TIDMGTC

RNS Number : 9502A

GETECH Group plc

07 June 2021

Getech Group plc

("Getech" or "the Company" and with its subsidiaries "the

Group")

Final Results for the 12 months ended 31 December 2020

The Getech Group (AIM; GTC) announces its Final Results for the

12 months ended 31 December 2020.

Highlights

Accelerating progress to global net-zero by supporting customers

in the optimisation of existing, and delivery of new, energy assets

and strategic mineral resources.

Covid-19 and customer activity update

-- In 2020 Getech balanced risk management with business development in zero-carbon energy.

-- Covid-19 has created a challenging business environment, 2020

customer budgets reduced by c35%.

-- Getech's orderbook, annualised recurring revenue and customer

relationships remained robust, but revenue declined as customers

cut back project work, which also impacted data sales.

-- The move to home working was smooth; projects continue to be delivered on time and to cost.

-- Actions implemented from 1 May 2020 reduced monthly Group costs by c26%.

-- Getech retains further cost flexibility and has maintained

the capacity to deliver its orderbook and the resources needed to

maximise the impact of its sales conversations and new business

activities.

2020 financial highlights

-- Revenue GBP3.6 million (2019: GBP6.1 million)

-- Gross margin 53%, protected by cost management initiatives (2019: 58%, adjusted)

-- Orderbook remained strong GBP2.7 million at 31 December 2020

(31 December 2019: GBP3.1 million)

-- Annualised Recurring Revenue GBP2.1 million at 31 December

2020 (31 December 2019: GBP2.3 million)

-- Total cost base 20% below 2019 (2020: GBP5.1 million; 2019: GBP6.4 million)

-- Adjusted[*] EBITDA GBP0.5 million loss (2019: GBP0.9 million profit)

-- Net cash at 31 December 2020 GBP1.4 million (31 December 2019: GBP2.7 million)

Beyond 2020 - delivering diversified growth

-- Getech is using its earth science and geospatial expertise to

accelerate progress to global net-zero, by supporting its customers

in the optimisation of existing, and delivery of new, energy assets

and strategic mineral resources.

-- For existing customers this means helping identify the

highest value/lowest carbon-impact petroleum assets, whilst also

utilising Getech's skills and technologies to support their

net-zero asset investment.

-- This work connects Getech with a wider group of net zero

customers, with whom the Company is beginning to build a more

diversified baseline of product and service sales.

-- Getech's commitment to this path is underlined by the Company

joining the United Nations' Race to Zero campaign - Getech's pledge

is to be carbon-neutral by 2030.

-- Getech will deliver this through the application of its products and skills, and by direct decarbonisation steps - taking targeted equity exposures in emergent carbon neutral value chains.

-- In April 2021 Getech raised GBP6.25 million through a

Placing, Subscription and Open Offer of shares.

-- This will be used to grow and diversify Getech's activities

across the zero-carbon economy, with particular focus on the green

hydrogen, carbon capture, geothermal and strategic minerals

sectors.

-- Our focus is on activities that are essential, repeatable and strongly scalable.

-- We will measure success through our carbon-neutral goal, our

profit and the creation of asset value.

-- In March 2021 Getech completed its first project investment -

acquiring H2 Green, a data-led business that is using Getech's

location analytics to establish a national network of green

hydrogen hubs.

-- Getech is also aligning its Board to these areas of focus -

appointing a new Chairman and new NEDs. This brings expertise in

clean technologies, zero-carbon investment, ESG and business scale

up.

-- Getech's Board is excited by the opportunities ahead and

values the continued support of the Company's shareholders,

customers and business partners.

For further information, please contact:

Getech Group plc Tel: 0113 322 2200

====================================== ===================

Jonathan Copus, Chief Executive

Cenkos Securities plc Tel: 0207 297 8900

Neil McDonald / Pete Lynch (Corporate

Finance)

Michael Johnson / Julian Morse

(Sales)

Camarco Tel: 020 3781 8331

Georgia Edmonds / James Crothers

/ Ollie Head

====================================== ===================

Chairman and CEO statement

Getech provides data, knowledge, software and analytical

products and services to help governments and investors locate and

manage new energy and mineral resources and to optimise their

development. Our mission is to accelerate progress to global net

zero by supporting our customers in the optimisation of existing,

and the delivery of new, energy assets. We do this through the

application of our extensive earth science and geospatial skills to

the transitioning primary energy sector, in particular targeting

growth across green hydrogen, carbon capture, geothermal energy and

the mining of strategic minerals.

Our market

In the 15 years since joining AIM, Getech has continually

provided products and services to many international oil and gas

companies and governments. We have developed a reputation for

technical excellence, which is built on Getech's unique product

Intellectual Property. From this we have built a strong financial

and operational platform, underpinned by a robust orderbook and

annualised recurring revenues.

As the world is transitioning towards net zero, petroleum

exploration activity has declined and demand for alternative

sources of energy has increased. These trends have been accelerated

by the Covid-19 pandemic and provide numerous growth opportunities

for the Group.

Getech's role in the path to net zero

The transition to a net zero economy is an unprecedented

challenge. As the world seeks to decarbonise, this will require the

replacement of more than 50% of the world's energy infrastructure

and new supplies of rare earths and other metals. We see the global

energy mix of our future as being built with many different

renewable energy technologies, delivered through a distributed

architecture. This presents a huge opportunity for Getech and our

overarching goal is to build a portfolio of products, services and

assets under management that build value and provide long-term

sustainable cash flows.

Our commitment to this cause is demonstrated by our membership

of the United Nations' Race to Zero campaign - Getech's pledge

being to be carbon neutral by 2030.

Our existing energy customers

In the near-term, our business plan is to continue to service

our existing energy customers. We will do this by optimising the

value and sustainability of their petroleum portfolios, whilst also

supporting their diversification into zero carbon assets and

technologies.

While customer sentiment remains relatively subdued in

comparison with the pre-Covid-19 environment, it is encouraging to

see some momentum returning. In Q1 2021, this was evidenced by new

data sales and service work, both of which were largely absent in

H2 2020. Existing customers are also renewing their software

licences, all of which is helping to build the orderbook and

increase recurring revenues.

Through our current work, we also naturally engage with a wider

group of new zero carbon customers, from whom we are already

beginning to secure product sales, and winning service work.

Across all customers we deploy our skills in ways similar to how

our earth scientists and geospatial experts have traditionally

worked with oil and gas assets, namely:

-- Where in the world will we find the resources required for the energy transition?

-- Who can help us develop these resources?

-- How do we optimise development and production?

-- How do we operate these new projects?

Sector focus

We concentrate our business development work on activities that

we consider to be essential, repeatable and strongly scalable.

Sectorally, our knowledge and geospatial skills are best suited

identifying economically privileged and environmentally sustainable

locations for:

-- Geothermal assets - baseload energy that can be utilised to produce heat and power.

-- Strategic minerals - deposits of rare earth and battery metals such copper and lithium.

-- Carbon capture and storage - the conditions required to deliver safe long-term storage.

-- Green hydrogen - utilising excess renewable energy to create hydrogen hubs.

We are excited to have already won new business in geothermal

and have continued this momentum in announcing business

collaborations in geothermal and hydrogen.

Investing for growth

To progress these sector focus areas, in April 2021 Getech

successfully raised GBP6.25 million through a share Placing,

Subscription and Open Offer. Since the completion of this

fundraise, our priority has been to reorganise and focus our team

on these exciting developing sectors, as we resource and commence

our expanded program of investment.

Domain experts are being appointed to lead business development

and product and service delivery in these new sector groupings. We

are focused on identifying people who share our passion for a zero

carbon future, who are established experts in their fields, with

both a track record in business scale up and the delivery of

commercial success in the green economy.

We are also reshaping the Non-Executive skills of our Board.

Since the appointment of a new Board Chair, we have recruited a new

Audit Chair designate who brings in-depth knowledge of clean

technologies, renewable energy finance, strategic minerals, and

environmental, social and governance (ESG).

Our ongoing program of investment focuses on repurposing our

existing products and services to address further opportunities in

the energy transition. We are also building partnerships and

broadening our offering to include assistance in the technical and

financial development of zero carbon assets.

By providing our customers with an integrated technical and

commercial overview of their development portfolios and by

expanding our work into emergent energy value chains, Getech can

capture direct exposure to the value that our skills and

technologies create at the asset level. This asset exposure brings

our shareholders transformative potential, which can be delivered

at low incremental capital costs.

We took our first step on this path in March 2021, when we

exercised our option to purchase H2 Green Limited. H2 Green is a UK

developer of hydrogen hubs, which we intend to use as a foundation

to develop a portfolio of hydrogen projects. The Company is focused

on establishing its first cash producing hydrogen assets, and has

already entered into a notable agreement with UK gas distributor

SGN Commercial Services with the aim of developing hydrogen hubs

utilising their land portfolio. The company has also notably signed

a Letter of Intent with Element 2, a Hydrogen fuel retailer, to

supply green hydrogen to its refuelling stations.

As part of our ambitious, long-term growth strategy, we are

focussed on identifying further value-enhancing partnerships and

initiatives over the months and years ahead.

Our role in the energy transition

Getech's role in the Energy Transition is not to compete with

industry mega projects that are currently being announced. Instead,

we intend to use our earth science and geospatial expertise to

identify and help develop economic zero carbon projects that will

become part of a distributed energy system.

In addition, our strategy is not only to help our customers

identify and develop zero carbon energy assets, but also to

participate in the projects and become wherever possible co-owners,

managers and/or service providers. We believe that such a portfolio

of assets will increase the net asset value of the company and,

with the recurring profits that result, substantially increase

shareholder value. In aggregate, this could become a substantial

energy business.

Outlook

With clear strategic focus, strong balance sheet, and new team

members aligned with our vision, we are very excited about the

outlook and growth prospects for Getech. 2021 will be about

continuing to service our current petroleum customers whilst

building on our foundations for growth in the green hydrogen,

carbon capture, strategic minerals and geothermal sectors. Similar

to our early steps into the hydrogen sector, we also see the

potential for acquisitions within geothermal and strategic minerals

as a path to both accelerate the build-out of our offering and to

provide access to operating projects. We also expect to announce

further product developments as we expand our offering further into

these areas.

We look forward to keeping our shareholders abreast of

developments as we identify further growth opportunities within the

energy transition.

We would like to thank our employees and fellow board members

for their continued dedication to the Company, helping Getech

perform robustly in what has been a very challenging period.

Richard Bennett: "It is a pleasure to become chairman of Getech

at this inflection point in the development of the Group, as we

apply our core geoscience skills and geospatial services to the

energy transition and contribute to the decarbonisation of the

world's energy systems."

Richard Bennett Jonathan Copus

Chairman CEO

Operations review

Getech's core value proposition combines our Geoscience and

Geospatial expertise to provide unique insight for our energy

sector customers.

In an energy market that is transitioning to deliver a

decarbonised and decentralised primary energy system, the

application of Getech's combination of skills and technologies

opens a wide front of commercial opportunity to the Group. In 2020

we embraced these changes by continuing to evolve our solutions for

our core petroleum markets, whilst also accelerating our plans to

diversify into other energy and natural resource markets -

including Mining, Geothermal and Hydrogen.

One of the foundations of our Petroleum offerings is our market

leading Gravity and Magnetic (G&M) expertise. Through 2020,

sales of data and related services declined as our customers

reduced their levels of project-based work. Getech responded to

this by focusing our staff's time on enhancing and broadening our

offering. In 2020, we completed and released 'Multi-Sat 2020' - a

major new gravity data product that integrates information from the

latest satellites with innovative processing methods to create the

most accurate, reliable and coherent gravity data for all offshore

areas, providing resolution comparable to regional 2D shipborne

solutions.

We also further enhanced our flagship earth modelling product,

Globe, with the release of 'Globe 2020', which delivered new

information, analytic tools and additional usability features,

including an initial version for ArcGIS Pro, Esri's latest desktop

GIS application. Our work to re-position Globe for the evolving

petroleum market were further rewarded in 2020 when we secured a

new super-major customer and high renewal rates for existing

subscribers and those on multi-year licence agreements.

Elsewhere in petroleum, our GIS Software team completed releases

that delivered significant enhancements to our software's data

integration, exploration prospectivity analysis and onshore shale

gas/oil well pad & lateral planning capabilities. As with

Globe, software renewal rates through 2020 remained high and we

were able to add several new customers through the year.

In addition, we continued to successfully deliver on a wide

variety of oil and gas GIS services contracts, including the

completion of our first significant GIS implementation project in

the pipeline sector. That these products and services projects were

delivered to customers on time and within budget was a notable

achievement given the migration to home working caused by Covid-19

from March 2020.

Alongside our work in petroleum, through 2020 we focussed on

better understanding how our core products were being used in the

Mining sector. As a result of this, we were able to leverage both

our G&M expertise and Globe to help customers deliver Copper

and Lithium exploration projects - both essential strategic

minerals for the Energy Transition. As a result of these project

successes, we commenced planning additional workstreams for further

expansion into the Mining market, and work is now well underway in

2021.

Our innovation and market diversification work also identified

Geothermal as a potentially untapped market for Getech. Through a

combination of our G&M, geoscience and GIS expertise we

developed the concept of the 'Heat Seeker' solution - a tool for

locating potential geothermal resource sites within reach of

readily available customer markets for heat or power. As we planned

the work likely to be necessary for developing a Heat Seeker

prototype, we also built a network of contacts within the

Geothermal market and established strategic relationships to assist

our work - one result of which was Getech becoming a member of the

International Geothermal Association (IGA) in March 2021, an

organisation that we continue to work in partnership with through

2021.

In 2020 we drove further diversification by entering the

Hydrogen sector through our relationship with H2 Green, securing an

exclusive option to acquire the business in November 2020. Early in

our discussions with H2 Green we recognised that a key component of

our joint value proposition was Getech's expertise in GIS and

geospatial location analytics. These skills were key to enabling H2

Green to identify and rank multiple site locations across the UK as

it developed and optimised its portfolio of green hydrogen

opportunities. The success of this approach led to the acquisition

of H2 Green in 2021 and the delivery of additional phases of

location analysis in support of identifying further green hydrogen

site locations.

Finally, our group-wide Innovation team, established in 2019,

continued through 2020 with its remit to research and develop

cross-discipline opportunities for new markets, capabilities,

partnerships, products, and services. In 2020 our innovation work

focussed on assessing opportunities within the geothermal and

mining domains; applying machine learning to our Globe and G&M

products to create new insight; further investigating the concepts

of IoT and Digital Twins to feed geospatial projects; and

developing solutions to enable organisations to analyse their CO2

emission sources and assess alternative greener energy supply as

part of their energy transition requirements.

Chris Jepps

Chief Operating Officer

Financial review

In 2020 the Covid-19 pandemic cast a shadow over the global

economy.

The impact of Covid-19 compounded macroeconomic and investment

themes that since 2014 have led to volatility and uncertainty in

both oil prices and the levels of petroleum exploration spending.

Brent averaged $42/bbl (2019: $64/bbl) and long-dated crude prices

traded around the mid-$40/bbl, down from mid-$50/bbl in 2019. The

impact of climate change has also continued to move up the social

agenda, placing the Energy Transition firmly on the strategic

roadmap of Getech and our customers.

To protect the Group against these dynamics, since 2016

management has focused on building Getech's foundation of recurring

revenue and orderbook. Between 2017 and 2019 this focus grew

Getech's annualised recurring revenue by 53% and orderbook by 197%.

In 2020, in the face of unparalleled business disruption, Getech's

orderbook, recurring revenue and customer relationships have all

proved to be robust. Annualised recurring revenue totalled GBP2.1m

at 31 December 2020 (31 December 2019: GBP2.3m) and order book

totalled GBP2.7m at 31 December 2020 (31 December 2019:

GBP3.1m).

Looking forward, Getech is also focused on the delivery of

diversified transformational growth, with particular focus on the

mining, hydrogen and geothermal sectors.

To aid in the analysis of Getech's underlying financial

performance, the table below sets out key reported figures from the

financial statements and the equivalent figure adjusted for

exceptional items, detailed in footnote 1.

Table 1 - Financial summary 2020 2019

======================================

Reported Adjusted (1) (unaudited) Reported Adjusted (1) (unaudited)

(audited) GBP'000 (audited) GBP'000

GBP'000 GBP'000

====================================== =========== ========================= =========== =========================

Revenue 3,563 3,563 6,058 6,058

Gross margin 53% 53% 64% 58%

EBITDA (601) (486) (1,935) 872

Operating loss (1,774) (1,659) (3,091) (284)

Loss after tax (1,644) (1,529) (3,088) (281)

Earnings per share (4.38)p (4.07)p (8.22)p (0.75)p

Cash (outflow)/inflow from operations

(before W/C adjustments) (516) (516) 934 934

Development costs (902) (902) (1,108) (1,108)

Net (decrease)/increase in cash (1,311) (1,311) 2,154 2,154

Cash and cash equivalents 2,192 3,554

Net cash 1,358 2,700

====================================== =========== ========================= =========== =========================

(1) Exceptional items

During the year, Getech incurred costs totalling GBP115,000 in

relation to restructuring the business. In 2019 there were

exceptional items relating to cost of sales and administrative

expenses.

Operating results

Revenue

Despite remote working throughout most of the year, Getech

remained close to its customers through a broad and innovative

program of online engagement.

This was rewarded by a high renewal rate on our subscription

revenues. Annualised recurring revenue totalled GBP2.1m at 31

December 2020 (31 December 2019: GBP2.3m). Getech's orderbook was

also robust, totalling GBP2.7m at 31 December 2020 (31 December

2019: GBP3.1m).

The Group did however see a drop in revenue, driven by our

customers' reducing their levels of short-term project work, which

also drove lower sales of off-the-shelf data. This resulted in an

overall reduction in revenue from GBP6.1m in 2019 to GBP3.6m in

2020. This can be seen in the analysis of revenue by timing of

recognition, where 'point in time' products revenue fell from

GBP2.41m in 2019 to GBP0.48m in 2020, whereas products revenue over

time (from subscriptions) increased from GBP1.96m in 2019 to

GBP2.13m in 2020.

Gross margin before exceptional items

A large proportion of Getech's cost of sales are invariable,

however Gross margin for the year was protected from the decrease

in revenue by cost saving measures that the Group announced in May

2020. Overall gross margin was 53% for 2020, compared to 58% in

2019, adjusted. The products margin remained strong at 72% compared

to 76% in 2019.

Getech's Services division returned to profit in 2019 and in

2020 the Group maintained a small gross profit, with a Services

gross margin of 2% (2019: 8% margin). Getech continues to target a

return to a 25% margin for the Services division in the

mid-term.

Table 2 - Gross margin by reporting segment 2020 2019

Products Services Products Services

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 2,602 962 4,324 1,636

Cost of sales (740) (942) (1,025) (1,506)

============================================= ========= ========= ========= =========

Gross profit 1,862 20 3,299 130

============================================= ========= ========= ========= =========

Gross margin 72% 2% 76% 8%

============================================= ========= ========= ========= =========

Administrative costs

Administrative expenses include GBP1,173,000 of depreciation and

amortisation charges. Excluding these charges and exceptional items

and restructure costs, administrative expenses totalled

GBP2,378,000; a 12% decrease (2019: GBP2,685,000). This reflects

the net impact of cost saving measures that the group took in May

2020, the expression of which was partially diluted in the total

administrative cost figure by fixed overhead costs such as rental,

rates and subscription costs. In 2021 Getech has sub-let the London

office, reducing fixed overhead costs.

Cost base analysis

Getech took significant cost saving measures in May 2020 as a

result of the Covid pandemic and the impact of our Oil and Gas

customers cutting their capex budgets by c35%. These measures

included a small reduction in headcount, savings on travel and

conference costs, utilisation of the government Furlough scheme in

the UK and PPP scheme in the US. Staff also agreed to temporary

salary reductions, ranging from 20% for Getech's board to 8% for

most other staff.

As a result, the monthly Group cost base was reduced by 26%, and

the Group cost base for 2020 as a whole was 20% lower than the cost

base for 2019 (excluding restructuring costs and exceptional

items).

The table below reconciles our cost base to the financial

statements.

Table 3 - Cost base reconciliation % variance 2020 2019

GBP'000 GBP'000

Cost of sales 1,681 2,532

Development costs capitalised 902 1,108

Administrative costs 3,551 3,809

Payment of lease liabilities 136 71

Depreciation and amortisation charges (1,173) (1,156)

Exchange adjustments 6 (2)

Movement on provisions - -

======================================== =========== ========= =========

Cost base, excluding exceptional items (20)% 5,103 6,362

======================================== =========== ========= =========

Cost base is measured as: cost of sales, administrative costs,

development costs capitalised and payment of lease liabilities,

less depreciation and amortisation, and adjusted for movement in

work in progress, non-cash foreign exchange adjustments.

EBITDA

A lower cost base and continued investment in the drivers of

recurring revenue has limited the impact of lower revenue on

EBITDA. Adjusted EBITDA totalled a GBP496,000 loss (2019:

GBP872,000 profit).

Income tax

To help our customers understand and resolve their exploration

and operational challenges requires Getech undertaking pioneering

research and development. Against the cost of this work we obtained

corporation tax relief, and subsequently realised a tax credit

relating to the current year of GBP174,000 (2019: GBP53,000

credit).

Getech reported a loss after tax, adjusted for exceptional items

and restructuring costs of GBP1,529,000 (2019: GBP281,000

loss).

Operating cash flows

Before working capital adjustments Getech's cash outflow from

operations was GBP516,000 (2019: GBP934,000 inflow), this included

restructuring costs of GBP115,000 paid during 2020.

Changes in working capital

In 2020 there was an overall net positive working capital

movement of GBP248,000. As a result of Covid restrictions, Getech

experienced delays in receipt of payment from several customers; at

the year-end, receivables overdue by more than 3 months totalled

GBP184,000 (2019: GBPnil), and deferred subscription invoices

totalled GBP271,000. In early 2021, these positions were quickly

resolved, however they negatively impacted working capital movement

in the year and year-end cash balance by GBP455,000.

In 2019 there was net positive working capital movement of

GBP2,525,000, this was largely due to the timing of product sales

towards the end of 2018, for which cash was received in early

2019.

Investment and Capital Expenditure

In line with the Group's strategy to invest and enhance its

product offering, Getech broadly maintained its development

expenditure on Globe and Software in 2020, totalling GBP902,000

(2019: GBP1,108,000). Having successfully completed a GBP6.25m

equity raise in H1 2021, Getech expects to increase investment in

its products during 2021 as part of its strategy of diversified

growth.

Financing

In April 2020, due to the uncertainties arising from Covid and a

low Oil Price, Getech took a 12-month capital repayment holiday on

its loan. During the year Getech made repayments against the loan

facility of GBP20,000 (2019: GBP78,000). Getech recommenced capital

repayments in April 2021.

Repayment of lease liabilities totalled GBP136,000 (2019:

GBP71,000) and relate to the London office lease. After the

year-end, in February 2021 Getech sub-leased the London office as

part of its continued capital efficiency measures.

Post balance sheet events

In January 2021, Getech appointed Richard Bennett to the board

as non-executive Chairman designate and Peter Stephens retired from

his position as non-executive director. In April 2021, Richard

assumed the position of Chairman, whilst Dr Stuart Paton stepped

down from his Chairman position, Stuart remains on the board for a

period of knowledge transfer.

In February 2021, Getech completed an agreement to sub-lease its

London office.

On 30 March 2021, Getech shareholders approved a share placing

to raise GBP6.25m to fund Getech's programme of growth through

diversification. At the same time, the board approved the

acquisition of H2 Green. Getech has agreed to pay up to GBP1m for

H2 Green, payable in cash and shares. Milestone payments are linked

to the hydrogen business achieving a number of key operational and

commercial targets.

At the date of the report, H2 Green had met the first two of

these milestones, resulting in up-front consideration of

GBP250,000. Of this, GBP53,750 of the consideration was cash, the

balance paid in shares.

In May 2021, the Group appointed Michael Covington as

non-executive director. Michael is audit chair designate and will

take the position of audit chair on 1 July 2021, following a period

of hand-over with Dr Alison Fielding.

Liquidity and Going Concern

At the end of 2020, Getech held GBP2,192,000 in cash and cash

equivalents (2019: GBP3,554,000).

Cash balances post-year-end increased significantly, Getech

completing a GBP6.25m equity raise in April 2021, detailed

above.

Getech's business activities and the factors likely to affect

its future development, performance and position are set out in the

Chairman's and Chief Executive's Review. The financial position of

the Group, its cash flows and its liquidity position are described

in the financial statements.

In making the going concern assessment, the Board of Directors

has considered Group budgets and detailed cash flow forecasts to 30

June 2022. The Board has considered the sensitivity of these

forecasts with regards to different assumptions about future income

and costs, and various scenarios have been run on the potential

impact of Covid-19.

These cash flow projections, when considered in conjunction with

Getech's existing cash balances, and the cost saving measures

implemented, demonstrate that the Group has sufficient working

capital for the foreseeable future. Consequently, the Directors are

fully satisfied that Getech is a going concern.

Andrew Darbyshire

Chief Financial Officer

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

Sales revenue 3,563 6,058

Cost of sales (1,681) (2,533)

Gross profit before exceptional items 1,882 3,525

Exceptional cost of sales - 325

======================================================================================= ========== =========

Gross profit 1,882 3,850

Administrative expenses (3,551) (3,809)

Fair value gains and losses 10 -

====================================================================================== ========== =========

Operating (loss)/profit before exceptional administrative costs (1,6 59 ) 41

Exceptional administrative expenses (115) (3,132)

======================================================================================= ========== =========

Operating loss (1,774) (3,091)

--------------------------------------------------------------------------------------- ---------- ---------

Finance revenue 1 14

Finance costs (45) (64)

======================================================================================= ========== =========

Loss before tax (1,818) (3,141)

Tax credit 174 53

======================================================================================= ========== =========

Loss for the year (1,644) (3,088)

Other comprehensive income

Currency translation differences on translation of foreign operations (57) 6

======================================================================================= ========== =========

Total comprehensive income for the year attributable to owners of the Parent Company (1,701) (3,082)

======================================================================================= ========== =========

Earnings per ordinary share (EPS)

Basic EPS (4.38)p (8.22)p

Diluted EPS (4.38)p (8.22)p

======================================================================================= ========== =========

All activities relate to continuing operations.

Consolidated Statement of Financial Position

as at 31 December 2020

2020 2019

GBP'000 GBP'000

Non-current assets

Goodwill 296 296

Intangible assets 3,509 3,568

Property, plant and equipment 2,716 2,906

Deferred tax asset 364 346

==================================== ========= =========

6,885 7,116

=================================== ========= =========

Current assets

Trade and other receivables 1,353 1,994

Tax receivable 278 136

Cash and cash equivalents 2,192 3,554

==================================== ========= =========

3,823 5,684

=================================== ========= =========

Total assets 10,708 12,800

==================================== ========= =========

Current liabilities

Short-term borrowings 85 78

Trade and other payables 1,366 1,697

==================================== ========= =========

1,451 1,775

=================================== ========= =========

Non-current liabilities

Long-term borrowings 750 776

Trade and other payables 282 421

Deferred tax liabilities 176 109

==================================== ========= =========

1,208 1,306

=================================== ========= =========

Total liabilities 2,659 3,081

==================================== ========= =========

Net assets 8,049 9,719

==================================== ========= =========

Share capital 94 94

Share premium 3,053 3,053

Merger reserve 2,407 2,407

Share-based payment (SBP) reserve 251 242

Currency translation reserve (26) 31

Retained earnings 2,270 3,892

==================================== ========= =========

Total equity 8,049 9,719

==================================== ========= =========

The financial statements of Getech Group plc (company number:

02891368) were approved by the Board of Directors and authorised

for issue on 4 June 2021.

Andrew Darbyshire

Chief Financial Officer

Consolidated Statement of Changes in Equity

for the year ended 31 December 2020

Currency

Share Share Merger translation Retained

capital premium reserve SBP reserve reserve earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

1 January 2019 94 3,053 2,407 183 25 6,980 12,742

Loss for the

year - - - - - (3,088) (3,088)

Other

comprehensive

income - - - - 6 - 6

=============== ============= ============= ============= ============ ============ ============= =============

Total

comprehensive

income - - - - 6 (3,088) (3,082)

Transactions

with owners:

Share-based

payment

charge - - - 59 - - 59

=============== ============= ============= ============= ============ ============ ============= =============

31 December

2019 94 3,053 2,407 242 31 3,892 9,719

=============== ============= ============= ============= ============ ============ ============= =============

Loss for the

year - - - - - (1,644) (1,644)

Other

comprehensive

income - - - - (57) - (57)

=============== ============= ============= ============= ============ ============ ============= =============

Total

comprehensive

income - - - - (57) (1,644) (1,701)

Transactions

with owners:

Share-based

payment

charge - - - 31 - - 31

Transfer of

reserves - - - (22) - 22 -

=============== ============= ============= ============= ============ ============ ============= =============

31 December

2020 94 3,053 2,407 251 (26) 2,270 8,049

=============== ============= ============= ============= ============ ============ ============= =============

Consolidated Statement of Cash Flows

for the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Loss before tax (1,818) (3,141)

Finance income (1) (14)

Finance costs 45 64

Fair value gains and losses (10) -

Depreciation charge 214 216

Amortisation of intangible assets 960 940

Impairment of goodwill - 3,132

Impairment of intangible assets - 621

Adjustment to direct cost accruals - (946)

Expected credit loss provisions on loans and loan commitments 70 -

Share-based payment charge 31 59

Foreign exchange adjustments (6) 3

================================================================ ========= =========

Cash (outflow)/inflow from operating activities (516) 934

Movements in working capital:

(Increase)/decrease in trade and other receivables 600 2,861

Increase/(decrease) in trade and other payables (352) (336)

================================================================ ========= =========

Cash generated from operations (268) 3,459

Tax (paid)/received 83 37

================================================================ ========= =========

Net cash (outflow)/inflow from operating activities (185) 3,496

================================================================ ========= =========

Cash flows from investing activities

Purchase of property, plant and equipment (24) (30)

Purchase of intangible assets - (5)

Development costs capitalised (902) (1,108)

Interest received 1 14

================================================================ ========= =========

Net cash outflow from investing activities (925) (1,129)

================================================================ ========= =========

Cash flows from financing activities

Repayment of loan (20) (78)

Repayment of lease liabilities (136) (71)

Interest paid (45) (64)

================================================================ ========= =========

Net cash outflow from financing activities (201) (213)

================================================================ ========= =========

(Decrease)/increase in net cash and cash equivalents (1,311) 2,154

Cash and cash equivalents at the beginning of the year 3,554 1,400

Foreign exchange adjustments to cash and cash equivalents (51) -

Cash and cash equivalents at the end of the year 2,192 3,554

================================================================ ========= =========

Notes to the Consolidated Financial Statements

for the year ended 31 December 2020

Basis of preparation

The financial statements set out in this preliminary

announcement do not constitute statutory accounts as defined by

section 434 of the Companies Act 2006. It has been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006. The principal

accounting policies of the Group have remained unchanged from those

set out in the Group's 2019 annual report as delivered to the

Registrar of Companies. The financial statements have been prepared

under the historical cost convention and are presented in

sterling.

Statutory accounts for the years ended 31 December 2020 and 31

December 2019 have been reported on by the Independent Auditor. The

Independent Auditor's Reports on the Annual Report and Financial

Statements for the periods ended 31 December 2020 and 31 December

2019 were unqualified, did not draw attention to any matters by way

of emphasis, and did not contain a statement under 498(2) or 498(3)

of the Companies Act 2006.

The statutory accounts for the year ended 31 December 2020 were

approved by the board on 4 June 2021 and the information included

in this preliminary announcement was extracted therefrom.

The Directors have performed regular reviews of trading and cash

flow forecasts and have considered the sensitivity of these

forecasts with regards to different assumptions about future income

and costs. Various scenarios have been run on the potential impact

of covid-19. These include an assessment of the orderbook -

customer contractual commitments and Getech's ability to deliver

this work; the drivers of licence renewals; and the modelling of

extreme and hypothetical 'zero new revenue' downside scenarios,

these extending across multiple years. Additional cost actions have

also been modelled, including a bottom up restructuring of the

Group's overhead, offices, technical staff and commercial

activities.

In addition to the sensitivity models of future income and

costs, we have made various assumptions to model cash flow

forecasts: It has been assumed that the UK Government Job Retention

Scheme will continue to be available until the end of September

2021 and that current social distancing measures and travel

restrictions, which impact our ability to meet clients in person,

will also be in place throughout H1 2021. In H2 2021, we make the

assumption that these costs will return. We have also not relied on

the availability of additional sources of cash in our forecast

assumptions.

These cash flow projections, when considered in conjunction with

Getech's existing cash balances, the net proceeds of a post

year-end equity raise totalling GBP5.7m, and the cost saving

measures implemented, demonstrate that the Group has sufficient

working capital to at least 30 June 2022, being the Director's

period of assessment. Consequently, the Directors are fully

satisfied that Getech is a going concern for a period of at least

12 months from the date of signing the financial statements.

Earnings per share (EPS)

Basic EPS is calculated by dividing the profit attributable to

equity holders of the parent by the weighted average number of

ordinary shares outstanding during the year.

Diluted EPS is calculated by dividing the profit attributable to

equity holders of the parent by the weighted average number of

ordinary shares outstanding plus the weighted average number of

shares that would be issued on conversion of all the dilutive share

options into ordinary shares.

2020 2019

GBP'000 GBP'000

Loss attributable to equity holders of the parent (1,644) (3,088)

Loss attributable to equity holders of the parent adjusted for dilution (1,644) (3,088)

========================================================================= ========= =========

2020 2019

Thousands Thousands

Weighted average number of ordinary shares for basic EPS 37,564 37,564

Effects of dilution from share options 588 979

Weighted average number of ordinary shares adjusted for dilution 38,151 38,543

================================================================== =========== ===========

There has been no dilution of EPS during 2020 or 2019 due to

losses after tax.

2020 2019

pence pence

Basic EPS (4.38) (8.22)

Diluted EPS (4.38) (8.22)

============= ======= =======

After the year-end, the board granted a one-year extension to

the 900,000 share options with expiry date of 27 April 2021 by way

of issuing identical options to those above except for an exercise

period of one year.

On 30 March 2021, shareholders approved the issue of 29,303,065

ordinary shares at a premium of 22p. As at 1 April 2021, there were

66,866,680 shares in issue, called up and fully paid.

Notice of Annual General Meeting

The Annual Report and Accounts and notice convening the Annual

General Meeting of the Company will be posted to shareholders on 7

June 2021 and will be available from the Company's website

www.getech.com from that date. The Annual General Meeting of Getech

Group plc will be held on 30 June 2021 at 12 noon.

[*] Adjusted for exceptional items as detailed in the financial

review

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAPKSEAAFEEA

(END) Dow Jones Newswires

June 07, 2021 02:00 ET (06:00 GMT)

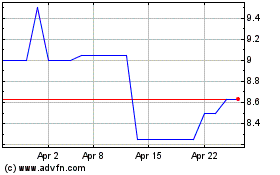

Getech (LSE:GTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Getech (LSE:GTC)

Historical Stock Chart

From Apr 2023 to Apr 2024