RNS Number:3454R

EMC Computer Systems (UK) Limited

01 April 2008

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS IN THAT JURISDICTION.

April 1, 2008

RECOMMENDED CASH OFFER OF 23.1 PENCE PER SHARE FOR CONCHANGO PLC ("CONCHANGO")

BY EMC COMPUTER SYSTEMS (UK) LIMITED ("EMC")

Summary

* The Boards of Conchango and EMC are pleased to announce that they have

reached agreement on the terms of a recommended cash offer of 23.1 pence

(the "Offer Price") per Conchango Share for the entire issued and to be

issued share capital of Conchango.

* The Offer values the entire issued and to be issued share capital of

Conchango at approximately �42.0 million.

* The Offer Price represents:

* a premium of approximately 44% to the Closing Price of 16.0 pence per

Conchango Share on March 31, 2008, being the last Business Day prior to the date

of this announcement; and

* a premium of approximately 24% to the average Closing Price of 18.7

pence per Conchango Share for the period commencing on January 15, 2008, being

the date of admission of Conchango to AIM and ended on March 31, 2008, being the

last Business Day prior to the date of this announcement.

* The Conchango Directors, who have been so advised by FinnCap,

unanimously consider the terms of the Offer to be fair and reasonable. In

providing such advice, FinnCap has taken into account the commercial

assessments of the Conchango Directors. Accordingly, the Conchango Directors

will unanimously recommend to Conchango Shareholders that they accept the

Offer, as the Conchango Directors have themselves irrevocably undertaken to

do in respect of their own beneficial holdings of 123,765,336 Conchango

Shares in aggregate, representing 68.4% of the Issued Share Capital.

* EMC has received further irrevocable undertakings to accept or procure

the acceptance of the Offer from Southwind Limited, Colin Bird, Herald

Investments Management Limited, Iyas Alqasem, Chris Saul and Williams de

Broe in respect of their holdings of 12,152,472, 2,826,447, 2,365,000,

1,732,258, 1,578,185 and 1,283,000 Conchango Shares, respectively,

representing 21,937,362 Conchango Shares, in aggregate and, approximately

12.1% of the Issued Share Capital.

* Accordingly, EMC has received irrevocable undertakings in respect of, in

aggregate, 145,702,698 Conchango Shares, representing approximately 80.5% of

the Issued Share Capital. These irrevocable undertakings will remain binding

in the event of a competing offer being made for Conchango, and will cease

to be binding only if the Offer lapses or is withdrawn.

* If the Offer becomes or is declared wholly unconditional, Michael

Altendorf and Richard Thwaite have agreed that EMC shall withhold the Escrow

Amount from the consideration otherwise payable to them and place such

amount in a stakeholders' account. The Escrow Amount shall become payable to

Michael Altendorf and Richard Thwaite upon the satisfaction of certain

revenue targets for the business in the 20 months after the closing of the

Offer. EMC shall also be entitled to draw upon the Escrow Amount if there is

a breach of certain warranties or indemnities given by Michael Altendorf and

Richard Thwaite to EMC.

* Separately today, Conchango announced its results for the year ended

December 31, 2007.

* With 2007 revenues of $13.23 billion and approximately 37,700 employees,

EMC Corporation, EMC's ultimate parent company, is the world's leading

developer and provider of information infrastructure technology and

solutions that enable organisations of all sizes to transform the way they

compete and create value from their information. EMC Corporation is listed

on the New York Stock Exchange and is a component of the S&P 500 Index.

* Conchango is a growing consultancy and systems integrator which

specialises in innovative technologies. Conchango provides clients with

complete solutions through business consulting, business intelligence,

enterprise architecture and systems integration, assisting customers to

deliver value from emerging digital channels. Conchango was admitted to AIM

on January 15, 2008.

* Conchango offers a strong strategic fit with EMC Corporation's growing

Global Services business, through the expansion of EMC Corporation's

international footprint, and through Conchango's expertise in technology

consulting to customers in the United Kingdom and across Europe. In

particular, Conchango's complementary Microsoft consulting services

capability will enhance EMC Corporation's existing U.S. and international

practice in this area. The combination of EMC Corporation's global reach and

Conchango's strong reputation and presence in the United Kingdom will

deliver benefits to both businesses' current and future customers and

stakeholders, and will reinforce EMC Corporation's end-to-end information

infrastructure offerings.

* EMC expects the Offer to become wholly unconditional immediately

following the posting of the Offer Document, which may enable Conchango

Shareholders who wish to dispose of their Conchango Shares for capital gains

tax purposes during the present tax year to do so.

Commenting on the Offer, Howard Elias, President, EMC Global Services and

Resource Management Software Group, said:

"We believe this offer represents a fair value for Conchango shareholders and a

tremendous opportunity to accelerate and expand Conchango's technology

consulting services in the UK and over time, throughout Europe. The addition of

Conchango will mark another key milestone in the evolution of EMC's rapidly

growing consulting services organisation, significantly expanding our global

capabilities to design, build and deliver integrated solutions for our

customers' most critical business applications. Conchango and its talented

employees have a proven track record of delivering many of the United Kingdom's

largest data integration projects using highly scalable tools and methodologies.

By combining Conchango with our own well-established Microsoft consultancy

practice begun in the U.S., we will be well-positioned to further expand our

joint capabilities to more customers and establish a strong foundation for a

growing consultancy practice in the UK and throughout Europe."

Richard Thwaite, co-founder and joint Managing Director of Conchango, commenting

on behalf of Conchango, said:

"Conchango has had a tremendous few years, where we have seen the return on our

strategy of helping enterprise clients in our target sectors make the most of

the rapidly evolving technology landscape. By helping our clients to be

successful we have grown our business to be one of the leaders in the UK and the

next stage in our strategy is to expand upon this success in new markets. We are

thrilled to become part of EMC which gives us the platform for expansion

throughout Europe and also access to the expertise and wider resources of the

global EMC team. We look forward to this next exciting stage in our development

and the benefits we believe it will bring to our clients, our employees and our

business partners."

Enquiries:

EMC

Michael Gallant, Tel: +1 508 293 6357 (Media relations)

EMC Investor Relations, Tel +1 866 362 6973 (Investor relations)

Investec Bank (UK) Limited (Financial adviser to EMC)

Tel: +44 (0) 207 597 5117

Ben Poynter

Andrew Pinder

Conchango

Tel: +44 (0) 1784 222 222

Alan Griffin

FinnCap (Financial adviser to Conchango)

Tel: +44 (0) 207 600 1658

Geoff Nash

Clive Carver

The above summary should be read in conjunction with, and is subject to, the

full text of this announcement. Terms used in the summary have the meaning given

to them in Appendix III to this announcement.

This announcement is not intended to and does not constitute, or form any part

of, any offer to sell or any solicitation of any offer to purchase or subscribe

for any securities or the solicitation of any vote or approval in any

jurisdiction. Any acceptance or other response to the Offer should be made only

on the basis of the information contained or referred to in the Offer Document

and the Form of Acceptance. The laws of relevant jurisdictions may affect the

availability of the Offer to persons not resident in the United Kingdom. Persons

who are not resident in the United Kingdom, or who are subject to the laws of

any jurisdiction other than the United Kingdom, should inform themselves about

and observe any applicable legal or regulatory requirements of their

jurisdiction. The Offer Document will be available for public inspection.

Unless otherwise determined by EMC, the Offer will not be made, directly or

indirectly, in, into or from or by the use of mails of, or by any means of

instrumentality (including, without limitation, telephonically or

electronically) of interstate or foreign commerce of, or through any facilities

of a national securities exchange of any jurisdiction if to do so would

constitute a violation of the relevant laws of such jurisdiction and the Offer,

when made, should not be accepted by any such use, means, instrumentality or

facilities or from or within any such jurisdiction.

Accordingly, copies of this announcement are not being, and must not be, mailed

or otherwise forwarded, distributed or sent in, into or from any jurisdiction if

to do so would constitute a violation of the relevant laws of such jurisdiction

and persons receiving this announcement (including, without limitation,

custodians, nominees and trustees) must not mail or otherwise forward,

distribute or send it in, into or from any such jurisdiction. Doing so may

render invalid any purported acceptance of the Offer.

Investec, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for EMC and no one else in

connection with the Offer and will not be responsible to anyone other than EMC

for providing the protections afforded to its customers or for providing advice

in relation to the Offer, the contents of this announcement or any transaction

or arrangement referred to herein.

FinnCap, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Conchango and no one

else in connection with the Offer and will not be responsible to anyone other

than Conchango for providing the protections afforded to its customers or for

providing advice in relation to the Offer, the contents of this announcement or

any transaction or arrangement referred to herein.

In accordance with normal UK market practice, EMC or its nominees or brokers

(acting as agents) may from time to time make certain purchases of, or

arrangements to purchase, Conchango Shares, other than pursuant to the Offer,

before or during the period in which the Offer remains open for acceptance.

These purchases may occur either in the open market at prevailing prices or in

private transactions at negotiated prices. Any information about such purchases

will be disclosed as required in the UK.

Forward-looking statements

This announcement includes certain ''forward-looking statements''. These

statements are based on the current expectations of the management of Conchango

and EMC Corporation (as applicable) and are naturally subject to uncertainty and

changes in circumstances. The forward-looking statements contained herein may

include statements about the expected effects on EMC Corporation or Conchango of

the Offer, the expected timing and scope of the Offer, anticipated earnings

enhancements, estimated cost savings and other synergies, costs to be incurred

in achieving synergies, other strategic options and all other statements in this

document other than historical facts. Forward-looking statements include,

without limitation, statements typically containing words such as ''intends'',

''expects'', ''anticipates'', ''targets'',''estimates'' and words of similar

import. By their nature, forward-looking statements involve risk and uncertainty

because they relate to events and depend on circumstances that will occur in the

future. There are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied by such

forward-looking statements. These factors include, but are not limited to, the

satisfaction of the condition to the Offer, and EMC Corporation's ability

successfully to integrate the operations and employees of Conchango, as well as

additional factors, such as changes in economic or market conditions, changes in

the level of capital investment, success of business and operating initiatives

and restructuring objectives, customers' strategies and stability, changes in

the regulatory environment, fluctuations in interest and exchange rates, the

outcome of litigation, government actions, natural phenomena such as floods,

earthquakes and hurricanes, delays or reductions in information technology

spending, EMC Corporation's ability to protect its proprietary technology,

competitive factors (including, but not limited to, pricing pressures and new

product introductions), the relative and varying rates of product price and

component cost declines and the volume and mixture of product and services

revenues, component and product quality and availability, the transition to new

products, the uncertainty of customer acceptance of new product offerings and

rapid technological and market change and insufficient, excess or obsolete

inventory. Other important factors disclosed previously and from time to time in

EMC Corporation's filings with the U.S. Securities and Exchange Commission and

unknown or unpredictable factors could also cause actual results to differ

materially from those in the forward-looking statements. Neither Conchango nor

EMC Corporation undertakes any obligation to update publicly or revise

forward-looking statements, whether as a result of new information, future

events or otherwise, except to the extent legally required.

Dealing disclosure requirements

Under the provisions of Rule 8.3 of the City Code, if any person is, or becomes,

"interested" (directly or indirectly) in one per cent or more of any class of

"relevant securities" of Conchango, all "dealings" in any "relevant securities"

of Conchango (including by means of an option in respect of, or a derivative

referenced to, any such "relevant securities") must be publicly disclosed by no

later than 3.30 p.m. (London time) on the London business day following the date

of the relevant transaction. This requirement will continue until the date on

which the Offer becomes, or is declared, unconditional as to acceptances, lapses

or is otherwise withdrawn or on which the "offer period" otherwise ends. If two

or more persons act together pursuant to an agreement or understanding, whether

formal or informal, to acquire an "interest" in "relevant securities" of

Conchango, they will be deemed to be a single person for the purposes of Rule

8.3 of the City Code.

Under the provision of Rule 8.1 of the City Code, all "dealings" in "relevant

securities" of Conchango by EMC or Conchango or by any of their respective

"associates", must be disclosed by no later than 12.00 noon (London time) on the

London business day following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Panel's website at www.thetakeoverpanel.org.uk

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the City Code, which can also be found

on the Panel's website. If you are in any doubt as to whether or not you are

required to disclose a "dealing" under Rule 8 of the City Code, you should

consult the Panel.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS IN THAT JURISDICTION.

April 1, 2008

RECOMMENDED CASH OFFER OF 23.1 PENCE PER SHARE FOR CONCHANGO PLC ("CONCHANGO")

BY EMC COMPUTER SYSTEMS (UK) LIMITED ("EMC")

1. INTRODUCTION

The boards of Conchango and EMC are pleased to announce that they have reached

agreement on the terms of a recommended cash offer of 23.1 pence per Conchango

Share for the entire issued and to be issued share capital of Conchango.

The Conchango Board will unanimously recommend to Conchango Shareholders that

they accept the Offer.

EMC has received irrevocable undertakings to accept the Offer in respect of, in

aggregate, 145,702,698 Conchango Shares, representing approximately 80.5% of the

Issued Share Capital.

The formal Offer will be set out in the Offer Document, which is expected to be

despatched to Conchango Shareholders on the date of this announcement.

2. OFFER

Under the Offer, which will be on and subject to the terms and the condition set

out below and in Appendix I to this announcement and to be set out in the Offer

Document and the Form of Acceptance, Conchango Shareholders will receive:

23.1 pence in cash for each Conchango Share.

The Offer, which is wholly in cash, values the entire issued and to be issued

share capital of Conchango at approximately �42.0 million.

The Offer Price represents:

* a premium of approximately 44% to the Closing Price of 16.0 pence per

Conchango Share on March 31, 2008, being the last Business Day prior to the

date of this announcement; and

* a premium of approximately 24% to the average Closing Price of

approximately 18.7 pence per Conchango Share for the period commencing on

January 15, 2008, being the date of admission of Conchango to AIM and ending

on March 31, 2008, being the last Business Day prior to the date of this

announcement.

The Conchango Shares will be acquired by EMC fully paid up and free from all

liens, charges, equitable interests, encumbrances, rights of pre-emption and any

other third party rights or interests whatsoever and together with all rights

now or hereafter attaching thereto, including voting rights and, without

limitation, the right to receive and retain in full all dividends, interests and

other distributions (if any) announced, declared, made or paid on or after the

date of this announcement.

The Offer extends to all Conchango Shares unconditionally allotted, issued and

fully paid on the date of the Offer and all Conchango Shares which are

unconditionally allotted or issued and fully paid before the date on which the

Offer closes (or such earlier date as EMC may, subject to the City Code decide,

not being earlier than the date on which the Offer becomes unconditional as to

acceptances).

The UK Government has announced significant proposed changes to the UK capital

gains tax regime with effect for disposals of capital assets occurring on or

after 6 April 2008. The changes include the withdrawal of the current taper

relief for chargeable capital gains and the introduction of a single rate of

capital gains tax (18% for the tax year 2008-2009). The proposals are not yet

law and may be subject to change.

Assuming that, immediately following the posting of the Offer Document today,

EMC receives valid acceptances pursuant to the irrevocable undertakings to

accept the Offer which it has received, the Offer will become wholly

unconditional and should enable Conchango Shareholders who also accept the Offer

and wish to dispose of their Conchango Shares for capital gains tax purposes

before 6 April 2008 to do so. Such Conchango Shareholders should ensure that

valid acceptances are received by Capita Registrars before that date.

3. ESCROW AMOUNT

If the Offer becomes or is declared wholly unconditional, Michael Altendorf and

Richard Thwaite have agreed that EMC shall withhold the Escrow Amount from the

consideration otherwise payable to them and place such amount in a stakeholders'

account. The Escrow Amount shall become payable to Michael Altendorf and Richard

Thwaite upon the satisfaction of certain revenue targets for the business in the

20 months after the closing of the Offer. EMC shall also be entitled to draw

upon the Escrow Amount if there is a breach of certain warranties or indemnities

given by Michael Altendorf and Richard Thwaite to EMC.

4. RECOMMENDATION

The Conchango Board, which has been so advised by FinnCap, unanimously considers

the terms of the Offer to be fair and reasonable. In providing its advice,

FinnCap has taken into account the commercial assessments of the Conchango

Directors.

Accordingly, the Conchango Directors will unanimously recommend to Conchango

Shareholders that they accept the Offer, as the Conchango Directors have

themselves irrevocably undertaken to do in respect of their beneficial holdings

of 123,765,336 Conchango Shares in aggregate, representing approximately 68.4%

of the Issued Share Capital.

5. BACKGROUND TO AND REASONS FOR THE RECOMMENDATION OF THE OFFER

Conchango offers a strong strategic fit with EMC Corporation's growing Global

Services business, through the expansion of EMC Corporation's international

footprint, and through Conchango's expertise in technology consulting to

customers in the United Kingdom and across Europe. In particular, Conchango's

complementary Microsoft consulting services capability will enhance EMC

Corporation's existing U.S. and international practice in this area. The

combination of EMC Corporation's global reach and Conchango's strong reputation

and presence in the United Kingdom will deliver benefits to both businesses'

current and future customers and stakeholders, and will reinforce EMC

Corporation's end-to-end information infrastructure offerings.

EMC Corporation believes that Conchango's strong reputation and presence in the

United Kingdom in the field of high-end technology consulting will accelerate

the expansion of EMC Corporation's own Global Services offerings into the United

Kingdom, in particular in application consulting services focused on Microsoft

technologies. Conchango's strengths in this field are complementary to and have

no material overlap with EMC Corporation's current service offerings and

capabilities in the United Kingdom. Conchango brings a long and successful

history of working with Microsoft in the United Kingdom to EMC Corporation's

existing Microsoft services presence in the United States and worldwide, and the

Offer demonstrates EMC Corporation's continued commitment to this service

offering. Overall, the combination of the two businesses will increase the

end-to-end business value of EMC Corporation's information infrastructure

offerings, in the United Kingdom, Europe and globally.

The Conchango Board believes that Conchango will benefit significantly from

being part of the EMC Group in a way that it would not as an independent

company. In particular, EMC Corporation has the financial resources and

managerial expertise to invest actively in the future development and growth of

the business. The Conchango Board believes that the combination with EMC

Corporation will benefit Conchango's customers by allowing Conchango to address

more broadly its customers' technology needs. Further, the Conchango Board

believes that Conchango's employees will be afforded a wider range of career and

development opportunities as part of EMC Corporation.

EMC Corporation intends to integrate the Conchango business into its Global

Services organisation shortly after the closing of the Offer. As part of this

integration, EMC Corporation intends that Conchango adopt certain standard

procedures and practices in use within the EMC Group, and may transfer the

assets of the Conchango business on an arm's length basis to a wholly owned

subsidiary of EMC Corporation.

The Offer of 23.1 pence per Conchango Share provides Conchango Shareholders with

an opportunity to realise their entire investment in the Company for a cash

premium of approximately 44% over the Closing Price of 16.0 pence per Conchango

Share on March 31, 2008, being the last Business Day prior to this announcement.

6. IRREVOCABLE UNDERTAKINGS

EMC has received irrevocable undertakings to accept the Offer in respect of, in

aggregate, 145,702,698 Conchango Shares, representing approximately 80.5% of the

Issued Share Capital.

Of this total:

* the Conchango Directors, Michael Altendorf, Richard Thwaite, Richard

Poole, Alan Griffin and John Herring have irrevocably undertaken to accept

the Offer in respect of their own beneficial holdings of 59,680,345,

59,680,345, 2,870,765, 992,806 and 541,075 shares, respectively,

representing 123,765,336 Conchango Shares, in aggregate, and approximately

68.4% of the Issued Share Capital. These irrevocable undertakings will

remain binding in the event of a competing offer being made for Conchango

and will cease to be binding only if the Offer closes, lapses or is

withdrawn; and

* EMC has received further irrevocable undertakings from Southwind

Limited, Colin Bird, Herald Investments Management Limited, Iyas Alqasem,

Chris Saul and Williams de Broe in respect of their holdings of 12,152,472,

2,826,447, 2,365,000, 1,732,258, 1,578,185 and 1,283,000 Conchango Shares,

respectively, representing 21,937,362 Conchango Shares, in aggregate and,

approximately 12.1% of the Issued Share Capital. These irrevocable

undertakings will remain binding in the event of a competing offer being

made for Conchango and will cease to be binding only if the Offer lapses or

is withdrawn.

7. INFORMATION ON THE EMC GROUP

EMC Corporation (the ultimate parent company of EMC) was founded in 1979, is

listed on the New York Stock Exchange and is a component of the S&P 500 Index.

EMC Corporation is the world's leading developer and provider of information

infrastructure technology and solutions that enable organisations of all sizes

to transform the way they compete and create value from their information. As at

December 31, 2007, EMC Corporation had approximately 37,700 employees worldwide.

EMC Corporation is represented by more than 100 sales offices and distribution

partners in more than 80 countries.

For the year ended December 31, 2007, EMC Corporation's consolidated net sales

were US$13.23 billion, its consolidated net income was US$1.67 billion and its

consolidated net assets were US$12.71 billion. For the year ended December 31,

2006, EMC Corporation's consolidated net sales were US$11.16 billion, its

consolidated net income was US$1.23 billion and its consolidated net assets were

US$10.33 billion.

EMC was originally incorporated in 1986. Its primary activities involve its role

as agent in distributing and providing sales support with respect to EMC

products manufactured by other members of the EMC Group. In addition to sales of

hardware and software in the United Kingdom, EMC also provides support relating

to the maintenance and implementation of such hardware and software.

For the year ended December 31, 2006, EMC's total turnover was �61.71 million,

its net profit was �3.08 million and its net assets were �25.72 million. For the

year ended December 31, 2005, EMC's total turnover was �51.18 million, its net

profit was �2.94 million and its net assets were �20.56 million.

8. INFORMATION ON THE CONCHANGO GROUP

Conchango is a growing business consultancy and systems integrator which

specialises in innovative technologies. Conchango provides clients with complete

solutions through business consulting, business intelligence, enterprise

architecture and systems integration, assisting customers to deliver value from

emerging digital channels. Conchango was admitted to AIM on January 15, 2008.

Comparing the results for the year ended December 31, 2004 with those for the

year ended December 31, 2007, the business of Conchango has achieved revenue

growth of 148% resulting in 2007 turnover of �37.8 million. Profit before tax

has increased by 424% over the same period to �2.8 million in 2007.

9. FINANCING FOR THE OFFER

Full acceptance of the Offer will result in an aggregate cash consideration of

approximately �42.0 million becoming payable by EMC.

EMC will fund the Offer from cash made available to it, upon demand, by EMC

Corporation. Investec, financial adviser to EMC, is satisfied that EMC will have

sufficient cash resources available to it to satisfy, in full, the cash

consideration payable to Conchango Shareholders under the Offer. EMC does not

intend that the payment of interest, or repayment of, or security for, any

liability (contingent or otherwise) will depend to any significant extent on the

business of Conchango.

10. NON-SOLICITATION

EMC has entered into an arrangement with Michael Altendorf and Richard Thwaite

under which they have undertaken, among other things, that:

* until such time as the Offer closes, lapses or is withdrawn (whichever

is the earlier), they will not, directly or indirectly, solicit or (except

where required by their fiduciary duties as a director of Conchango or by

their duties under the City Code and, in each case, only in response to an

unsolicited approach) encourage, any person to make an offer for any shares

or other securities of Conchango or enter into discussions with, or provide

any information to, any person making such an offer;

* (except where required by their fiduciary duties as a director of

Conchango or by their duties under the City Code), they will not knowingly

take any action which is designed to or may be prejudicial to the successful

outcome of the Offer or which would or might have the effect of preventing

the condition in the Offer from being fulfilled; and

* they will promptly notify EMC in the event that they receive an approach

from a third party which may lead to an offer for Conchango and will keep

EMC informed of any such approach.

11. DIRECTORS, MANAGEMENT AND EMPLOYEES

EMC Corporation plans to run Conchango and its existing business on an

integrated basis and believes that the combination of Conchango's expertise with

EMC Corporation's global reach will be of benefit to the enlarged business, the

employees and customers.

EMC Corporation attaches great importance to the skills, experience and industry

knowledge of the existing management and employees of Conchango, who have

contributed to Conchango's success to date, and whom EMC Corporation would

anticipate playing an important role in the development of the enlarged

business. EMC Corporation believes that the Conchango employees will benefit

from a broader range of opportunities for personal and professional development

as part of a larger, more diverse and financially stronger group. Accordingly,

it is EMC Corporation's intention to continue to retain as far as reasonably

practicable Conchango's existing operating and employment structure.

Following the Offer becoming or being declared unconditional in all respects,

the existing employment rights of the employees of Conchango will be

safeguarded.

It is intended that the current non-executive directors of Conchango will resign

upon or after the Offer becoming or being declared unconditional in all

respects.

12. CONCHANGO ENTERPRISE MANAGEMENT INCENTIVE SCHEME

The Offer extends to any Conchango Shares issued or unconditionally allotted

prior to the date on which the Offer closes (or such earlier date or dates as

EMC may, subject to the City Code, or with the consent of the Panel, determine),

including any which are so unconditionally allotted or issued pursuant to the

exercise of options granted under the Conchango Enterprise Management Incentive

Scheme.

Conchango has operated the Conchango Enterprise Management Incentive Scheme

since 2002, pursuant to which options over ordinary shares are issued to certain

directors and employees.

To the extent options granted under the Conchango Enterprise Management

Incentive Scheme have not been exercised prior to the date on which the Offer

closes, it is intended that appropriate proposals will be made to Conchango

Optionholders, subject to the Offer becoming or being declared unconditional in

all respects.

13. DISCLOSURE OF INTERESTS IN CONCHANGO

Save for the irrevocable undertakings referred to in paragraph 6 of this

announcement, neither EMC, nor (so far as EMC is aware) any person acting, or

deemed to be acting, in concert with EMC for the purposes of the Offer has:

(i) any interest in, or a right to subscribe for, Conchango

Shares or in any securities convertible or exchangeable into Conchango Shares

("Relevant Conchango Securities");

(ii) any short position in Relevant Conchango Securities (whether

conditional or absolute and whether in the money or otherwise), including any

short position under a derivative, any agreement to sell or any delivery

obligation or right to require another person to purchase or take delivery; or

(iii) borrowed or lent any Relevant Conchango Securities (except

for any borrowed Conchango Shares which have been either on-lent or sold) or has

any arrangement in relation to Relevant Conchango Securities.

For these purposes, "arrangement" includes any agreement to sell or any delivery

obligation or right to require another person to purchase or take delivery and

borrowing or lending of Conchango Shares. An "arrangement" also includes any

indemnity or option arrangement, any agreement or understanding, formal or

informal, of whatever nature, relating to Conchango Shares, which may be an

inducement to deal or refrain from dealing in such securities. "Interest"

includes any long economic exposure, whether conditional or absolute, to changes

in the price of securities and a person is treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

There are no arrangements of the kind referred to in Note 6(b) on Rule 8 of the

City Code which exists between EMC or any person acting, or presumed to be

acting, in concert with EMC, and any other person nor between Conchango or any

associate of Conchango and any other person.

In view of the requirement for confidentiality, EMC has not made enquiries of

certain persons who may be deemed by the City Code to be acting in concert with

it for the purpose of the Offer.

14. COMPULSORY ACQUISITION, DE-LISTING AND REREGISTRATION

If EMC receives acceptances of the Offer in respect of, and/or otherwise

acquires, 90% or more of the Conchango Shares to which the Offer relates, EMC

intends to exercise its rights pursuant to the provisions of the Companies Act

to acquire the remaining Conchango Shares to which the Offer relates on the same

terms as the Offer.

Assuming the Offer becomes or is declared unconditional in all respects and

subject to any applicable requirements of the London Stock Exchange, EMC intends

to procure the making of an application by Conchango to the London Stock

Exchange for the cancellation of admission of the Conchango Shares from AIM. If

this withdrawal occurs, it will significantly reduce the liquidity and

marketability of any Conchango Shares not assented to the Offer. It is

anticipated that the withdrawal from trading will take effect on the earlier of

(i) 20 Business Days after the date on which EMC has, by virtue of its

shareholdings and acceptances of the Offer, acquired or agreed to acquire issued

share capital carrying 75 per cent. of the voting rights of Conchango and (ii)

the first date of issue of compulsory acquisition notices under the Companies

Act. The AIM Rules normally require the consent of at least 75% of the votes

cast by a company's shareholders in general meeting to a cancellation of

admission of its shares to trading on AIM. However, the London Stock Exchange

has indicated that, provided EMC is the owner of not less than 75% of the entire

issued ordinary share capital of Conchango before the proposed date of

cancellation and, provided that Conchango formally seeks derogation from this

requirement, the passing of such a resolution will not be required. In

connection with the cancellation of listing, EMC intends that Conchango

withdraws from CREST.

It is currently intended that, following the Offer becoming or being declared

unconditional in all respects and after the cancellation of admission of the

Conchango Shares from AIM, Conchango will be re-registered as a private company

under the relevant provisions of the Companies Act.

15. OTHER

The Offer Document and Form of Acceptance is expected to be posted to Conchango

Shareholders and, for information only, to participants in the Conchango

Enterprise Management Incentive Scheme today. The full terms and conditions of

the Offer will be set out in the Offer Document and Form of Acceptance. In

deciding whether or not to accept the Offer, Conchango Shareholders should rely

on the information contained in, and follow the procedures described in, the

Offer Document and Form of Acceptance.

The availability of the Offer to persons not resident in the UK may be affected

by the laws of their relevant jurisdiction. Any persons who are subject to the

laws of any jurisdiction other than the UK should inform themselves about and

observe any applicable legal or regulatory requirements of their jurisdiction.

Further details in relation to overseas shareholders will be contained in the

Offer Document.

The Offer will be governed by English law and will be subject to the exclusive

jurisdiction of the English courts. The Offer will be subject to the applicable

requirements of the City Code, the Panel, the London Stock Exchange and other

legal or regulatory requirements. The Offer will comply with the provisions of

the City Code.

Appendix I sets out the condition and certain further terms of the Offer.

Appendix II contains source notes relating to certain information contained in

this announcement. Certain terms used in this announcement are defined in

Appendix III to this announcement.

Enquiries:

EMC

Michael Gallant, Tel: +1 508 293 6357 (Media relations)

EMC Investor Relations, Tel +1 866 362 6973 (Investor relations)

Investec Bank (UK) Limited (Financial adviser to EMC)

Tel: +44 (0) 207 597 5117

Ben Poynter

Andrew Pinder

Conchango

Tel: +44 (0) 1784 222 222

Alan Griffin

FinnCap (Financial adviser to Conchango)

Tel: +44 (0) 207 600 1658

Geoff Nash

Clive Carver

This announcement is not intended to and does not constitute, or form any part

of, any offer to sell or any solicitation of any offer to purchase or subscribe

for any securities or the solicitation of any vote or approval in any

jurisdiction. Any acceptance or other response to the Offer should be made only

on the basis of the information contained or referred to in the Offer Document

and the Form of Acceptance. The laws of relevant jurisdictions may affect the

availability of the Offer to persons not resident in the United Kingdom. Persons

who are not resident in the United Kingdom, or who are subject to the laws of

any jurisdiction other than the United Kingdom, should inform themselves about

and observe any applicable legal or regulatory requirements of their

jurisdiction. The Offer Document will be available for public inspection.

Unless otherwise determined by EMC, the Offer will not be made, directly or

indirectly, in, into or from or by the use of mails of, or by any means of

instrumentality (including, without limitation, telephonically or

electronically) of interstate or foreign commerce of, or through any facilities

of a national securities exchange of any jurisdiction if to do so would

constitute a violation of the relevant laws of such jurisdiction and the Offer,

when made, should not be accepted by any such use, means, instrumentality or

facilities or from or within any such jurisdiction. Accordingly, copies of this

announcement are not being, and must not be, mailed or otherwise forwarded,

distributed or sent in, into or from any jurisdiction if to do so would

constitute a violation of the relevant laws of such jurisdiction and persons

receiving this announcement (including, without limitation, custodians, nominees

and trustees) must not mail or otherwise forward, distribute or send it in, into

or from any such jurisdiction. Doing so may render invalid any purported

acceptance of the Offer.

Investec, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for EMC and no one else in

connection with the Offer and will not be responsible to anyone other than EMC

for providing the protections afforded to its customers or for providing advice

in relation to the Offer, the contents of this announcement or any transaction

or arrangement referred to herein.

FinnCap, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Conchango and no one

else in connection with the Offer and will not be responsible to anyone other

than Conchango for providing the protections afforded to its customers or for

providing advice in relation to the Offer, the contents of this announcement or

any transaction or arrangement referred to herein.

In accordance with normal UK market practice, EMC or its nominees or brokers

(acting as agents) may from time to time make certain purchases of, or

arrangements to purchase, Conchango Shares, other than pursuant to the Offer,

before or during the period in which the Offer remains open for acceptance.

These purchases may occur either in the open market at prevailing prices or in

private transactions at negotiated prices. Any information about such purchases

will be disclosed as required in the UK.

Forward-looking statements

This announcement includes certain ''forward-looking statements''. These

statements are based on the current expectations of the management of Conchango

and EMC Corporation (as applicable) and are naturally subject to uncertainty and

changes in circumstances. The forward-looking statements contained herein may

include statements about the expected effects on EMC Corporation or Conchango of

the Offer, the expected timing and scope of the Offer, anticipated earnings

enhancements, estimated cost savings and other synergies, costs to be incurred

in achieving synergies, other strategic options and all other statements in this

document other than historical facts. Forward-looking statements include,

without limitation, statements typically containing words such as ''intends'',

''expects'', ''anticipates'', ''targets'',''estimates'' and words of similar

import. By their nature, forward-looking statements involve risk and uncertainty

because they relate to events and depend on circumstances that will occur in the

future. There are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied by such

forward-looking statements. These factors include, but are not limited to, the

satisfaction of the condition to the Offer, and EMC Corporation's ability

successfully to integrate the operations and employees of Conchango, as well as

additional factors, such as changes in economic or market conditions, changes in

the level of capital investment, success of business and operating initiatives

and restructuring objectives, customers' strategies and stability, changes in

the regulatory environment, fluctuations in interest and exchange rates, the

outcome of litigation, government actions, natural phenomena such as floods,

earthquakes and hurricanes, delays or reductions in information technology

spending, EMC Corporation's ability to protect its proprietary technology,

competitive factors (including, but not limited to, pricing pressures and new

product introductions), the relative and varying rates of product price and

component cost declines and the volume and mixture of product and services

revenues, component and product quality and availability, the transition to new

products, the uncertainty of customer acceptance of new product offerings and

rapid technological and market change and insufficient, excess or obsolete

inventory. Other important factors disclosed previously and from time to time in

EMC Corporation's filings with the U.S. Securities and Exchange Commission and

unknown or unpredictable factors could also cause actual results to differ

materially from those in the forward-looking statements. Neither Conchango nor

EMC Corporation undertakes any obligation to update publicly or revise

forward-looking statements, whether as a result of new information, future

events or otherwise, except to the extent legally required.

Dealing disclosure requirements

Under the provisions of Rule 8.3 of the City Code, if any person is, or becomes,

"interested" (directly or indirectly) in one per cent. or more of any class of

"relevant securities" of Conchango, all "dealings" in any "relevant securities"

of Conchango (including by means of an option in respect of, or a derivative

referenced to, any such "relevant securities") must be publicly disclosed by no

later than 3.30 p.m. (London time) on the London business day following the date

of the relevant transaction. This requirement will continue until the date on

which the Offer becomes, or is declared, unconditional as to acceptances, lapses

or is otherwise withdrawn or on which the "offer period" otherwise ends. If two

or more persons act together pursuant to an agreement or understanding, whether

formal or informal, to acquire an "interest" in "relevant securities" of

Conchango, they will be deemed to be a single person for the purposes of Rule

8.3 of the City Code.

Under the provision of Rule 8.1 of the City Code, all "dealings" in "relevant

securities" of Conchango by EMC or Conchango or by any of their respective

"associates", must be disclosed by no later than 12.00 noon (London time) on the

London business day following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Panel's website at www.thetakeoverpanel.org.uk

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the City Code, which can also be found

on the Panel's website. If you are in any doubt as to whether or not you are

required to disclose a "dealing" under Rule 8 of the City Code, you should

consult the Panel.

APPENDIX I

CONDITION AND CERTAIN FURTHER TERMS OF THE OFFER

The Offer, which will be made by EMC, will comply with the rules and regulations

of the London Stock Exchange and the City Code.

Part A: Condition of the Offer

The Offer will be subject to the condition that valid acceptances have been

received (and not, where permitted, withdrawn) by not later than 3.00 p.m. on

the first closing date of the Offer (or such later time(s) and/or date(s) as EMC

may, with the consent of the Panel or in accordance with the City Code, decide)

in respect of not less than 72% (or such lower percentage as EMC may, subject to

the City Code, decide) in nominal value of the Conchango Shares to which the

Offer relates provided that, unless agreed by the Panel, this condition shall

not be satisfied unless EMC and/or any of its wholly-owned subsidiaries shall

have acquired or agreed to acquire, whether pursuant to the Offer or otherwise,

Conchango Shares carrying in aggregate more than 50% of the voting rights then

normally exercisable at general meetings of Conchango.

For the purposes of this condition:

(i) the Conchango Shares which have been unconditionally

allotted but not issued before the Offer becomes or is declared unconditional as

to acceptances, whether pursuant to the exercise of any outstanding subscription

or conversion rights or otherwise, shall be deemed to carry the voting rights

they will carry on being entered into the register of members of Conchango;

(ii) the expression "Conchango Shares to which the Offer relates"

shall be construed in accordance with Chapter 3 of Part 28 of the Companies Act

2006; and

(iii) valid acceptances shall be deemed to have been received in

respect of the Conchango Shares which are treated for the purposes of section

979(8) of the Companies Act 2006 as having been acquired or contracted to be

acquired by EMC by virtue of acceptances of the Offer.

EMC expects the Offer to become wholly unconditional immediately following the

posting of the Offer Document, which may enable Conchango Shareholders who wish

to dispose of their Conchango Shares for capital gains tax purposes during the

present tax year to do so.

If EMC is required by the Panel to make an offer for Conchango Shares under the

provisions of Rule 9 of the City Code, EMC may make such alterations to the

above condition as are necessary to comply with the provisions of that Rule.

Part B: Certain further terms of the Offer

If the Offer lapses, it will cease to be capable of further acceptance.

Conchango Shareholders who have already accepted the Offer shall then cease to

be bound by acceptances delivered on or before the date on which the Offer

lapses.

The Offer will be governed by English law, the rules and regulations of the

Financial Services Authority, the Panel and the City Code and be subject to the

exclusive jurisdiction of the English courts, to the condition set out in Part A

above and the further terms set out in this Part B, and to the terms and the

condition set out in the Offer Document and related Form of Acceptance.

The Offer will not be made, directly or indirectly, in or into, or by use of the

mails of, or by any means or instrumentality (including, without limitation,

facsimile transmission, telex, telephone or e-mail) of interstate or foreign

commerce of, or of any facility of a national securities exchange of any

jurisdiction if to do so would constitute a violation of the relevant laws in

such jurisdiction and the Offer will not be capable of acceptance by any such

use, means, instrumentality or facility or from within any such jurisdiction.

Conchango Shares will be acquired under the Offer by EMC fully paid, free from

all liens, charges, equitable interests, encumbrances, rights of pre-emption and

any other third party rights or interests whatsoever and together with all

rights now or hereafter attaching thereto, including voting rights and, without

limitation, the right to receive and retain in full all dividends, interests and

other distributions (if any) announced, declared, made or paid on or after the

date of this announcement.

In accordance with Rule 2.10 of the City Code, Conchango confirms that, at the

close of business on the date of this announcement, it will have the following

securities in issue:

180,966,465 ordinary shares of 1 pence ISIN GB0008823493

each

APPENDIX II

BASES OF CALCULATION AND SOURCES OF INFORMATION

In this announcement, unless otherwise stated or the context otherwise requires,

the following bases and sources have been used:

Historic share Closing Prices are sourced from the AIM appendix to the Daily

Official List and represent the closing middle market prices for Conchango

Shares on the relevant dates.

The Offer value is calculated by multiplying the Offer Price by the entire

issued and to be issued share capital of Conchango of 181,724,173 Conchango

Shares, being the Issued Share Capital and the number of Conchango Shares

capable of being issued to satisfy existing options under the Conchango

Enterprise Management Incentive Scheme.

Unless otherwise stated, the financial information on Conchango is extracted or

derived without material adjustment from the annual report and accounts of the

Conchango Group for the year ended December 31, 2007.

APPENDIX III

DEFINITIONS

The following definitions apply throughout this announcement, unless the context

requires otherwise:

"AIM" the Alternative Investment Market

"AIM Rules" the rules of the Alternative Investments Market as

the published and amended by the London Stock

Exchange from time to time

"Business Day" a day, not being a public holiday, Saturday or

Sunday, on which clearing banks in London are open

for normal business

"City Code" the City Code on Takeovers and Mergers

"Closing Price" the closing middle market quotation of a Conchango

Share as derived from the Daily Official List on

any particular day

"Companies Act" the Companies Act 2006, to the extent in force,

and otherwise the Companies Act 1985

"Conchango" or the means Conchango plc

"Company"

"Conchango Board" or the board of directors of Conchango

"Conchango Directors"

"Conchango Enterprise the enterprise management incentive scheme under

Management Incentive which there are currently 757,708 options in

Scheme" issue, granted in 2002, at an exercise price of 14

pence per Conchango Share

"Conchango Shareholders" the registered holders of Conchango Shares

"Conchango Shares" includes: (a) the existing unconditionally

allotted or issued and fully paid ordinary shares

of 1 pence each in the capital of Conchango; and

(b) any further ordinary shares of 1 pence each in

the capital of Conchango which are unconditionally

allotted or issued and fully paid, or credited as

fully paid, before the date on which the Offer

closes (or before such earlier date as, subject to

the City Code, Conchango may determine, not being

earlier than (i) the date on which the Offer

becomes or is declared unconditional as to

acceptances or (ii) if later, the first closing

date of the Offer) but excludes any treasury

shares

"Daily Official List" the daily official list of the London Stock

Exchange

"EMC" EMC Computer Systems (UK) Limited, a private

limited company incorporated in England and Wales

with registered number 2051360 or the EMC Group,

as the context may require

"EMC Corporation" a corporation existing under the laws of the State

of Delaware

"EMC Group" EMC Corporation and its subsidiaries

"Escrow Amount" �4.5 million

"FinnCap" JMFinn Capital Markets Limited, nominated advisor

and financial advisor to Conchango

"Form of Acceptance" the form of acceptance relating to the Offer,

which will accompany the Offer Document

"Investec" Investec Bank (UK) Ltd

"Issued Share Capital" the entire issued share capital of Conchango of

180,966,465 ordinary shares of 1 pence each at the

date of this announcement

"London Stock Exchange" The London Stock Exchange plc

"Offer" the cash offer to be made by EMC recommended by

the Conchango Directors to acquire the entire

issued and to be issued share capital of Conchango

on the terms and subject to the conditions to be

set out in the Offer Document and (in relation to

Conchango Shares held in certificated form) the

Form of Acceptance and, where the context so

requires, any subsequent revision, variation,

extension or renewal thereof

"Offer Document" the formal document to be sent to Conchango

Shareholders containing the Offer

"Offer Price" 23.1 pence per Conchango Share

"Panel" The Panel on Takeovers and Mergers

"Pound Sterling" or "�" means the lawful currency of the United Kingdom

(and references to "pence" shall be construed

accordingly)

"subsidiary", "subsidiary shall be construed in accordance with the

undertaking", "associated Companies Act, other than paragraph 20(1)(b) of

undertaking" or Schedule 4A to the Companies Act 1985 which shall

"undertaking" be excluded

United Kingdom" or "UK" the United Kingdom of Great Britain and Northern

Ireland and its dependent territories.

All times referred to are London times unless otherwise stated.

This information is provided by RNS

The company news service from the London Stock Exchange

END

OFFSSWFMFSASEEL

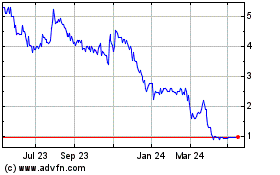

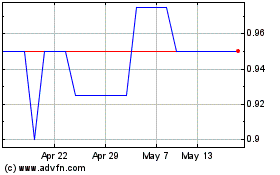

Contango (LSE:CGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Contango (LSE:CGO)

Historical Stock Chart

From Nov 2023 to Nov 2024