TIDMGRC

RNS Number : 9903Q

GRC International Group PLC

02 November 2021

GRC International Group plc ("GRC" or the "Group")

Trading Update

GRC International Group plc (AIM: GRC), a leading supplier of IT

governance, cyber security, risk management and compliance products

and services, is pleased to announce the following trading update

in respect of its trading performance in H1 FY22 (6 months ending

30 September 2021).

Continued growth in billings* delivers EBITDA positive H1

The Group saw the strong positive momentum which it reported

through H2 FY21 continue across all areas of the business in H1

FY22, notwithstanding the economic headwinds in the UK economy from

the on-going impact of COVID-19, rising energy prices, inflationary

pressures and staff shortages.

As a result, billings* in H1 FY22 were up 26% on the comparative

period.

The improved H1 FY22 performance generated positive EBITDA for

the period, the first time that the Group has reported an EBITDA

positive 6-month period since the first set of results it reported

after it was admitted to trading on AIM in March 2018.

The resulting cash flow was sufficient to reduce the previously

reported deferred HMRC liabilities resulting from the Government's

COVID-19 initiatives by approximately half.

The Group also saw its recurring revenue continue to perform

strongly, with recurring revenue billings accounting for 55% of

total billings in the period. Benefiting from an increase of 31% in

the 3,600 subscribers at year end FY21 (31 March 2021), there are

now a cumulative 4,720 subscribers to recurring revenue Lines of

Business in Vigilant Software, GRC e-Learning, IASME Cyber

Essentials, ITGP Toolkits, and GRCI Law, with a combined rolling

annual churn rate of only 4%.

H1 FY21

to H1

H1 FY21 H2 FY21 H1 FY22 FY22

GBP'000 GBP'000 GBP'000 %<DELTA>

---------------------------- ---------- ---------- ---------- ---------

Total billings* 5,583 6,670 7,061 +26%

Total billings per

FTE** 39 47 48 +23%

Cyber Security billings*** 3,568 4,485 5,008 +40%

Recurring & contracted

billings*** 3,012 3,636 3,900 +29%

Website billings*** 1,731 2,271 2,671 +54%

No. No. No. %<DELTA>

---------------------------- ---------- ---------- ---------- ---------

Website visits 1,688,059 1,938,710 2,048,780 +21%

(The 'Cyber security', 'Recuring and contracted' and 'Website'

categories in the table above are non-exclusive. An invoice or web

sale can feature in more than one category.)

The EBITDA positive half year result evidences the success of

the Group's recovery from the COVID-19 impacted prior year

performance, with higher billings* and improved levels of client

delivery delivered on an almost unchanged headcount.

57% of transactions in the period were from returning existing

customers, with the balance from new customers.

GRC's previous acquisitions (being the domain, web platform,

customer list and goodwill of www.gdpr.co.uk in August 2018 and

Data Quality Management Group Limited in March 2019) continue to

perform strongly and integration into the Group on an operational

level has proved successful.

Cash and available finance facilities

The Group ended the half year on 30 September 2021 with cash of

GBP0.1m, ahead of management forecasts, after repayment of certain

deferred HMRC liabilities (as referred to above), with the majority

of the balance expected to be paid down by the end of the financial

year on 31 March 2022.

The Group's facility headroom available at the half year end on

30 September 2021 was circa GBP0.5m.

Outlook

Trading through to the end of October has been in line with

management expectations and the Board will provide a further update

at the time of the Interim Results in December.

* Billings equate to the total value of invoices raised as cash

sales through the Group's websites. The figure does not take

account of accrued or deferred income adjustments that are required

to comply with accounting standards for revenue recognition.

** FTE stands for Full Time Equivalent employee.

*** Non-exclusive - invoice or web sales feature in more than one category

Enquiries:

GRC International Group plc +44 (0) 330 999 0222

Alan Calder, Chief Executive Officer

Christopher Hartshorne, Finance Director

Grant Thornton UK LLP (Nominated Adviser) +44 (0) 20 7383

5100

Philip Secrett

Lukas Girzadas

Dowgate Capital Limited (Broker) +44 (0) 20 3903 7715

James Serjeant

David Poutney

Russell Cook

Nicholas Chambers

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 which is part of UK law by virtue of

the European Union (withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

About GRC International Group plc

GRC was admitted to trading on the London Stock Exchange's AIM

market in March 2018.

GRC provides a comprehensive suite of products and services to

address the IT governance, risk management and compliance

requirements of organisations seeking to address a wide range of

data protection and cyber security regulation. The Company provides

a range of services and products through three divisions: Training,

Consultancy, and Publishing and Distribution.

The Group has an international customer base which is expected

to grow as GRC expands its geographical footprint. Since admission

to AIM, the Group has expanded internationally with operations now

established in Ireland, the US and Northern Europe.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFSMFUFEFSEDF

(END) Dow Jones Newswires

November 02, 2021 03:00 ET (07:00 GMT)

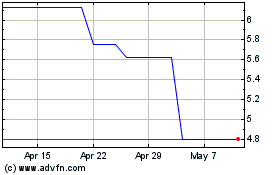

Grc (LSE:GRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Grc (LSE:GRC)

Historical Stock Chart

From Apr 2023 to Apr 2024