TIDMBLOE

RNS Number : 3413W

Block Energy PLC

17 April 2023

17 April 2023

Block Energy plc

("Block" or the "Company")

Q1 Operational Update

Block Energy Plc, the exploration and production company focused

on Georgia, is pleased to announce its operations update for the

three months ended 31 March 2023.

Highlights

-- Over 106,976 operational man-hours worked in Q1 2023, with

one minor Lost Time Incident ('LTI').

-- As announced after the quarter end, drilling operations on

well WR-B01Za proved successful, providing back-to-back drilling

successes on Project I.

-- Completion of farmout of non-core areas of licence XIB in

exchange for work programme valued at c. US$3m gross to Georgia Oil

and Gas Limited.

-- As announced after the quarter end, an MOU signed with the

Ministry of Economy and Sustainability.

-- Q1 production of 36.0 Mboe (Q4: 34.4 Mboe) or an average of 400 boepd (Q4: 374 boepd).

-- Q1 revenue of US$1,190,000(1) (Q4: US$1,840,000).

-- Secured senior loan facility of US$2.0m with US$1.06 million drawn.

(1) Oil Revenue of c. US$ 1.0 million not included in this

quarterly report as sales happened after quarter end.

Health, Safety & Emissions

Over 106,976 operational man-hours were worked by staff and

contractors in Q1, with one minor LTI and no serious incidents.

The Company again sought to minimise emissions, in-line with its

commitments, but needed to flare 60,656 m(3) of gas due to

unplanned shutdowns and WR-B01Za testing operations.

Operations

As planned, the WR-B01Za trajectory penetrated and followed a

seismic lineation running parallel to and around 500m to the west

of the lineation penetrated by JKT-01Z. The well crossed a fault

immediately before entering the productive part of the fracture

system, which caused unstable wellbore conditions. The Company's

drilling team conducted a successful low-cost wellbore intervention

resulting in a production rate of 269 boepd (241 bopd oil &

4,800 m3/d gas), as notified on 3 April 2023. Following this

reporting period, the well was handed over to the production team

and remains on production.

The results of JKT-01Z followed by WR-B01Za provide back-to-back

drilling success, further validating the Company's reservoir

understanding and confirming its ability to accurately place

horizontal wells in areas of good productivity.

Total production from Project I sidetrack wells exceeds 250,000

boe gross to date.

Corporate

The Company has completed the previously announced agreement for

a 50% farm-out of non-core areas of Licence XIB to Georgia Oil

& Gas Limited, in exchange for a work programme with an

estimated value of $3m gross, comprising $2.5m for 2D seismic

acquisition and $0.5m for seismic reprocessing ("Project IV").

As announced on 9(th) March 2023 (https://bit.ly/409ej7i), the

farmout provides the Company with direct exposure to a high-impact

exploration play, targeting prospective resource volumes of 3.1

TSCF gas and 1,400 MMbbl oil, which is benefiting from a material

work programme at no cost to the Company. None of the existing

fields, current production nor future development plans associated

with Projects I, II and III, within Licence XIB, are subject to the

farm-out.

Additionally, the Company secured a senior loan facility of US

$2.0m, of which US$ 1.06 million has been drawn down. The funds

provide Block with the resources to accelerate its Project I

development programme, which includes the recent successful

drilling of well WR-B01Za.

Oil and Gas Production

During Q1, gross production (including the state of Georgia's

share) was 36.0 Mboe (Q4: 34.4 Mboe), comprising 26.8 Mbbls of oil

(Q4: 27.4 Mbbls) and 9.2 Mboe of gas (Q4: 7.0 Mboe). The average

gross production rate for Q1 was 400 boepd (Q4: 374 boepd).

Oil Sales

In Q1 2023, the Company sold 13.3 Mbbls of oil (Q4: 21.3 Mbbls)

for US$ 999,000 (Q3: US$ 1,691,000), at a weighted average price of

US$75 per barrel (Q4: US$ 79 per barrel). The decrease in sales,

compared to production, relates to the timing of liftings.

As of 31 March 2023, the Company had c. 12,500 bbls of oil in

storage, which is expected to be sold in April, generating

approximately US$1.0m in revenue at the current Brent price and

therefore falls into the next reporting period.

Gas Sales

In Q1 2023, the Company sold 37.7 MMcf of gas (Q4: 27.3 MMcf)

for US$ 194,900 (Q4: US$ 149,000), resulting in a weighted average

price of approximately US$ 5.57/Mcf (Q4: US$ 5.45/Mcf).

Block Energy plc's Chief Executive Officer, Paul Haywood,

said:

"The first quarter of 2023 saw a robust start to the year. The

Company continued to deliver on its successful drilling and asset

development programme, with the results of WR-B01Za leading to

record group production levels being realised outside this

reporting period.

"Our focus on operational excellence and cost discipline has

allowed us to deliver good results this quarter, further

demonstrating our resilience and ability to create value for our

shareholders. We remain busy on many fronts, and look forward to

providing further updates on our progress in due course."

Stephen James BSc, MBA, PhD (Block's Subsurface Manager) has

reviewed the reserve, resource and production information contained

in this announcement. Dr James is a geoscientist with over 40 years

of experience in field development and reservoir management.

**ENDS**

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

For further information please visit

http://www.blockenergy.co.uk/ or contact:

Paul Haywood Block Energy plc Tel: +44 (0)20

(Chief Executive 3468 9891

Officer)

Neil Baldwin Spark Advisory Partners Tel: +44 (0)20

(Nominated Adviser) Limited 3368 3554

Peter Krens Tennyson Securities Tel: +44 (0)20

(Corporate Broker) 7186 9030

P hilip Dennis C elicourt Communications Tel: +44 (0)20

/ M ark Antelme 8 434 2 643

/ Ali AlQahtani

(Financial PR)

Notes to editors

Block Energy plc is an AIM-listed independent oil and gas

company focused on production and development in Georgia, applying

innovative technology to realise the full potential of previously

discovered fields.

Block has a 100% working interest in Georgian onshore licence

blocks IX and XIB. Licence block XIB is Georgia's most productive

block. During the mid-1980s, production peaked at 67,000 bopd and

cumulative production reached 100 MMbbls and 80 MMbbls of oil from

the Patardzeuli and Samgori fields, respectively. The remaining 2P

reserves across block XIB are 64 MMboe, comprising 2P oil reserves

of 36 MMbbls and 2P gas reserves of 28 MMboe. (Source: CPR Bayphase

Limited: 1 July 2015). Additionally, following an internal

technical study designed to evaluate and quantify the undrained oil

potential of the Middle Eocene within the Patardzeuli field, the

Company has estimated gross unrisked 2C contingent resources of 200

MMbbls of oil.

The Company has a 100% working interest in licence block XIF

containing the West Rustavi onshore oil and gas field. Multiple

wells have tested oil and gas from a range of geological horizons.

The field has so far produced over 75 Mbbls of light sweet crude

and has 0.9 MMbbls of gross 2P oil reserves in the Middle Eocene.

It also has 38 MMbbls of gross unrisked 2C contingent resources of

oil and 608 Bcf of gross unrisked 2C contingent resources of gas in

the Middle, Upper and Lower Eocene formations (Source: CPR

Gustavson Associates: 1 January 2018).

Block also holds 100% and 90% working interests respectively in

the onshore oil producing Norio and Satskhenisi fields.

The Company offers a clear entry point for investors to gain

exposure to Georgia's growing economy and the strong regional

demand for oil and gas.

Glossary

-- bbls: barrels. A barrel is 35 imperial gallons.

-- Bcf: billion cubic feet.

-- boe: barrels of oil equivalent.

-- boepd: barrels of oil equivalent per day.

-- bopd: barrels of oil per day.

-- Mbbls: thousand barrels.

-- Mboe: thousand barrels of oil equivalent.

-- Mcf: thousand cubic feet.

-- MD: measured depth.

-- MMbbls: million barrels.

-- MMboe: million barrels of oil equivalent.

-- MMcf: million cubic feet.

-- TVD: True Vertical Depth.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGPUPWCUPWGQQ

(END) Dow Jones Newswires

April 17, 2023 02:00 ET (06:00 GMT)

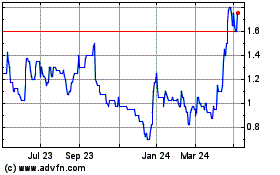

Block Energy (LSE:BLOE)

Historical Stock Chart

From Jan 2025 to Feb 2025

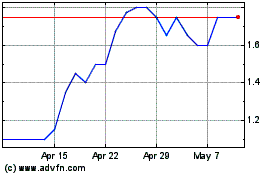

Block Energy (LSE:BLOE)

Historical Stock Chart

From Feb 2024 to Feb 2025