TIDMBLOE

RNS Number : 8515P

Block Energy PLC

12 October 2023

12 October 2023

Block Energy plc

("Block" or the "Company")

Q3 Operational Update

Block Energy plc, the development and production company focused

on Georgia, is pleased to announce its operational update for the

three months ended 30 September 2023.

Highlights

-- Average production of 630 boepd during the quarter (Q2: 664 boepd)

-- Third successful Project 1 well, with WR-34Z placed on production at 150 boepd

-- Results from well WR-34Z validates internal field 3C contingent resources of 27.5 MMstb

-- Focus now on the spud of the fourth Project I well, KRT-45Z and advancing Project III

Health, Safety & Emissions

Over 109,316 operational man-hours were worked by staff and

contractors in Q3, with no Lost Time Incidents.

The Company continues to minimise emissions, in-line with its

comm itments, flaring only 98,572 m(3) or approximately 1.1m(3) /d

of gas over the period as a result of power shutdowns and

maintenance.

Operations

Average production for Q3 was 630 boepd which, combined with a

healthy realised Brent price, means Block continues to build its

cash position, which can be redeployed to advance its higher impact

opportunities, such as the significant multi TCF contingent gas

under Project III, whilst continuing to execute Project I.

The results of well WR-34Z further validate the conclusions of

the ERCE reserves report, which attributed 3.01 MMstb oil and 2.14

BSCF gas, with an NPV10 of $57m, to a portion of the West

Rustavi/Krtsanisi field. It also supports the Company's internal

contingent resource report, which ascribes 3C contingent resources

of 27.5MMstb to the wider field.

Well WR-34Z was drilled without incident, on time and within

budget, by the Company's drilling team and is the third successful

Project I well, further enhancing the Company's sub-surface

model.

Corporate

During the quarter, the Company's financial position continued

to improve on the back of strong sales and a higher, relative to

last period, oil price. This ongoing improvement in the Company's

cash position will drive additional work across its various

projects, with an immediate focus on Project III.

Post period, the Company completed the evaluation of bids for a

Competent Persons Report on its Lower Eocene and Upper Cretaceous

gas reservoirs (Project III) and has now awarded the contract to

RISC Advisory. The CPR will be shared with potential Project III

farm-in partners, in due course.

Oil and Gas Production

During Q3, gross production was 58.0 Mboe (Q2: 60.4 Mboe),

comprising 44.3 Mbbls of oil (Q2: 48.5 Mbbls) and 13.6 Mboe of gas

(Q2: 11.9 Mboe). The average gross production rate for Q3 was 630

boepd (Q2: 664 boepd).

Oil Sales

In Q3 2023, the Company sold 24.9 Mbbls of oil (Q2: 38.0 Mbbls)

for US$1,740,000 (Q2: US$ 2,451,000).

As of 30 September 2023, the Company had c. 17.34 Mbbls of oil

in storage.

Gas Sales

In Q3 2023, the Company sold 57.4 MMcf of gas (Q2: 50.3 MMcf)

for US$ 256,000 (Q2: US$ 266,000).

Block Energy plc's Chief Executive Officer, Paul Haywood,

said:

"The third quarter of the year saw continued progress from the

Company. Block's third consecutive well continues to add confidence

to our Project I drilling strategy, whilst positioning the Company

to pursue the higher impact opportunities throughout our portfolio,

such as those defined within Project III and now being audited by

RISC. Focus now shifts to the spud of our fourth well under this

programme, KRT-45Z whilst we continue to advance our high impact

strategy across Project III. I look forward to providing further

updates on this activity soon."

Stephen James BSc, MBA, PhD (Block's Subsurface Manager) has

reviewed the reserve, resource and production information contained

in this announcement. Dr James is a geoscientist with over 40 years

of experience in field development and reservoir management.

**ENDS**

THIS ANNOUNCEMENT CONTAINS INFORMATION PREVIOUSLY DEEMED BY THE

COMPANY TO BE INSIDE INFORMATION AS STIPULATED UNDER THE UK VERSION

OF THE MARKET ABUSE REGULATION NO 596/2014 WHICH IS PART OF ENGLISH

LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018, AS AMENDED.

WITH THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, SUCH INFORMATION IS CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

For further information please visit

http://www.blockenergy.co.uk/ or contact:

Paul Haywood Block Energy plc Tel: +44 (0)20

(Chief Executive 3468 9891

Officer)

Neil Baldwin Spark Advisory Partners Tel: +44 (0)20

(Nominated Adviser) Limited 3368 3554

Peter Krens Tennyson Securities Tel: +44 (0)20

(Corporate Broker) 7186 9030

P hilip Dennis C elicourt Communications Tel: +44 (0)20

/ M ark Antelme 7770 6424

/ Ali AlQahtani

(Financial PR)

Notes to editors

Block Energy plc is an AIM-listed independent oil and gas

company focused on production and development in Georgia, applying

innovative technology to realise the full potential of previously

discovered fields.

Block has a 100% working interest in Georgian onshore licence

blocks IX and XIB. Licence block XIB is Georgia's most productive

block. During the mid-1980s, production peaked at 67,000 bopd and

cumulative production reached 100 MMbbls and 80 MMbbls of oil from

the Patardzeuli and Samgori fields, respectively. The remaining 2P

reserves across block XIB are 64 MMboe, comprising 2P oil reserves

of 36 MMbbls and 2P gas reserves of 28 MMboe. (Source: CPR Bayphase

Limited: 1 July 2015). Additionally, following an internal

technical study designed to evaluate and quantify the undrained oil

potential of the Middle Eocene within the Patardzeuli field, the

Company has estimated gross unrisked 2C contingent resources of 200

MMbbls of oil.

The Company has a 100% working interest in licence block XIF

containing the West Rustavi onshore oil and gas field. Multiple

wells have tested oil and gas from a range of geological horizons.

The field has so far produced over 75 Mbbls of light sweet crude

and has 0.9 MMbbls of gross 2P oil reserves in the Middle Eocene.

It also has 38 MMbbls of gross unrisked 2C contingent resources of

oil and 608 Bcf of gross unrisked 2C contingent resources of gas in

the Middle, Upper and Lower Eocene formations (Source: CPR

Gustavson Associates: 1 January 2018).

Block also holds 100% and 90% working interests respectively in

the onshore oil producing Norio and Satskhenisi fields.

The Company offers a clear entry point for investors to gain

exposure to Georgia's growing economy and the strong regional

demand for oil and gas.

Glossary

-- bbls: barrels. A barrel is 35 imperial gallons.

-- Bcf: billion cubic feet.

-- boe: barrels of oil equivalent.

-- boepd: barrels of oil equivalent per day.

-- bopd: barrels of oil per day.

-- Mbbls: thousand barrels.

-- Mboe: thousand barrels of oil equivalent.

-- Mcf: thousand cubic feet.

-- MD: measured depth.

-- MMbbls: million barrels.

-- MMboe: million barrels of oil equivalent.

-- MMcf: million cubic feet.

-- TVD: True Vertical Depth.

Project I: focused on the West Rustavi/Krtsanisi development and

supported by an independent Competent Person's Report from ERCE.

The Rustavi/Krtsanisi development sits across licence areas XIF

& XI . An internal report assigns 27.5 MMbbl 3C Contingent

Resources.

Project II : evaluation of large, undrained areas of the deeper

zones of the Middle Eocene reservoir within the Patardzeuli field,

within licence XI . Designed to evaluate and test 200 MMbbl 2C

Contingent Resources.

Project III: aimed at the appraisal and monetization of

substantial contingent resources of gas within the XI & XIF

licenses, within the Lower Eocene, Paleocene and Upper Cretaceous

geological formations. Internal estimates attribute 984 BCF 2C

Contingent Resources.

Project IV: exploration of the extensive gas potential within

the Company's wider portfolio, including licence area XIF and

exploration license IX, in partnership with Georgia Oil & Gas

limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBCBDGRXBDGXB

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

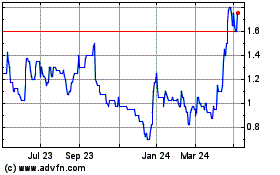

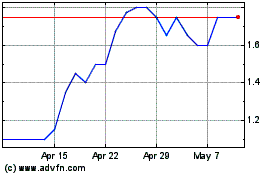

Block Energy (LSE:BLOE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Block Energy (LSE:BLOE)

Historical Stock Chart

From Feb 2024 to Feb 2025