Bruntwood Bond 2 PLC Bruntwood statement re Covid-19

15 April 2020 - 5:18PM

RNS Non-Regulatory

TIDMBRU2

Bruntwood Bond 2 PLC

15 April 2020

15 April 2020

BRUNTWOOD GROUP LIMITED

BRUNTWOOD INVESTMENTS PLC

BRUNTWOOD BOND 2 PLC

STATEMENT ON COVID-19

Bruntwood Group Limited ("Bruntwood") today updates the market

on the impact of the Covid-19 pandemic on its business.

Chris Oglesby, CEO of Bruntwood, said

"Our primary focus is the health, safety and well-being of our

employees, whilst working hard to support our customers and other

business partners during this challenging period. The Bruntwood

team is operational, working at home, with full access to our

central systems and communications network.

Financial Position

Following the issue of the Bruntwood Bond 2 plc retail eligible

bond in February 2020, there are current cash reserves in excess of

GBP25m and undrawn committed available debt facilities of GBP50m.

On repayment of the balance of the Bruntwood Investments plc 2013

retail bond in July 2020, we will have an additional estimated

GBP68m of unencumbered assets released from security arrangements

against which Bruntwood expects to be able to raise additional

finance as and when market conditions permit.

The Board has modelled various scenarios including reviewing

estimated customer default rates, lower retention rates, higher

concessions and valuation yield movement. Based on the output of

these models, The Board considers there to be sufficient income and

valuation headroom across Bruntwood's debt facilities and does not

expect Bruntwood to breach any terms relating to them. Valuations

would need to fall in excess of 30% and net income by 50% before

any covenants are breached. The earliest major bank facility

maturity is not until March 2022.

Impact on Operations

Bruntwood benefits from a diverse customer base across a variety

of sectors. We appreciate that current circumstances are putting

pressure on the cash flows of some of our customers. Where

Bruntwood itself is making savings that directly relate to customer

space (for example in the running of service charge) we will pass

these savings on to our customers. We will also work with customers

to help with their cash flow while they are waiting for government

payments, predominantly through the deferral of rent or the

provision of an incentive on entering new lease terms. We will look

at each customer's request for help on a case by case basis, but we

do anticipate those larger customers with strong balance sheets and

the ability to pay, to continue to pay their rent rather than

seeking to pass their rental liabilities on to the landlord.

As at 9th April 2020, 67% of March quarter rents due had been

collected compared to 75% at the same date in 2019. We have engaged

with almost the entire customer base and to date have received

requests for support from customers representing less than 10% of

the overall portfolio. The majority of requests relate to the

deferral of rent rather than the waiver of liabilities. We are

working closely with these customers to reach an agreement, and

will continue to closely monitor rent receipts over the coming

quarter.

We are continuing with our fully funded pre-let or predominantly

pre-let constructions. Major projects at Circle Square and Booths

Park continue to progress whilst complying with guidance around

social distancing. Work at Citylabs 2 had been paused for two weeks

following a national policy decision by the main contractor to shut

down work, but it has now been agreed that the development will

resume imminently. There are some shortages of materials on site

but contractors remain confident that they continue to make

progress to resolve such issues.

In order to control costs at a time of uncertain income, the

Board has taken active measures to ensure business continuity in

the near term. 490 colleagues have been furloughed from a total

workforce of 867. The Board has also cancelled all non-essential

overhead expenditure and deferred all capital expenditure unless

already linked with a committed customer transaction. All dividend

payments have been cancelled until the market returns to a more

settled state.

Assisting our local communities

Alderley Park is now operating as one of the national Covid-19

testing hubs staffed by medical professionals and volunteers.

Universities, research institutes and companies are lending testing

equipment to the new laboratory. Samples will be delivered to the

hub laboratories from across the country for analysis and we are

proud to be working together with the wider science community on

such a vitally important project.

We are working with the NHS to provide free access to parking at

our sites and we have handed over part of Citylabs on the

Manchester Foundation Trust Campus for NHS use supported by

Bruntwood colleagues.

We are liaising with our local community partners across the

business to develop volunteering opportunities for furloughed staff

during the crisis and are constantly reviewing opportunities for

further support in the coming months.

ENDS

For further information, please see Bruntwood's website at

https://bruntwood.co.uk/ or contact:

Kevin Crotty (Chief Financial Officer) +44 (0) 161 212 2222

Sean Davies (Director of Financing

& Investment) +44 (0) 161 212 2222

Forward-Looking Statements: This announcement contains certain

forward-looking statements with respect to Bruntwood's expectations

and plans, strategy, management objectives, future developments and

performances, costs, revenues and other trend information. These

statements are subject to assumptions, risk and uncertainty. Many

of these assumptions, risks and uncertainties relate to factors

that are beyond Bruntwood's ability to control or estimate

precisely and which could cause actual results or developments to

differ materially from those expressed or implied by these

forward-looking statements. Certain statements have been made with

reference to forecast process changes, economic conditions and the

current regulatory environment. Any forward-looking statements made

by or on behalf of Bruntwood are based upon the knowledge and

information available to Directors on the date of this

announcement. Accordingly, no assurance can be given that any

particular expectation will be met and Bruntwood's bondholders are

cautioned not to place undue reliance on the forward-looking

statements. Additionally, forward-looking statements regarding past

trends or activities should not be taken as a representation that

such trends or activities will continue in the future. Other than

in accordance with its legal or regulatory obligations (including

under the UK Listing Rules and the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority), Bruntwood

does not undertake to update forward-looking statements to reflect

any changes in events, conditions or circumstances on which any

such statement is based. Past bond performance cannot be relied on

as a guide to future performance. Nothing in this announcement

should be construed as a profit forecast. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in Bruntwood or an invitation or inducement to

engage in any other investment activities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRAUVRBRRNUSARR

(END) Dow Jones Newswires

April 15, 2020 03:18 ET (07:18 GMT)

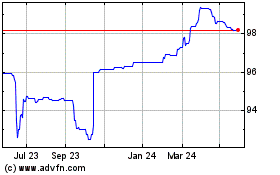

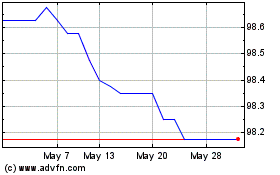

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Dec 2023 to Dec 2024