Market Update and AGM 2009 Results

03 February 2009 - 6:00PM

UK Regulatory

TIDMGEM

Gemfields Resources Plc

("Gemfields" or the "Company")

Market Update and AGM 2009 Results

3 February 2009

With the current economic climate and deteriorating markets for diamonds and

other gemstones in mind, Gemfields announces a reduction in the scale of its

mining activity at the Kagem emerald mine. In addition, and until the prospects

for a recovery in the gemstone market become clearer, Gemfields will minimise

all non-essential capital, project development and exploration expenditure.

The current global financial crisis and the sharp falls in gemstone prices

experienced since October 2008 have resulted in significant uncertainty about

emerald prices and demand for the remainder of 2009. Given the weakening

markets and the associated uncertainty, Gemfields' performance for 2009 will be

significantly lower than projected during 2008, at the time of readmission to

AIM, and will result in a loss for the financial year ending 30 June 2009.

Gemfields presently has USD 16 million in cash and Gemfields' management

estimate the value of current inventory (comprising both rough and polished

emeralds) at USD 18 million.

Gemfields has to date not made significant sales of either rough or polished

stones, having favoured a policy of building sufficient inventory to provide

customers with a reliable and consistent source of supply. The sale of polished

stones will commence officially in Q2 2009, with some rough sales expected

during Q1 2009.

KAGEM PRODUCTION UPDATE

The Kagem emerald mine in Zambia is Gemfields' key production asset. Having

entered into a contract to manage Kagem in November 2007, Gemfields acquired a

75% stake in Kagem Mining Ltd on 6 June 2008. Accordingly Gemfields is now able

to give an update on Kagem's performance during the first half (July 2008

through December 2008) of the financial year ending 30 June 2009 (the

"Period"). All figures are unaudited.

During the Period, Kagem:

* produced 14.7 million gemstone carats (comprising emerald and beryl), an

average of 2.4 million carats per month. For the same period in 2007,

production totalled 3.7 million carats and, in 2006, 5.5 million carats (an

average of 0.6 and 0.9 million carats per month respectively).

* produced 40,122 tonnes of gemstone-bearing ore (known as "Reaction Zone"),

an average of 6,687 tonnes of ore per month. For the same period in 2007,

ore production totalled 17,713 tonnes and, in 2006, 7,264 tonnes (an

average of 2,952 and 1,211 tonnes per month respectively). The implied ore

grade during the Period was 367 carats per tonne which compares favourably

with the average grade over 4 years (from January 2005 to December 2008) of

340 carats per tonne.

* moved 2.8 million tonnes of waste. For the same period in 2007, waste

moving totalled 1.2 million tonnes and in 2006, 1.5 million tonnes.

Accordingly, Kagem's stripping ratio during the Period averaged 69:1

(compared with 70:1 for the same period in 2007 and 210:1 in the same

period in 2006).

During the Period, Kagem's unaudited operating cost per tonne of ore was USD

346 per tonne. This equates to USD 0.94 per carat. Mining efficiencies and

operating costs have shown an improving trend during the Period.

In the present market circumstances, and in the absence of significant sales to

date allowing realisable prices to be confidently estimated, Gemfields'

management is assuming an unaudited value of USD 0.75 per carat (for rough

gemstones). This value is an assumed average value across the range of gemstone

production. Values can vary widely from low grade to top grade material where,

for example, top grade production can exceed USD 500 per carat on a rough value

basis (but makes up only a small fraction of production). The historic realised

average values per rough carat are tabulated below:

KAGEM Annual Year Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Dec-07 Dec-08

Summary Ending:

Carats produced carats 13.5 6.4 9.1 10.5 9.5 5.9 20.9

(emerald+beryl) million

Revenue USD 4.4 4.5 6.4 9.5 12.7 8.5 15.7

million

Revenue per carat USD per 0.33 0.70 0.71 0.91 1.33 1.43 0.75

carat

Notes:

* Due to a change in year-end, the period ending December 2007 is a nine

month period

* Revenue for the year ending December 2008 is estimated by assuming a value

of USD 0.75 per carat

Note that these values do not account for any value-uplift derived from cutting

and polishing which may be derived from Gemfields' facility in Jaipur, India.

The scaled-down mining plan presently being implemented at Kagem aims to

continue the current trend of improving mining efficiency, a further reduction

in operating costs and a focus on higher grade areas in pursuit of optimising

financial performance based on the aforementioned revenue assumption. The

reduced scale of the mining plan will be re-assessed as and when market

conditions improve.

During the Period, Gemfields' unaudited worldwide monthly operating costs

averaged about USD 2.5 million, 90% of which relate to Kagem.

A graphical production update can be downloaded from Gemfields' website at

www.gemfields.co.uk/jan08update.asp.

POLISHED EMERALD COLLECTION

Gemfields opened its own state-of-the-art cutting and processing facility in

Jaipur, India in August 2008. A small proportion of Kagem's rough production is

selected for cutting and polishing at the Jaipur facility and results to date

suggest encouraging potential for value-addition.

As a result, Gemfields was able to unveil its new collection of cut and

polished emeralds at the Jaipur Jewellery Show (JJS) in December 2008. In so

doing, the Company became the first mining company to present a significant

emerald collection directly from mine to market. The display showcased emeralds

ranging from 5 carats up to 100 carats, all from the Kagem mine. The collection

includes a 1,000 carat bead necklace priced at over USD 1 million. Official

sales of Gemfields' polished emerald collection will commence in Q2 2009.

A selection of the stones can be viewed at www.gemfields.co.uk/

image_gallery7.asp.

ANNUAL GENERAL MEETING

At the Company's annual general meeting held at 9:00 am on 30 January 2009, all

resolutions were duly passed save for the resolution proposing the re-election

of Mr Rajiv Gupta as a director of the Company. Mr Gupta withdrew his consent

to be re-elected as a director prior to the meeting and steps down as a

director on the board of Gemfields with effect from 30 January 2009. This

change reflects Mr Gupta's focus on Gemfields' Indian operations where he will

continue as "Vice Chairman".

For more information:

Richard James, CFO richard.james@gemfields.co.uk

Gemfields Resources Plc Tel: +44 (0)20 7016 9416

Mike Jones/Tarica Mpinga Tel: +44 (0)20 7050 6500

Canaccord Adams Limited

Charlie Geller/Ed Portman Tel: +44 (0)20 7429 6666/ +44 (0) 7528 233 383

Conduit PR

END

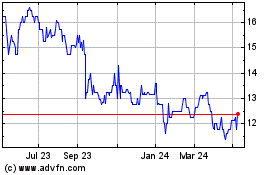

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gemfields (LSE:GEM)

Historical Stock Chart

From Feb 2024 to Feb 2025