TIDMGDP

RNS Number : 6303H

Goldplat plc

05 August 2021

G ol dp lat plc / Ti cker: GDP / Index: AIM / Secto r: M in i ng

& E x p l o rati on

5 August 2021

Goldplat plc

( 'Goldplat', t he 'Group' or 'the Company ')

Quarterly Update - Update on the twelve months ended 30 June

2021

G ol dp lat pl c, the AIM li sted g o ld p r o ducer, w ith

internati onal g o ld reco very o perati ons l o cated in South Afr

i ca and Ghana, is p leased to announce an operational update for

the twelve months ended 30 June 2021.

The recovery operations achieved a combined operating profit for

the twelve months ended 30 June 2021 of GBP5,300,000 (30 June 2020:

GBP6,350,000) and a combined operating profit in the 4(th) Quarter

of the

financial year of GBP1,080,000 (4(th) Quarter - 2020: GBP2,546,000).

The Ghana operations continue to perform well as a result of

steady supply of material and achieved an operating profit for the

4(th) Quarter of GBP729,000 (4(th) Quarter - 2020: GBP366,000 ).

The South African operation achieved an operating profit for the

4(th) Quarter of GBP350,000 (4(th) Quarter - 2020:

GBP2,180,000).

The following events have contributed to the 4(th) Quarter's

operating results -

Ghana

-- There was continued good supply of material from regular

clients during the period, with supply and production from two

large batches from different clients continuing;

-- Our engagement with mine management and government officials

on different levels has continued, with the aim of increasing our

footprint to ensure ongoing and regular supply. During the quarter

specific progress have been made with respect to engagement with

potential suppliers and government officials in Burkina Faso and

Mali.

South Africa

-- Excluded from profits at the end of the 4(th) Quarter, 30

June 2021, was GBP1,100,000 of unrealised profit in gold material

produced not sold, compared with the end of the 4(th) Quarter of

the previous year, 30 June 2020, when the equivalent number was

GBP400,000. This was mainly due to higher amount of gravity

concentrated gold produced during the quarter, that had not been

sold by the period end;

-- The Group had an extremely profitable 4(th) quarter at end of

the previous financial period, driven by increasing gold prices and

sale of material produced in the 3(rd) quarter;

-- Gold production during the 4(th) quarter was above the

average of the last 8 quarters, with production in our CIL circuit

contributing the most to this. Although volumes and gold grades of

by-product received during the 4(th) quarter were lower than 2 to 3

years ago, they have stabilised over the last 18 months and we

expect them to remain stable on the back of a 3-year contract

renewal with one of our major suppliers;

-- Operating profitability, year on year, continue to be

impacted by higher electricity prices and increased water usage

from the local municipality due to poor water quality from one of

the Group's other water sources.

-- The Group has started to see benefits of equipment installed

to remove carbonaceous material pre-milling towards end of the

period. Based on successes in other circuits, we have decided to

incur capital to the amount of GBP75,000 to install gravity

circuits in our largest milling circuits, to increase gold

recoveries from the carbonaceous material. This will be commission

during September 2021.

-- The authorities requested us to submit additional supporting

information for, should it be required, an adjusted design for our

tailing's facility. We estimate the resubmission and evaluation to

take a further 3 months. We continue to manage and extend the

deposit of material within the Group's current facility with the

help of consulting engineers.

-- As indicated, we have identified what we believe to be the

best available options for both the processing facility and the

deposition site and we are in discussions to start the approval

process with the relevant parties.

The cash and cash equivalents on hand on 30 June 2021 in the

Group was GBP3,110,000 (30 June 2020- GBP3,100,000) and loan

outstanding to Scipion was GBP33,000 (30 June 2020 - GBP1,000,000).

The Scipion loan has subsequently been settled in full in

accordance with Nedbank's requirements with regard to the financing

of the Goldplat Recovery (Pty) Limited share repurchase as

announced on 20 July 2021.

Werner Klingenberg, CEO of Goldplat commented: "I am pleased to

report continued profitability in the Group and expect returns in

the first quarter of the current financial year in South Africa to

benefit from the sale of the stockpile of gravity concentrates at

the year end. The regular supply into Ghana remains encouraging,

but even more so the increased engagement in neighbouring countries

creating the potential of future supply. With the sale of

Kilimapesa, the Group will focus on growth and diversification

within its recovery operations, whilst remaining cognisant of its

goal of distributing value to shareholders."

For further i n fo rmat i on v i s it www .g o ld p lat.com, f o

l l ow on Twitter @GoldPlatPlc or contact:

Werner Klingenberg Goldplat plc Tel: +27 (0) 82 051 1071

(CEO)

Colin Aaronson / George Grant Thornton UK LLP Tel: +44 (0) 20 7383

Grainger (Nominated Adviser) 5100

Jessica Cave / Lydia WH Ireland Limited Tel: +44 (0) 207 220

Zychowska (Broker) 1666

Tim Thompson / Mark Edwards Flagstaff Strategic and Tel: +44 (0) 207 129

/ Investor Communications 1474

Fergus Mellon goldplat@flagstaffcomms.com

Th e i n formati on co ntai ned w ith in t h is ann oun cement

is deemed to const itute in s ide i nf o rma t i on as st ipu lated

under the Market Abu se Regulation (EU) No. 596/2014 which is part

of UK law by virtue of the European Union (withdrawal) Act 2018. Up

on the pub l ication of this ann o u ncement, this in s i de i n fo

rmati on is now c o n s i dered to be in the pub l ic domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDKQBBNBKBPFK

(END) Dow Jones Newswires

August 05, 2021 02:00 ET (06:00 GMT)

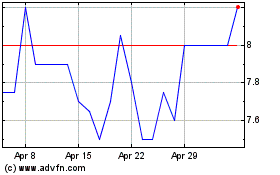

Goldplat (LSE:GDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

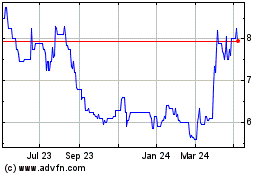

Goldplat (LSE:GDP)

Historical Stock Chart

From Apr 2023 to Apr 2024