TIDMGDP

RNS Number : 2738J

Goldplat plc

15 August 2023

Goldplat plc / Ticker: GDP / Index: AIM / Sector: Mining &

Exploration

15 August 2023

Goldplat plc

('Goldplat' or the 'Company')

4(th) Quarter Operating Results update for period ended 30 June

2023

Goldplat Plc, (AIM:GDP) the AIM listed Mining Services Group,

with international gold recovery operations located in South Africa

and Ghana, servicing the African and South American Mining

Industry, is pleased to announce an operational update for the

4(th) quarter ended 30 June 2023 ("Q4"), of the financial year just

ended.

The South African operational results for the period continued

to be impacted by electricity cuts and infrastructure related

issues. In addition, the Ghana operation could not capitalise on

its continued strong production profile as it could only start

exporting material produced during Q3 and Q4 towards the end of Q4,

resulting in minimal sales during the quarter.

As a result the two recovery operations achieved combined

operating profit for the quarter of GBP1,188,000 (excluding listing

and head office costs, interest and foreign exchange losses),

comprising operating performances in South Africa of GBP750,000 (Q4

2022 - GBP1,237,000) and in Ghana of GBP438,000 (Q4 2022 -

GBP1,810,000, which included gains as a result of movements in the

GHS against the USD of circa GBP1 million, with exchange losses of

circa GBP1 million recorded below the line).

Despite the reduced operating performance in Q4, the operating

entities delivered a strong combined operating profit performance

for the year of GBP6,028,000 (FY 2022 - GBP9,070,000) and the

Company expects net profit before tax to exceed market expectations

for the 2023 financial year.

The following events have contributed to the reduced Q4

operating results:

Gold Recovery Ghana

-- Although the license was approved by Minerals Commission of

Ghana and signed by regulated authorities during Q4, it did not

provide sufficient time to sell and realise margins locked up in

inventory at the end of the year. During the period supply from

clients and production remained strong and we expect a higher than

usual sales volume during Q1 of the 2024 financial year.

-- The supply of material from South America and Ghana has

remained steady and we continue to have positive engagements with

clients in South America and West Africa.

Goldplat Recovery (Pty) Ltd

-- The South African operation lost a total of 23 operating

days, 25% of the total days available in the quarter, due to

electricity cuts and infrastructure related issues during Q4. Due

to the increased uncertainty of supply in the medium term and as

announced on 31 May 2023, we have made a decision to invest in

diesel generators which will be able to sustain operations in South

Africa during electricity cuts. We expect the diesel generators to

be operational by the end of October 2023.

-- The construction of the new tailings storage facility ('TSF')

was completed during the first week of August and commissioning has

started. It is expected that the commissioning of the new TSF will

take 9 months during which period tailings will be deposited

between the new and old tailings facility.

-- With the new TSF commissioned we can turn our focus to the

processing of our old TSF which has a JORC Resource of 81,959

ounces (Table 1) at a DRD Gold process facility. The processing of

our old TSF remains dependent on the approval of the water use

license over certain areas for the installation of a pipeline to

the DRD Gold process facility and finalising commercial agreements

with DRD Gold in this regard.

-- We estimate that we will require a further GBP1,150,000

excluding investment of GBP750,000 to be spent on generators the

next 18 months to be spent on repairing and maintaining current

operations, on completing the TSF and improving the environmental

impacts of our current operations.

We continue to assess the economic and environmental feasibility

of the fine coal recovery technology company we invested in, which

is in line with our strategy to diversify our recovery operations

into other commodities.

Our cash balances in the group remained strong at GBP2,800,000

at the end of Q4, with significant balances invested in inventory

and debtors with our main exposure to smelters in Europe and South

Africa. This was driven by delays experienced in settlement from

one of the smelters and we only started receiving settlements on

long outstanding batches of material delivered, towards the end of

Q4 and into Q1 of 2024, as well as the delay in receiving our gold

license in Ghana. As a result, we expect interest on pre-financing

of material to be higher than usual.

Werner Klingenberg, CEO of Goldplat commented: "The completion

of the new TSF in South Africa is a big milestone for the group

from a business continuity perspective, but it also opens up

opportunities for the processing of the old TSF and other potential

projects. I am pleased with the operating results achieved by the

group during Q4 and the for the year as a whole, considering some

of the difficult circumstances we faced, and we look forward

particularly to improved operating results in Ghana during Q1 of

the 2024 financial year."

For further information visit www.goldplat.com, follow on

Twitter @GoldPlatGDP or contact:

Werner Klingenberg Goldplat plc Tel: +27 (0) 82 051 1071

(CEO)

Colin Aaronson / Samantha Grant Thornton UK LLP Tel: +44 (0) 20 7383

Harrison (Nominated Adviser) 5100

James Bavister / Andrew WH Ireland Limited Tel: +44 (0) 207 220

de Andrade (Broker) 1666

Tim Thompson / Mark Flagstaff Strategic Tel: +44 (0) 207 129

Edwards / Fergus Mellon and Investor Communications 1474

goldplat@flagstaffcomms.com

Table 1

Mineral Resource Estimate of the TSF, South Africa

Total Resource

Domain Class Tonnes Density Au (g/t) Au (Oz) U (3) O U (3) O Ag (g/t) Ag (Oz)

(Mil) (8) (g/t) (8) (lbs)

----------- ------------ -------- --------- -------- ----------- ----------- --------- --------

TOTAL

RESOURCE Measured 0.87 1.32 1.82 50,907 61.41 117,754 4.85 135,573

----------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Indicated 0.49 1.37 1.77 27,897 59.73 64,506 4.71 74,165

------------------------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Inferred 0.07 1.30 1.4 3,154 71.40 11,016 2.82 6,356

------------------------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Grand Total 1.43 1.34 1.78 81,959 61.32 193,276 4.70 216,094

------------ -------- --------- -------- ----------- ----------- --------- --------

The Tailings Mineral Resource Estimate was announced in

accordance with the JORC Code (2012) in a press release on 29

January 2016. Mark Austin of Applied Geology & Mining (Pty) Ltd

was the Competent Person responsible for that announcement. The

Company confirms that all material assumptions and technical

parameters underpinning the Resource Estimate continue to apply and

have not materially changed.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUSSVROSUWAAR

(END) Dow Jones Newswires

August 15, 2023 02:00 ET (06:00 GMT)

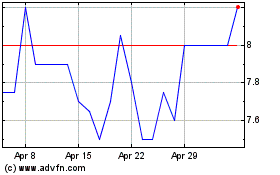

Goldplat (LSE:GDP)

Historical Stock Chart

From Apr 2024 to May 2024

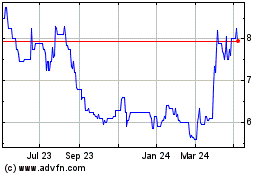

Goldplat (LSE:GDP)

Historical Stock Chart

From May 2023 to May 2024