarterly instalments from March 2025 and carries an interest rate

of 9.5%. per annum. This loan is secured by the value of the above

land plot, with no recourse to the Group's other assets and

entities.

The financial results of the Group are presented in US Dollars

as all of the Group's budgeting, cost management and future trading

are primarily denominated and maintained in US Dollars. All

translation differences arising from translation from functional to

reporting currency are taken to the Foreign Currency Translation

Reserve on the statement of financial position."

Consolidated Statement of Comprehensive Income

Year ended 31 December 2022 and period ended 31 December

2021

2022 2021

Note US$000 US$000

Continuing Operations

Administrative expenses 2 (5,830) (2,267)

Other Income 62 -

Investment grant 170 24

--------- ---------

Operating loss (5,598) (2,243)

Finance income 2 -

Finance costs (2) -

--------- ---------

Loss before tax (5,598) (2,243)

Total income tax (charge)/credit - -

Loss for the year from continuing operations (5,598) (2,243)

========= =========

Share of loss attributable to non-controlling

interest 119 -

Loss for the year attributable to equity

holders (5,479) (2,243)

========= =========

Other comprehensive income, net of tax

Items that may be reclassified subsequently

to profit or loss

Exchange differences on translation of

foreign operations (387) 56

Total comprehensive loss for the year

attributable

--------- ---------

to the equity holders of the parent (5,866) (2,187)

========= =========

Loss per share US cents US cents

Basic loss per share from continuing operations 3 (16.80) (8.96)

========= =========

Diluted loss per share from continuing

operations (16.80) (8.96)

========= =========

Consolidated Statement of Financial Position

As at 31 December 2022 and 2021

2022 2021

ASSETS US$000 US$000

Non-current assets

Goodwill 6 6

Property, plant and equipment 939 45

945 51

-------- --------

Current assets

Trade and other receivables 2,223 6,355

Cash and cash equivalents 3,452 1,865

5,675 8,220

-------- --------

TOTAL ASSETS 6,620 8,271

======== ========

LIABILITIES

Current liabilities

Trade and other payables 1,649 1,198

Short term facility - 1,415

1,649 2,613

-------- --------

Non-current liabilities

Non-current portion of leases - 22

- 22

-------- --------

TOTAL LIABILITIES 1,649 2,635

======== ========

EQUITY

Share capital 96 87

Share premium 11,901 7,653

Retained loss (7,722) (2,243)

Translation reserve (331) 56

Share option reserve 1,146 83

-------- --------

5,090 5,636

Non-controlling interest (119) -

TOTAL EQUITY 4,971 5,636

-------- --------

TOTAL EQUITY AND LIABILITIES 6,620 8,271

======== ========

Consolidated Statement of Changes in Equity

Year ended 31 December 2022 and period ended 31 December

2021

Share Profit Non-

capital and

& loss Other controlling Total

premium account Reserves Total Interest Equity

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 6 January

2021 - - - - - -

Share-based payments - - 83 83 - 83

Shares issued on

reorganisation 67 67 67

Offer of shares to

public 8,071 - - 8,071 - 8,071

Costs of issue new

shares (398) - - (398) - (398)

Transactions with

the owners 7,740 - 83 7,823 - 7,823

-------- -------- --------- -------- ------------ --------

Loss for the period - (2,243) - (2,243) (2,243)

Translation reserve - - 56 56 56

Total comprehensive

loss for the year - (2,243) 56 (2,187) - (2,187)

-------- -------- --------- -------- ------------ --------

Balance at 31 December

2021 7,740 (2,243) 139 5,636 - 5,636

======== ======== ========= ======== ============ ========

Share-based payments - - 1,063 1,063 - 1,063

Offer of shares to

public 4,394 - - 4,394 - 4,394

Costs of issue new

shares (137) - - (137) - (137)

Transactions with

the owners 4,257 - 1,063 5,320 - 5,320

-------- -------- --------- -------- ------------ --------

Loss for the year - (5,479) - (5,479) (119) (5,598)

Translation reserve - - (387) (387) - (387)

Total comprehensive

loss for the year - (5,479) (387) (5,866) (119) (5,985)

-------- -------- --------- -------- ------------ --------

Balance at 31 December

2022 11,997 (7,722) 815 5,090 (119) 4,971

======== ======== ========= ======== ============ ========

Consolidated Statement of Cash Flows

Year ended 31 December 2022 and period ended 31 December

2021

2022 2021

US$000 US$000

Cash flows from operating activities

Cash (used in) / generated by operating activities

(Note 4) (6,152) 24

(6,152) 24

-------- --------

Cash flows from investing activities

Expenditure on development and production

assets - -

Acquisition Paraguay - (3)

Acquisition Iceland - (3)

- (6)

-------- --------

Cash flows from financing activities

Proceeds from issue of shares (net of expenses) 7,965 1,849

Repayment of obligations under leases (26) (2)

7,939 1,847

-------- --------

Net increase in cash and cash equivalents 1,787 1,865

Opening cash and cash equivalents at beginning

of period 1,865 -

Exchange gains/(losses) on cash and cash

equivalents (200) -

Closing cash and cash equivalents 3,452 1,865

======== ========

Notes

1. Accounting policies and preparation

The financial information set out in this announcement does not

constitute the Company's statutory financial statements and is

derived from the consolidated financial statements for the year

ended 31 December 2022 and period ended 31 December 2021.

Financial statements for the year ended 31 December 2022 and

period ended 31 December 2021 will be delivered in due course. The

auditors have reported on those accounts; their report was (i)

unqualified, (ii) did not include a reference to matters to which

the auditors drew attention by way of emphasis except for potential

material uncertainty that may arise in the event if, despite the

Directors' stated confidence, the Company is unable to achieve

project finance by December 2024, around the Company's ability to

continue as a going concern, and (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006 in respect

of the accounts for 2022 and 2021.

The Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Therefore, they continue to adopt the going

concern basis in preparing the financial statements for the year

ended 31 December 2022 and period ended 31 December 2021.

Whilst the consolidated financial statements from which this

preliminary announcement has been derived are prepared in

accordance with International Financial Reporting Standards

("IFRS") and applicable law, this announcement does not itself

contain sufficient information to comply with IFRS. The Annual

Report, containing consolidated financial statements that comply

with IFRS, will be sent out to shareholders by 30 June 2023.

2 Administrative expenses

2022 2021

US$000 US$000

Directors and staff costs (including non-executive

Directors) 2,946 167

Expenditure by Atome Limited under President

Energy - 1,249

Cost of issue for existing shares 164 679

Share-based payments 1,063 83

Depreciation 24 2

Other 1,633 87

5,830 2,267

======= =======

2022 2021

Expenditure by Atome Limited under President

Energy US$000 US$000

Director fees - 737

Legal fees - 55

Consultancy - 248

Finance and other administration - 209

- 1,249

========= =======

3 Loss per share 2022 2021

US$000 US$000

Loss for the period attributable to

the equity holders of the Parent Company (5,479) (2,243)

========= =========

Number Number

'000 '000

Weighted average number of shares in issue 32,606 25,021

========= =========

US cents US cents

Loss per share

Loss per share from continuing operations (16.80) (8.96)

========= =========

Diluted Loss per share from continuing operations (16.80) (8.96)

========= =========

At 31 December 2022, 2,129,000 (2021: 2,091,500) share options

and share warrant awards were in issue that, if exercised, would

dilute earnings per share in the future. No dilution per share was

calculated as with the reported loss adding share options and

warrants is anti-dilutive.

4 Notes to the consolidated statement

cash flows

2022 2021

US$000 US$000

Loss from operations before taxation (5,598) (2,243)

Interest on bank deposits 2 -

Depreciation of property, plant and equipment 24 2

Foreign exchange difference (203)

Share-based payments 1,063 83

-------- --------

Operating cash flows before movements

in working capital (4,712) (2,158)

Decrease / (increase) in receivables (394) (199)

Increase / (decrease) in short term facility (1,415) 1,415

Increase / (decrease) in payables 369 966

Net cash (used in) / generated by operating

activities (6,152) 24

======== ========

5 Segment reporting

In the opinion of the Directors, the operations of ATOME Energy

PLC comprise one class of business, the development, production and

the sale of green fuel energy and related activities.

An operating segment is a component of an entity that engages in

business activities from which it may earn revenues and incur

expenses and whose results are regularly reviewed by the Board of

Directors.

The Board of Directors reviews operating results by reference to

the core principle of geographic location. The Group currently has

projects in two geographical markets: the Paraguay and Iceland. It

has a head office and associated corporate expenses in the UK.

Iceland Paraguay UK Total

2022 2022 2022 2022

US$000 US$000 US$000 US$000

Administrative expenses 614 299 4,917 5,830

Other Income (62) (62)

Investment grant (170) - - (170)

Segment costs 444 299 4,855 5,598

-------- --------- -------- --------

Segment operating profit/(loss)

for the year ended 31 December

2022 (444) (299) (4,855) (5,598)

======== ========= ======== ========

Iceland Paraguay UK Total

2021 2021 2021 2021

US$000 US$000 US$000 US$000

Administrative expenses 20 8 2,239 2,267

Investment grant (24) - - (24)

Segment costs (4) 8 2,239 2,243

-------- --------- -------- --------

Segment operating profit/(loss)

for the period ended 31 December

2021 4 (8) (2,239) (2,243)

======== ========= ======== ========

Segment assets Iceland Paraguay UK Total

2022 2022 2022 2022

US$000 US$000 US$000 US$000

Goodwill 3 3 - 6

Property, plant and equipment - 939 - 939

-------- --------- ------- -------

3 942 - 945

Other assets - 44 2,179 2,223

-------

Total assets as at 31 December

2022 3 986 2,179 3,168

======== ========= ======= =======

Iceland Paraguay UK Total

2021 2021 2021 2021

US$000 US$000 US$000 US$000

Goodwill 3 3 - 6

Property, plant and equipment - 45 - 45

-------- --------- ------- -------

3 48 - 51

Other assets 3 3 6,349 6,355

-------

Total assets as at 31 December

2021 6 51 6,349 6,406

======== ========= ======= =======

Segment liabilities Iceland Paraguay UK Total

2022 2022 2022 2022

US$000 US$000 US$000 US$000

Total liabilities as at 31

December 2022 51 866 732 1,649

======== ========= ======= =======

Iceland Paraguay UK Total

2021 2021 2021 2021

US$000 US$000 US$000 US$000

Total liabilities as at 31

December 2021 5 52 2,578 2,635

======== ========= ======= =======

Reconciliation of the amounts reported for segment assets to the

Group's consolidated statement of financial position is as

follows:

2022 2021

US$000 US$000

Segment assets 3,168 6,406

Group cash 3,452 1,865

Group assets as at 31 December 6,620 8,271

======= =======

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKABPFBKDDAB

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

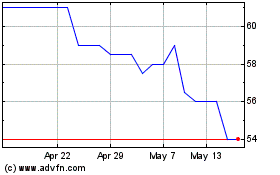

Atome (LSE:ATOM)

Historical Stock Chart

From Apr 2024 to May 2024

Atome (LSE:ATOM)

Historical Stock Chart

From May 2023 to May 2024