TIDMGRC

RNS Number : 8576Y

GRC International Group PLC

10 May 2023

10 May 2023

GRC International Group PLC

Year-end trading update

GRC International Group PLC (AIM: GRC, "GRC" or the "Group"),

the international governance, risk management and compliance

company whose main business is cyber defence-in-depth, announces a

trading update for the 12 months ended 31 March 2023 ("FY23").

Highlights

-- Revenue expected to be GBP14.5m - GBP15.0m (FY22: GBP13.9m).

-- Annualised Recurring Revenue ('ARR') increased by 7% in one

month to GBP6.7m at the end of March.

-- Contracted and recurring revenues expected to account for over 60% of total revenues.

-- Q4 billings* up 23% on Q3 to GBP4.3m (Q3: GBP3.5m). Notably,

Q4 included the signing of several significant multi-year

contracts, with an aggregate value of GBP5.0m.

-- Gross margin expected to increase to 61% (FY22: 59%).

-- EBITDA expected to be GBP0.3m - GBP0.6m (FY22: GBP0.9m)

impacted by economic headwinds and wider macro uncertainties in

Q3.

-- Year-end cash GBP0.1m (2022: GBP2.0m). Facility headroom at

the period end circa GBP0.5m (FY22: GBP0.5m).

The Group saw strong positive momentum through Q4 of FY23 across

all areas of the business, despite experiencing the widely reported

effects in Q3 of the economic headwinds in the UK economy from

uncertainty in the financial markets, inflationary pressures and

staff shortages.

Q4 saw the highest levels of training course attendance and

training revenue for the Group across all delivery options since

the end of the GDPR boom as well as a number of significant

multi-year contract signings.

The improved revenue performance was supported by ongoing

investment in staff capability and product quality, resulting in

improvements in the Group NPS (Net Promoter Score) score from 39 in

FY22 to 53 (+50 is 'excellent') in FY23 and an initial TrustPilot

rating of 4.5 (also 'excellent'). Service quality is one of the

Group's key competitive differentiators.

The Group also continued to invest in the development of its

websites and software-as-a-service platforms, whilst at the same

time substantially reducing the HMRC liabilities deferred during

the pandemic in line with its agreements, utilising the funds

raised from the successful share placing in January 2022.

Alan Calder , Chief Executive Officer, commented:

"Our solid performance in H1 of FY23 continued into Q4,

resulting in revenue growth and continued margin improvements.

However, the economic and geopolitical headwinds materially

impacted our Q3 performance.

"Our technology capabilities and our track record, with deep

expertise and cyber defence-in-depth model, provide our clients

with peace of mind. They know their assets are safe and, equally

importantly, comply with the numerous cyber regulations.

"As we have previously stated, our strategy is to grow

organically and by acquisition. In the current financial market

conditions, our primary focus is on organic growth and, in

particular, in positioning our Cyber Comply platform at the heart

of our service offering.

" With our recurring revenue activities continuing to perform

strongly and the goo d momentum in Q4 continued into the start of

the new financial year, we are looking forward with increasing

confidence.

"T rading to the end of April 2023 is in line with our

expectations."

* Billings equate to the total value of invoices raised as cash

sales through the Group's websites. The figure does not take

account of accrued or deferred income adjustments that are required

to comply with accounting standards for revenue recognition.

Note: the FY23 numbers detailed above are unaudited and actual

outturn for the financial year will be determined during the audit

process to be completed during the Summer

ENDS

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014, which is part of UK law by virtue of

the European Union (withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

Enquiries:

GRC International Group PLC +44 (0)330 999 0222

Alan Calder, Chief Executive Officer

Christopher Hartshorne, Finance Director

Singer Capital Markets (Nominated Adviser and Joint Broker) +44

(0)20 7496 3000

Phil Davies, James Fischer

Dowgate Capital Limited (Joint Broker) +44 (0)20 3903 7715

James Serjeant, Russell Cook, Nicholas Chambers

Meare Consulting

+44 (0)7990 858548

Adrian Duffield

About GRC International Group PLC

GRC is an international governance, risk management and

compliance company whose main business is cyber defence in

depth.

A technology business, its proprietary premier brands including

the market leader, IT Governance, offer 'Our expertise, your peace

of mind' for GRC's wide range of domestic and international

corporate customers across all industrial sectors.

GRC's three operating divisions - Software as a Service (SaaS),

E-Commerce and Services - offer a wide range of products and

services encompassing: IT governance, risk management, compliance

with data protection and cyber security regulations, online and

in-person training and staff awareness, consultancy, online

publishing and distribution, as well as software. The Group's

capabilities also include products and services to enable

corporates to address wider governance issues, such as money

laundering and bribery.

In addition to its UK business, GRC has operations in the EU, US

and Asia-Pacific regions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSSEFAUEDSESI

(END) Dow Jones Newswires

May 10, 2023 02:00 ET (06:00 GMT)

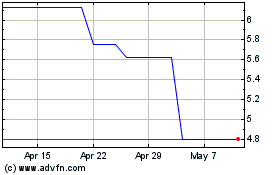

Grc (LSE:GRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Grc (LSE:GRC)

Historical Stock Chart

From Nov 2023 to Nov 2024