TIDMDNLM

RNS Number : 9515T

Dunelm Group plc

12 January 2017

12(th) January 2017

Dunelm Group plc

Second Quarter Trading Update

Dunelm Group plc ("Dunelm" or "the Group"), the UK's leading

homewares retailer, reports the following trading update for the

second quarter of its current financial year, comprising the 13

week period ended 31(st) December 2016.

Revenue

Total revenue for the second quarter rose by 6.6% to GBP261.9m.

Total revenue, excluding the acquisition of Worldstores, for the

second quarter rose by 3.3% to GBP253.8m. Total like-for-like (LFL)

growth (combining LFL stores and Home Delivery) increased by 0.2%.

Due to the change in the accounting period end date, the figures

include six days of the Winter Sale, compared to eight days in the

comparative period last year. Without this impact LFL growth would

have been approximately GBP4.0m higher (equivalent to 1.7% in the

quarter and 0.9% over the half year). We expect this to reverse in

the second half of the year.

As expected, we saw an improved second quarter with seasonal

product in particular performing well. The homewares market has

continued to decline but we believe that we are continuing to

outperform the market as a whole.

We also continue to see good growth in the online business,

including a 21.7% increase in home delivery sales for the

quarter.

13 weeks to 31(st) 26 weeks to 31(st)

December 2016 December 2016

-------------------- ---------------------------------- ----------------------------------

Sales YoY Growth YoY Growth Sales YoY Growth YoY Growth

(GBPm) (GBPm) (%) (GBPm) (GBPm) (%)

-------------------- -------- ----------- ----------- -------- ----------- -----------

-1.4

LFL stores 215.6 -3.0 % 389.4 -12.5 -3.1%

-------------------- -------- ----------- ----------- -------- ----------- -----------

Home Delivery 20.1 +3.5 +21.7% 33.7 +5.6 +20.1%

-------------------- -------- ----------- ----------- -------- ----------- -----------

Total LFL 235.7 +0.5 +0.2% 423.1 -6.9 -1.6%

-------------------- -------- ----------- ----------- -------- ----------- -----------

Non-LFL stores 18.1 +7.5 +70.6% 29.3 +11.2 +61.4%

-------------------- -------- ----------- ----------- -------- ----------- -----------

Total Dunelm

excl. Worldstores 253.8 +8.0 +3.3% 452.4 +4.3 +1.0%

-------------------- -------- ----------- ----------- -------- ----------- -----------

Worldstores* 8.1 +8.1 - 8.1 +8.1 -

-------------------- -------- ----------- ----------- -------- ----------- -----------

Total Dunelm

Group 261.9 +16.1 +6.6% 460.5 +12.4 +2.8%

-------------------- -------- ----------- ----------- -------- ----------- -----------

*Worldstores figures represent the five week period post

acquisition on 28th November 2016, until 31st December 2016

Gross Margin

Gross margin percentage for the half year is estimated to be

broadly flat compared with the first half of last financial year.

In the quarter, we started to see some impact from adverse currency

conditions, affecting goods sourced directly or from third parties,

and expect this to increase as we move into the second half of the

year. Overall, we expect gross margin to remain broadly flat in the

second half, compared to the same period last year.

Store Portfolio

We opened five new stores in the period leaving our superstore

footprint at 157 stores. We are now legally committed to a further

seven new stores of which five are due to open in the current

financial year. We have completed three store refits within the

year to date and have at least a further nine planned for the

remainder of the financial year.

Business Investment

We are continuing to develop our strategic plans and invest in

our business, particularly in systems, capability and

marketing.

We have been improving our supply chain with the opening of a

new warehouse and the consolidation of our suppliers. These

initiatives have caused some disruption to in-store availability

during the quarter and we have incurred GBP3m of additional

transitional costs as part of that process. However, availability

has already improved to near normal levels and we should see

significantly less transitional costs in the second half of the

year.

Worldstores

The development of our online business is a key strategic

objective and we firmly believe our acquisition of Worldstores,

which completed on 28(th) November, is an opportunity to accelerate

the growth of our internet operation, more than doubling its size,

and enhancing our position as the destination homewares retailer in

the UK, both online and offline.

Since the acquisition, the business has generated GBP8.1m of

revenue. We have invested around GBP6.2m in working capital and

paid GBP1m of the purchase consideration. The additional GBP7.5m

consideration is due at the end of January 2017. The business is

performing in line with our expectations and we will give a further

update in our interim report.

Financial Position

As at 31st December 2016, net debt was approximately GBP103m.

Daily average net debt across the half year amounted to GBP77.6m.

The movement in net debt reflects the investment in Worldstores,

higher capital expenditure on new stores and refits, as well as the

acquisition of two freehold properties.

Commenting on Dunelm's performance, John Browett, Chief

Executive, said:

"Following a difficult first quarter we have seen an improvement

in performance both in our stores and online. It was encouraging to

see customers respond well to our seasonal product lines,

especially our new Christmas offer. We have continued to outperform

the homewares market in what is a challenging and volatile retail

environment.

"We were pleased to complete the acquisition of Worldstores in

the quarter and remain excited by the opportunity it gives us to

accelerate the growth of our online proposition.

"We continue to focus on and invest in our key strategic

initiatives, which will improve the business over the medium term,

whilst ensuring we maintain our unique offer of tremendous value

for money, combined with an unrivalled range and great

service."

Ends

For further information please contact:

Dunelm Group plc 0116 2644439

John Browett, Chief Executive

Keith Down, Chief Financial

Officer

MHP Communications 020 3128 8100

John Olsen/Simon Hockridge/Gina dunelm@mhpc.com

Bell

Forthcoming Newsflow:

Dunelm's half year results announcement will be on 8th February

2017. The Q3 trading update will be on 7(th) April.

Notes

1. Like-for-like (LFL) sales represents revenues from stores

trading for at least one full financial year prior to 2(nd) July

2016 and excludes stores with significant change of space in the

current or previous financial year.

2. Quarterly sales and margin analysis (excluding Worldstores):

13 weeks to 31st December 2016

-------------- ------------------------------------------------------

Q1 Q2 H1 Q3 Q4 H2 FY

-------------- ---------- ---------- ---------- --- --- --- ---

Total sales GBP198.7m GBP253.8m GBP452.4m

-------------- ---------- ---------- ---------- --- --- --- ---

Total sales

growth -1.8% 3.3% 1.0%

-------------- ---------- ---------- ---------- --- --- --- ---

LFL sales

growth -3.8% 0.2% -1.6%

-------------- ---------- ---------- ---------- --- --- --- ---

Gross margin 0bps +10bps +5bps

growth*

-------------- ---------- ---------- ---------- --- --- --- ---

*estimated

13 weeks to 2(nd) January 2016

----------------- ----------------------------------------------------------------------------------

Q1 Q2 H1 Q3 Q4 H2 FY

----------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Total sales GBP202.3m GBP245.7m GBP448.1m GBP229.0m GBP203.8m GBP432.8m GBP880.9m

----------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Total sales

growth 12.0% 8.8% 10.3% 5.9% 1.8% 3.9% 7.1%

----------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

LFL sales

growth 5.5% 3.9% 4.6% 1.1% -0.6% 0.3% 2.5%

----------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Gross margin +20bps +30bps +30bps +90bps +80bps +90bps +60bps

growth/decline

----------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Notes to Editors

Dunelm is market leader in the GBP11bn UK homewares market. It

currently operates 161 stores, of which 157 are out-of-town

superstores and 4 are located on high streets, and an online store,

to be found at www.dunelm.com.

The company acquired the assets of Worldstores, including Achica

and Kiddicare, on the 28(th) November 2016. Worldstores is one of

the UK's largest online retailers of products for the home and

garden, with over 500,000 products on the site. Achica is a

members-only online store offering furniture, homewares and

accessories, often at significant discounts to RRPs for limited

periods through flash sales. Kiddicare is a multichannel retailer,

selling nursery supplies and merchandise for children and young

families.

Dunelm's "Simply Value for Money" customer proposition offers

industry-leading choice of quality products at keen prices, with

high levels of availability and supported by friendly service. Core

ranges include many exclusive designs and premium brands such as

Dorma and Fogarty, and are supported by a frequently changing

series of special buys. The superstore format provides an average

of 30,000 sq. ft. of selling space with over 20,000 products across

a broad spectrum of categories, extending from the Group's home

textiles heritage (bedding, curtains, cushions, quilts and pillows)

to a complete homewares offer including kitchenware and dining,

lighting, wall art, furniture and rugs. Dunelm is one of the few

national retailers to offer an authoritative selection of curtain

fabrics on the roll, and owns a specialist UK facility dedicated to

producing made-to-measure curtains.

Dunelm was founded in 1979 as a market stall business, selling

ready-made curtains. The first shop was opened in Leicester in 1984

and over the following years the business developed into a

successful chain of high street shops before expanding into broader

homewares categories following the opening of the first Dunelm

superstore in 1991.

Dunelm has been listed on the London Stock Exchange since

October 2006 (DNLM.L) and has a current market capitalisation of

approximately GBP1.6bn.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSFEFWFFWSEFF

(END) Dow Jones Newswires

January 12, 2017 02:00 ET (07:00 GMT)

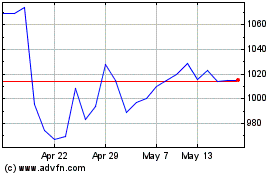

Dunelm (LSE:DNLM)

Historical Stock Chart

From Mar 2024 to May 2024

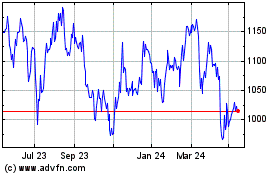

Dunelm (LSE:DNLM)

Historical Stock Chart

From May 2023 to May 2024