TIDMDPA

RNS Number : 9821H

DP Aircraft I Limited

13 June 2017

13 June 2017

DP AIRCRAFT I LIMITED (the "Company")

INTERIM UPDATE

The Company is issuing this report for the period from 28

October 2016 to 26 May 2017 as an investor update. It should not be

relied on by Shareholders, or any other party, as the basis for an

investment in the Company or for any other purpose.

Overview

DP Aircraft I Limited, a Guernsey based company, was launched in

October 2013. Its US$ 113 million placing was oversubscribed. To

date the company has acquired four Boeing 787-8 aircraft, with two

leased to Norwegian Air Shuttle ASA and two leased to Thai Airways

International PCL. DP Aircraft I Limited took over the Norwegian

aircraft, LN-LNA (previously EI-LNA) and LN-LNB (previously

EI-LNB), on 9 October 2013 and the Thai aircraft, HS-TQC and

HS-TQD, on 18 June 2015. Since these dates all lease obligations

have been met in full by Norwegian and Thai and no incidents of

note concerning operations of the aircraft have occurred.

To date the Company has, as scheduled, paid out 14 dividends of

2.25 cents each. The Company pays out dividends on a quarterly

basis and targets a yearly distribution of 9 per cent. The next

interim dividend payment is due on 18 August 2017. The quarterly

distributions are targeted for February, May, August and November

in each year.

Company Information

Ticker DPA

---------------------------- ---------------------------------

Company Number 56941

---------------------------- ---------------------------------

ISIN Number GG00BBP6HP33

---------------------------- ---------------------------------

SEDOL Number BBP6HP3

---------------------------- ---------------------------------

Traded Specialist Fund Segment

(previously known as Specialist

Fund Market)

---------------------------- ---------------------------------

SFS Admission Date 4 October 2013

---------------------------- ---------------------------------

Share Price USD1.073 as at 26 May

2017

---------------------------- ---------------------------------

Country of Incorporation Guernsey

---------------------------- ---------------------------------

Current Shares in Issue 209,333,333 Ordinary Shares

---------------------------- ---------------------------------

Administrator and Company Aztec Financial Services

Secretary (Guernsey) Limited (previously

Fidante Partners (Guernsey)

Limited

---------------------------- ---------------------------------

Asset Manager DS Aviation GmbH & Co.

KG

---------------------------- ---------------------------------

Auditor and Reporting KPMG

Accountant

---------------------------- ---------------------------------

Corporate Broker Canaccord Genuity Limited

---------------------------- ---------------------------------

Aircraft Registration LN-LNA (28 June 2013)

(Date of Delivery) LN-LNB (23 August 2013)

HS-TQC (29 October 2014)

HS-TQD (9 December 2014)

---------------------------- ---------------------------------

Manufacturer Serial Number MSN 35304

MSN 35305

MSN 36110

MSN 35320

---------------------------- ---------------------------------

Aircraft Type and Model B787-8

---------------------------- ---------------------------------

Lessees Norwegian Air Shuttle

ASA

Thai Airways International

PCL

---------------------------- ---------------------------------

Website www.dpaircraft.com

---------------------------- ---------------------------------

The company's investment objective is to obtain income returns

and a capital return for its Shareholders by acquiring, leasing and

then, when the Board considers it is appropriate, selling the

aircraft.

Aviation Market

2016 proved to be a strong year for the aviation market, with

demand (measured by reference to Revenue Passenger Kilometres

(RPK)) growing by 6.3 per cent; this exceeded the ten year average

growth rate of 5.5 per cent according to the International Air

Transport Association (IATA). Capacity (Available Seat Kilometres

(ASK)) increased by 6.2 per cent, while the load factor remained

stable compared to 2015. According to the International Civil

Aviation Organization (ICAO), all geographic regions reported

positive growth in capacity, with the three regions of Asia

Pacific, Europe and North America accounting for 82 per cent of

global capacity. IATA anticipates that 3.7 billion passengers were

transported worldwide and around 700 routes were newly established

during the course of the year. Demand for international air traffic

operated by Asian Pacific carriers increased by 8.3 per cent, while

capacity went up by 7.7 per cent and the load factor increased

slightly to 78.6 per cent. European carriers recorded an increase

of 4.8 per cent in demand for international traffic while capacity

rose by 5.0 per cent.; the load factor consequently dropped

slightly to 82.8 per cent, but remains the highest among the

geographical regions. European carriers recorded an improvement in

passenger volumes, particularly in the second half of 2016.

First quarter traffic results 2017 were strong according to

IATA. In March, European carriers reported an increase of 5.7 per

cent in international passenger demand while Asian Pacific carriers

reported an increase of 9.1 per cent compared to the same month in

2016. While European carriers have benefitted from the momentum of

the region's economy, routes between Asia and Europe continue to

recover from terrorism-related disruptions in early 2016. Air

traffic increased by 6.8 per cent while capacity grew by 6.1 per

cent.

In contrast to 2016, which is expected to register the airline

industry's highest ever annual net profit (amounting to USD 35.6

billion), conditions for airlines are expected to tighten in 2017;

mainly as it is assumed that the price of jet fuel will rise, and

will account for 18.7 per cent of airlines' costs. Nevertheless,

IATA expects global airline profits to amount to USD 29.8 billion

in 2017. It is anticipated that new destinations will increase by 4

per cent and that USD 769 billion (about 0.9 per cent of global

GDP) will be spent on air transport. Moreover, governments are

expected to receive USD 123 billion in tax revenues generated by

airlines and their passengers.

Both Airbus (Global Market Forecast 2016-2035) and Boeing

(Current Market Outlook 2016-2035) continue to forecast that the

global passenger and freighter fleet will at least double by 2035.

According to Airbus, the fleet in 2035 will comprise 39,820

aircraft with 33,070 aircraft being delivered within the next 20

years to either grow the fleet or to replace older aircraft. Boeing

forecasts an even larger fleet of 45,240 aircraft in 2035, with new

aircraft deliveries valued at more than USD 5.9 trillion.

Furthermore, the manufacturer expects 38 per cent of these aircraft

to be delivered to operators based in the Asia Pacific region, 40

per cent to North American and European carriers and 22 per cent to

carriers based in the Middle East, Latin America, the Commonwealth

of Independent States and Africa.

In the last 20 years, the cost of air transportation has halved

whereas connectivity and city-pairs have doubled. On a daily basis

approximately 10 million people are transported on circa. 100,000

flights. Air traffic supports about 63 million jobs, over half of

them in the tourism sector, as well as 3.5 per cent of global GDP.

This results in air traffic playing a major role in globalisation,

trade and tourism.

The Assets - Boeing 787-8s

As at 30 April 2017, the aircraft manufacturer Boeing had

delivered 541 aircraft belonging to the Dreamliner Boeing 787

family, of which 334 aircraft are B787-8s and 207 aircraft are

B787-9s. The total order for this aircraft family amounts to 1,213

aircraft. As at the end of 2016, the B787 was in service with 48

operators spread across all continents and applying different

business models. Aircraft from the B787 family are operated on all

continents. Today, more than 130 new non-stop routes operated by

B787 aircraft are in service or have been announced. In May 2017,

Boeing announced an order for 10 Dreamliners by the Canadian air

carrier WestJet, who became a new customer of this aircraft

family.

Norwegian has equipped its B787 fleet with a total of 291 seats,

of which 32 are premium economy and 259 economy class seats. This

type of aircraft is used to fly from Europe to destinations in

Asia, America and the Caribbean including, amongst others, New

York, Fort Lauderdale and Bangkok. During the summer peak season

the airline deploys B787s on some of its Oslo-Nice flights as well.

Since the acquisition by DP Aircraft I Limited of the two aircraft

LNA and LNB in 2013, Norwegian has met all of its lease obligations

in full. In December 2016, aircraft LNA was inspected by DS Skytech

Limited at the Boeing maintenance facilities at Copenhagen

International Airport. Aircraft LNB was inspected on 6 April 2017

at the British Airways Maintenance facilities in Cardiff during

Base Maintenance (every 6,000 flight hours).

Both aircraft and their technical records were found to be in

good condition with no significant defects or airworthiness related

issues.

Thai Airways' B787 fleet offers a total of 264 seats, of which

24 are business and 240 economy class seats. The carrier operates

this aircraft type to destinations within the Asia-Pacific region

such as Beijing, Delhi, Phuket, Nagoya and Brisbane. Since DP

Aircraft I Limited acquired the two aircraft TQC and TQD in 2015,

Thai Airways has met all of its lease obligations in full. In July

2016, both aircraft, TQC and TQD, were inspected by DS Skytech

Limited at Bangkok International Airport. The inspection found the

aircraft and their technical records to be in good condition with

no significant defects or airworthiness related issues.

Thai Airways has requested permission to modify the aircraft

through the installation of a crew rest compartment and the

introduction of in-flight connectivity equipment (including a Wi-Fi

antenna). The flight crew and flight attendant rests will be fitted

overhead in order to minimise the loss of cargo and cabin holds;

although passenger capacity will be reduced by two Business and six

Economy class seats, it will allow the airline to operate the B787s

more efficiently within the network and to deploy them on longer

routes. As on-board Wi-Fi connectivity becomes more common, the

installation of a Wi-Fi antenna for a network carrier represents a

logical proposal from a commercial perspective. Initial designs,

plans and engineering will be performed by the Boeing Company.

Physical installation is scheduled to take place in December 2017

and January 2018, over the course of approximately three weeks in

each instance, and will be conducted by Boeing Shanghai. All costs

of the process will be borne by Thai Airways, and the modifications

made will remain part of the aircraft upon expiry of the lease

agreements with Thai Airways and the return of the assets to the

Company. Thai Airways will be obliged to continue lease payments to

the Company during downtime, and any modifications to the aircraft

will be made in accordance with the relevant OEM manuals and will

be approved by the Federal Aviation Administration and the Civil

Aviation Authority of Thailand. It is considered that these

modifications will improve both the marketability and the value of

the assets. The request by Thai Airways has therefore been approved

by the Board.

The charts below give a short overview of the utilisation of

airframe and engines of each of the four aircraft.

AIRFRAME STATUS Norwegian Air Shuttle Norwegian Air Shuttle

(30 April 2017) LN-LNA LN-LNB

--------------------- ------------------------------------ --------------------------

TOTAL April 2017 TOTAL April 2017

--------------------- ---------------------- ------------ ------------ ------------

Total Flight

hours 18,002 487 19,280 355

--------------------- ---------------------- ------------ ------------ ------------

Total Cycles 2,156 56 2,334 52

--------------------- ---------------------- ------------ ------------ ------------

Average Monthly 391 hours --- 436 hours ---

Utilisation 47 cycles 53 cycles

--------------------- ---------------------- ------------ ------------ ------------

Flight hours/Cycles 8.35 : 8.26 :

Ratio 1 8.70 : 1 1 6.83 : 1

--------------------- ---------------------- ------------ ------------ ------------

ENGINE DATA

(30 April 2017)

--------------------- ------------------------------------ --------------------------

Engine Serial

Number 10118 10119 10130 10135

--------------------- ---------------------- ------------ ------------ ------------

Engine Manufacturer Rolls-Royce Rolls-Royce Rolls-Royce Rolls-Royce

--------------------- ---------------------- ------------ ------------ ------------

Engine Type Trent 1000 Trent 1000 Trent 1000 Trent 1000

and Model

--------------------- ---------------------- ------------ ------------ ------------

Total Time

[flight hours] 15,639 13,707 9,828 14,191

--------------------- ---------------------- ------------ ------------ ------------

Total Cycles 1,904 1,700 1,089 1,683

--------------------- ---------------------- ------------ ------------ ------------

Location LND LNF Workshop LNB

--------------------- ---------------------- ------------ ------------ ------------

AIRFRAME STATUS Thai Airways International Thai Airways International

(30 April 2017) HS-TQC HS-TQD

--------------------- ----------------------------- -----------------------------

TOTAL April 2017 TOTAL April 2017

--------------------- -------------- ------------- -------------- -------------

Total Flight

hours 10,418 376 9,584 380

--------------------- -------------- ------------- -------------- -------------

Total Cycles 2,542 90 2,374 92

--------------------- -------------- ------------- -------------- -------------

Average Monthly 347 hours --- 338 hours ---

Utilisation 85 cycles 84 cycles

--------------------- -------------- ------------- -------------- -------------

Flight hours/Cycles 4.10 : 4.04 :

Ratio 1 4.18 : 1 1 4.13 : 1

--------------------- -------------- ------------- -------------- -------------

ENGINE DATA

(30 April 2017)

--------------------- ----------------------------- -----------------------------

Engine Serial

Number 10239 10240 10244 10248

--------------------- -------------- ------------- -------------- -------------

Engine Manufacturer Rolls-Royce Rolls-Royce Rolls-Royce Rolls-Royce

--------------------- -------------- ------------- -------------- -------------

Engine Type Trent 1000 Trent 1000 Trent 1000 Trent 1000

and Model

--------------------- -------------- ------------- -------------- -------------

Total Time

[flight hours] 9,933 9,846 8,077 9,220

--------------------- -------------- ------------- -------------- -------------

Total Cycles 2,387 2,415 2,041 2,277

--------------------- -------------- ------------- -------------- -------------

Location TQB TQD TQB TQA

--------------------- -------------- ------------- -------------- -------------

The Lessees

Norwegian Air Shuttle ASA

Norwegian Air Shuttle, the third largest low cost carrier in

Europe, has offered commercial air services since 1993. In 2013,

Norwegian launched long-haul services and as at 31st March 2017 had

a fleet of 124 passenger aircraft including 13 Boeing 787s. The

airline received one Boeing 787-9 in the first quarter 2017. The

airline is aiming to have a fleet of 21 B787s by the end of 2017.

As at 31st March 2017, Norwegian Air Shuttle had 23 operational

bases and operated a total of 482 routes to 133 destinations on

four continents. In 2016, the airline had nearly 30 million

passengers transported, with 30 per cent of intercontinental

passengers transferred to intra-European flights. Since 2013, the

carrier has transported more than 4 million passengers between

Europe and the U.S. In 2016, the airline was awarded the "World's

Best Long Haul Low-Cost Airline" for the second time and "Europe's

Best Low-Cost Airline" for the fourth year in a row by Skytrax. In

2017, Brand Finance ranked Norwegian the 31st most valuable airline

brand worldwide after having been ranked at 44 the previous

year.

For the financial year 2016, Norwegian Air Shuttle reported

operating revenues of NOK 26.05 billion (USD 3.03 billion) which is

an increase of 16 per cent on the previous financial year.

Ancillary revenues per passenger increased by 5 per cent, while

unit revenue and yield decreased by 3 per cent and 5 per cent

respectively. Unit costs, including fuel, decreased by 3 per cent

whereas unit costs, excluding fuel, increased by 2 per cent.

Operating profit was up 423 per cent and amounted to NOK 1.82

billion (USD 212 million), while net profit grew by 361 per cent to

NOK 1.14 billion (USD 132 million). The carrier's results were

influenced by strong network expansion, continued revenue growth,

efficiency im-provements and lower fuel costs as well as by the

weaker Norwegian currency and unreal-ised gains on fuel hedges for

the years 2017 and 2018. Capacity grew by 18 per cent and demand

increased by 20 per cent, and the load factor consequently improved

by 1.5 percentage points to 87.7 per cent. 34 new routes were

opened and 23 aircraft, including four B787-9s, were delivered. As

at 31 December 2016, cash and cash equivalents stood at NOK 2.32

billion (USD 271 million) and total assets amounted to NOK 37.76

billion (USD 4.40 billion).

In the first quarter 2017, operating revenues increased by 9 per

cent to NOK 5.41 billion (USD 632 million) compared to the same

quarter in the previous year. Ancillary revenues per passenger

remained stable but increased by 15 per cent in total. Operating

losses were NOK 1.70 billion (USD 199 million), an increase of 90

per cent, while net losses rose by 86 per cent to NOK 1.49 billion

(USD 174 million). The first quarter was affected by increasing

fuel prices, a strengthening krone and a relatively late Easter.

Norwegian Air Shuttle continues to grow, with passenger increase of

14 per cent in the first quarter of 2017 compared to the same

quarter in 2016.

The biggest share of passengers originated in Norway, Spain and

Sweden; and the strongest growth rates in passenger numbers were

recorded in U.S., Spain and France. Capacity grew by around 24 per

cent and demand by 23 per cent; the load factor therefore decreased

slightly by 0.8 per cent to 84.4 per cent. Cash and cash

equivalents as at 31 March 2017 were NOK 4.76 billion (USD 556

million) and total assets amounted to NOK 40.96 billion (USD 4.79

billion).

In 2017, the airline plans to take delivery of 32 new aircraft,

including nine B787-9s, hire an additional 2,000 employees and

launch 50 new routes, of which 39 have already been launched during

the first quarter of 2017. In April, the airline announced three

new long haul routes out of London Gatwick to Singapore, Denver and

Seattle. A global partnership with Expedia has been entered into

offering benefits to Norwegian's loyal customers, including access

to exclusive rates at a wide range of hotels. The carrier

anticipates 60 per cent capacity growth on long haul routes and 30

per cent growth in total. In January, Norwegian established an

Argentinian subsidiary and applied for an Argentinian Air

Operator's Certificate (AOC). In May, Norwegian's Board gave

approval for the set-up of operations to proceed. The first routes

are anticipated to be launched and opened for sale by the end of

2017.

Thai Airways International PCL

Thai Airways International Public Company Limited, with its

headquarters in Bangkok, is a full-service network carrier and flag

carrier of the Kingdom of Thailand. It is majority-owned by the

Thai Government (Ministry of Finance) (51.03 per cent) and has a

fleet of 94 aircraft as at 31st March 2017, including six B787-8s.

Two B787-9s are on order as part of the airline's fleet renewal

plan. The carrier transported more than 22 million passengers in

2016 and flies from Bangkok to over 63 destinations in 34

countries. The carrier received ten awards during 2016, amongst

others two from Skytrax as "the World's Most Improved Airline for

Service Quality" and "World's Best Airline Lounge Spa". In May

2017, the Thai low cost carrier Nok Air issued new shares and

generated proceeds of THB 1.2 billion (USD 35 million). Thai

Airways, which at the time had a stake of 39.20 per cent, did not

increase its shareholding so the percentage which it holds has been

reduced to 17.63 per cent. Thai Airways remains the single largest

shareholder of Nok Air.

The restructuring plan, "Transformation", seems to be proving

successful in regard to the financial results and improving

customer satisfaction. Thai Airways, including all subsidiaries,

returned to profitability in 2016. The carrier reported an

operating profit of THB 4.07 billion (USD 113 million) compared to

a loss of THB 1.30 billion (USD 36 million) in 2015. Net profits

were THB 47 million (USD 1.3 million) compared to a net loss of THB

13.05 billion (USD 362 million) in 2015. Net profits were impacted

by one-time cost items of THB 1.32 billion, expenses of the

Transformation plan of THB 1.23 billion, and impairment losses of

THB 3.63 billion; but benefited from foreign currency exchange

gains of THB 685 million. Although total revenues decreased by 4.3

per cent to THB 180.56 billion (USD 5.03 billion), total expenses

declined by 7.1 per cent to THB 176.49 billion (USD 4.92 billion).

Capacity grew by 1.9 per cent whereas demand increased by 2.5 per

cent and the load factor slightly improved to 73.4 per cent.

Passenger numbers increased by 4.8 per cent and aircraft

utilisation increased by 5.5 per cent to 11.5 block hours per

aircraft per day compared to 2015. Cash and cash equivalents as at

31 March 2017 stood at THB 13.39 billion (USD 373 million) and

total assets were THB 283.12 billion (USD 7.89 billion).

First quarter results for 2017 showed revenues of THB 49.80

billion (USD 1.44 billion) which is a slight decrease of 0.8 per

cent compared to the same quarter in the previous year, in

consequence of high competition and lower fuel surcharges. While

capacity grew by 4.4 per cent, demand increased by 11.6 per cent

and the load factor improved from 77.5 per cent to 82.8 per cent.

Passenger numbers increased by 10.1 per cent to 6.52 million and

aircraft utilisation rose by 7.8 per cent to 12.4 block hours per

aircraft per day. Operating profits decreased by 60.1 per cent to

THB 2.87 billion (USD 83 million) and net profits declined by 47.3

per cent to THB 3.17 billion (USD 92 million). Results were

impacted by the 45.8 per cent increase in average jet fuel prices

compared to the same period in 2016. Cash and cash equivalents

stood at THB 13.61 billion (USD 395 million) and total assets were

THB 283.00 billion (USD 8.21 billion) as at 31 March 2017.

Passengers travelling in and out of Bangkok increased by 2.7 per

cent, whereas the total number of tourists grew by 1.7 per cent in

the first quarter of 2017 compared to the same quarter in 2016. As

a result of the ICAO audit and downgrade of Thailand, the former

department of Civil Aviation has been replaced by the Civil

Aviation Authority of Thailand (CAAT). Airlines need to be

re-certified with new AOCs to continue international operations

after 1 July 2017. Thai Airways received its new AOC on 8 May

2017.

This year, Thai Airways has entered the third and final stage,

"sustainable growth", of its restructuring plan. This includes,

amongst other things, the use of a single home-base airport

(Bangkok Suvarnabhumi) for both Thai Airways and Thai Smile since

January 2017, as well as the introduction of a new internet and

mobile sales platform to facilitate internet bookings. In April,

Thai Airways signed a Memorandum of Understanding with Airbus and

Thai Royal Navy to develop U-Tapao as an MRO (Maintenance, Repair

and Overhaul) centre, offering line and heavy maintenance services

as well as air cargo and a logistic hub. Furthermore, the airline

intends to expand into new markets and focus on new routes to

India, China and the ASEAN member states. Part of the network

growth includes codeshare agreements with Bangkok Airways. The

carrier also plans to enhance the travel experience and to retrofit

passenger seats and entertainment systems to achieve consistency

across its entire passenger fleet. The implementation of a new

First Class and short haul Business Class to upgrade the premium

product has been announced as well. The installation of the

previously mentioned crew rest and in-flight connectivity to all

B787s within the fleet of Thai Airways will further increase fleet

flexibility as it will enable the airline to operate this aircraft

type into Europe as well.

Material Events since November 2016

November 2016

Interim update (4 November 2016)

The interim investor update report for the period 22 July 2016

to 27 October 2016 was published.

Notification of major interest in shares (16 November 2016)

On 16 November 2016, a notification of major interest in shares

was published, in relation to the 22%-23% threshold that was

crossed by Prudential plc group of companies.

January 2017

Interim Dividend (18 January 2017)

The Company declared an interim dividend, in respect of the

quarter ended December 2016, of 2.25 cents per Share, to holders of

Shares on the register at 27 January 2017. The ex-dividend date was

26 January 2017, and payment was made on 13 February 2017.

April 2017

Annual Report and Accounts (6 April 2017)

The Annual Report and Consolidated Financial Statements for the

year ended 31 December 2016 was published.

Announcement of modification by Thai Airways (12 April 2017)

The Board of Directors of DP Aircraft I Limited announced that

Thai Airways, lessee of two of the Company's B787s (serial numbers

MSN 36110 and MSN 35320), had requested permission to modify the

aircraft through the installation of a crew rest compartment and

the introduction of in-flight connectivity equipment (including a

Wi-Fi antenna). The request was approved by the Board.

Interim Dividend (20 April 2017)

The Company declared an interim dividend, in respect of the

quarter ended March 2017, of 2.25 cents per Share, to holders of

Shares on the register at 28 April 2017. The ex-dividend date was

27 April 2017, and payment was made on 19 May 2017.

Investor Information

The latest available portfolio information can be accessed by

eligible Shareholders via www.dpaircraft.com

Enquiries:

Kellie Blondel / Chris Copperwaite

Aztec Financial Services (Guernsey) Limited

As Company Secretary to DP Aircraft I Limited

Tel: + 44 (0) 1481 748833

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUOOSRBVANAAR

(END) Dow Jones Newswires

June 13, 2017 10:38 ET (14:38 GMT)

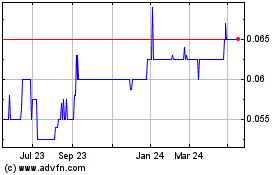

Dp Aircraft I (LSE:DPA)

Historical Stock Chart

From Mar 2024 to May 2024

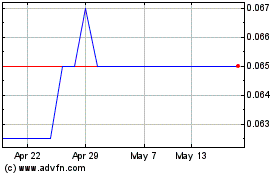

Dp Aircraft I (LSE:DPA)

Historical Stock Chart

From May 2023 to May 2024