Baker Steel Resources Trust Ltd Net Asset Value(s) (1893H)

06 June 2017 - 4:01PM

UK Regulatory

TIDMBSRT

RNS Number : 1893H

Baker Steel Resources Trust Ltd

06 June 2017

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

6 June 2017

31 May April 2017 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 31 May 2017:

Net asset value per Ordinary Share: 49.0 pence

Since 28 April 2017 the NAV per share has decreased by 1.4%. A

19.4% fall in the share price of Ivanhoe Mines on the Toronto Stock

Exchange was partially offset by a 57.3% rise in the share price of

China Polymetallic on the Hong Kong Stock Exchange.

The Company had a total of 116,139,980 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 31 May

2017.

Portfolio Update

The Company's top 10 investments are as follows as a percentage

of NAV:

Polar Acquisition Ltd 36.0%

Bilboes Gold Limited 12.8%

Ivanhoe Mines Limited 11.5%

Cemos Group plc 7.0%

Metals Exploration plc 6.2%

Black Pearl Limited Partnership 4.8%

Ironstone Resources Limited 4.2%

Nussir ASA 3.3%

China Polymetallic Mining Limited 3.2%

Gobi Coal & Energy Limited 1.2%

Other Investments 2.2%

Net Cash, Equivalents and Accruals 7.6%

Investment Update

On 17 May 2017, Ivanhoe Mines Limited ("Ivanhoe") - whose share

price has experienced significant volatility over recent months -

announced an updated Mineral Resource estimate for its Kakula

discovery on the Kamoa project in the Democratic Republic of Congo.

Kakula's Indicated Mineral Resource has increased 62% to 116

million tonnes at a grade of 6.09% copper, using a 3% cut-off

grade. This updated resource statement has brought the total

Indicated Mineral Resource at Kamoa to 31.4 million tonnes of

contained copper with a further 5.2 million tonnes of contained

copper in the inferred category. An updated preliminary economic

assessment is scheduled for the third quarter 2017.

During May 2017, China Polymetallic Mining Limited ("CPM")

announced that it had agreed to acquire the entire share capital of

Horeb Mountain Mining Company Limited ("Horeb") for RMB 98 million

(GBP10.8 million) in cash. This was accompanied by a placing to

third party investors which raised HKD 80 million (GBP8.0

million).

Horeb is the owner of a copper-lead mine in Mandalay State,

Myanmar and the acquisition continues CPM's strategy to diversify

its assets from the Shizishan lead-zinc-silver mine in Yunan

province, China. Since its construction, the Shizishan mine has

experienced problematic mining conditions and flooding and has

failed to reach its target production rate. CPM identified Myanmar

as a prospective emerging market for mining.

Previously, in December 2015, CPM acquired 90% of Harbor Star

Mining Company Limited for RMB 125 million (GBP13.7 million) and in

January 2017, CPM announced an agreement to acquire Hua Xing Global

Limited for RMB 101.5 million (GBP11.1 million). Both of these

companies also have base metal projects in Myanmar.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure is set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVDMGGVKKMGNZM

(END) Dow Jones Newswires

June 06, 2017 02:01 ET (06:01 GMT)

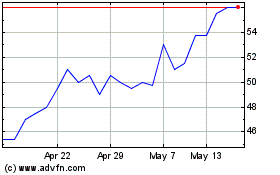

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Apr 2024 to May 2024

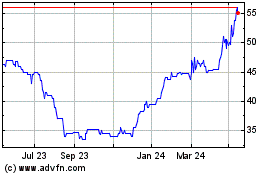

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From May 2023 to May 2024