Forterra plc Trading Update (5078T)

25 November 2021 - 5:59PM

UK Regulatory

TIDMFORT

RNS Number : 5078T

Forterra plc

25 November 2021

25 November 2021

FORTERRA PLC

Trading Update: Continued Strong Performance

Forterra plc, a leading UK producer of manufactured masonry

products, provides this trading update covering the four months

ended 31 October 2021 (the "period").

Headlines

-- Strong trading performance in the period with brick sales

volumes up 6% vs 2019 leaving YTD brick sales volumes in line with

2019

-- Significant cost inflation experienced across a range of

categories including energy, raw materials and transportation. c90%

of energy requirement secured for remainder of the year

-- Concrete product selling price increases to recover cost

inflation have already been achieved with significant brick price

increases secured from 1 January 2022

-- Accordingly, we expect to deliver a 2021 result in line with management's expectations

-- Strong market demand has meant that inventory levels remain at very low levels

-- Short term impact on margins experienced due to cost

inflation in 2021, but selling price increases are expected to

benefit margins in 2022

-- Positive market demand dynamics looking into 2022 although

business remains broadly capacity constrained until Desford brick

factory commissioning

-- Around 60% of total energy requirements secured for 2022 with

c85% secured for Q1 when risk of volatility is greatest

-- Desford and Wilnecote expansion projects progressing

according to plan with commissioning of Desford expected in Q4

2022, within GBP95m budget

Stephen Harrison, Chief Executive of Forterra plc commented:

"The strong trading seen in the both the housebuilding and

repair maintenance and improvement (RM&I) markets in first half

of the year continued into the second half. As expected, we

encountered significant pressures across our supply chain in the

period, although, due to the agility of our operational management,

we have been successful in limiting any disruption. We also

experienced meaningful input cost inflation, which has had a

short-term impact on margins, however we are mitigating this

through significant selling price increases. Notwithstanding these

factors, we continue to anticipate delivering a full year result in

line with management's expectations, with higher than expected

revenues offsetting the increased cost base.

"Heading into 2022 we are optimistic about the continuing

buoyant demand for our products, underpinned by favourable market

fundamentals. With the brick capacity uplift provided by the new

Desford brick factory now only a year away, and with the Wilnecote

project increasing our presence in the commercial and specification

market from 2023, we are confident that Group performance will

continue to strengthen."

ENQUIRIES

Forterra plc +44 1604 707 600

Stephen Harrison, Chief Executive Officer

Ben Guyatt, Chief Financial Officer

FTI Consulting +44 203 727 1340

Richard Mountain / Nick Hasell

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBLBDBDSDDGBS

(END) Dow Jones Newswires

November 25, 2021 01:59 ET (06:59 GMT)

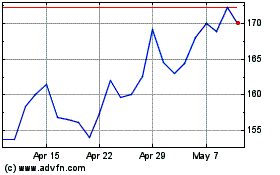

Forterra (LSE:FORT)

Historical Stock Chart

From Mar 2024 to Apr 2024

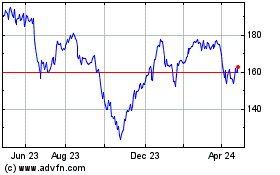

Forterra (LSE:FORT)

Historical Stock Chart

From Apr 2023 to Apr 2024