Airlines Start To Count The Cost Of EU Emissions Trading Scheme

28 September 2011 - 1:32AM

Dow Jones News

Airlines are facing a bill of up to EUR1 billion to implement

the E.U.'s Emissions Trading Scheme when they are included in the

European carbon market in January, and they are planning to absorb

much of the extra costs initially in an effort to prevent

exacerbating a renewed downturn in the sector.

From next year, any airline flying into or out of the E.U. will

be required to hold permits that allow them to emit one ton of CO2

for every flight landing and taking off in the European Union.

In an effort to help an industry united in its opposition to the

emissions scheme, the European Commission this week said it will

give airlines permits to cover 85% of their CO2 emissions in 2012

for free. Between 2013 and 2020, airlines will get 82% of the

permits for free, with 15% auctioned to meet additional needs and

3% set aside for new entrants to the scheme.

However, Standard & Poor's estimates that this will still

mean airlines have to pay about EUR975 million to fund the rest of

their trading scheme needs next year alone, assuming a carbon price

of EUR13 per ton of carbon dioxide.

The figures are backed by Europe's major airlines. Deutsche

Lufthansa AG (LHA.XE) said it expects to have to buy permits to

cover about 30-40% of its ETS needs, at a cost of between EUR150

million and EUR350 million. Europe's largest budget carrier,

Ryanair Holdings PLC (RYA.DB), has forecast its bill will top EUR15

million to EUR20 million in 2012, while easyJet PLC (EZJ.LN) said

it estimates costs to be GBP25 million between January and

September alone. British Airways, part of International

Consolidated Airlines Group S.A. (IAG.LN), and Virgin Atlantic

declined to give estimates, although Virgin said it would be a

"significant cost" to the business.

The E.U.'s rationale for its carbon scheme is to try and combat

climate change by capping CO2 emissions. It is bringing airlines

into the scheme because although the industry is only responsible

for between 2% and 3% of global emissions, that proportion is

expected to grow rapidly in coming years as air travel becomes more

accessible.

However, the scheme is coming at a bad time for airlines, which

already face high fuel bills and taxes and the latest signs of a

renewed downturn in travel demand amid the sovereign debt crisis

and weak consumer and business sentiment. Given that background,

airlines will be hard pressed to push the extra costs on to

travellers.

The European Commission has calculated that the Emissions

Trading Scheme will push prices up between EUR2 and EUR12 a ticket,

but until that can be passed on airlines face an added burden in

the first year.

A spokesman for easyJet said the airline would absorb the

increased cost initially as it usually takes 18 months to pass on

the costs in full without forcing customers onto rival airlines.

Virgin Atlantic echoed those comments.

The scheme applies to all airlines operating into and out of the

E.U., but a group of U.S. airlines is arguing in the European

Courts of Justice that it shouldn't apply to non-E.U. airlines.

United Continental Holdings Inc.'s (UAL) President and Chief

Executive Officer Jeff Smisek said earlier this month that the

airline "has no choice but to comply" and that it is already doing

so with data collection processes. However he added: "We are

obviously suing and we hope we win."

"(The) fact is that today China, India, the USA and even

medium-sized countries such as Algeria are expressing strong

opposition and heavy complaints against EU-ETS," a Lufthansa

spokesman said. He said it was important that there is a global

aviation solution to climate change, otherwise competition

distortion would arise.

By Kaveri Niththyananthan, Dow Jones Newswires; 4420 7842 9299;

kaveri.niththyananthan@dowjones.com

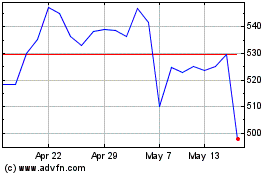

Easyjet (LSE:EZJ)

Historical Stock Chart

From Apr 2024 to May 2024

Easyjet (LSE:EZJ)

Historical Stock Chart

From May 2023 to May 2024