Burford Capital Burford Raises £175million (US$225m) in Bond Issue (6670F)

19 May 2017 - 7:05PM

UK Regulatory

TIDMBUR

RNS Number : 6670F

Burford Capital

19 May 2017

19 May 2017

BURFORD CAPITAL RAISES $225 MILLION IN BOND ISSUE

TO FURTHER SUPPORT CLIENT DEMAND AND BUSINESS GROWTH

Burford Capital Limited ("Burford"), a leading global finance

firm focused on law, announces that it has today raised GBP175

million (approximately $225 million) through an oversubscribed

issue of bonds on the Main Market of the London Stock Exchange by

Burford Capital PLC, its financing subsidiary. The bonds will pay

interest at an annual rate of 5% and mature on 1 December 2026.

This new capital will permit Burford to continue growing its

legal finance business, which already stands at more than $2

billion invested and available for investment. Burford's portfolio

today is larger and more widely diversified than ever before, with

hundreds of individual litigation matters underlying its

investments for clients from around the world along with an

ever-increasing range of diverse and innovative transactions.

In addition to using the proceeds of the GBP175 million bond

issue in its investment activities, Burford intends to repay early

the $43.75 million of loan notes due 2019 created as part of the

December 2016 acquisition of Gerchen Keller Capital.

Christopher Bogart, Burford's Chief Executive Officer,

commented:

"We are delighted with the strong response to this bond issue,

which has well exceeded both our previous issues and continues to

provide us with a flexible and immediately accessible capital base

to address the attractive opportunities we see.

"Law firms and corporate clients are coming to us with needs

which have evolved far beyond the single-case financing model on

which this industry is founded - although that remains a core area

of our business. This additional long-term capital will enable us

to continue to meet the global demand for Burford's services and

further solidifies our position as the industry leader with the

industry's lowest cost of capital.

"We appreciate the ongoing support of our investors through our

debt and equity, which together enable the further expansion of our

business. We look forward to demonstrating Burford's further

potential."

The bonds have not been and will not be registered under the US

Securities Act of 1933, as amended, and may not be offered and sold

in the United States absent registration or an applicable exemption

from registration.

For further information, please contact:

Peel Hunt LLP (Lead Manager on +44 (0) 20

the Bond) 7418 8900

Adrian Bell

Mark Glowrey

Henrietta Podd

Macquarie Capital (Europe) Limited +44 (0)20 3037

- NOMAD 2000

Jonny Allison

Nicholas Harland

Neustria Partners - Financial +44 (0)20 3021

Communications for Burford Capital 2580

Robert Bailhache [email]

Charles Gorman [email]

Nick Henderson [email]

About Burford Capital

Burford Capital is a leading global finance firm focused on law.

Its businesses include litigation finance and risk management,

asset recovery and a wide range of legal finance and advisory

activities. Burford is publicly traded on the London Stock

Exchange, and it works with law firms and clients around the world

from its principal offices in New York, London and Chicago.

For more information about Burford, visit

www.burfordcapital.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IODKKLBFDEFBBBB

(END) Dow Jones Newswires

May 19, 2017 05:05 ET (09:05 GMT)

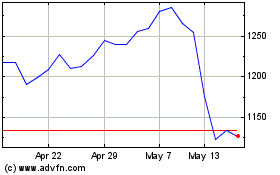

Burford Capital (LSE:BUR)

Historical Stock Chart

From Apr 2024 to May 2024

Burford Capital (LSE:BUR)

Historical Stock Chart

From May 2023 to May 2024