Lapsing of Gemfields' Tender Offer for T1

11 November 2008 - 6:01PM

UK Regulatory

RNS Number : 8714H

Gemfields Resources PLC

11 November 2008

Gemfields Resources Plc

11 November 2008

Lapsing of Gemfields' Tender Offer for TanzaniteOne Limited

On 21 October 2008, Gemfields Resources Plc ("Gemfields") announced a tender offer to all TanzaniteOne Limited ("T1") shareholders to

purchase up to 30,754,970 common shares of US$0.0003 each ("T1 Shares") at 42.75 pence per share (the "Tender Offer"). The Tender Offer was

conditional upon, among other things, receipt by Gemfields of tenders totalling not less than 50.1 per cent. of the fully diluted T1 share

capital (the "Condition").

The Tender Offer was oversubscribed within four days of its announcement and, as at yesterday's date, was oversubscribed by 8,974,665 T1

Shares with an aggregate of 39,729,635 T1 Shares having been tendered.

In response to the Tender Offer, on 27 October 2008, the T1 directors announced that they had issued 83,739,976 nil paid issued and

unlisted B shares in T1 to TanzaniteOne Mining Ltd, a wholly owned subsidiary of TanzaniteOne (SA) Limited, which is in turn a wholly owned

subsidiary of T1 (the "B Share Scheme"). The new B shares represent 50.2 per cent. of the enlarged issued voting share capital of T1.

The T1 directors stated that they implemented the B Share Scheme to ensure that control of T1 could not be transferred without an offer

being made to all shareholders. Control of T1 now rests with the T1 board, which cannot be removed by T1 shareholders while the B Share

Scheme remains in place. Gemfields notes that the T1 board rejected an offer to all T1 shareholders (at 42.75p per share with 50% in cash

and 50% in Gemfields shares at a ratio of 1.4 Gemfields shares per T1 share) as proposed by Gemfields in discussions with T1's financial

advisors on 14 October 2008.

As a direct result of the B Share Scheme having been implemented by the T1 directors, and notwithstanding the overwhelming positive

response to the Tender Offer, Gemfields announces that as at today's date (the Final Closing Date as defined in the Tender Offer), the

Condition remains unsatisfied and Gemfields will (in accordance with the terms of the Tender Offer) not complete the acquisition of any T1

Shares pursuant to the Tender Offer which shall lapse and be of no further effect.

Gemfields has no current intention of making any revised or further offer for T1.

Gemfields advises T1 shareholders who have tendered their T1 Shares that Computershare Investor Services Plc (as escrow agent) has been

instructed, in the case of T1 Shares held in certificated form, to return share certificates and other documents of title to relevant T1

shareholders by post, and, in the case of T1 Shares held in uncertificated form, to provide instructions to Euroclear UK & Ireland Limited

to transfer all T1 Shares held in escrow balance by TFE instruction to the original available balances to which those T1 Shares relate.

Sean Gilbertson, CEO of Gemfields said: "While the holders of a majority of T1 shares wanted to see the Tender Offer succeed, the Tender

Offer failed because of the implementation of the B Share Scheme by the T1 directors. It is now up to the T1 board to deliver value for T1

shareholders as they have undertaken to do."

Enquiries:

Richard James, CFO Tel: +44 (0)20 7016 9416

Gemfields Resources Plc

Gerard Kisbey-Green/Paul Gray/Avital Lobel Tel: +44 (0)20 7597 4000

Investec Bank (UK) Limited

Financial Adviser to Gemfields

Mike Jones/Tarica Mpinga Tel: +44 (0)20 7050 6500

Canaccord Adams Ltd

Nominated Adviser and Joint Broker to Gemfields

Press Enquiries

Charlie Geller/Ed Portman Tel: +44 (0)20 7429 6666

Conduit PR

This information is provided by RNS

The company news service from the London Stock Exchange

END

TENBMBBTMMBBTLP

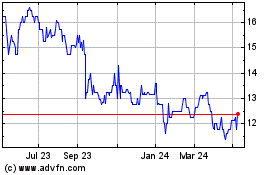

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gemfields (LSE:GEM)

Historical Stock Chart

From Feb 2024 to Feb 2025