Cropper(James) PLC Grants under Long Term Incentive Plan (9794W)

07 August 2018 - 4:00PM

UK Regulatory

TIDMCRPR

RNS Number : 9794W

Cropper(James) PLC

07 August 2018

7 August 2018

James Cropper PLC (the "Company")

Grants under Long Term Incentive Plan

The Company provides the following update in options over

ordinary shares of 25p each in the Company ("Options").

On 6 August 2018, the trustees of the James Cropper Employee

Trust of James Cropper EBT Ltd advised the Company that they have

approved grant awards to certain employees and PDMRs under the

terms of The James Cropper Plc 2008 Long Term Incentive Plan (the

"LTIP" or the "Plan"), which grants participating employees a

conditional right to become entitled to options with an exercise

price of nil over ordinary shares of 25p each ("Shares") in the

Company. Grant awards to PDMRs are set out below:

Grant Date: 06/08/2018 Award Reference Price: 1562.6p per Share

Maximum

number

of Shares Nature of

under LTIP conditional

award award

----------------- ----------- ------------ -------------

Mark Cropper (Director) 2,413 Cash Awards

Free Cost

Phil Wild (Director) 9,530 Options

Free Cost

Steve Adams (Director) 5,016 Options

Free Cost

Isabelle Maddock (Director) 5,016 Options

Free Cost

Martin Thompson (Director) 5,016 Options

Free Cost

Dave Watson (Director) 5,016 Options

Patrick Willink (Director) 4,216 Cash Awards

Free Cost

Jim Aldridge (PDMR) 472 Options

Free Cost

David Nicholson (PDMR) 515 Options

Conditional cash awards ("Cash Awards") grant participating

employees a conditional right to be paid a cash amount based on the

proceeds of the sale of a specified number of Shares following the

vesting of the award.

The LTIP Options are subject to the achievement of

pre-determined performance conditions and become exercisable at the

end of a predetermined holding period from the date of the award.

Further details are set out in the appendix below.

Appendix

The number of options that can be awarded to any participant in

a financial year under the Plan, determined by reference to

Company's 20-day average mid-market share price at the time of the

award, is limited to a maximum of 75% of the participant's basic

salary.

The LTIP awards are subject to the achievement of certain

performance conditions, specific to each participant, as set out

below:

Conditions of Award for Participants

(i) Earnings per share conditions

- Awards will vest in full on the third anniversary of the Award

provided the growth in the Company's earnings per share, adjusted

for IFRS pension adjustments, between the preceding financial year

end when the award was granted and the preceding financial year end

when the grant is vested exceed the increase in retail price index

plus 20% per annum;

- Awards will vest at 25% on the third anniversary of the Award

if the growth in the Company's earnings per share, adjusted for

IFRS pension adjustments, between the preceding financial year end

when the award was granted and the preceding financial year end

when the grant is vested exceed the increase in retail price index

plus 6.0% per annum;

- Awards will vest proportionally between 25% and 100% on the

third anniversary of the Award if the growth in the Company's

earnings per share, adjusted for IFRS adjustments, between the

preceding financial year end when the award was granted and the

preceding financial year end when the grant is vested exceed the

increase in retail price index by more than 6.0% but less than 20%

per annum; and

- Awards will lapse on the third anniversary of the Award if the

growth in the Company's earnings per share, adjusted for IFRS

pension adjustments, between the preceding financial year end when

the award was granted and the preceding financial year end when the

grant is vested, does not exceed the increase in retail price plus

6.0% per annum.

Enquiries:

Isabelle Maddock, Group Robert Finlay, Henry Willcocks

Finance Director

Jim Aldridge, Company Richard Johnson

Secretary

James Cropper PLC (AIM:CRPR) Stockdale Securities Limited

Tel: +44 (0) 1539 722002 Tel: +44 (0) 207 601 6100

www.cropper.com www.stockdalesecurities.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCQQLFBVVFFBBX

(END) Dow Jones Newswires

August 07, 2018 02:00 ET (06:00 GMT)

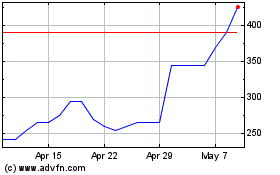

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Apr 2024 to May 2024

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From May 2023 to May 2024