Babcock International Group PLC Response to speculation and update on trading (9771G)

12 November 2018 - 6:00PM

UK Regulatory

TIDMBAB

RNS Number : 9771G

Babcock International Group PLC

12 November 2018

12 November 2018

Babcock International Group PLC (Babcock or the Group)

Response to speculation and update on trading

Babcock, the engineering services company, is issuing this

statement to address recent speculation following the release of a

report by the anonymous and so far untraceable Boatman Capital.

This report included many false and malicious statements which the

Group strongly refutes. At the same time, the Group continues to

seek to discover who is behind Boatman Capital.

Ministry of Defence

Babcock has been a key supplier of critical services to the

Ministry of Defence (MOD) for over thirty years and we are

currently its second largest supplier, providing critical assets

and support across the UK's armed forces. We meet with the MOD on a

regular basis and our relationship remains as strong as ever.

Babcock is one of the 34 top cross-Government Strategic Suppliers,

who are continuously monitored, and we are one of the MOD's top 19

Strategic Suppliers. We are also a participant in the Government's

Strategic Partnering Programme. In total, Babcock is currently

delivering 128 contracts for the UK Government, with future

opportunities continuing to form a key part of our bidding

pipeline.

A UK Government spokesperson said:

"We monitor the health of all of our strategic suppliers,

including Babcock, and remain committed to working with them on a

wide range of programmes.

Babcock plays a key part in equipping our world leading armed

forces and the MOD spent more than GBP1.7 billion with the company

last year, supporting thousands of jobs across the nation."

Trading

Our most recent trading update, issued on 19 September 2018,

confirmed that underlying earnings were in line with expectations

and we confirmed our outlook for the financial year ending 31 March

2019. We gave an update on our programme of exiting a number of

small, low-margin businesses, which includes the Appledore

shipyard, and we announced that we are reshaping our oil and gas

business. As previously announced, we will provide an update on

these activities at our half year results.

The Board and Executive Management remain firmly focused on

delivering for our customers and shareholders. We can confirm that

the Group continues to enjoy a healthy financial position with cash

generation in line with expectations for the half year ending 30

September 2018. We continue to expect to reduce our debt during the

year, with our net debt to EBITDA ratio expected to be around 1.4

times by March 2019 and around 1.1 times by March 2020.

We will publish our half year results on 21 November 2018, when

we look forward to providing a detailed update on our

performance.

Ends

For further information please contact:

Babcock International Group PLC

Simon McGough Kate Hill

Director of Investor Relations Group Director of

Communications

Tel: +44 (0)20 3 235 5592 Tel: +44 (0)20 7355 5312

FTI Consulting

Andrew Lorenz

Nick Hasell

Tel: +44 (0)20 3737 1340

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RSPBFLLFVFFLFBB

(END) Dow Jones Newswires

November 12, 2018 02:00 ET (07:00 GMT)

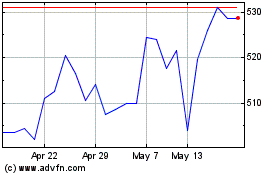

Babcock (LSE:BAB)

Historical Stock Chart

From Apr 2024 to May 2024

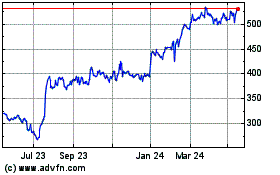

Babcock (LSE:BAB)

Historical Stock Chart

From May 2023 to May 2024