TIDMGEN

RNS Number : 4589T

Genuit Group PLC

15 November 2023

15 November 2023

Genuit Group plc

Trading Update

Genuit Group plc ("Genuit", the "Company" or the "Group"), the

UK's largest provider of sustainable water, climate, and

ventilation products for the built environment, today issues an

update on trading for the ten months ended 31 October 2023. The

Company will report its full year results for the twelve months

ending 31 December 2023 in March 2024.

Highlights

-- Trading in the prior four months has been in-line with management expectations

-- Full Year 2023 Adjusted Operating Profit is expected to be

marginally above market expectations(1)

-- Strong strategic progress has been made in the period, focussed on business simplification

and continued investment in sustainability-linked growth

opportunities

Current trading and outlook

Against a backdrop of continued macro-economic uncertainty, the

Group's trading performance has remained resilient since interim

results were reported in August, supported by the diversity of the

Group's market segment exposure. Group revenue for the ten months

ended 31 October 2023 was GBP504.2 million (2022: GBP527.2

million), 4.8% lower than the prior year on like-for-like basis(2)

, driven by a volume reduction of circa 11%, partially offset with

successful new product launches and commercial management,

including international expansion.

-- Sustainable Building Solutions (SBS) sales were GBP210.0

million, down 12.3% on the prior year, with revenues in line with

previous actions to reduce lower margin and non-core business in

line with business simplification objectives and volume

expectations given prevailing market conditions.

-- Water Management Solutions (WMS) sales were GBP148.7 million,

in line with the prior year, following resilient demand for the

Company's drainage and stormwater attenuation products.

-- Climate Management Solutions (CMS) sales were GBP139.0

million, representing growth of 5.3% on the prior year, driven by

strong demand in the Nuaire ventilation business, which more than

offset reductions in sales at Adey due to the softness in the gas

boiler market.

The Group has continued to focus on business simplification

measures that increase the efficiency of operations and partially

mitigate the impact of lower volumes. These measures include

undertaking site consolidations to increase economies of scale,

without any associated reduction in production capacity. Together

with other self-help measures, the Group is on course to deliver a

further GBP7 million of annualised savings in addition to the GBP8

million announced previously. These further savings have already

started to contribute to the Group's FY23 performance, will help

navigate the current uncertain environment, as well as benefiting

the expected incremental profit improvement when volumes return to

more normal levels.

The Group's proactive cost action and continued commercial

progress is expected to result in full year adjusted operating

profit marginally above market expectations. This demonstrates

progress, despite the current market headwinds, towards the Group's

mid-term operating margin target(3) set out at the Capital Markets

Day in November 2022.

The Group remains highly cash generative and net debt has

further reduced since the half year. We continue to anticipate that

capital expenditure for the full year will be less than GBP40

million, with investments focussed on business simplification,

organic and sustainability-linked growth projects. The Group

expects to report pre-IFRS16 net debt to EBITDA of circa 1.1x at

the year end, reduced from 1.3x at 30 June 2023.

Joe Vorih, Chief Executive Officer, commented:

"We have made good progress over the last four months, with

demand in our drainage, storm water and ventilation markets holding

up well, supported by structural and sustainability growth drivers.

Our continued focus on simplifying the business and driving

operating efficiencies means that we are well positioned to

navigate the current uncertain environment and benefit from

incremental margin improvement when volumes return to more normal

levels."

Strategy Progress Update

The Group will hold a Strategy Progress Update for investors and

analysts at Deutsche Numis in London on 22 November 2023 at 13.30

GMT.

Enquiries:

Genuit Group plc

Joe Vorih, Chief Executive Officer

Tim Pullen, Chief Financial Officer

+44 (0) 113 831 5315

Brunswick

Nina Coad

Tom Pigott

+44 (0) 20 7404 5959

Notes to Editors:

Genuit Group plc ("Genuit", the "Company" or the "Group"), the

UK's largest provider of sustainable water, climate and ventilation

products for the built environment, and among the ten largest

manufacturers in Europe, of piping systems for the residential,

commercial, civils and infrastructure sectors by revenue. It is

also a leading designer and manufacturer of energy efficient

solutions in water-based heating systems in the UK.

The Group manufactures the UK's widest range of solutions for

heating, plumbing, drainage and ventilation. The Group primarily

targets the UK and European building and construction markets with

a presence in Italy and the Netherlands and sells to specific

niches in the rest of the world.

END

______________________________________________________________________________

(1) Genuit compiled analyst consensus forecasts for 2023 show

Adjusted Operating Profit of GBP89.7m

(2) Like-for-like as adjusted for acquisitions and disposals.

Group revenue including Polypipe Italia GBP6.5m

(3) Greater than 20% Adjusted Operating Margin over the

mid-term

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUSSKROKUAAAA

(END) Dow Jones Newswires

November 15, 2023 02:00 ET (07:00 GMT)

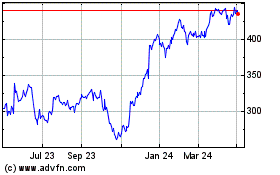

Genuit (LSE:GEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

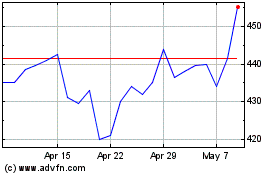

Genuit (LSE:GEN)

Historical Stock Chart

From Jan 2024 to Jan 2025